Value Appeal Property Tax Services

File for an appeal of your property tax assessment. We save property owners time and money appealing property taxes.

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Ad valorem tax and property tax appeal services we’ll manage the property tax appeal process on your behalf to positively impact your bottom line.

Value appeal property tax services. And basically, the first step in this appeal is to write a letter to the tax assessor’s office. How much effort you decide to put into a challenge depends on the stakes. C onsider for a moment a taxing jurisdiction in which thousands of properties of varying types are located.

But, the appeal process is often long, requires a great deal of documentation and varies considerably between jurisdictions. Daniel has 26 years of real estate valuation experience. If your commercial real estate is assessed at above actual fair market value, an assessment appeal is the only way to combat the unplanned increase in commercial property tax liability.

Often inaccurate “quick” values are concocted. Resolution order setting deadline for filing late appeals for 2021 reassessment cycle (pdf, 56kb) to file a business personal property or individual personal property formal appeal: By john cook on october 15, 2013 at 9:32 am.

Property tax adjust 2875 ne 191st street suite 703a aventura, florida 33180 phone: Since the assessor’s values are not reliable, they are subject to negotiation. Appraisal documents within the past three (3) years;

After you receive your letter, if you decide that you disagree with the state’s assessed value for your home, you can file an appeal. October 15, 2013 at 9:49 am. Choose the options below that identifies your need and let hoppe & associates assist you with.

For tax valuation challenges, examples of our satisfied clients include: Commercial real estate property appeals. · commercial and residential property owners · lenders · property managers we have successfully appealed tax valuation challenges for the following types of properties:

Commercial property tax services in wisconsin property tax services is committed to helping property owners and managers, ensure they are not over paying property taxes on their real estate and personal property. Fair assessments may lower your residential property taxes by reducing and capping tax assessments. Daniel jones handles all residential property tax appeals.

Property tax services was founded in 1992 by albert (al) gay. Will appeal your high property tax bill with the county value adjustment board. In the event of an untimely property tax assessment increase, paradigm tax group’s team of expert consultants are here to assure that your appeal case is prepared thoroughly and in a timely manner.

Minimum energy is allocated to this rendering of house appraised. Real and personal property tax appeal preparation; Clients depend on the property tax team to manage and minimize their overall property tax liability with a level of client service and integrity that is without peer.

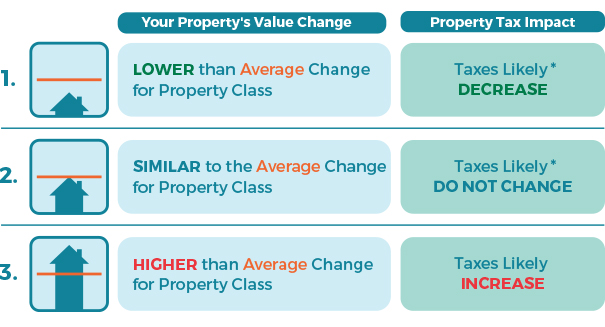

Tax assessors use the least reliable method of valuation, the cost approach, to value homes for property taxes. Washington state law requires the assessed value of a property reflect 100% of market value. This letter must be sent within 45 days of the receipt of your letter from the state.

The median property tax paid in 2015 was about $1,500 per capita (the most recent numbers available from the tax foundation, a tax policy nonprofit). Value appeal property tax services. We handle the whole process from start to finish

On your authorization and the $40.00 filing fee property tax experts, inc. To appeal the value of your property you may include documentation such as: Let our legal and appraisal experience work in your favor.

Assessors use the cost approach due to limited staff and time to generate many thousands of values in a period of a few months. If the assessed value exceeds market, you are paying more than your fair share of taxes. Tax appeal consultants provides no stress property tax appeal services for all types of real property throughout southern california.

The property tax appeal project is a free legal service provided by the university of michigan law school and the coalition for property tax justice. O’connor is the largest property tax consulting firm in the u.s. Decide if a property tax appeal is worth your time.

If you disagree with your property assessment, you have the right to appeal the 2021 market value on your assessment to the jackson county board of equalization. Property tax audit support services Al initially started doing property tax appeals in wisconsin for convenience stores, and was soon involved in appeals for subsidized housing valuations.

Listings of comparable property sales Value appeal property tax services. At fair assessments, we have the knowledge, experience, and resources to successfully appeal a wide variety of residential properties.

Fair assessments may lower your residential property taxes by reducing and capping tax assessments. Our experts are devoted to property tax issues and have the resources of our national v&a practice at their disposal, making us the premier practice in the industry. Valueappeal shuts down property tax appeal service, changes focus to ‘moneyball’ for real estate agents.

Al saw a great need for a service to help property owners, and managers make sure their property taxes are fair and equitable. Ssp provides comprehensive strategies to reduce your property tax bill, bringing aggressive and creative challenges to tax valuations. If we believe the property is being incorrectly valued, we will establish a target value and appeal.

