South San Francisco Sales Tax Rate 2021

The minimum combined 2021 sales tax rate for south san francisco, california is. Proposition e was approved by san francisco voters on november 6, 2012.

Which Cities And States Have The Highest Sales Tax Rates - Taxjar

How 2021 sales taxes are calculated in south san francisco.

South san francisco sales tax rate 2021. South woodbridge, ca sales tax rate: Build the online store that you've always dreamed of. Depending on the zipcode, the sales tax rate of south san francisco may vary from 6.5% to 9.75%.

Therefore, there is no change to the tax rate. The current transient occupancy tax rate is 14%. Set to go into effect on jan.

South shore, ca sales tax rate: This is the total of state, county and city sales tax rates. Proposition f will complete the city’s transition from a payroll expense tax to a gross receipts tax, a decision initially approved by the voters in 2012 (proposition e).

South whittier, ca sales tax rate: This is the total of state, county and city sales tax rates. The hike came after voters passed two 0.5 percent tax hikes in 2020:

Ad with secure payments and simple shipping you can convert more users & earn more!. The current total local sales tax rate in south san francisco, ca is 9.875%. The california sales tax rate is 6.5%, the sales tax rates in cities may differ from 6.5% to 11.375%.

Homeowner, no child care, taxes not considered: The south san francisco, california sales tax is 9.25%, consisting of 6.00% california state sales tax and 3.25% south san francisco local sales taxes.the local sales tax consists of a 0.25% county sales tax, a 0.50% city sales tax and a 2.50% special district sales tax (used to fund transportation districts, local attractions, etc). The local sales tax rate in south san francisco, california is 9.875% as of november 2021.

The san francisco sales tax rate is 0%. South san jose hills, ca sales tax rate: The december 2020 total local sales tax rate was 9.750%.

As we all know, there are different sales tax rates from state to city to your area, and everything combined is the required tax rate. Method to calculate south san francisco sales tax in 2021. Every 2021 combined rates mentioned above are the results of california state rate (6%), the county rate (0.25%), the.

City of south san francisco: The south san francisco sales tax rate is %. 3 the city approved a new 0.50 percent tax (srtu) consolidating the two existing 0.25 percent taxes (srgf and satg) by repealing these taxes and replacing them with a new 0.50 percent tax.

Find out what's happening in alameda with. The california sales tax rate is currently 6%. The average sales tax rate in california is 8.551%.

South san francisco, ca sales tax rate: Information and tax returns for the collection of transient occupancy tax and conference center tax in south san francisco is available below. The south san francisco, california, general sales tax rate is 6%.

The minimum combined sales tax rate for san francisco, california is 8.5%. The county sales tax rate is %. The county sales tax rate is 0.25%.

South san francisco, ca sales tax rate. Boost your business with wix! South san gabriel, ca sales tax rate:

The tax rate here is now 10.75 percent. Proposition f was approved by san francisco voters on november 2, 2020 and became effective january 1, 2021. South pasadena, ca sales tax rate:

The california sales tax rate is currently %. Tax returns are required monthly for all hotels and motels operating in the city. South taft, ca sales tax rate:

Measure c in march and measure w in november.

