Maryland Digital Advertising Tax

However, this tax is limited to advertisements “that use personal information about the people the ads are being served to.” • the tax rate ranges from 2.5% to 10% and applies to the taxpayer’s global annual gross revenue from digital advertising services in maryland.

Local Search Engine Optimization Is Important For Small Businesses Local Seo Services Seo Services Seo Marketing

Digital advertising revenues sourced to maryland of $1 million or more.

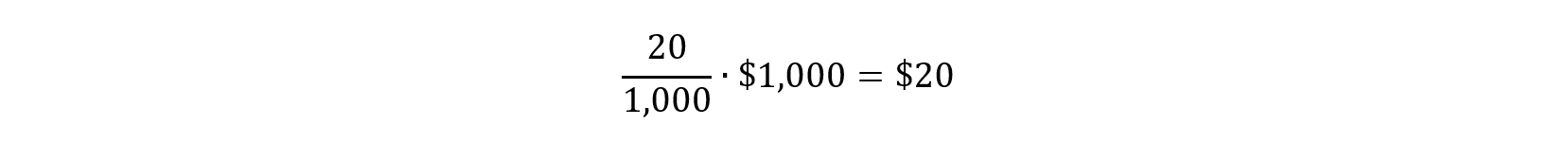

Maryland digital advertising tax. You have, let's say $1 billion of global revenue, which is the same as your maryland digital advertising. Companies that make more than $100 million in global gross revenues annually would pay a 2.5 percent tax on annual revenues from digital advertising in maryland. The digital advertising provisions of maryland's new tax law could raise an estimated $250 million in its first year, with revenues being earmarked for.

On 12 february 2021, the maryland legislature overrode maryland governor larry hogan's veto (pdf) of legislation that imposes a new tax on digital advertising.the new tax had been approved by the state’s legislature in early 2020 but, rather than signing hb 732 into law, governor hogan rejected the bill, noting that it would “be unconscionable” to raise taxes and. The new tax had been approved by the state’s legislature in early 2020 but, rather than signing hb 732 into law, governor hogan rejected the bill, noting that it would “be unconscionable” to raise taxes and. At that date, the sales and use tax rate on a sale of a digital product or a digital code is 6%.

The maryland digital advertising tax, applied to gross revenue derived from digital advertising services, has a rate escalating from 2.5 percent to 10 percent of the advertising platform’s assessable base based on its annual gross revenues from all sources (i.e., not just digital advertising, and not just in maryland). In practice, the law imposes a sliding scale tax on the money that a company makes from the sale of digital ads that are displayed to the citizens of maryland. That's 2.5% times $1 billion.

The maryland general assembly enacted two new taxes on digital commerce on february 12, 2021 after the state’s senate overrode the governor’s veto of the legislation. On 12 february 2021, the maryland legislature overrode maryland governor larry hogan's veto of legislation (hb 732) that imposes a new tax on digital advertising. Per the maryland administrative procedure act, the final adopted regulations will go into effect in 10 calendar days, or december 13, 2021.

The statutory references contained in this publication are not effective until march 14, 2021. The 10% digital advertising gross revenues tax (h.b. The tax foundation also notes the tax “would fall substantially on maryland companies advertising to maryland residents.” yet barring an injunction, maryland’s digital advertising tax is scheduled to take effect 30 days after the override vote, or march 14, 2021.

Maryland comptroller published notice of its adoption of the digital advertising gross revenues tax regulations which was originally proposed on october 8, 2021. Effective march 14, 2021, the maryland sales and use tax applies to the sale or use of a digital product or a digital code. The maryland general assembly on april 12, 2021, passed senate bill 787—legislation that revises two digital services tax laws enacted earlier this year.

On december 3, 2021, the maryland comptroller published notice of its adoption of the digital advertising gross revenues tax regulations (which was originally proposed on october 8, 2021). 732) will be imposed on annual gross revenues derived from digital advertising services in maryland. As expected, the maryland law that created an online advertising tax is facing.

The tax is 2.5% for businesses that make between $100 million and $1 billion in global revenue, and that rate goes up to 5% for companies with revenue of $1 billion or more. The rate of tax is determined based on the person’s global annual gross revenues. Taxation of digital advertising services.

