Rsu Tax Rate Uk

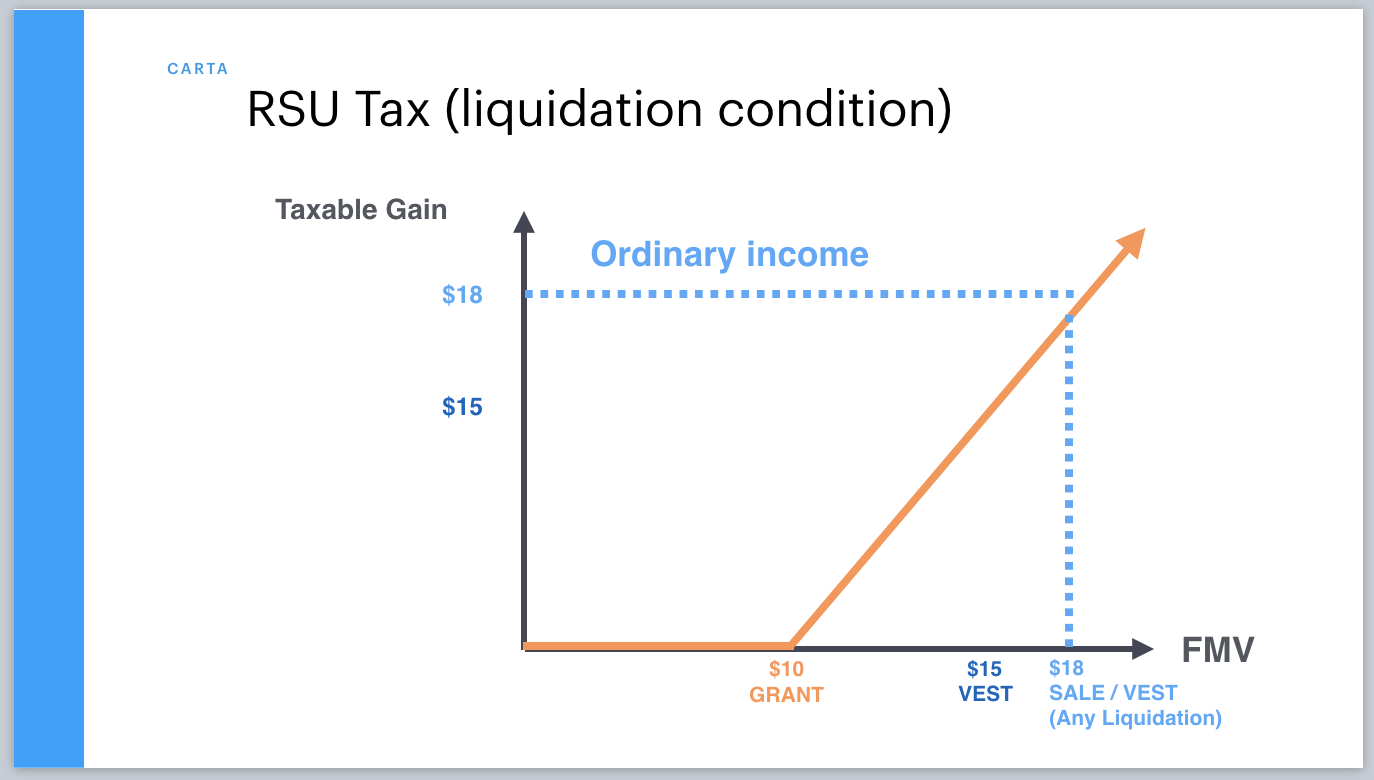

You realize the main tax hit when the rsu vests. The ordinary earned income tax rate when the rsus vest, or;

Research And Statistics Bulletin - October 2007 - Bfi

Extra tax of £4,310 (due to loss of personal allowance as income above £100,000)

Rsu tax rate uk. The shares have to be held for more than 1 year. Because there is no actual stock issued at grant, no section 83 (b) election is permitted. On the sale of rsus, esops and espps, the gains/profit made are subject to capital gains tax.

