Carried Interest Tax Loophole

May 21, 2021, 9:59 am edt Ending the carried interest loophole act

Beyond The Carried Interest Tax Loophole Occasional Links Commentary

Another reason that carried interest is at the center of debates is because of how it's taxed.

Carried interest tax loophole. Ending the carried interest loophole act If you hear the phrase carried interest loophole, you could think it allows someone to pay taxes on earned interest at a later date, like a 401k plan. Hema parmar, melissa karsh, and.

Because it's not classified as ordinary income, general partners have to pay far less tax than they normally would. In summary, the carried interest fairness act of 2021 would seek to tax all carried interest allocations at ordinary rates regardless of the character of income determined at the partnership level, and only for taxpayers with taxable income exceeding $400,000. The proposed ending the carried interest loophole act (s.

According to the tax policy center, carried interest, income flowing to the general partner of a private investment fund, often is treated as capital gains for the purposes of taxation. This same loophole also fuels other predatory investing strategies that originate with private equity and real estate developers. 11 fleischer, supra note 9, at 5.

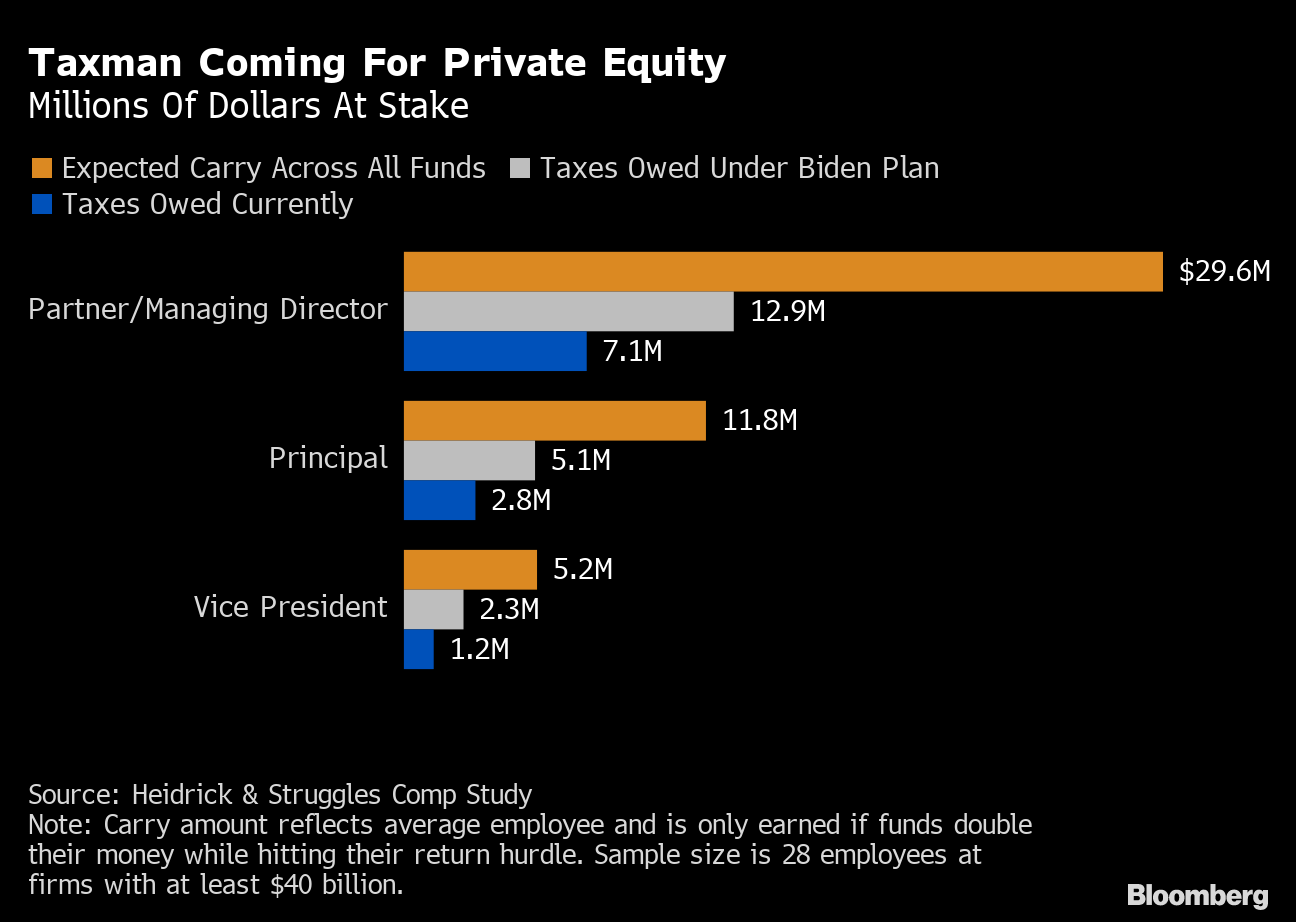

Others argue that it is consistent with the tax treatment of other entrepreneurial income. This allows wealthy private equity, real estate, and hedge fund managers to claim the fees they receive for their services as capital gains, which are taxed at a rate of just 23.8 percent, instead of the top marginal income tax rate of 37 percent. Eye on a tax loophole, n.y.