How To Appeal Property Taxes And Win Over The Appraiser We Did - Njcom

Property Tax Appeals When How Why To Submit Plus A Sample Letter

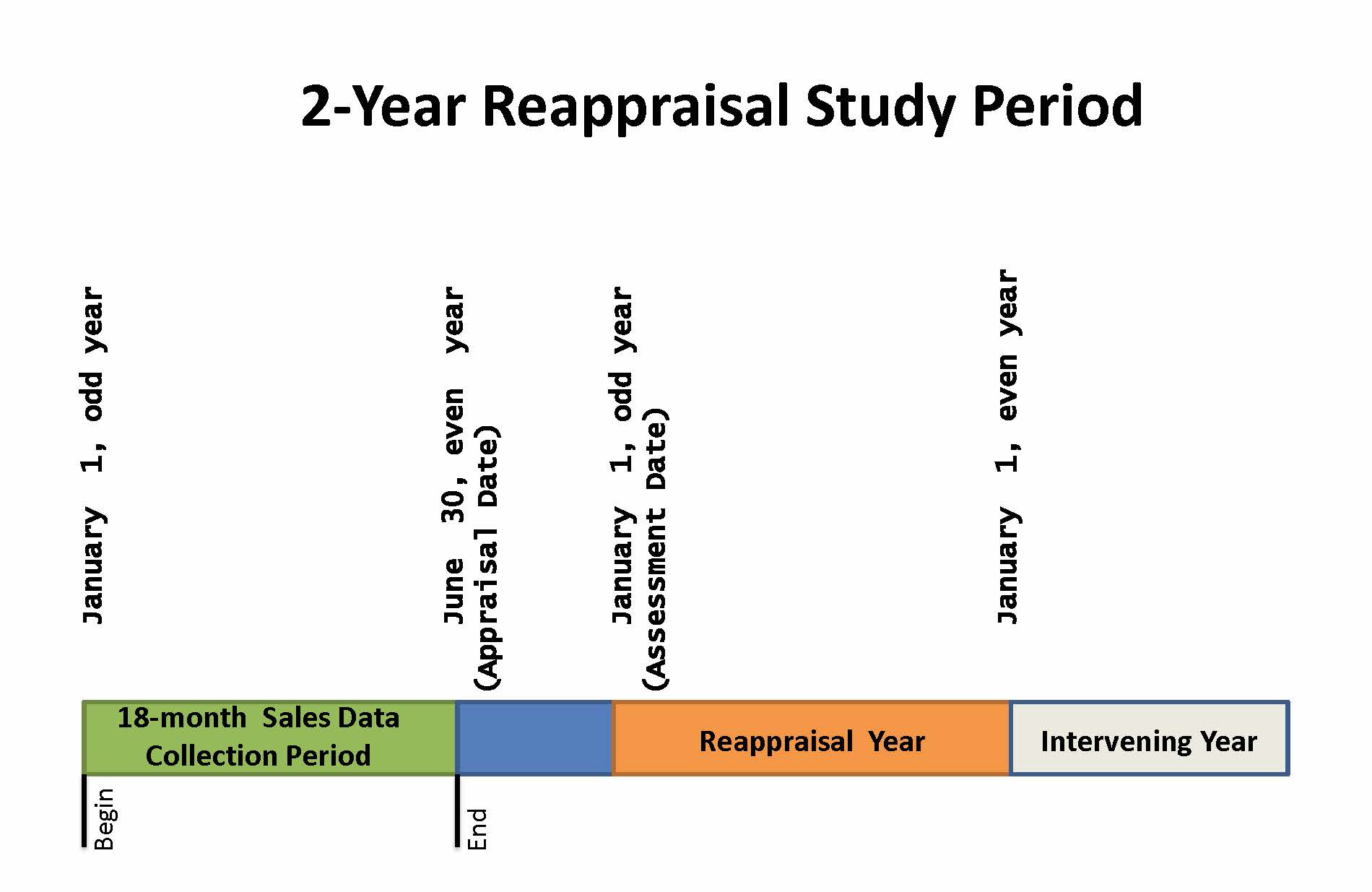

Property Assessment Process Adams County Government

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Contesting Your Property Value Los Angeles County - Property Tax Portal

