How Does Retirement Annuity Reduce Tax

Taxpayers can save for retirement by contributing to a pension, provident or retirement annuity fund (or even a combination of these). Taxpayers won’t owe taxes on contributions and earnings until they withdraw money or receive income payments.

Taxation Of Annuities Ameriprise Financial

The tax on the lumpsum can be reduced if you do not take the full 1/3.

How does retirement annuity reduce tax. Even for those investors with $4 million in. When you purchase an annuity, you’re purchasing an insurance contract. The lower your cost of living in retirement, the less income you will need to cover your costs.

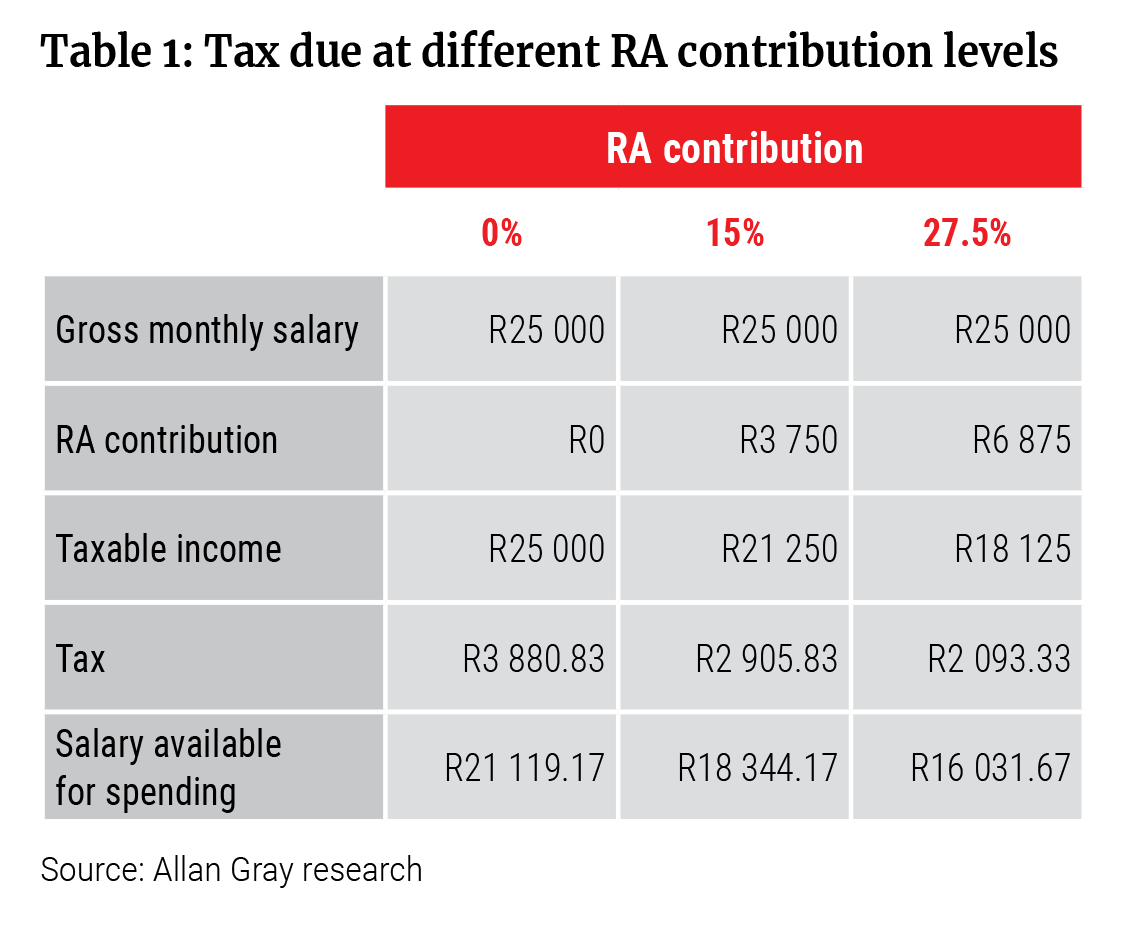

These taxpayers will enjoy a tax benefit whereby their contributions will qualify for a tax deduction of up to 27.5% of the greater of their taxable income or remuneration (limited to r350 000 per year). As indicated above, the two thirds of the retirement interest from a pension, pension preservation or retirement annuity fund is received in the form of an annuity (a regular pension). This may be preferable for some people.

