New Mexico Gross Receipts Tax Due Date

The tax is due on the 25th day of the month following the month of production unless otherwise authorized by the department. On april 4, 2019, new mexico gov.

Online Services Taxation And Revenue New Mexico

Small business sales tax holiday, saturday, november 28, 2020.

New mexico gross receipts tax due date. Retailers that maintain their primary place of business in new mexico and employ no more than 10 employees at any one time do not have to charge customers gross receipts tax on. Read more do you accept electronic fund transfers for fiduciary returns? The gross receipts tax filer's kit.

The gross receipts tax rate varies statewide from the state base of 5.125 percent to 8.8125 percent; New mexico sales tax may also be levied at the city/county/school/transportation and spd (special purpose district) levels. The grt filer's kit, published twice a year, is the main source of information about reporting and paying gross receipts tax.

Tear at perforation and return bottom portion only to: As we previously reported, the new mexico taxation and revenue department announced that withholding tax returns normally due on the 25th of march, april, may and june 2020 are due on july 25, 2020. New mexico taxation and revenue department generally, the postmark date determines if filing is timely.

It varies because the total rate combines rates imposed by the state, counties, and, if applicable, municipalities where the businesses are located. The state’s portion of the gross receipts tax is determined by state law. Michelle lujan grisham signed house bill (h.b.) 6, enacting major changes in the state's corporate income tax and gross receipts tax (grt) regimes.

Changes only occur once a year, usually in july. Michelle lujan grisham recently signed into law a bill that waives penalties and interest on late payments in a variety of tax programs, including income taxes,. If this date falls on a weekend or holiday, returns and payments will be considered timely if made by the following business day.

Latest news hearing thursday on new gross receipts tax regulations Supreme court decision in south dakota v. Due date extended due date ;

Filing statuses for gross receipts tax and their due dates are: Anything over 5.125 percent represents local option rates imposed by counties and municipalities. Gross receipts location code and tax rate map.

The changes to the grt came primarily in response to the u.s. The combined rates vary from the state rate of 5.125% up to 8.8675% in some areas. Below, we've grouped new mexico gross receipts tax filing due dates by filing frequency for your convenience.

25th of month following end of report period. The gross receipts tax rate varies throughout the state from 5.125% to 9.4375%. How to register for a gross receipts tax permit in new mexico.

Your new mexico state gross receipt tax returns and payments are due on the 25 th of the month following the close of the period in question. Just now the new mexico trd requires all gross receipts tax filing to be completed by the 25th day of the month following the tax period. After registering, the business will be issued a combined reporting system (crs) number, sometimes known as a new mexico tax identification number.

For monthly gross receipts tax filers, gross receipts tax returns due august 25 will be the first gross receipts tax report using the new sourcing rules. County commissioners govern a county’s. Nm taxation and revenue department p.o.

Please consult local authorities where appropriate to confirm grt location codes and tax rates. New mexico sales & use tax guide avalara.

Home Taxation And Revenue New Mexico

2

2

5 Free Income Statement Examples And Templates Income Statement Statement Template Income

2

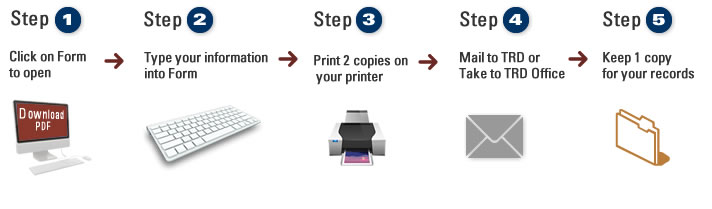

Fill Print Go Taxation And Revenue New Mexico

2

Islamic Republic Of Afghanistan Request For A 42-month Arrangement Under The Extended Credit Facilitypress Release Staff Report And Statement By The Executive Director For The Islamic Republic Of Afghanistan In Imf Staff

A Guide To New Mexicos Tax System New Mexico Voices For Children

2

Islamic Republic Of Afghanistan Request For A 42-month Arrangement Under The Extended Credit Facilitypress Release Staff Report And Statement By The Executive Director For The Islamic Republic Of Afghanistan In Imf Staff

Banking Privilege Ocbc Nisp

Banking Privilege Ocbc Nisp

A Guide To New Mexicos Tax System New Mexico Voices For Children

What Is Gross Receipts Tax Overview States With Grt More

Haiti 2019 Article Iv Consultationpress Release Staff Report And Statement By The Executive Director For Haiti In Imf Staff Country Reports Volume 2020 Issue 121 2020

News Alerts Taxation And Revenue New Mexico

Banking Privilege Ocbc Nisp

New Mexico Sales Tax - Taxjar