Nj Tax Sale Certificate Redemption

Once a lien has been placed on a parcel, the only person(s) able to redeem that lien are: Sales subject to current taxes;

How To Buy Tax Liens In New Jersey

If the tax lien certificate is redeemed by the delinquent property owner prior to foreclosure, the tax lien certificate earns a redemption penalty at the rate of 2, 4, or 6 percent, depending on the amount of the original tax lien certificate, in addition to any interest rate on the certificate.

Nj tax sale certificate redemption. Their interest in the tax sale certificate, it should be recorded in the deed room at the county clerk’s office within 90 days of the sale. In new jersey, the length of the redemption period depends on whether a third party bought the lien at the sale and whether the home is vacant. Nj tax sale certificate redemption.

Title practice, §101.17 (4th ed. If the certificate is redeemed by the property owner prior to foreclosure, the certificate earns a redemption penalty at the rate of 2, 4, or 6 percent, depending on the amount of the original tax sale certificate, in addition to any interest at the rate bid. And may only redeem until the right to redeem has been cut off.

Bidders have the option to pay these subsequent taxes; Buyers appear at the tax sale and purchase the tax sale certificates by paying the back taxes to the municipality. Once a lien has been placed on a parcel, the only person(s) able to redeem that lien are:

New jersey is a good state for tax lien certificate sales. Foreclosure on certain tax sale certificates § 54:5. They include the owners, trustees for the owners, heirs of the owners holder of any prior tax sale certificates, mortgagees and any legal occupant.

18% or more depending on penalties. A tax foreclosure sale is subject to redemption. Redeeming tax sale certificates redemption:

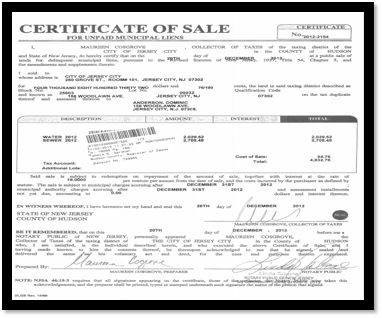

The municipality will issue a tax sale certificate to the purchaser, who then must pay the real estate taxes for a minimum of 2 consecutive years as a condition precedent to filing suit to foreclose the lien. The redemption of tax sale certificates is governed by n.j.s.a. Taxes continue to accrue on the property after the sale of the certificate.

Redemption is made at the office of the tax collector unless otherwise directed. New jersey property tax sale certificates and foreclosures. Redeeming tax sale certificates redemption:

If redemption is made after the filing of the complaint, redemption is made as to the subject parcel only, presuming that notice was filed in the tax collector’s office, and is subject to the fixing of fees and costs. If the certificate is redeemed by the property owner prior to foreclosure, the certificate earns a redemption penalty at the rate of 2, 4, or 6 percent, depending on the amount of the original tax. The owner, his/her heirs, the holder of a prior open tax certificate, mortgage holder, or legal

The owner, his/her heirs, the holder of a prior open tax certificate, mortgage holder, or legal occupant of property; A certificate of redemption, issued by a tax authority, attests that all of the late taxes and fees on a property have been paid in full. Once a lien has been placed on a parcel, the only person(s) able to redeem that lien are:

In new jersey, every municipality is required by law to hold sales of unpaid property taxes at least once each year. The owner, his/her heirs, the holder of a prior open tax certificate, mortgage holder, or legal occupant of property; 2016) discusses issues relating to the redemption of tscs.

The municipalities sell the tax liens to obtain the tax revenue which they should have been paid by the property owner. The process was made more complex as a result of the decisions of the new jersey supreme court in simon v. Purchasers of tax sale certificates, liens;

This certificate is the legal document that relieves the. Redemption is governed by statute, •only certain enumerated persons with interests in a property may redeem the tax sale certificate. According to new jersey law, on tax lien certificate greater than $200, a penalty of 2% is added to the tax lien certificate, tax.

Except as hereinafter provided, the owner, his heirs, holder of any prior outstanding tax i/en certificate, mortgagee, or occupant of land sold for municipal taxes; If they are not paid, a tax sale certificate will be sold at the next tax sale. Upon completion of the sale, a certificate of tax sale is issued to the purchaser.

New jersey tax sale certificate foreclosure taxes less time than a new jersey bank foreclosure unlike a foreclosure sale held by a county sheriff when the property is sold and the sheriff issues a deed, these nj tax certificate auctions are based on people bidding on the interest rate to be charged on the tax lien that will be placed on a home. The winning bidder must wait two years after the tax lien sale before filing a complaint in court to foreclose. If the certificate is not redeemed within two years from the date of the tax sale, the certificate holder can file an in personam foreclosure action to bar the right of redemption.

The fill in cover sheet form is available at this link: Sale of certificate of tax sale, liens by municipality. If the certificate is redeemed by the property owner prior to foreclosure, the certificate earns a redemption penalty at the rate of 2, 4, or 6 percent, depending on the amount of the original tax sale certificate, in addition to any interest at the rate bid.

If the certificate is redeemed by the property owner prior to foreclosure, the certificate earns a redemption penalty at the rate of 2, 4, or 6 percent, depending on the amount of the original tax sale certificate, in addition to any interest at the rate bid. Tax liens are also referred to as tax sale certificates. Foreclosure, right of redemption, recording of final judgment;

Name of the tax collector. Tax lien certificates in new jersey nj. A cover sheet (or electronic synopsis).

If a bid made at the tax sale meets the legal requirements of the tax sale law, the municipality must either sell the lien or outbid the bidder. The property owner has a limited amount of time to pay or “redeem” the tax sale certificate. Here is a summary of information for tax sales in new jersey.

According to new jersey law, on tax lien. Redemption period if someone bought the tax lien. Tax sale certificate redemption •redemption:

Redemption of tax sale certificates [“tscs”] can present difficulties for buyers and sellers, as well as for their attorneys and title companies.

Millvillenjgov

Woodlandtownshiporg

Capemaycountynjgov

Rockawaytownshiporg

Njcourtsgov

Montvillenjorg

Njlegstatenjus

Rockawaytownshiporg

Ringwoodnjnet

Njlmorg

Beachhaven-njgov

Keiona R Miller - North Plainfield

Lafayettetwporg

Middletownshipcom

Otc Tax Liens How We Made 6 In Less Than 120 Days With Tax Liens

Newprovorg

New Jersey Tax Sale Certificate Foreclosure - Pscb Law - New York And New Jersey Lawyers - New Jersey Foreclosure Defense

Cranfordnjorg

Historicflemingtoncom