What Is The Tax Rate In Tulsa Ok

Only exempt in oklahoma if the hotel primarily operates as an apartment like provider and then no hotel tax would be due. Taxpayers pay an excise tax of 3.25 percent of the price when they buy a new vehicle and a lower tax rate on used vehicles (depending on the sales price).

Pin On Oklahoma Legislature

Estimated combined tax rate 8.52%, estimated county tax rate 0.37%, estimated city tax rate 3.65%, estimated special tax rate 0.00% and vendor discount none.

What is the tax rate in tulsa ok. For single taxpayers living and working in the state of oklahoma: [ 2 ] state sales tax is 4.50%. You can find more tax rates and allowances for tulsa and oklahoma in the 2022 oklahoma tax tables.

The december 2020 total local sales tax rate was also 8.517%. For tax rates in other cities, see oklahoma sales taxes by city and county. There is no applicable special tax.

Tulsa sales tax rates for 2022. Future job growth over the next ten years is predicted to be 29.5%, which is lower than the us average of 33.5%. Tulsa, ok sales tax rate.

Tulsa county collects, on average, 1.06% of a property's assessed fair market value as property tax. Inside the city limits of tulsa, the sales tax and use tax is 8.517%, which is allocated between three taxing jurisdictions: 3.25% of the purchase price (or taxable value, if different) used vehicle:

It isn’t all good news for oklahoma taxpayers, however. Tax rate of 0.5% on the first $1,000 of taxable income. The median property tax (also known as real estate tax) in tulsa county is $1,344.00 per year, based on a median home value of $126,200.00 and a median effective property tax rate of 1.06% of property value.

This is also in addition to the state tax rate of 4.5%. The county sales tax rate is %. We can also see the progressive nature of oklahoma state income tax rates from the lowest ok tax rate bracket of 0.5% to the highest ok tax rate bracket of 5%.

It was higher than in 97.2% u.s. Not at the state level. Oklahoma is ranked 972nd of the 3143 counties in the united states, in order of the median amount of property taxes collected.

The 8.517% sales tax rate in tulsa consists of 4.5% oklahoma state sales tax, 0.367% tulsa county sales tax and 3.65% tulsa tax. $20.00 on the 1st $1500.00 of. Sales is under consumption taxes.

Standard vehicle excise tax is assessed as follows: Tulsa county headquarters, 5th floor | 218 w. 4988, thus salina is in mayes county which has a county tax that must be added to the city tax and the state tax.

4.5% is the smallest possible tax rate ( 74183, tulsa, oklahoma) 4.867%, 5.5% are all the other possible sales tax rates of tulsa area. You can print a 8.517% sales tax table here. Would be rare since hotels more often will be primarily characterized as hotels.

The tulsa sales tax rate is %. The tulsa county sales tax is 0.367%. This is the total of state, county and city sales tax rates.

Tulsa county, oklahoma sales tax rate 2021 up to 9.967%. The oklahoma tax commission estimated that government revenue decreased by $50 million from this change. The oklahoma sales tax rate is currently %.

Wright — tulsa county assessor. 8.517% is the highest possible tax rate ( 74101, tulsa, oklahoma) the average combined rate of every zip code in tulsa, oklahoma is 8.046%. The 2019 tulsa crime rate fell by 6% compared to 2018.

Tulsa has seen the job market increase by 2.7% over the last year. That puts oklahoma’s top income tax rate in the bottom half of all states. 2022 school rates [pdf] for more information on homestead exemptions and how to file, click here.

The current total local sales tax rate in tulsa, ok is 8.517%. Tulsa has an unemployment rate of 4.7%. Tulsa in oklahoma has a tax rate of 8.52% for 2022, this includes the oklahoma sales tax rate of 4.5% and local sales tax rates in tulsa totaling 4.02%.

For the 2020 tax year, oklahoma’s top income tax rate is 5%. The minimum combined 2021 sales tax rate for tulsa, oklahoma is. The us average is 6.0%.

There is also an annual registration fee of $26 to $96 depending on the age of the. The average yearly property tax paid by tulsa county residents amounts to about 2.16% of their yearly income. Tax rate of 1% on taxable income between $1,001 and $2,500.

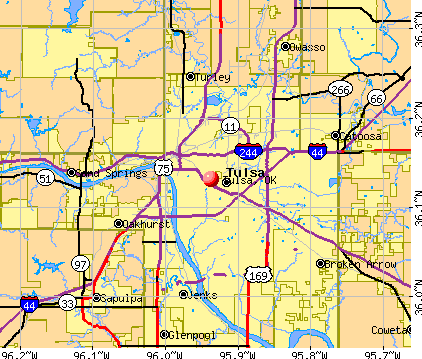

Sales tax and use tax rate of zip code 74134 is located in tulsa city, tulsa county, oklahoma state.

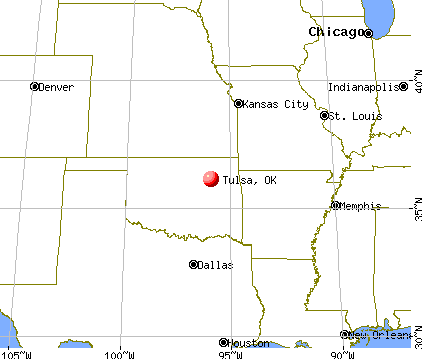

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Bruce Plante Cartoon Act Scores In Oklahoma Oklahoma Cartoon Tulsa World

Pros And Cons Of Living In Tulsa Ok - Securcare Self-storage Blog

Credit Repair Baltimore Credit Repair Tulsa Ok Start Your Own Credit Repair Business Software Credit Repair Letters Credit Repair Business Credit Dispute

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Tulsa Oklahoma Will Pay You 10000 To Move There And Work From Home

Best Cheap Hotels In Tulsa From 39night Hotelscom

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Pin On Hope Center Ideas

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Coronavirus On Tulsa Time

Pros And Cons Of Living In Tulsa Ok - Securcare Self-storage Blog

Moving To Tulsa Here Are 14 Things To Know Extra Space Storage

Map Of Tulsa Oklahoma Area What Is Tulsa Known For - Best Hotels Home

Tulsa Oklahoma Pictures Download Free Images On Unsplash

How Tulsa Oklahoma Is Making Mental Health A Priority Urban Institute

Tulsa Oklahoma Pictures Download Free Images On Unsplash

Tulsa Furniture Rental Furniture Options