2022 Annual Gift Tax Exclusion Amount

The new numbers essentially […] The amount increased from $15,000 in 2021.

Irs Adjusts Tax Rates And Deductions For Ty 2022 Cpa Practice Advisor

There has been no legislation passed which would change the amount of gift that can be given in 2022 from the current exclusion amount of $15,000 per individual per year.

2022 annual gift tax exclusion amount. This is the amount that each person can give to another person without using any gift and estate tax exemption. The annual exclusion for gifts increases to $16,000 for calendar year 2022, up from $15,000 for calendar year 2021. However, as the law does not concern itself with trifles congress has permitted donors to give a “small” amount to each beneficiary of their choosing before facing the federal gift.

In 2018, 2019, 2020, and 2021, the annual exclusion is $15,000. The gift tax annual exclusion allows taxpayers to make certain gifts without eroding the taxpayer’s lifetime exemption amount. The internal revenue code imposes a gift tax on property or cash you give to any one person, but only if the value of the gift exceeds a certain threshold called the annual gift tax exclusion.

As a result, starting in 2022 individuals will be able to give $16,000 per year ($32,000 for a married couple) to any number of recipients, completely free of gift or estate taxes. The annual exclusion is the aggregate amount of present interest gifts that. For 2022 the annual gift tax exclusion has increased to $16,000.

The estate and gift tax lifetime exemption amount is projected to increase to $12,060,000 (currently $11,700,000) per individual. This means that an individual can give away $16,000 to any person in a calendar year ($32,000 for a married couple) without having to file a federal gift tax return. The irs is raising the gift tax limit for 2022.

The gift tax annual exclusion in 2022 will increase to $16,000 per donee. Estate, estate planning, gift and trust taxation, taxation, taxes in 2022, the annual gift tax exclusion will increase from $15,000 to $16,000 per recipient. The annual gift tax exclusion was indexed for inflation as part of the tax relief act of 1997, so the amount can increase from year to year to keep pace with the economy, but only in increments of $1,000.

In addition, the basic estate tax exclusion amount for the estates of decedents dying during calendar year 2022 will be $12,060,000. The federal government imposes a tax on gifts. And the gift tax annual exclusion amount jumps to $16,000 for 2022, up from $15,000 where it’s been stuck since 2018.

In 2022, the annual exclusion is $16,000. 2022 annual gift tax exclusion will increase to $16,000. The amount an individual can gift to any person without filing a gift tax return has remained at $15,000 since 2018.

This amount is known as the annual exclusion amount, which for 2021 is $15,000 per beneficiary.below is an explanation of annual. The annual gift tax exclusion for 2020 the gift tax limit for individual filers for 2020 is $15,000. According to the wolters kluwer projections, in 2022 the gift tax annual exclusion amount will increase to $16,000 (currently $15,000) per donee.

When you file a gift tax return, the irs will decrease your remaining lifetime exclusion amount by the amount of your annual gift tax return. The gift tax annual exclusion amount increased to $16,000 for 2022. The amount increased from $15,000 in 2021.

The maximum credit allowed for adoptions for tax year 2022 is the amount of qualified adoption expenses up to $14,890, up from $14,440 for 2021. The specific amount is known as the annual gift exclusion. This means a person can give any other person at least $16,000 before it is subject to the federal gift tax.

What is the gift tax annual exclusion amount for 2022? It'll also limit the donor to $20,000 annual exclusion gifts in total. Gift tax rules for 2022 onwards.

For 2022, that annual gift tax exclusion amount is $16,000, up from $15,000 in 2021. For 2022, the annual exclusion is $16,000 per person, up from $15,000 in 2021. For the first time in several years, the annual exclusion from gift tax will increase from $15,000 to $16,000 per year per donee effective january 1.

Starting in 2022, currently proposed legislation would reduce the annual gift tax exclusion to $10,000 per year per donee (recipient). This means a person can give any other person at least $16,000 before it is subject to the federal gift tax. For the past four years, the annual gift exclusion has been $15,000.

