Fulton County Ga Property Tax Sales

The courtesy tax sale listings are updated monthly: As of december 1, fulton county, ga shows 1,747 tax liens.

Fulton County Sends Out Annual Assessment Notices To Milton Homeowners News Milton Ga

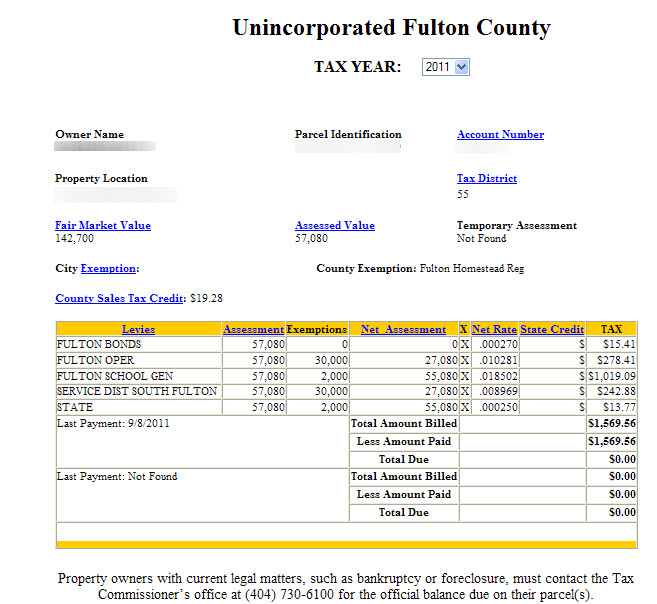

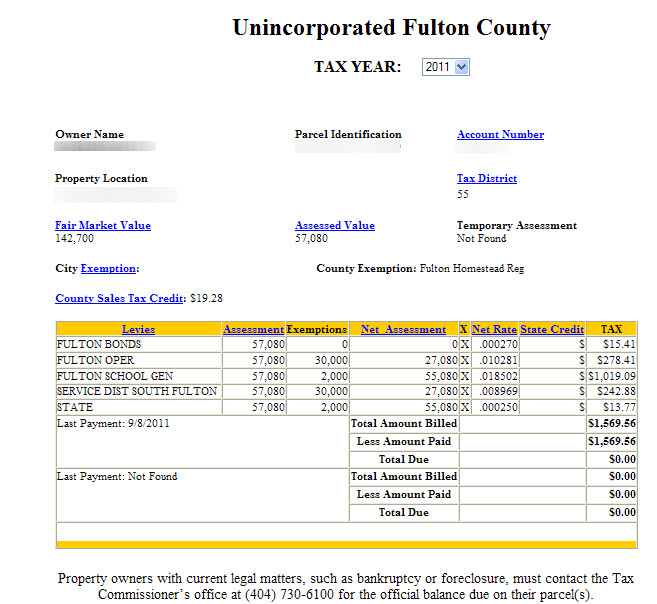

Property owners can view their property assessment online.

Fulton county ga property tax sales. Tax sales are held on the first tuesday of each month, between the hours of 10 am and 4 pm on the steps of the fulton county courthouse, 136 pryor street, sw (except when the first tuesday of the month falls on a legal holiday in which case the sale is held the next business day). (except when the first tuesday of the month falls on a legal holiday in which case the sale is held the next business day). Tax refund after lien sale read more contact us 141 pryor st.

The tax commissioner takes the appraised value and the exemption status provided by the board of tax assessors, along with the millage rates set by the board of commissioners and other. The board of assessors issues an annual notice of assessment for each property in fulton county. Fulton county sheriff’s tax sales are held on the first tuesday of each month, between the hours of 10 a.m.

Appraisers will also periodically canvas fulton county to reconcile our records with businesses that are in operation, as well as those which have closed. Tax liens in fulton county, ga buy tax liens and tax lien certificates in fulton county, ga, with help from foreclosure.com. In order to change the mailing address for your property tax bill, you must submit a written request to the board of tax assessors.

A tax sale is the sale of a tax lien by a governmental entity for unpaid property taxes by the property’s owner. If the county board of tax assessors disagrees with the taxpayer’s return on personal property (such as airplanes, boats or business equipment and inventory), the board must send a notice of. Search fulton county, ga sheriff sales and find a great deal on your next home or investment property.