States With Highest And Lowest Sales Tax Rates

San Francisco Bay Area Apartment Rental Report Managecasa

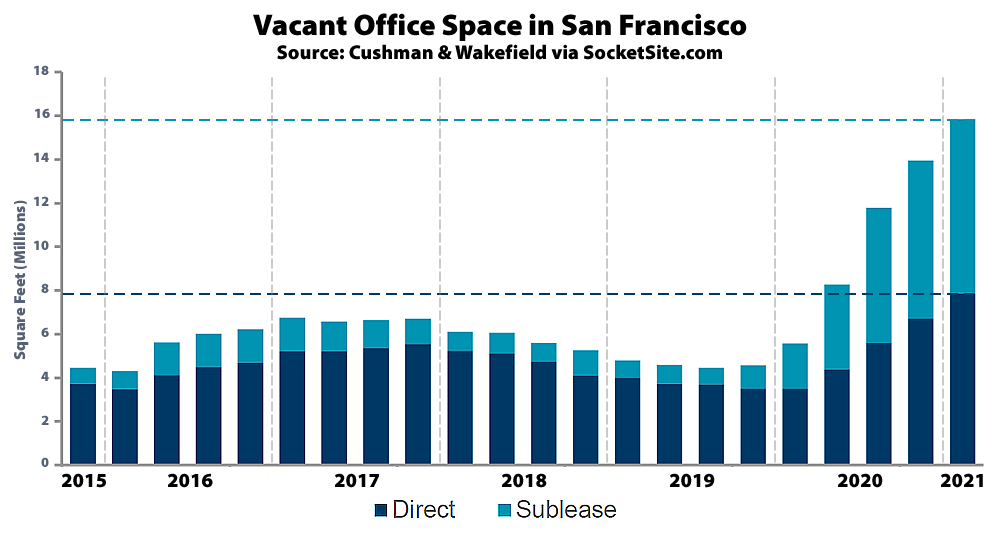

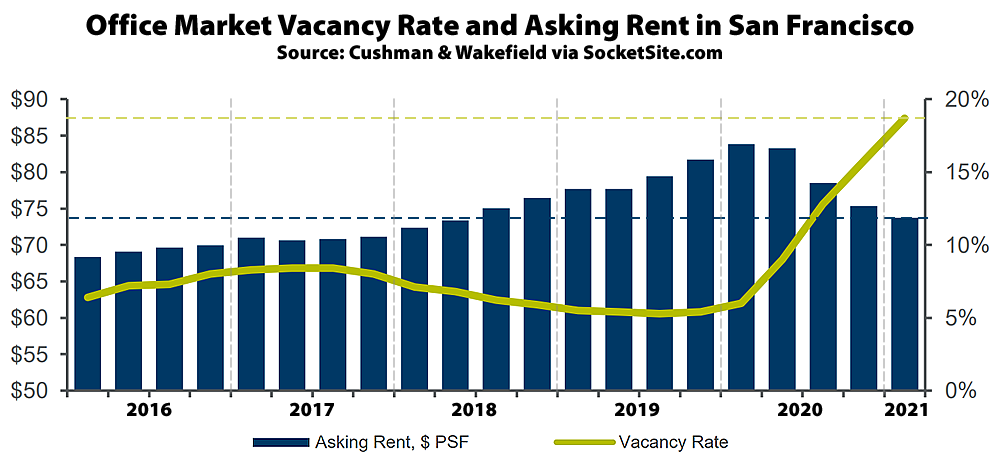

Office Vacancy Rate Continues To Climb In San Francisco

Pdf Evaluating Saudi Arabias 50 Carbonated Drink Excise Tax Changes In Prices And Volume Sales