That means you can give up to $16,000 to as many recipients as you want without having to pay any gift tax. In 2022, the estate and gift tax exemption will increase from $11.7 million to $12.06 million per taxpayer. The irs has announced that the annual gift exclusion will rise to $16,000 for calendar year 2022.

The annual gift tax exclusion has increased from $15,000 to $16,000. How gift tax is calculated and how the annual gift tax exclusion works in 2021, you can give up to $15,000 to someone in a year and generally not. And the gift tax annual exclusion amount jumps to $16,000 for 2022, up from $15,000 where it’s been stuck since 2018.

The annual gift tax exclusion will be $16,000—the highest ever. Despite the large federal estate tax exclusion amount, new york.

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720000 More Tax Free

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation-skipping Transfer Tax Return

The Senate Introduced A New Estate And Gift Tax Law - Hartmann Doherty Rosa Berman Bulbulia

2021 Guide To Potential Tax Law Changes

0fkwfi5qxqml7m

Pin By Paul Lionetti On Quick Saves In 2021 Internal Revenue Service Fillable Forms Tax Forms

Projected Increases In 2022 For The Gift Tax Annual Exclusion Amount And Lifetime Exemption Preservation Family Wealth Protection Planning

Thoughtful Gifting Part 1 Use It Or Lose It Now Could Be The Time To Use Your Gift And Estate Tax Exemption

Budget 2019 - Revised Section 87a Tax Rebate - Tax Liability Calculation Illustration Income Tax Tax Deductions List Tax Deductions

California Gift Taxes Explained - Snyder Law

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Template Acknowledgement Letter Donation Gift Templates Sample Charity Receipt Documents Letter Templates Professional Reference Letter Letter Writing Template

