Iowa Inheritance Tax Return Instructions

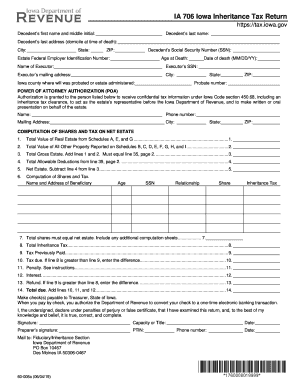

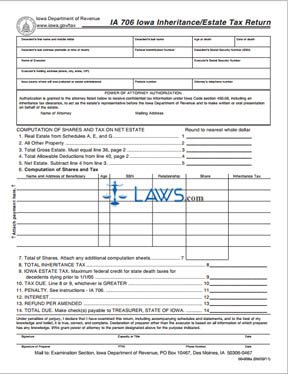

Enter the executor's name, social security number, mailing address, the iowa county where the will was probated or the estate. Failure to file on time will trigger interest to accrue on the payment along with fines.

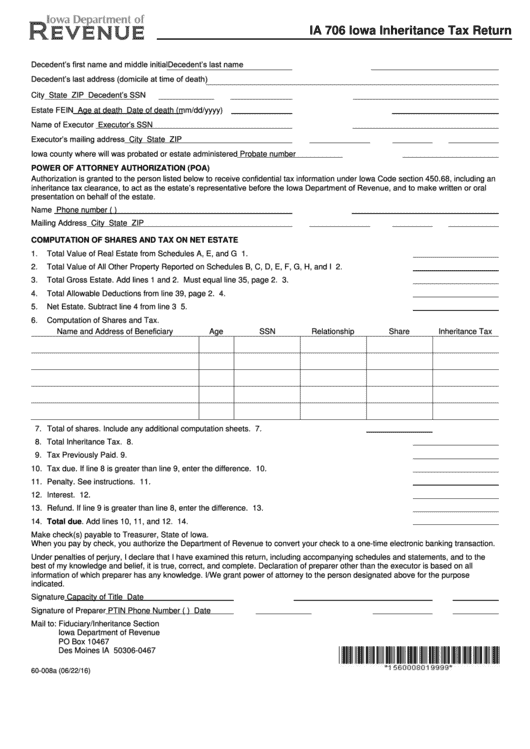

2020 Form Ia Dor 706 Fill Online Printable Fillable Blank - Pdffiller

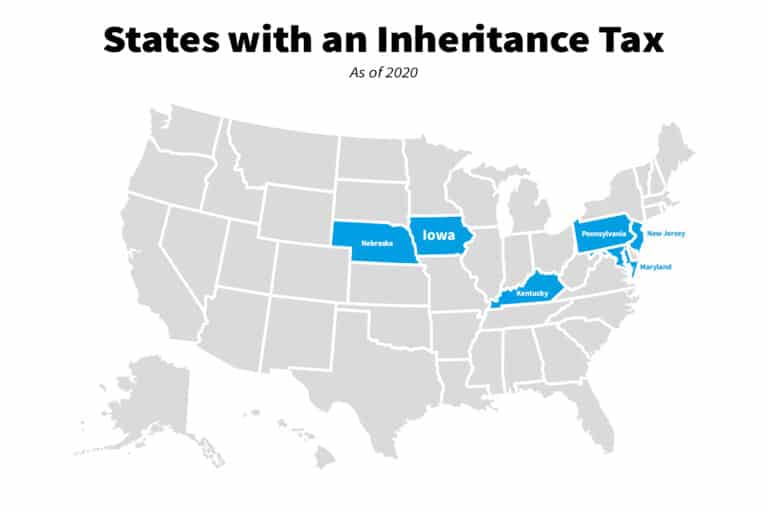

For instance, iowa’s inheritance tax does not apply if the estate is valued at $25,000 or less.

Iowa inheritance tax return instructions. Those individuals that die on or after january 1, 2021 also receive some. Iowa inheritance/estate tax return ia 706 step 1: But that looks to be coming to an end.

It is phased in with reductions for the first few years, but on january 1, 2025 the iowa inheritance tax will be fully repealed, assuming governor reynolds signs the bill (sf619). Authorization is granted to the person listed below to receive confidential tax information under iowa code section 450.68, including an inheritance tax clearance, to act as the estate’s representative before the iowa department of revenue, and to make written or oral presentation on behalf of the estate. The good news in light of all this tax talk is that iowa’s inheritance tax only applies in certain situations.

