Tn Franchise And Excise Tax Return

The minimum franchise tax payable each year is $100. If a business’ liquidation starts and ends on the same.

Franchise Excise Tax Workshop - Youtube

Schedule e (partnership) schedule e (s corporation) schedule e (estate or trust) select the applicable activity name or number.

Tn franchise and excise tax return. The franchise tax is based on the greater of the entity’s net worth or the book value of certain fixed assets, plus an imputed value of rented property. Tennessee department of revenue attention: The tennessee franchise, excise tax return.

The franchise tax is 0.25% of the greater of the corporation’s or llc’s net worth or the value of the real property and tangible personal property owned in tennessee for each tax year. The franchise tax rate is 25 cents per $100, or major fraction thereof, applied to the greater of a taxpayer’s net worth or the book value o f property owned or used in tennessee at the close of the tax year covered by the required return. The franchise tax on a final return is computed using either the book value of assets or net worth immediately preceding liquidation or the average monthly values of net worth or assets, depending on how the business actually liquidated.

A tntap logon should be created to. Select tennessee smllc franchise, excise tax return from the left navigation menu. All franchise and excise returns and associated payments must be submitted electronically.

The excise tax is based on net earnings or income for the tax year. If you have questions about franchise and excise tax online, contact. The franchise tax is a privilege tax imposed on entities for the privilege of doing business in tennessee.

The excise tax is 6.5% of the net earnings of the corporation or llc generated from business transaction in tennessee for each tax year. Quarterly franchise, excise tax declaration: Schedule e (rental) schedule f/form 4835;

Net taxable income starts with federal taxable income and certain adjustments are applied to arrive at net taxable income for tennessee purposes. The minimum franchise tax of $100 is payable if you are incorporated, domesticated, qualified, or otherwise registered through the secretary of state to do business in tennessee,. This can be accomplished by using the tennessee taxpayer access point (tntap).

When you have completed all of pages on the return, select the “submit” button. Select the applicable form (ctrl+t) from dropdown menu: Franchise and excise tax annual exemption renewal :

To close a franchise and excise tax account: Select the file now link for the current franchise and excise return. From that starting point adjustments are made to arrive at tennessee taxable income.

Go to screen 54, taxes. These entities that are subject to the franchise or excise tax must file their own separate franchise and excise tax return. Amounts, including irc section 179 and contributions passed through to shareholder partners, shown in the line 5 enter any brownfield property credit available per tenn.

General partnerships not seeking llc protection and single member llcs with corporate owners are not required to file separate tennessee tax. Franchise and excise tax return kit: The minimum tax is $100.

The excise tax is 6.5% of the net taxable income. Taxpayer services 500 deaderick street nashville, tennessee 37242 phone: Select yes to “is this a final return for termination or withdrawal?” file your final return for termination or withdrawal.

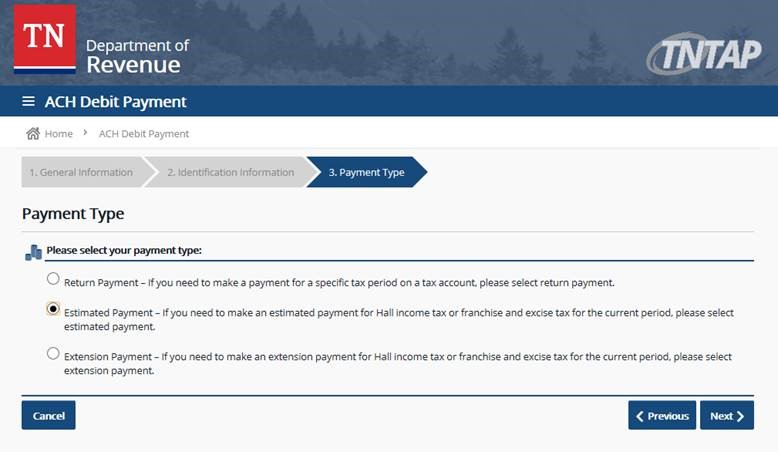

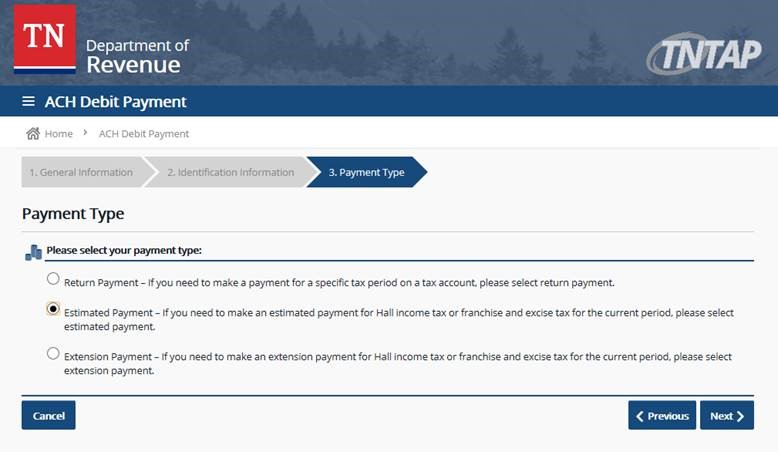

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

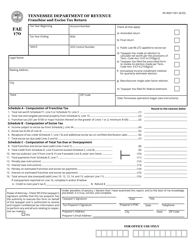

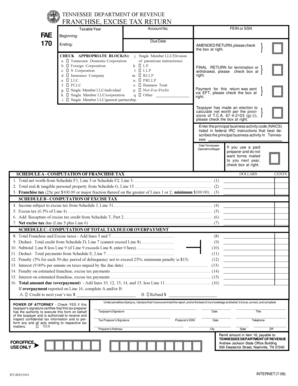

Form Fae170 Rv-r0011001 Download Printable Pdf Or Fill Online Franchise And Excise Tax Return Tennessee Templateroller

