Oregon 529 Tax Deduction 2020 Deadline

In 2020, contributions and the principal portion of rollover contributions of up to $3,340 per beneficiary per year ($1,670 for those married filing separately or divorced), are deductible from wisconsin state income tax. Received by virginia529 by 11:59 p.m.

Oregon 529 Plan And College Savings Options Or College Savings Plan

• penalty and interest upon request.

Oregon 529 tax deduction 2020 deadline. Tax deduction procedures for 529 tactics: Families can deduct up to $4,865 worth of these contributions from their state tax returns. Tax deduction rules for 529 ideas:

This opens in a new window. To ensure your contribution qualifies for a 2020 virginia income tax deduction, please complete your transaction by the following deadlines: Currently, the deduction is based strictly on contributions:

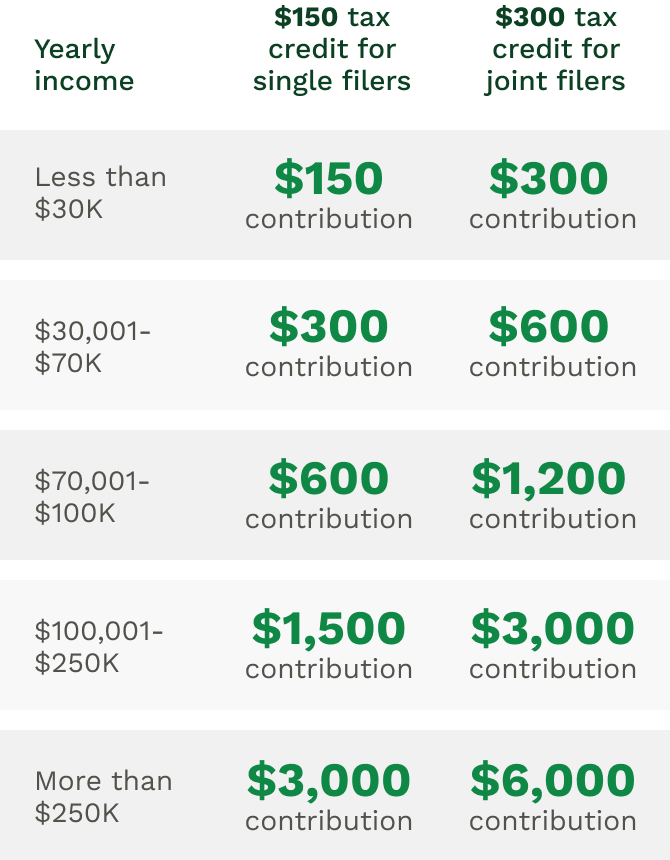

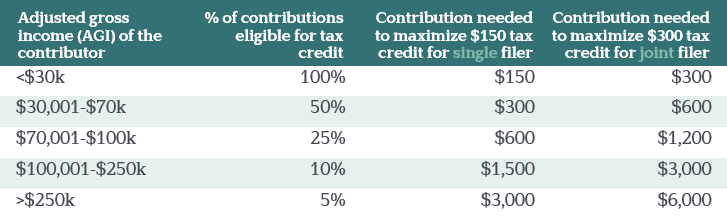

Contributions and rollover contributions up to $2,435 for a single return and up to $4,865 for a joint return are deductible in computing oregon taxable income. Oregon is now the first state in the nation to offer a refundable tax credit for 529 plan contributions. Excess contributions made through the 2019 tax year remain eligible.

Federal deadline for payments and returns due after september 7, 2020 extended to january 15, 2021. This year’s tax deadline is july 15, 2020. Here's what you need to do:

Before the april 30, 2020, deadline, taxpayers can still make contributions to a 529 that could be included on their 2019 returns. The end of the year is here again, and that means it’s time to finalize contributions to your 529 accounts before ringing in 2021. While filing and paying taxes can be painful, governments offer several deductions that can reduce a family’s tax burden and increase any possible refund.

If holly and rob make that same $10,000 contribution in 2020, they will receive a maximum tax credit of $300. How to make last minute 529 plan contributions. The software limits me to $2,435 in contributions per year.

On april 30, 2021, governor reynolds issued a public health disaster emergency proclamation which, in part, extended the deadline to make such contributions and still deduct them on a 2020 return from april 30, 2021, to may 30, 2021. For virginia taxpayers, maximizing contributions also means maximizing tax benefits. You get a tax deduction for every dollar you contribute up to the maximum deductible amount.

• underpayment interest on estimated payments. What families need to know. Leave a comment / direct online payday loans / by aspasia stefanou

The credit replaces the current tax deduction on january 1, 2020. No longer accepted by virginia529. Exactly what people need to know.

So, rob and holly just lost nearly. The deduction amount for tax year 2019 is $3,387. Single filers can deduct up to $2,435.

If you file an oregon income tax return, contributions made to your account before the end of 2019 are deductible up to a certain limit. Starting january 1st, 2020 the oregon college savings plan is moving to a tax credit. The received a tax deduction of $4,865.

That translates to a maximum. If we assume that their oregon state income tax rate is 10% (it’s actually a bit less than this), their 2019 contribution would have resulted in a tax benefit of $487. For example, if a couple contributed $15,000 to their son’s oregon college savings plan account in 2019, they may subtract a maximum of $4,865 (because they file jointly) on their 2019 oregon taxes.

April 15, 2021 529 plan tax deduction: The former subtraction has been changed to a state tax credit beginning with the 2020 tax year., with the credit amount based upon the taxpayers’ adjusted gross income agi) and amount contributed to the oregon 529 plan. They contributed $10,000 to the oregon 529 plan in 2019.

Starting with contributions made in tax years beginning on or after january 1, 2020, a tax credit based on your contributions to an oregon college or mfs 529 savings plan account or an able account may now be claimed. And oregonians can still take advantage of this perk based on the contributions they made before december 31, 2019. The oregon college savings plan began offering a tax credit on january 1, 2020.

For 2019, the limit individual taxpayers are allowed to deduct is $2,435 or $4,865 if filing jointly. Although there’s no federal tax deduction for 529 contributions, most states offer some kind of tax break or other incentive to contribute to their college savings plans. The following chart outlines the new law’s provisions:

For a short window of time, oregon taxpayers can qualify for both a deduction and a credit over the next four years. You also get federal income tax benefits as you do not pay income tax on your earnings. Virginia residents can deduct contributions up to.

You may carry forward the balance over the following four years for contributions made before the end of 2019.

The Or 529 Plan - No More Tax Deduction For Savers Springwater Wealth Management

Tax Changes Ahead For Oregons 529 Plan Vista Capital Partners

How Much Is Your States 529 Plan Tax Deduction Really Worth

529 Plan Deductions And Credits By State Julie Jason

Oregongov

Taxes Faqs Oregon College Savings Plan

Tax Benefits Oregon College Savings Plan

Oregon Individual Income Tax Guide Revised For 2020 - Isler Northwest Llc

Oregongov

Oregongov

529 Plan Contribution Deadlines For State Tax Benefits

How Much Can You Contribute To A 529 Plan In 2021

Tax Benefits Oregon College Savings Plan

Big Changes To Oregon 529 And Able Accounts - Jones Roth Cpas Business Advisors

Taxes Faqs Oregon College Savings Plan

Tax Changes Ahead For Oregons 529 Plan Vista Capital Partners

Oregongov

Oregongov

Tax Deduction Rules For 529 Plans What Families Need To Know - College Finance