Iowa inheritance tax rates inheritance ia 706 general instructions for iowa inheritance tax return inheritance Enter the decedent's name, date of death, age at the time, their address at the time of death, and federal identification and social security numbers. Completing the authorization on page 2 will authorize the attorney to represent the estate and receive confidential information.

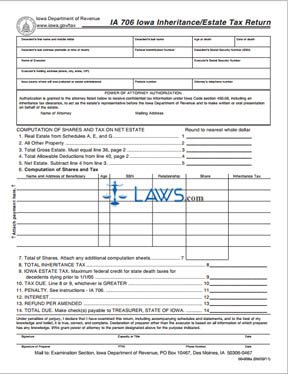

Name of attorney mailing address www.iowa.gov/tax iowa department of revenue 7. The tax return is due nine months from the date of death, unless the state department of revenue. Iowa.gov/tax ia 706 iowa inheritance/estate tax return decedent s first name and middle initial decedent s last name age at death federal identification number decedent s social security number ssn name of executor date of death executor s.

Iowa inheritance/estate tax return ia 706 step 1: Iowa inheritance/estate tax return (form ia 706) to pay inheritance and estate tax in the state of iowa, file a form ia 706. Inheritance tax clearance, to act as the estate’s representative before the iowa department of revenue and to make written or oral presentation on behalf of the estate.

An iowa inheritance tax return must be filed if estate assets pass to both an individual listed in iowa code section 4509. Even if no tax is due, a return may still be required to be filed. This terminates an automatic inheritance tax lien on property in the estate.

If the net estate of the decedent, found on line 5 of ia 706, is less than $25,000, the tax is zero. Iowa department of revenue www. Ia 706 iowa inheritance tax return keywords iowa, income, tax, alternate, tax, 2007 created date:

Read more about probate form (for use by iowa probate attorneys only) print. This document is found on the website of the government of iowa. Once the return is received the iowa department of revenue will issue an inheritance tax clearance, which terminates the automatic inheritance tax lien on the property in the estate.

The iowa legislature recently passed a bill to repeal the iowa inheritance tax. The tax return, along with copies of the deceased person's will, trust, and federal estate tax return (if any), must be filed with the iowa department of revenue. Not every iowan who passes away will render their heirs subject to more taxes.

An iowa inheritance tax return must be filed for an estate when the gross share, subject to tax without reduction for liabilities, of any beneficiary, heir, transferee, or surviving joint tenant exceeds the allowable exemption from General instructions for iowa inheritance tax return (ia 706) who must file? Authorization is granted to the attorney listed below to receive confidential tax information under iowa code section 450.68, including an inheritance tax clearance, to act as the estate’s representative before the iowa department of revenue and to make written or oral presentation on behalf of the estate.

(1) if an inheritance tax return is not required because the estate meets the criteria in paragraph 86.2(1)c, the final report (beginning with iowa code section 633469. Enter the decedent's name, date of death, age at the time, their address at the time of death, and federal. Instructions for iowa inheritance tax return (ia 706)

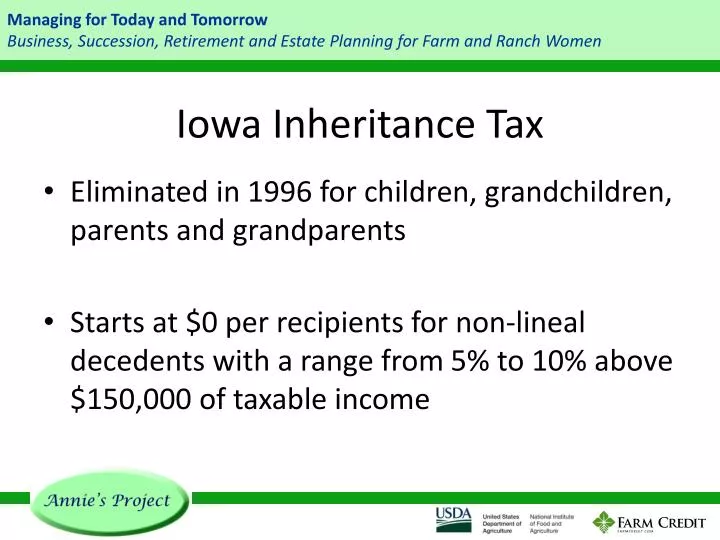

Iowa inheritance tax basics • spouses, children, grandchildren, parents and grandparents — all “lineal” descendants and ascendants, pay no state tax on an inheritance, no matter the size.[1] • if the net value of an estate is less than $25,000, there also is no tax.[1] • for others, inheritance rates vary. Therefore, signnow offers a separate application for mobiles working on android. Iowa inheritance/estate tax return ia 706 step 2:

Appraisals of certain assets may also be required. Tax return must be filed and tax paid by the last day of the ninth month after the death of the life tenant.