In the wake of the tax cuts and jobs act, this. For example, single taxpayers with income over $25,000 must pay. However, when you invest in an ra you cannot access your money until you leave the fund any time after you reach 55 years of age.

When you start putting money away for retirement, you might be thinking of the tax benefits or consequences you'll incur. But you should also have an understanding of how your taxes in retirement will affect your savings and your future income.here are seven tips to help you restructure your payment strategies to optimize your tax results in the areas of social security,. However, investing in a retirement annuity (ra) now is not only a great way to save for the longer term, but it can also substantially reduce your tax liability for the current tax year and beyond.

If, at retirement, you still have carried forward contributions, then your excess contributions can be used to decrease the tax you may need to pay on any cash lump sum you take out, or to reduce the taxable portion of your living annuity income in retirement. Ten strategies to pay less tax in retirement (not an exhaustive list and. This article will discuss ten strategies to reduce taxes if approaching retirement or already retired.

So if you contribute, say r12,000 per year, and your marginal tax. To calculate your retirement annuity tax relief, you must multiply the amount of your contribution by your marginal tax rate (the highest tax rate applied to any part of your income). Each distribution from a traditional ira annuity is fully taxable.

In the top example within the table, the annuity payment has no effect on the tax due as the overall income is still below the personal allowance. However, your 15% contribution to an ra (0.15 x 500 000 = 75 000) reduces your taxable income from r500 000 to r425 000. If you contribute more than the limits, your excess contributions can be used to decrease the tax you may need to pay on any cash lump sum you take before, or at retirement age, or to reduce the taxable portion of your living annuity income in retirement.

This means that you use more of the value of your investment to buy an annuity, and you get less cash out. As a result, you need to pay income tax of only 71,069.50, not r95,655. Less income equals less tax.

You pay premiums to the annuity company and the annuity company then makes payments to you beginning at a later date. However, in the bottom example, the annuity income pushes the total income into the higher rate band by £10,000 creating an additional £4,000 tax liability (40%). Part of your contributions come from tax savings, which means that the south african revenue service (sars) is actually paying a part of your retirement savings.

You save tax your retirement annuity contributions reduce your taxable income up to certain limits: Using the sars tax tables and current primary rebate of r15 714, we calculate that you would have paid income tax of r106 725 if you didn’t contribute any amounts to a retirement fund. Managing your income by using the right mix of investments and annuities in retirement could help you trim your retirement tax rate to under 10%.

If the income from your annuity exceeds the tax threshold, tax is payable on the amount. A retirement annuity (ra) is also tax free, and in addition, any investments you make into an ra are tax deductible (within certain limits), which means that they reduce your taxable income for the year. Annuities can provide you with a guaranteed stream of income in retirement.

If you receive pension or annuity payments before age 59½, you may be subject to an additional 10% tax on early distributions, unless the distribution qualifies for an exception. Consider an annuity to avoid rmd taxes. Another big tax advantage is that the growth on your investment is tax free.

Your additional 15% contribution to an ra (0.15 x 500 000 = 75 000) reduces your taxable income from r450,000 to r375,000.

Annuity Annuity Retirement Cheating

How Do Annuities Work - Wealthfit Annuity Annuity Retirement Saving For Retirement

Retirement Annuities Is The Tax Refund Worth It - Sanlam Intelligence - Retail

Pin By Lauren Kaligo On Money In 2021 Investment Advisor Trust Tax Deductions

Retirement Annuities Is The Tax Refund Worth It

Allan Gray Part 3 How To Maximise Tax Benefits Before The End Of The Tax Year

Retirement Annuities Is The Tax Refund Worth It - Sanlam Intelligence - Retail

Annuity Taxation How Various Annuities Are Taxed

Retirement Calculator Spreadsheet

The Continuum Ii Blog Canadian Income Tax Preparation Checklist Tax Preparation Income Tax Preparation Income Tax

Retirement Annuities Is The Tax Refund Worth It

Tax Deferral How Do Tax-deferred Products Work

Retirement Annuities Is The Tax Refund Worth It - Sanlam Intelligence - Retail

Retirement Annuity Ra Or Tax-free Savings Account Tfsa Which Is Better - Sanlam Intelligence - Retail

Tax-free Savings Account Vs Retirement Annuity Which Is Better

Section 162 Executive Bonus Plan And Its Benefits Life Insurance Policy Permanent Life Insurance How To Plan

Retirement Annuities Is The Tax Refund Worth It - Sanlam Intelligence - Retail

Tax-free Savings Account Vs Retirement Annuity Which Is Better

Retirement Annuities Is The Tax Refund Worth It