Pin On Cats Small Business Success Tips

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

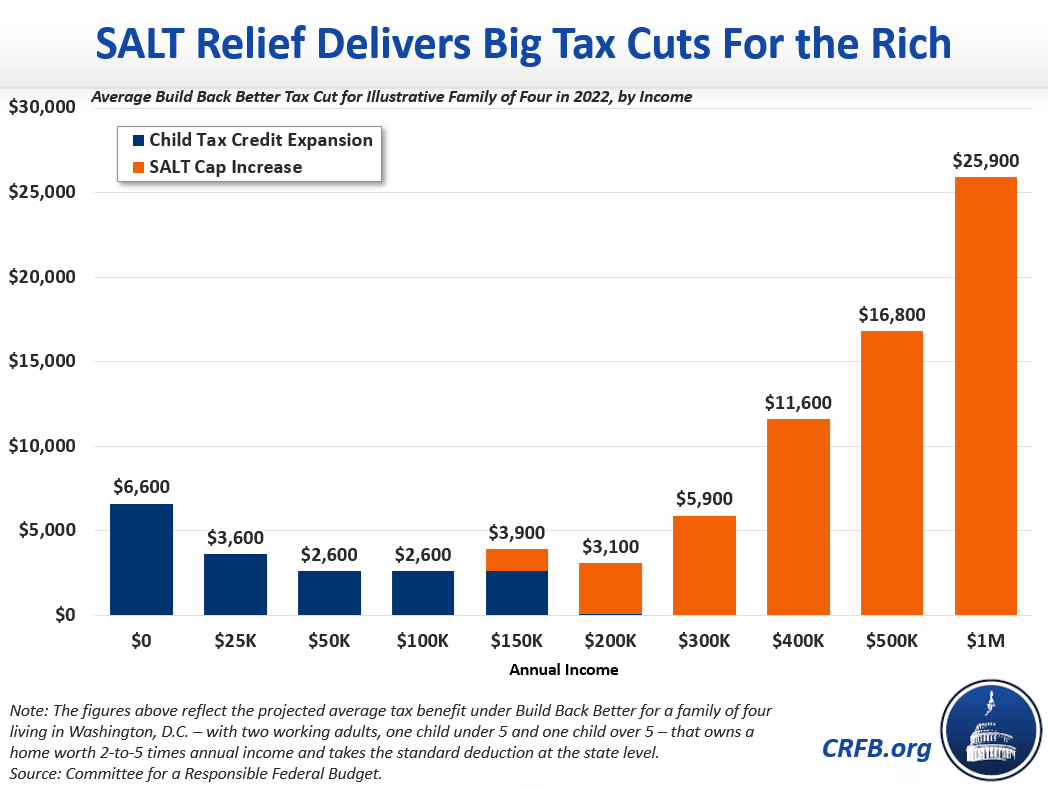

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

Gift Tax Exclusion For Tuition - Frank Financial Aid

