Tennessee Inheritance Tax Consent To Transfer

In that case, the representative will need to file a short form inheritance tax return in order to obtain a closing certificate. Open the template in the online editing tool.

Free Form Application For Inheritance Tax Waiver - Free Legal Forms - Lawscom

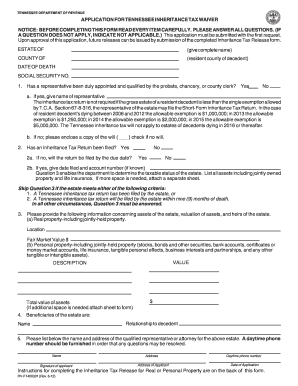

The net estate is the fair market value of all assets, less any allowable deductions such as property passing to a surviving spouse, debts, and administrative expenses.

Tennessee inheritance tax consent to transfer. New jersey taxes new jersey estate: Applications should be submitted online for consent to transfer stocks, bonds, and other registered securities and real property. Transfers of real property and securities.

Within seven to 10 business days, the department will review the application and either approve or deny it. You may use our online services to obtain an inheritance tax consent to transfer (formerly known as an inheritance tax release). Irs iowa /estate consent lien:

In the case of resident decedent’s dying between 2006 and 2012, the allowable exemption is $1,000,000; The statute of limitations for assessment is three years from december 31 of the year in which the return is filed. In 2013, the allowable exemption is $1,250,000;

For the payment of any inheritance tax, penalty, and interest that may be due. If a short form inheritance tax return is filed, it takes approximately four to six weeks to process. New jersey taxes nj transfer:

Choose the document you need in the collection of legal templates. After it’s signed it’s up to you on how to export your tennessee inheritance tax waiver form 2012: Statute limitations iowa /estate consent lien:

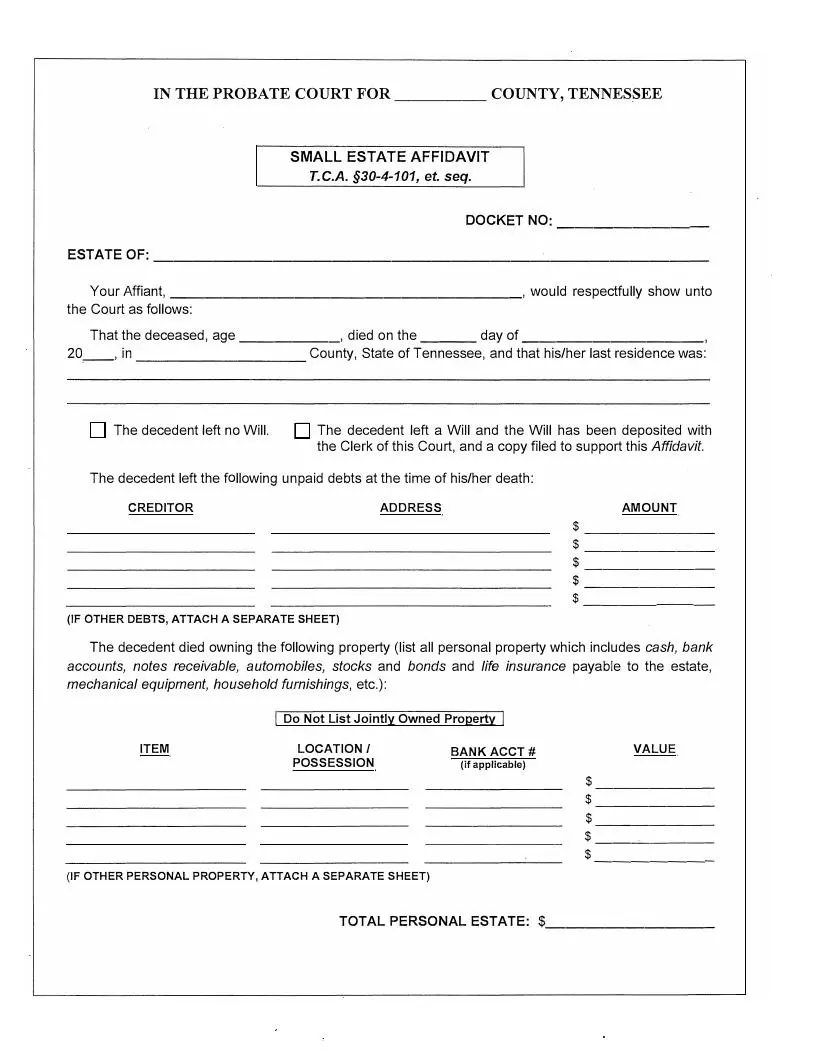

Escrow new jersey division taxation: Consent to transfer is not needed for: If no please enclose a copy of the will check if no will.