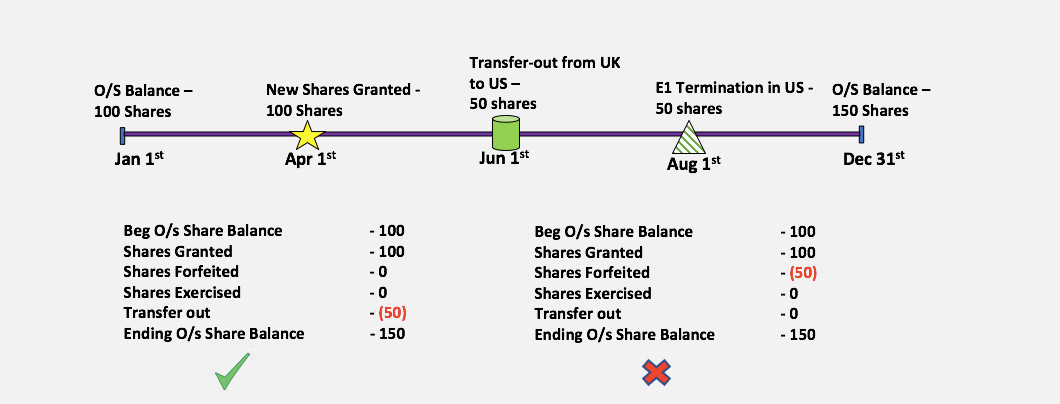

On the date that your rsus vest you will get shares net of the tax your employer withholds. For calculating tax on rsu sale, is it the price of “vesting date” or the “actual rsu crediting date” taken into account? In case a company is granting 200 rsus with a condition of 25% rsu vesting every year, then 25% (50 shares) can be claimed at the end of the first year.

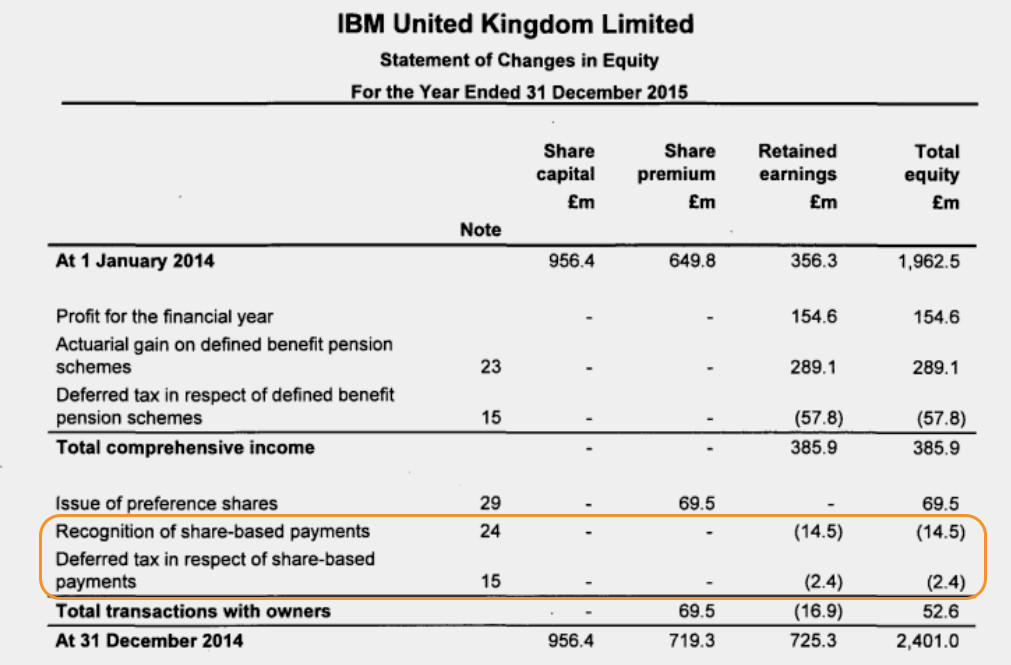

Employee total salary before rsu is £100,000. Tax on the capital gains. Income tax @ 40% of remaining = £8,620;

When you become vested in your stock, its fair market value gets taxed at the same rate as your ordinary income. If you can sell the rsu at the basis price, there is no tax implication. Sales tax rate in the united kingdom averaged 16.91 percent from 1977 until 2021, reaching an all time high of 20 percent in 2011 and a record low of 8 percent in 1978.