Irs Announces 2017 Estate And Gift Tax Limits The 11 Million Tax Break

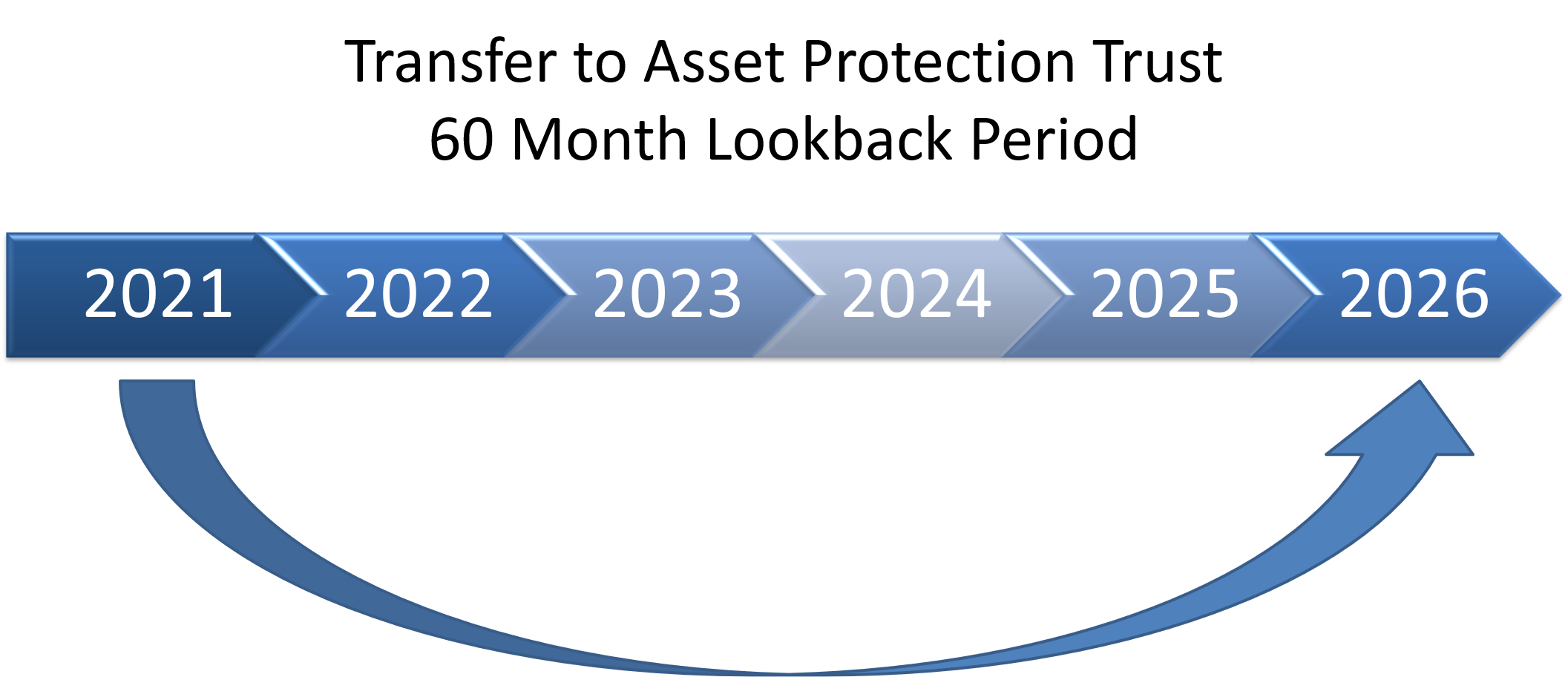

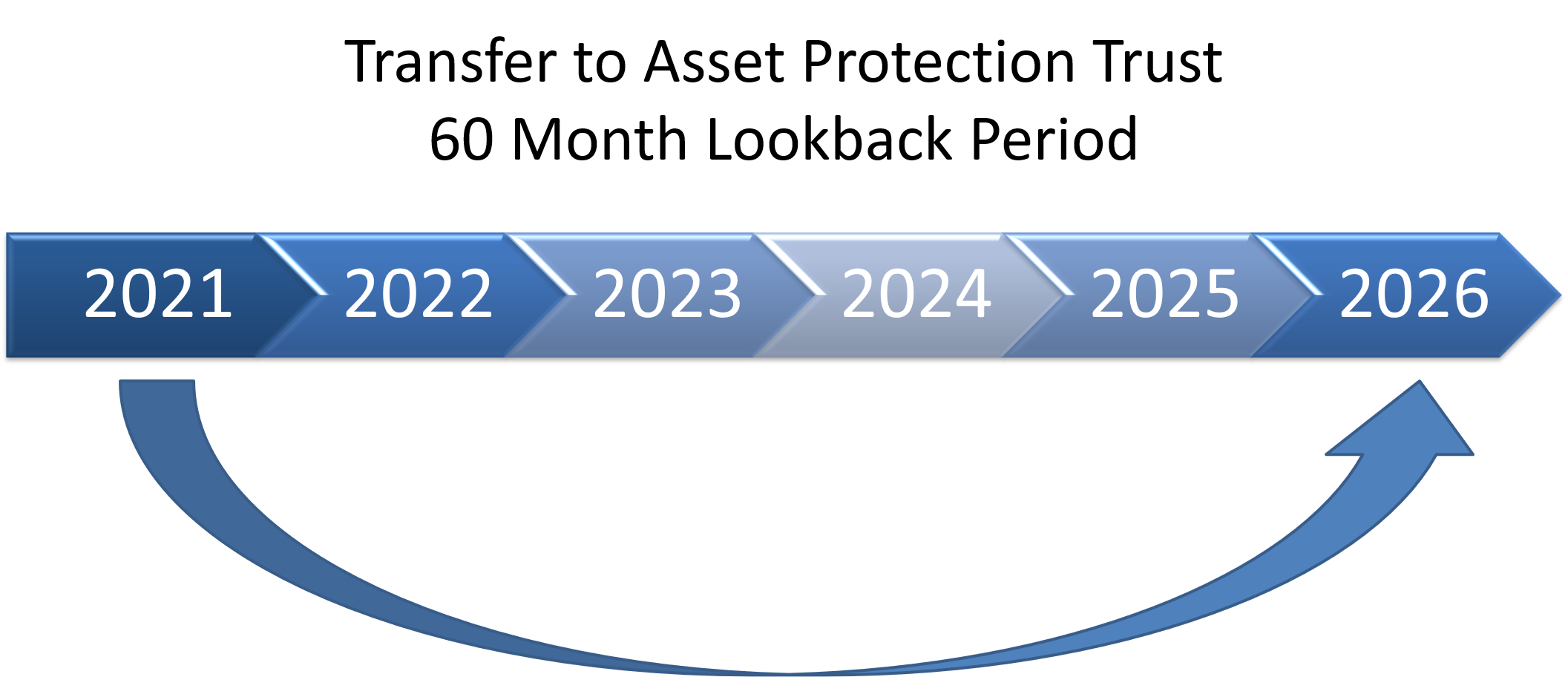

Annual Gift Tax Exclusion Vs Medicaid Look Back Period Cornetet Meyer Rush Stapleton

Historical Estate Tax Exemption Amounts And Tax Rates 2022