Mississippi Income Tax Rate

Mississippi has a population of over 2 million (2019) and is known as the catfish capital of the united states. In general, mississippi businesses are subject to.

Mississippi Income Tax Calculator - Smartasset

Mississippi’s individual income tax rate schedule (tax year 2021, all filers) 3% > $4,000 4% > $5,000 5% > $10,000 source:

Mississippi income tax rate. The tax brackets are the same for all filing statuses. Employees who earn more than $10,000 a year will hit the top bracket. Mississippi governor tate reeves (r), in his budget proposal for fiscal year (fy) 2022, has announced his goal of phasing out the state’s income tax by 2030.

Compare your take home after tax and estimate your tax return online, great for single filers, married filing jointly, head of household and widower Mississippi's maximum marginal corporate income tax rate is the 3rd lowest in the united states, ranking directly below north dakota's 5.200%. These rates are the same for individuals and businesses.

There are just three income tax brackets, and the tax rates range from 3% to 5%. 5% on all taxable income over $10,000. These income tax brackets and rates apply to mississippi taxable income earned january 1, 2020 through december 31, 2020.

Mississippi has three marginal tax brackets, ranging from 3% (the lowest mississippi tax bracket) to 5% (the highest mississippi tax bracket). If filing a combined return (both spouses work), each spouse can calculate their tax liability separately and add the results. 1 in 10 mississippians had illegal contaminants in drinking water since 2018.

Mississippi state income tax forms for tax year 2021 (jan. Find your pretax deductions, including 401k, flexible account contributions. 3% on the next $3,000 of taxable income.

4% on the next $5,000 of taxable income. There is no tax schedule for mississippi income taxes. How to calculate 2021 mississippi state income tax by using state income tax table.

Currently, the corporate income tax rates are 3 percent for the first $5,000, 4 percent for the next $5,000, and 5 percent on anything beyond $10,000. Mississippi salary tax calculator for the tax year 2021/22. 3% on the next $2,000 of taxable income.

Compare your take home after tax and estimate your tax return online, great for single filers, married filing jointly, head of household and widower Our calculator has recently been updated to include both the latest federal tax rates, along with the latest state tax rates. Mississippi fiscal year starts from july 01 the year before to june 30 the current year.

The graduated income tax rate is: Below are forms for prior tax years starting with 2020. Under house bill 1439, in tax year 2022, the personal exemption would increase to $47,700 for single filers, $95,400 for joint filers, and $46,600 for head of family filers.

0% on the first $2,000 of taxable income. The mississippi tax rate and tax brackets are unchanged from last year. 4% on the next $5,000 of taxable income.

Check the 2021 mississippi state tax rate and the rules to calculate state income tax. You are able to use our mississippi state tax calculator to calculate your total tax costs in the tax year 2021/22. 2021 mississippi tax tables with 2022 federal income tax rates, medicare rate, fica and supporting tax and withholdings calculator.

Because the income threshold for the top bracket is quite low ($10,000), most taxpayers will pay the top rate for the majority of their income. 5% on all taxable income over $10,000. Each marginal rate only applies to earnings within the applicable marginal tax bracket, which.

The mississippi single filing status tax brackets are shown in the table below. Mississippi’s state income tax is fairly straightforward. Other things to know about mississippi state taxes the state also collects taxes on cigarettes and.

Mississippi’s income tax currently has three marginal rates of 3 percent, 4 percent, and 5 percent. Our calculator has been specially developed. Details on how to only prepare and print a mississippi 2021 tax return.

Mississippi's sales tax rate consists of a state tax (7 percent) and local tax (0.07 percent). Mississippi collects a state corporate income tax at a maximum marginal tax rate of 5.000%, spread across three tax brackets. Mississippi has a graduated tax rate.

This means that these brackets applied to all income earned in 2013, and the tax return that uses these tax rates was due in april 2014. 0% on the first $3,000 of taxable income. The median household income is $43,529 (2017).

2020 mississippi tax tables with 2022 federal income tax rates, medicare rate, fica and supporting tax and withholdings calculator. The graduated income tax rate is: The mississippi corporate tax rate is changing.

Mississippi's income tax brackets were last changed four years ago for tax year 2016, and the tax rates have not been changed since at least 2001. The income tax in the magnolia state is based on four tax brackets, with rates of 0%, 3%, 4% and 5%.

South Carolinas Uncompetitive Income Tax The South Carolina Policy Council

Mississippians Have Among The Highest Tax Burdens - Mississippi Center For Public Policy

Mississippi Tax Rate Hr Block

Strengthening Mississippis Income Tax Hope Policy Institute

Wheres My State Refund Track Your Refund In Every State

Mississippi State Income Tax Ms Tax Calculator Community Tax

Mississippi Tax Rate Hr Block

Mississippi Income Tax Calculator - Smartasset

Mississippi State Tax Hr Block

Mississippi Income Tax Brackets 2020

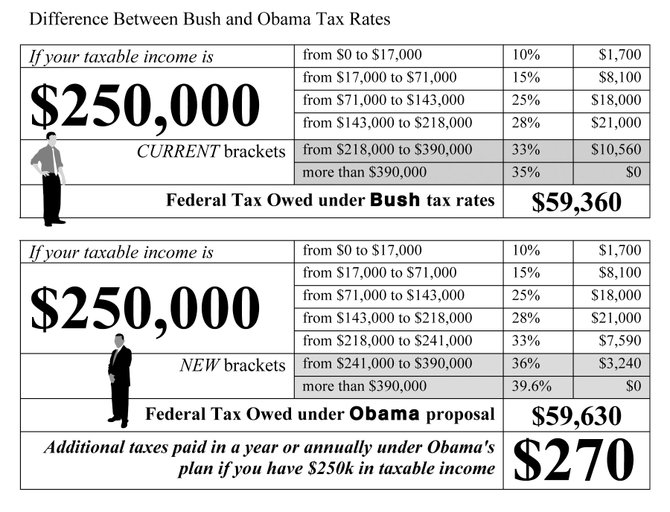

Taxes Obama Vs Bush Rates Jackson Free Press Jackson Ms

2

25 Percent Corporate Income Tax Rate Details Analysis

Historical Mississippi Tax Policy Information - Ballotpedia

Mississippi Sales Tax - Small Business Guide Truic

Eliminating The State Income Tax Would Wreak Havoc On Mississippi Itep

Its All About The Context A Closer Look At Arkansass Income Tax Arkansas Advocates For Children And Families Aacf

Mississippi Tax Forms And Instructions For 2020 Form 80-105

Mississippi Who Pays 6th Edition Itep