Plan for the rsu vesting event once you’ve used the rsu tax calculator to determine your estimated taxes and estimated proceeds, you’ll want to make a plan so you know what you want to do with your company shares after the vesting date. Suppose you had 100 rsus vested on october 31. Total tax and nic = £10,000;

Theapayroll operator is satisfied thattaxa foreign income tax applies and has established the effective tax rates on the doubly taxed amount. Tax rates and allowances have been added for the tax year 2020 to 2021. For most goods, it is the time of delivery or passage of title.

50% tax and nic paid. In my case, though the rsus were vested on feb 28th 2013, the actual shares were credited into my account (and became available for sale) only on mar 2nd 2013, after 31.1% of the vested shares were sold to adjust for. An rsu, or a proportion of an rsu, is liable to income tax under the paye system and is also a income tax in a state with which there is a double taxation agreement.

If you are a higher rate taxpayer, you will need to report and pay for any excess on your annual uk tax return. Rsu and capital gain tax rates.i have an rsu that vests this year. Salary £100,000, rsu value £25,000.

The withholding rate is what might be different, which is a common source of confusion. At any rate, rsus are seen as supplemental income. It’s important to remember that the rsu tax rate will be the same as your income tax rates.

This is true whether we’re talking about: What is the tax rate for an rsu? Some rsu receivers might opt to pay for the tax owed via personal check or would prefer the tax withhold via deduction of their paycheck.

Please note that your former uk employer will only account for uk income tax due at the basic rate of taxation (currently 20%). For rsus, the profit/gain is the difference between the sale price and the vesting price. The rsus are subject to ni and income tax at your marginal rate on their value at the time they vest.you can either choose to pay the tax yourself and receive all the shares,but most people will opt to have shares deducted to pay for these deductions.so if you are a higher rate tax payer you will be due to pay 42% tax and ni which would mean your 50 shares would be netted.

Deducting employer’s nic @ 13.8% = £3,450; The closing price of the stock on that day is $50, and the tax withholding rate is 40%. This is because rsus, stock grants, and.

Rates and allowances updated for 2021 to 2022. Most employers will withhold taxes on your rsus at a rate of 22%, but you could easily be in a higher tax bracket than that. It is then payable to the tax authorities 30 days after the vat reporting period end (monthly or quarterly).

If you can sell same day (or shortly thereafter) with no price appreciation, there is no tax gain for the lack of diversification by holding for a year. The taxation of rsus is a bit simpler than for standard restricted stock plans. Most companies will withhold federal income taxes at a flat rate of 22%.

The exact tax rate will depend on your specific tax bracket as determined by your income. Another 25% or 50 shares can then be claimed in the second year, and only at the end of the fourth year will an. The value of over $1 million will be taxed at 37%.

The tax point (time of supply) rules in the uk determine when the vat is due. The capital gains tax rate when you sell the shares you own; Sales tax rate in the united kingdom remained unchanged at 20 percent in 2021 from 20 percent in 2020.

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation - Flow Financial Planning

Rsus - A Tech Employees Guide To Restricted Stock Units

Amazons Other Pay Benefit A Higher Uk Tax Rate - Bbc News

Taxation Of Restricted Stock Units Rsus - Carter Backer Winter Llp

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsus - A Tech Employees Guide To Restricted Stock Units

Rsu Tax Rate Is Exactly The Same As Your Paycheck

What Is A Restricted Stock Unit Rsu Everything You Should Know Carta

2

Rsus - A Tech Employees Guide To Restricted Stock Units

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

How Much Income Tax And Nic Is Due At Rsu Vesting

Issuing Equity Abroad Top Tax Challenges Of International Subsidiaries - Equity Methods

How Much Income Tax And Nic Is Due At Rsu Vesting

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Rsu Taxes Explained 4 Tax Saving Strategies For 2021

Rsus - A Tech Employees Guide To Restricted Stock Units

Issuing Equity Abroad Top Tax Challenges Of International Subsidiaries - Equity Methods

Draft Finance Bill 2016 Restricted Stock Units