Treasury said on thursday it will close an unintended loophole created by the republican tax overhaul that let some wall street financial. Private equity fumes over higher taxes and threat to end billionaires' loophole by. “under current law, the fund manager’s carried interest is taxed as income from the partnership, which allows the deferral of tax payments until.

Which is the fairest payfor of them all? 10, 2009, at b1) (internal quotation marks omitted). Ending the carried interest loophole act

The carried interest tax loophole is an income tax avoidance scheme that allows private equity and hedge fund executives — some of the richest people in the world — to substantially lower the amount they pay in taxes. All of these types of investment firms have been accused of victimizing the public, evading their tax obligations, and benefitting from a preferential tax treatment buttressed by spending millions on. Carried interest in funds with an average investment holding period of less than 40 months will be taxed as trading income at 45% and, where capital gains tax treatment is still available, all carried interest returns are taxed at a minimum special capital gains tax rate of 28%, without any allowance for the acquisition cost of the underlying.

Others argue that it is consistent with the tax treatment of other entrepreneurial income. In summary, the carried interest fairness act of 2021 would seek to tax all carried interest allocations at ordinary rates regardless of the character of income determined at the partnership level, and only for taxpayers with taxable income exceeding $400,000. Carried interest, income flowing to the general partner of a private investment fund, often is treated as capital gains for the purposes of taxation.

The prospect for trillions of dollars in new federal spending in fy 22 and a consensus that the spending should be paid for — by taxes, not by borrowing and adding debt — put a premium on payfors, provisions to raise up to $3.5 trillion in revenue. Update 551 — carried interest loophole: For instance, say a hedge fund invested in bonds.

1639) would treat the grant of carried interest to a general partner as a loan from the limited partners made at a preferred interest rate. Carried interest allows hedge funds to evade their tax obligations. This creates a controversy that carried interest is a tax loophole.

Carried interest has long been the center of debate in the u.s., with many politicians arguing that it is a “loophole” that allows private equity investments to avoid being taxed at a. Carried interest is a rule in the tax code that lets the managers of some types of private investment funds—hedge, private equity, venture capital, real estate and other types of vehicles—pay. The bill proposes interest rates above the

In summary, the carried interest fairness act of 2021 would seek to tax all carried interest allocations at ordinary rates regardless of the character of income determined at the partnership level, and only for taxpayers with taxable income exceeding $400,000. The carried interest loophole allows private equity barons to claim large parts of their compensation for services as investment.

The Commander In Chief Has Again Voiced His Displeasure With The Carried Interest Tax Provision Which Allows Invaded Poland Philip Iv Of France Private Equity

Wells Maine Outdoor Structures Outdoor Decor Outdoor

Treasury To Issue Carried Interest Regulations Closing Perceived S Corporation Loophole - Butler Snow

Carried Interest Tax Private Equity Billionaires Angry Over Closing Loophole - Bloomberg

Loopholes 101 - Carried Interest Loophole - Patriotic Millionaires University

A Recap Of The Final Carried Interest Regulations For Asset Managers

Carried Interest Tax Proposals What You Need To Know Private Funds Cfo

Debunking Fiscal Myths There Is No Loophole For Carried Interest

Why Carried Interest Matters

Carried Interest Calculation Tax Loophole Understanding Pe Vc - Youtube

How Does Carried Interest Work - Napkin Finance

Pin On Buildings

All Strange And Wonderful How To Plan Tax Haven Bernie

Pin On Typography

How Does Carried Interest Work - Napkin Finance

Biden Proposal Would Close Longtime Real-estate Tax Loophole The Wall Street Journal In 2021 Real Estate Estate Tax Estates

What Were Seeing Is A Risk-off Flight To Boring Safe Assets Fund Bad Timing Risk

Loopholes 101 - Carried Interest Loophole - Patriotic Millionaires University

Ending Carried Interest Benefit Is One Tax Policy Trump And Clinton Agree On