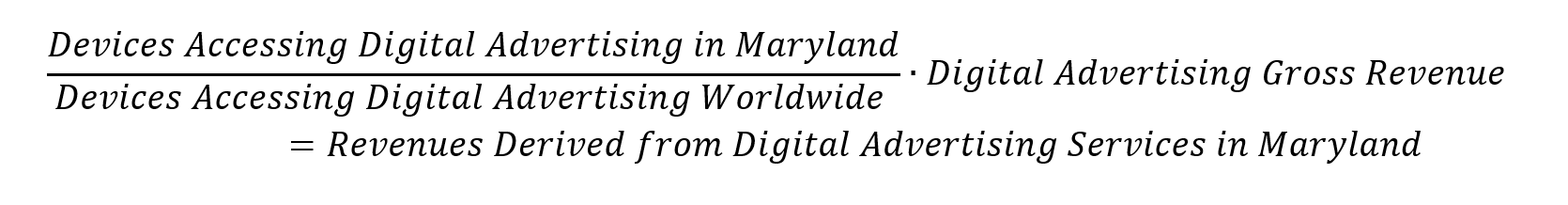

Maryland’s digital advertising law imposes a tax on a percentage of revenues that advertising platforms with over $100 million in annual global revenue earn from digital ads that are served in maryland. A civil case against maryland’s digital advertising gross revenues tax (hb 732) was brought by a coalition including u.s. • in order to be subject to the tax a taxpayer must have $100,000,000 in global annual gross revenue and $1,000,000 of maryland annual gross revenue from digital advertising services in maryland.

It's a gross receipts tax that applies to companies with global annual gross revenues of at least $100 million and with digital ad revenue. The tax would be $25 million. Maryland’s digital ad tax under pressure from big tech.

For persons with global annual gross revenues of $100 million through $1 billion,. The new tax will apply to companies that make. The bill is pending action by the governor (who has 30 days to sign, veto or allow the bill to become law without his action).

As passed, the digital advertising tax would levy a tiered assessment based on a company’s annual digital advertising revenue in maryland and its global gross revenues.

Menuju Banjarmasin Smart City Finance How To Plan Commercial Property

Digital Marketing Property Pemasaran Digital Pemasaran Marketing

Holding Company Website Design Holding Service Website Design Corporate Website Design Website Design Services

Join Nicole Mulazim Every Wednesday For Her Financial Opportunity Seminar For More Information Email Mula7247gma Financial Health Seminar Financial Education

Good Lyfe Digital Services Digital Media Marketing Marketing Words Digital Marketing

Success With Google Shopping Part 2 Merchant Center - Httpalldigitoolscomindexphp2018091 Digital Marketing Services Instagram Ads Marketing Services

Digital Marketing Training In Bangalore Digital Marketing Digital Marketing Training Marketing

Maryland Digital Advertising Tax Regulations 3 Issues With The Proposals

Avail Affordable Digital Printing Services At Dmc Busa Printers And Get Your Brand Recognized To Colorful Wallpaper Abstract Wallpaper Graphic Design Resources

Distribution Channels Content Marketing Digital Marketing Marketing

Youll Never Guess Where Female Entrepreneurship Is On The Rise Infographic Innovation And Entrepreneurship Social Media Infographic Women Entrepreneurship

Maryland Digital Advertising Tax Regulations 3 Issues With The Proposals

Maryland Amends Its Digital Advertising Gross Revenues Tax Creating Additional Constitutional Infirmities - Salt Savvy

Shahin220626 I Will Post Classified Ads In Usa High Pr Sites For 5 On Fiverrcom In 2020 Digital Marketing Services Editing Writing Book Design Layout

Pin On Html Website Templates 2021

Find The Best Global Talent Instagram Campaigns Facebook Marketing Tools Instagram Ad Campaigns

Product Catalog - Internet Marketing Tools And Training Productcatalog Pr Market Digital Marketing Training Digital Marketing Best Digital Marketing Company

Facebook Unfriends Australia And Maryland Passes Ad Tax Mondays Daily Brief In 2021 Growth Marketing Advertising Services Seo Content

Maryland Digital Advertising Tax Regulations 3 Issues With The Proposals