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Statenjus

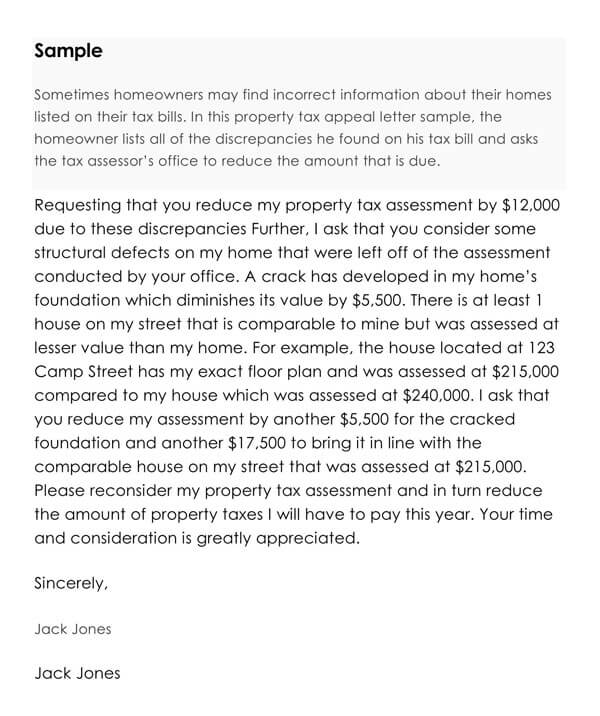

Property Tax Assessment Appeal Letter How To Write Examples

Property Tax Assessment Appeal Letter How To Write Examples

Property Tax Assessment Appeal Letter How To Write Examples

Property Tax Assessment Appeal Letter How To Write Examples

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Understanding Californias Property Taxes

Propertytax

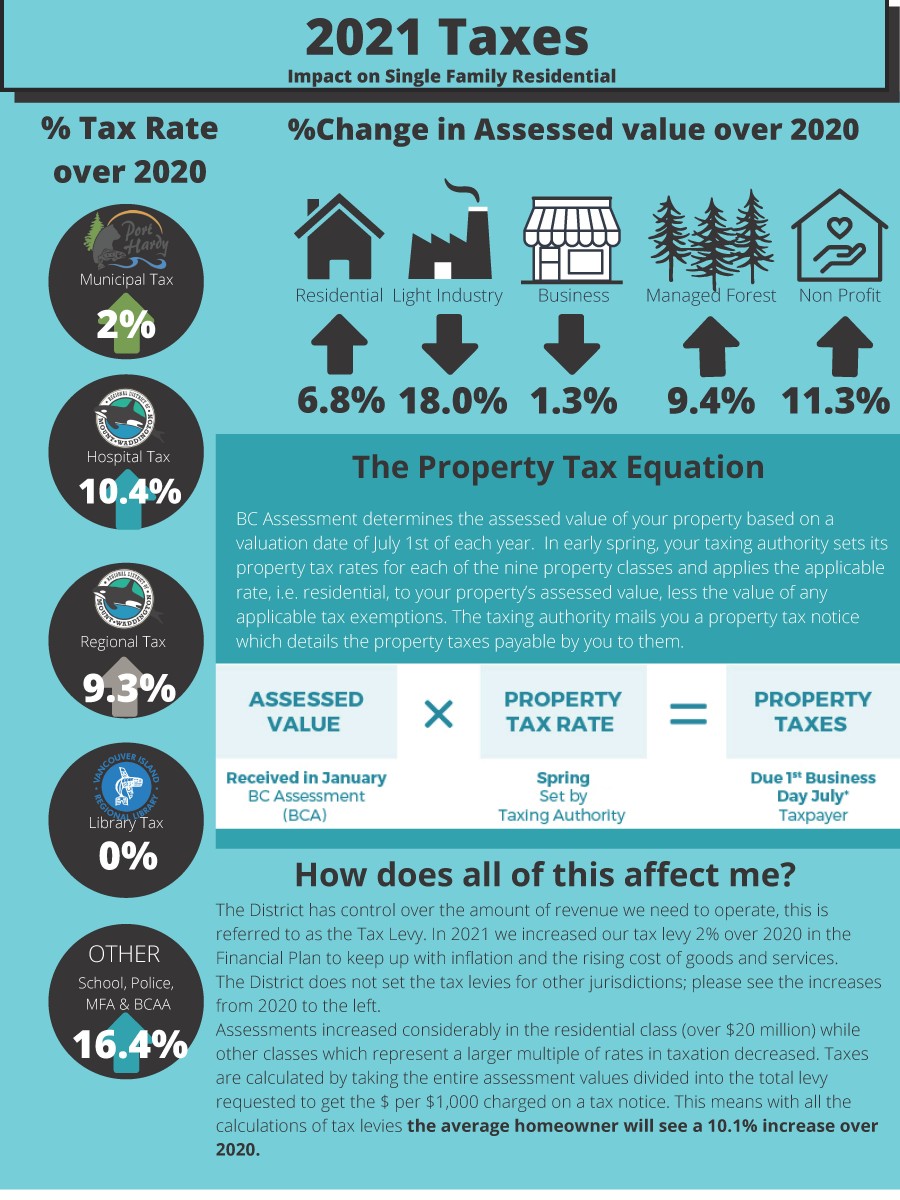

Port Hardy Property Tax Rates Property Assessments Tax Deadlines

Iswdataclientazurewebsitesnet

Successful Tax Appeal Tips Property Tax Commercial Property Tax Reduction

Property Tax Appeals When How Why To Submit Plus A Sample Letter