Transfer Tax In San Mateo County California Who Pays What

Car Rentals In South San Francisco From 39day - Search For Rental Cars On Kayak

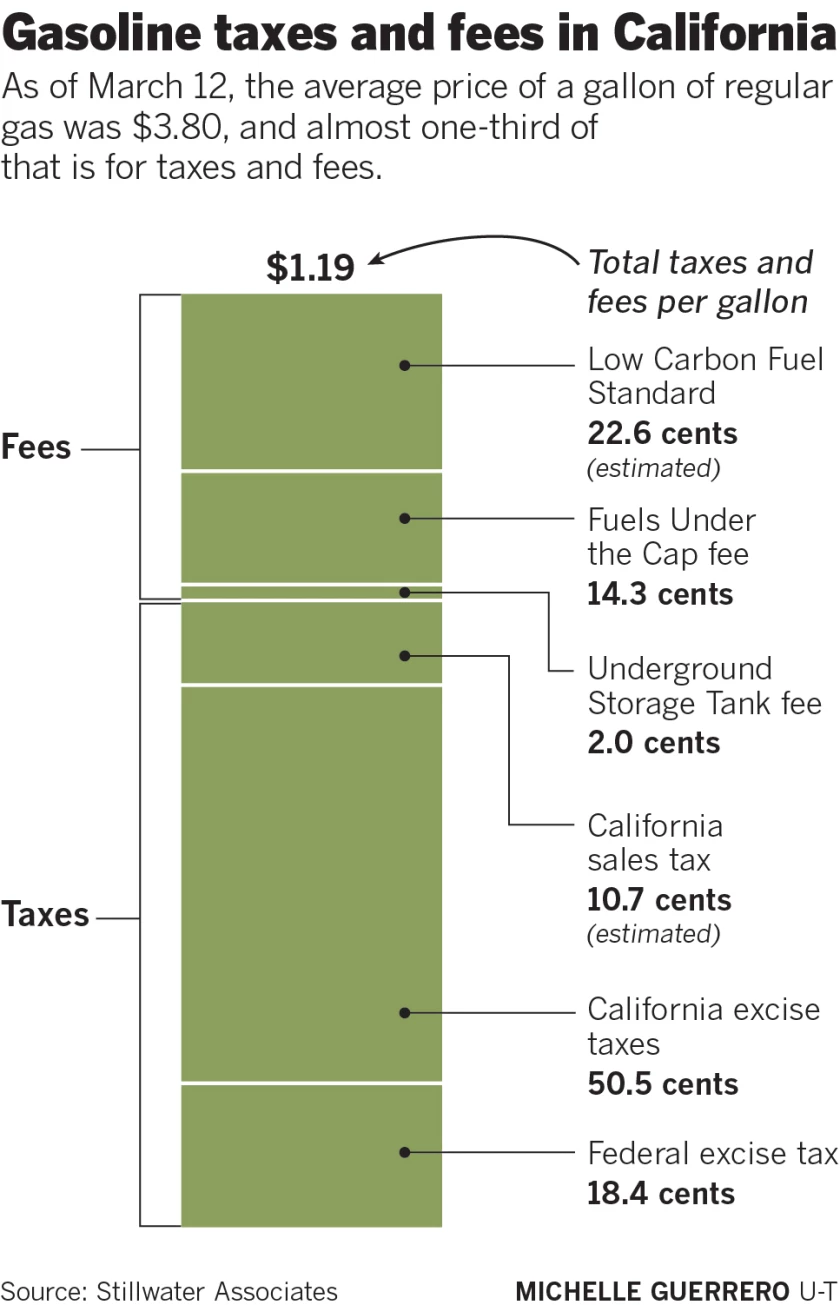

How Much Are You Paying In Taxes And Fees For Gasoline In California - The San Diego Union-tribune

Office Vacancy Rate Continues To Climb In San Francisco

States With Highest And Lowest Sales Tax Rates

Sales Tax Rates Rise Up To 1075 In Alameda County Highest In California Cbs San Francisco

California Sales Tax Rates By City County 2021

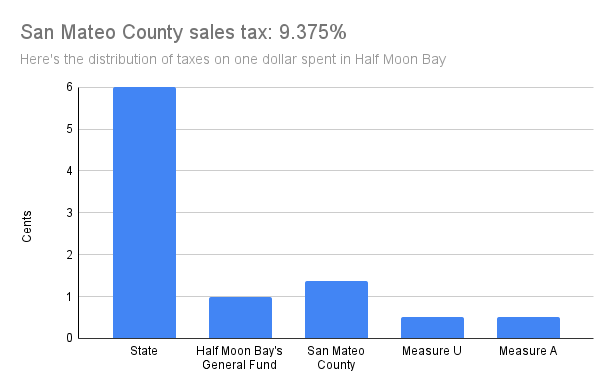

County Begins Collecting Higher Sales Tax Local News Stories Hmbreviewcom

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

California Housing Market Continues To Normalize As Home Sales And Prices Curb In July Car Reports

South San Francisco California Ca 94080 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

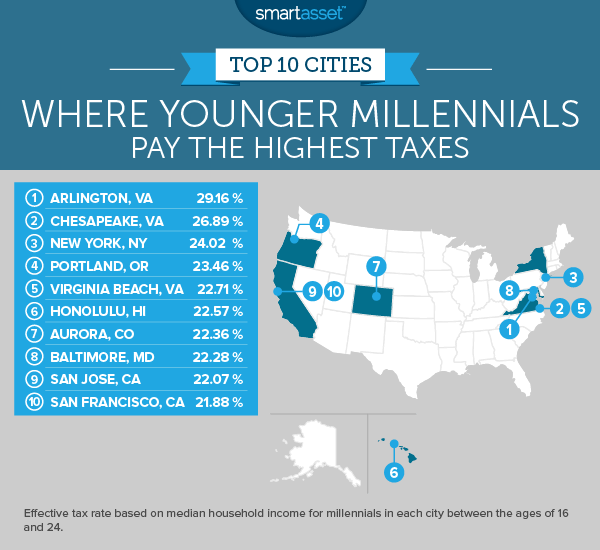

Where Millennials Pay The Highest Taxes - 2017 Edition - Smartasset

Frequently Asked Questions City Of Redwood City

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Finance Department City Of South San Francisco