National Tax Services Pakistan

National numbering plan structure leading digit number of digits for subscriber number geographic area/ services ndc sn area/service 0 1 digit national/international direct dialling 01 8 digits mobile services 02 8 digits geographic numbers (sind & baluchistan provinces) This applies to both export and import shipments.

National Tax Services - Home Facebook

National tax number is the abbreviation of ntn.

National tax services pakistan. It can help taxpayers during business transactions and for opening of bank accounts. Pakistan's service sector accounts for about 61.7% of gdp. Having an ntn is really beneficial.

In case of individuals, 13 digits computerized national identity card (cnic) will be used as ntn or registration number. The us and pakistan have a tax treaty that can offer taxpayers additional benefits. Below is a summary of the applicable sales tax rates in pakistan:

Ntn is so indispensable to continue and complete your applied work or any documentation. Every taxpayer and filer in pakistan should have an ntn number. Service industries limited (sil) is a public limited company listed on the stock exchanges of pakistan.

Khyber pakhtunkhwa (kpk) sales tax on services: Baluchistan sales tax on services: Ntn number (national tax number) is a unique code issued by fbr (federal board of revenue) to identify someone’s business or he/she is paying tax to the government.

Overall length of national significant number is ten digits. It has annual revenues of about pkr 24 billion. Contact us and we will guide you.

Preparing tax returns is always a hassle. Effective and efficient tax services provide competitive advantage by lowering the tax and administrative costs yet keeping your business compliant with the tax laws. Sales tax on services is an indirect tax, so collected from the person receiving the.

For filing tax return of individuals and companies, an. In general, payments made on account of dividend, interest, royalty, and fee for technical services income derived from pakistan sources are subject to a 15% withholding tax (wht), which tax has to be withheld/deducted from the gross amount paid to the recipient. National tax services is one the leading tax services provider in pakistan.

Transport, storage, communications, finance, and insurance account for 24% of this sector, and wholesale and retail trade about 30%. Orion world law provide the taxation legal services of the according to the national tax service pakistan. Check ntn verification national tax number.

Or you can also enter your cnic number too, without using any dashes. 67,554 likes · 28,732 talking about this. Even the corporate and business executives require an ntn to file their income tax returns.

Tax function role has gone miles ahead from managing and optimizing an organization’s tax impact and as tax advisor to managing the global tax exposure and as business advisor. The user will be redirected to the atl verification page. Islamabad capital territory (tax on.

Encase you face any difficulties, please contact your customer service representative at maersk on uan: But you must file a tax return with the internal revenue service to qualify for these benefits. Sindh sales tax on services:

To use the online verification services via tax asaan app first click on the active taxpayer list tab. Pntn is a number allocated by the government of punjab to a person/aop /company, involved in providing taxable service listed in the second schedule of the punjab sales tax act, 2012 from his office or place of business in punjab in the course of economic activity. Ntn is also known as income tax registration number in pakistan.

National tax services is one the leading tax services provider in pakistan. When someone wants to verify online his business he uses the online ntn verification number and to complete the requirements you will have to enter your cnic number on the fbr website link. We can help you with all treaty benefits.

Enter the registration number i.e. Punjab sales tax on services: 69,238 likes · 547 talking about this.

Fbr ntn verification national tax number. It is just like a business identity card that authorities use to confirm the business registration with fbr. The national highway authority (nha) was created, in 1991, through an act of the parliment, for planning, development, operation, repair and maintenance of national highways and.

Any special equipment including but not limited to 45'hc, flat racks, open tops and reefers cannot be taken outside pakistan on merchant haulage.

Qi0dgiw7f9lsxm

Pin On Business News Ppn

Quy Djinh Moi Ve Thue Dja Co Cac Huong Dan Truoc Khi Thuc Hien Tax Services Income Tax Tax Preparation

National Tax Services - Home Facebook

National Tax Services - Home Facebook

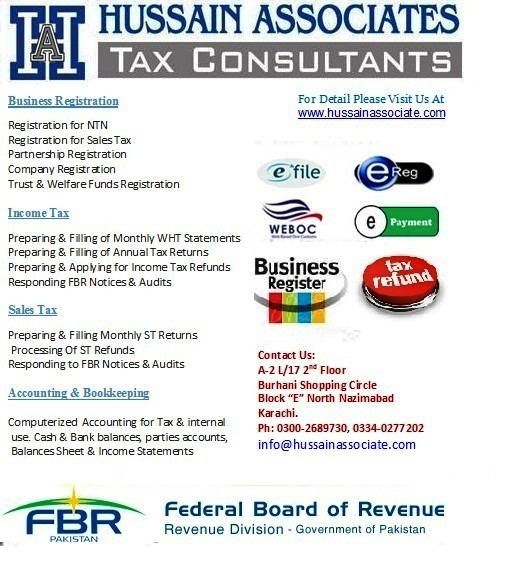

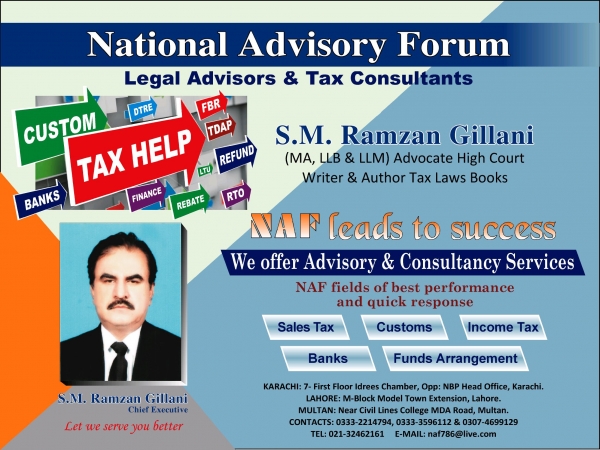

Best Tax Consultants In Karachi Pakistan - List Of Tax Consultants Pakistan

National Tax Services - Home Facebook

Online Ntn Verification In Pakistan Strn Inquiry Tax Asaan App More Zameen Blog

Top Tax Consultants In Lahore Pakistan Global Tax Consultants Tax Return Tax Software Tax Preparation

Befiler Has Set Up A Free Tax Assistance And Filing Help Desk At Luckyone Mall On The Mezzanine Floor Near Carrefour Thi Filing Taxes Free Tax Filing Tax Free

Learn How You Can Become Eligible For A Tax Refund Use Befiler Tax Facts To Get Your Numbers Right Tax Refund Filing Taxes Tax Services

National Tax Services - Home Facebook

Do Not Miss This Last Opportunity To File Your Income Tax Return Before The Final Deadline Of Dec 31 19 Reaches Only _ D Income Tax Filing Taxes Tax Services

National Tax Services - Home Facebook

Befiler Tax Calculator Provides An Easy Way To Have Access To Tax Calculations Gearup Taxcalculations Befiler Onlin Filing Taxes Tax Services Income Tax

Befiler - Income Tax Filing Ntn Registration Tax Services

Best Tax Consultants In Karachi Pakistan - List Of Tax Consultants Pakistan

Learn How You Can Become Eligible For A Tax Refund Use Befiler Tax Facts To Get Your Numbers Right Tax Refund Filing Taxes Tax Services

National Tax Services - Home Facebook