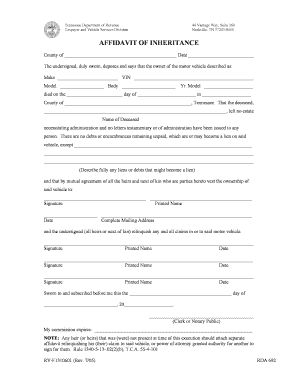

Read the guidelines to determine which details you will need to give. Under tennessee law, jointly held property can be considered part of the deceased individual’s taxable estate. Download it to your mobile device, upload it to the cloud or send it to another party via email.

If the administrator wishes to transfer real property or securities, an inheritance tax consent to. If the administrator wishes to transfer real property or securities, an inheritance tax consent to transfer must be obtained. So there are no separate considerations needed to handle any tennessee inheritance tax.

While the probate and intestate succession processes are meant to take care of the inheritance of all of your assets and property, there are some things that are handled independently when it comes to tennessee inheritance laws. Inheritance tax is imposed on the value of the decedent’s estate that exceeds the exemption amount applicable to the decedent’s year of death. Real property or securities of the decedent are not to be transferred without first obtaining the consent of the commissioner.

_____ inheritance tax waiver list (revised 11/14/05) state inheritance tax waiver list the information in this appendix is based on information published as of june 27, 2005 Fore completing the inheritance tax consent to transfer form. If a return has not been filed and an administrator or executor has not been appointed by the court, issuance of the consent form may be delayed to permit an investigation.

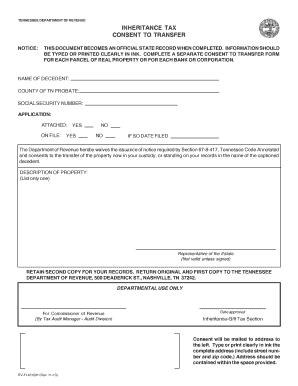

Additionally, the tennessee inheritance tax is now abolished in tennessee for any person who dies in 2016 or later. This document becomes an official state record when completed. Without such consent, the person in possession or control of the property may be help personally liable for the payment of any inheritance tax, penalty, and interest that may be due.

Apply for an inheritance tax consent to transfer for real property; Has a representative been duly appointed and qualified by the probate, chancery, or county clerk? It simply does not exist any longer.

In 2015, the allowable exemption is $5,000,000. Apply for an inheritance tax consent to transfer for transfers of stocks, bonds, and registered securities; Inheritance tax consent to transfer should submit an application to the department of revenue electronically using the department’s website at:

In 2014, the allowable exemption is $2,000,000; Tennessee department of revenue inheritance tax consent to transfer notice: Complete a separate consent to transfer form for each parcel of real property or for each bank or corporation.

Applications may be submitted through the department’s Follow me on twitter at @jasonalee for updates from the tennessee wills and estates blog. Tennessee department of revenue application for inheritance tax consent to transfer notice before completing this form read every item carefully.

Within 7 to 10 business A long form inheritance tax return will take longer. New jersey taxes nj l8

The signnow application is equally as efficient and powerful as the online tool is. Transfer nj tennessee dept revenue: The tennessee inheritance tax will not apply to estates of decedents dying in 2016 or thereafter.

A separate consent to transfer is required for each parcel of real property,. Posted on jul 29 2013 8:26am by attorney, jason a. The consent of the commonwealth [or state] of _____ is hereby given to the immediate transfer of described property listed above.

Upon approval of this application, future consent forms can be issued by submission of the completed inheritance tax consent to transfer form. Information should be typed or printed clearly in ink. The state of tennessee has a statutory lien on all property of the decedent.

2013 Estate Planning_seminar

2013-2021 Form Tn Rv-f1400301 Fill Online Printable Fillable Blank - Pdffiller

Consent To Transfer Application Home

Fillable Online Online Inheritance Tax Consent To Transfer Application - Tngov Fax Email Print - Pdffiller

Fillable Online Online Inheritance Tax Consent To Transfer Application - Tngov Fax Email Print - Pdffiller

Consent To Transfer Application Home

2013-2021 Form Tn Rv-f1401501 Fill Online Printable Fillable Blank - Pdffiller

2013-2021 Form Tn Rv-f1400301 Fill Online Printable Fillable Blank - Pdffiller

Is Your Inheritance Considered Taxable Income Hr Block

Online Inheritance Tax Consent To Transfer Application - Tngov - Fill And Sign Printable Template Online Us Legal Forms

2

2

Consenttotransfer - Fill Online Printable Fillable Blank Pdffiller

2

Fillable Online Online Inheritance Tax Consent To Transfer Application - Tngov Fax Email Print - Pdffiller

2

2

Fillable Online Online Inheritance Tax Consent To Transfer Application - Tngov Fax Email Print - Pdffiller

Free Tennessee Small Estate Affidavit Form Pdf Formspal