Fulton county board of tax assessors, homestead and return division, 141 pryor street, suite 1047b, atlanta, ga 30303. Fulton county sheriff’s tax sales are held on the first tuesday of each month, between the hours of 10 a.m. A tax sale is the sale of a tax lien by a governmental entity for unpaid property taxes by the property’s owner.

How does a tax lien sale work? The fulton county tax commissioner is responsible for collecting property taxes on behalf of fulton county government, two school systems, and some city governments. Please type the text you see in the image into the text box and submit

Watch our video explaining the property assessment process. Courtesy lists are provided before the auction, a final list of properties for sale and the starting bid prices, will be available in the tax commissioner’s office on the day of sale. (except when the first tuesday of the month falls on a legal holiday in which case the sale is held the next business day).

How does a tax lien sale work? Fulton county tax records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in fulton county, georgia. Interested in a tax lien in fulton county, ga?

Interested in a tax lien in fulton county, ga? These records can include fulton county property tax assessments and assessment challenges, appraisals, and income taxes. In certain cases when a tax lien is sold, a property owner may be eligible to apply for a refund of property taxes.

The county board of tax assessors must send an annual notice of assessment which gives the taxpayer information on filing a property tax appeal on real property (such as land and buildings affixed to the land). Fulton county has one of the highest median property taxes in the united states, and is ranked 220th of the 3143 counties in order of median property taxes. The certificate is then auctioned off in fulton county, ga.

Fulton county is committed to helping property owners understand their rights and responsibilities throughout the property tax process. A tax sale is the sale of a tax lien by a governmental entity for unpaid property taxes by the property’s owner. The fulton county, georgia sales tax is 7.75%, consisting of 4.00% georgia state sales tax and 3.75% fulton county local sales taxes.the local sales tax consists of a 3.00% county sales tax and a 0.75% special district sales tax (used to fund transportation districts, local attractions, etc).

Fulton county, ga tax liens and foreclosure homes. The median property tax in fulton county, georgia is $2,733 per year for a home worth the median value of $253,100. Tax refund after lien sale.

Fulton county collects, on average, 1.08% of a property's assessed fair market value as property tax. The buyer of the tax lien has the right to collect the lien, plus interest based on. All taxes on the parcel in question must be paid in full prior to making a refund request.

(a) any person who becomes the purchaser of any real or personal property at any sale made at public outcry by any executor, administrator, or guardian or by any sheriff or other officer under and by virtue of any execution or other legal process, who fails or refuses to comply with the terms of the sale when requested to do so, shall be liable for the amount of the purchase money.

108 Marsh Landing Dr Brunswick Ga 31523 Mls 1610283 Zillow Foreclosures Brunswick Zillow

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

2506 Parkside Drive Ne Atlanta Dorsey Alston Atlanta Homes Luxury Real Estate Luxury Real Estate Marketing

153 Part Of Driveway Spring Country Roads Road Country

309 Peachtree Battle Ave Nw Atlanta Ga - 4 Beds35 Baths Atlanta Real Estate House Prices Home Warranty

Georgia Property Tax Liens Breyer Home Buyers

Tgea3caaj-4ynm

Your Guide On Property Taxes In Atlanta Georgia Farkas Real Estate Group

How To Redeem A Tax Deed In Georgia - Gomez Golomb Law Office Gomez Golomb Llc

Gwinnett County Leads Atlanta Regions Growth Adds 17300 Residents Gwinnett County Atlanta Ads

Cheap Homes For Sale In Fulton County Ga - 1373 Listings

Fulton County Georgia Property Tax Calculator Unincorporated Millage Rate Homestead Exemptions

Us Technosoft Pvt Ltd- Customer Obsession Is In Our Dna Customer Experience Network Marketing Business Improve Sales

Why Is It So Hard To Get A Mortgage Httpwwwhomesampedcomcategoryfinancing-and-mortgages Model Homes Sale House House Design

Bank Owned Property Selling In Hart County 53 Sylvester Drive Hartwell 2 Bedrooms Hudson And Marshal Bank Owned Properties Macon Georgia Rockdale

Land For Sale In Atlanta Ga - Sell Land In Ga - Sh Consulting How To Buy Land Land For Sale Cheap Land For Sale

276 Sinclair Marina Rd Ne Milledgeville Ga 31061 Zillow Milledgeville Zillow Marina

What Is Georgias Sales Tax - Discover The Georgia Sales Tax Rate For 159 Counties

Find This Home On Realtorcom Luxury Real Estate Luxury Real Estate Marketing Atlanta Homes