The Inheritance Tax In Iowa - How To File

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It - Njcom

2

Iowa Tax Forms And Instructions For 2020 Ia 1040

2

Iowa Inheritance Tax Law Explained

Senate Panel Votes To End Iowa Inheritance Tax Iowa Public Radio

Iowa 706 Schedule J - Fill Online Printable Fillable Blank Pdffiller

The Inheritance Tax In Iowa - How To File

The Inheritance Tax In Iowa - How To File

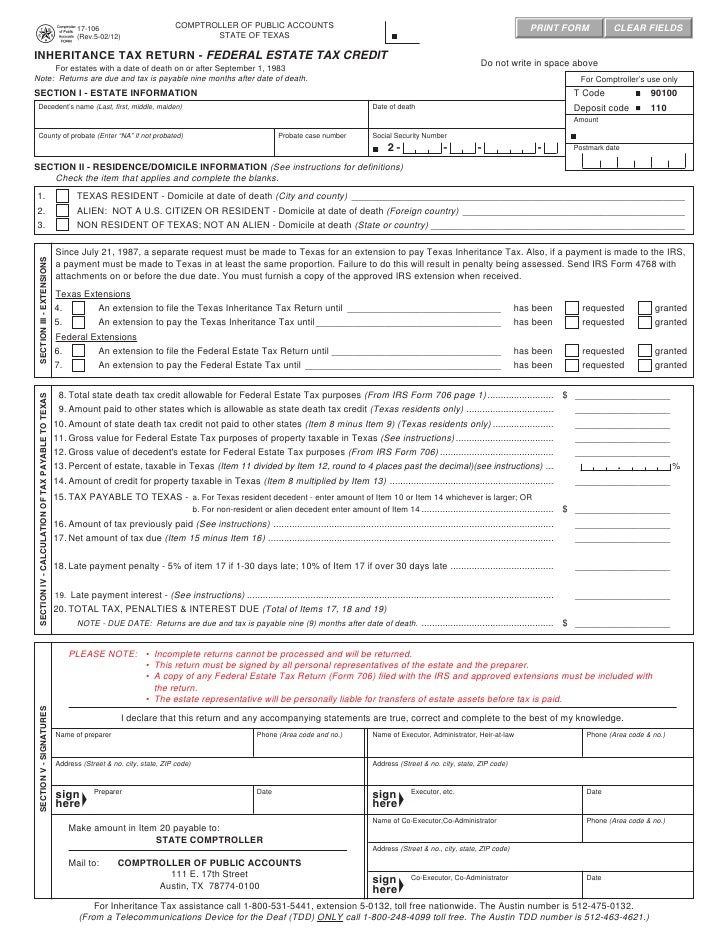

Texas Inheritance Tax Forms-17-106 Return -- Federal Estate Tax Credi

Fillable Online Iowa Inheritance Tax Rates Fax Email Print - Pdffiller

Free Form Ia 706 Iowa Inheritance Estate Tax Return - Free Legal Forms - Lawscom

Zillionformscom

Can Deathbed Instructions Amend A Trust - Beattymillerpccom

2

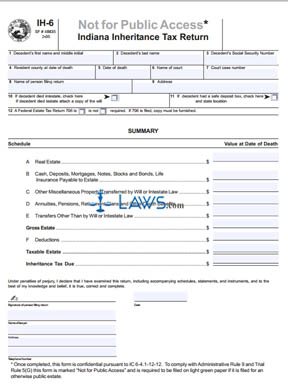

Free Form Ih-6 Indiana Inheritance Tax Return - Free Legal Forms - Lawscom

Ppt - Iowa Inheritance Tax Powerpoint Presentation Free Download - Id2926639

Texas Inheritance Tax Forms-17-110 Generation-skipping Transfer Tax R