How To Make Your Tn Estimated Franchise And Excise Payments Via Tntap Blackburn Childers Steagall Cpas

Form Fae170 Rv-r0011001 Download Printable Pdf Or Fill Online Franchise And Excise Tax Return Tennessee Templateroller

Form Fae-170 Franchise And Excise Tax Return Kit

Franchise And Excise Guide - Tennessee - Free Download Pdf

Fillable Online Tn Tennessee Department Of Revenue Application For Extension Of Time To File Franchise Excise Tax Return Fae 173 Taxable Year Account No - Tn Fax Email Print - Pdffiller

Tngov

Franchise Excise Tax Workshop - Filing And Paying Requirements - Youtube

Fae170 - Fill Online Printable Fillable Blank Pdffiller

Tngov

Tngov

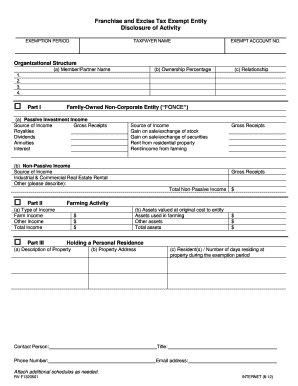

Tennessee Franchise And Excise Tax Exemption - Fill Online Printable Fillable Blank Pdffiller

State Extends Tax Deadlines For Businesses News Wsmvcom

Free Form Fae 170 Franchise And Excise Tax Return Kit - Free Legal Forms - Lawscom

Form Fae-170 Franchise And Excise Tax Return Kit

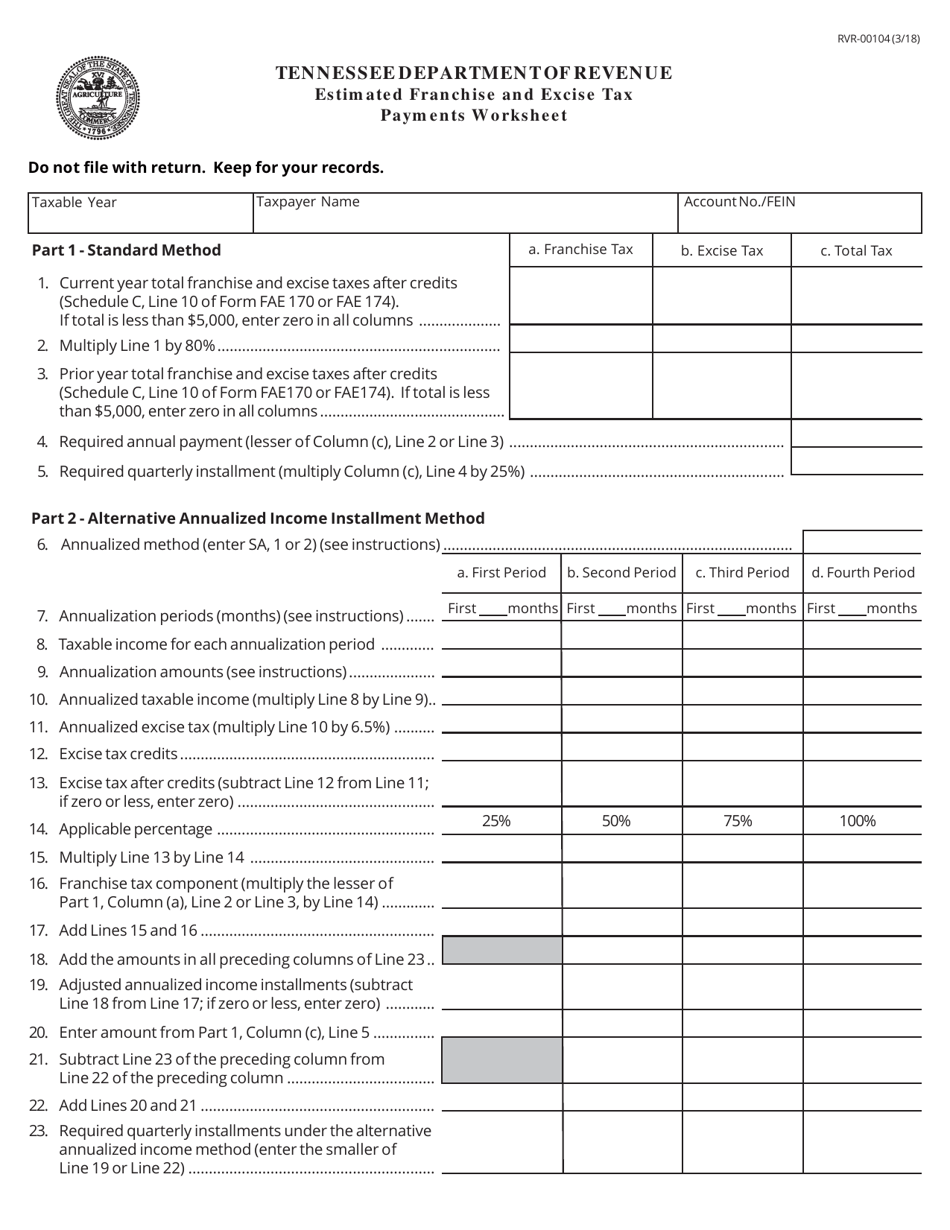

Form Rvr-00104 Download Printable Pdf Or Fill Online Estimated Franchise And Excise Tax Payments Worksheet Tennessee Templateroller

Fae 170 - Fill Out And Sign Printable Pdf Template Signnow

Tngov