Hawaii Tax Id Number Cost

The report includes the estimated total tax rate to collect from guests, number of required registrations, number and frequency of returns per year, and minimum number of rented days to qualify as a taxable stay. What is fair market rental value?

Calculator How Much Must You Earn At A Job In Another State To Maintain Your Quality Of Life Best Places To Live Cheapest Places To Live States In America

Vehicles 4,001 pounds to 7,000 pounds are 2 cents per pound.

Hawaii tax id number cost. We look forward to serving you. Please contact us early so we can be sure to help you. The real id compliant card will allow the cardholder to use the hawaii state identification card as a form of identification accepted by the department of homeland security (dhs) transportation security administration (tsa) and other security personnel at airports, other ports of entry and federal installations requiring a real id credential.

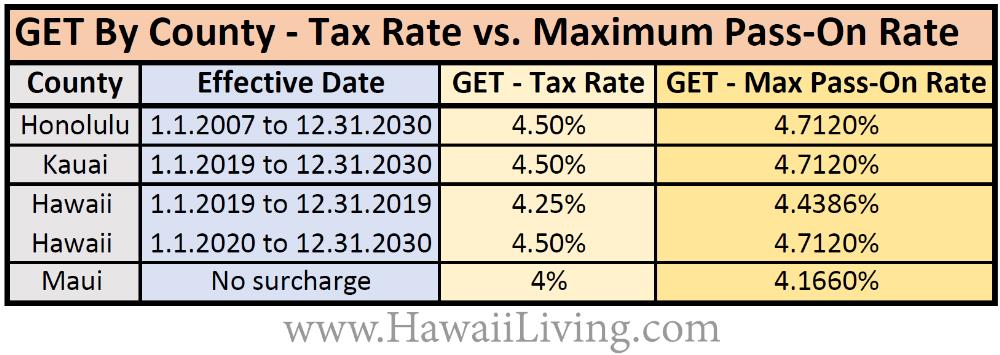

Get is 4.5% on oahu (4% on neighbor islands) on all gross rental income, including get you might have collected (!), before deducting any expenses. The application fee in both cases is $20. You may collect 4.714% from your tenant to cover the 4.5% get on the total collected (rent + get collected) tat is 10.25% on all gross transient accommodation rental income.

The personal exemption amount is $1,144 per exemption, including an additional exemption for those age 65 or older. Simple guide to hawaii get (general excise tax) forms Vehicles over 10,001 pounds are a flat rate of $300.

The get is a privilege tax imposed on business activity in the state of hawaii. The tax id number registers a business for various tax licenses, with the most common being the general excise tax license (get), which is similar to a sales tax. How long does it take to get a hawaii general excise tax license?

Dotax offers a voluntary disclosure program for taxpayers who have not yet been contacted regarding their outstanding taxes. Company name changes done through the dcca will not be reflected automatically in your hce account. While hawaii tax id numbers have changed for corporate income, franchise, and public service company tax accounts, existing federal employer i.d.

So if you don’t report it, your tenant might be reporting to the state of hawaii that he’s paying rent to you, so make sure you pay the appropriate taxes. Instead, we have the get, which is assessed on all business activities. Make sure you seek out the most updated form, as hawaii has revised the form recently, and there are some links leading to hawaii government web pages that.

Are there local get tax rates in the state of hawaii? Vehicles 7,001 pounds up to 10,000 pounds are 2.25 cents per pound. How much does a general excise tax license cost in hawaii?

In most cases, if a taxpayer is accepted into the program, dotax will waive applicable civil penalties. Use this search engine to find the latest hawaii tax id numbers for cigarette and tobacco, fuel, general excise, seller’s collection, transient accommodations, use, and withholding tax accounts. You will receive your hawaii tax id immediately.

To avoid inconveniencing taxpayers, the department will continue to process returns and payments received with old hawaii tax id numbers. How to calculate your get & tat on hawaii rental income: Hawaii tax id number prefixes also make it possible to know the associated tax type at a glance.

The tax rate is 0.15% for insurance commission, 0.5% for wholesaling, manufacturing, producing, wholesale services, and use tax on imports for resale, and 4% for all others. State department of labor ui id# mailing address; Gross income includes any cost passed on to the customer such as the get.

For example, did you know that as a renter in the state of hawaii, you get a $50 tax break, if the renter provides the contact info for the landlord. The tso tax is the appropriate tax rate multiplied by the fair market rental value of the time share and multiplied by the number of days the time share is occupied. The county surcharge does not apply to transactions taxed at lower rates such as

You also need to obtain any additional (and required) tax licenses. Our time for new clients becomes limited as deadlines approach. The tax is imposed on the gross income received by the person engaging in the business activity.

Numbers (fein) will continue to serve as the. Transactions attributable to a county that has adopted a county surcharge and subject to the state get or use tax rate of 4% are also subject to a county surcharge of 0.5%, for a total tax rate of 4.5%. Licenses and certificates of registration reflecting new hawaii tax id numbers were mailed to taxpayers with active ge, rv, sc, ta, and uo accounts in.

See a full list of all available functions on the site. Use our lodging tax lookup tool to get a rate report specific to your hawaii rental’s address. Hawaii does not have a sales tax;

You need to obtain a hawaii tax id number (from the hi department of taxation) after your llc is formed. Your gross income is the total of all your business income before you deduct any business expenses. All passenger vehicles are 1.25 cents per pound for all weights (minimum $12.00).

Business Lease Credit Application Form - How To Create A Business Lease Credit Application Form Download This Busin Application Form Creating A Business Lease

This Is What Homebuyers Want Most In 2021 Solar News Solar Alternative Energy

Hot Promo Malaysia Airlines Cek Yuk Sekarang Selagi Ada Untuk Pertanyaan Informasi Tourharga Tiket Pesawat Booking Hotel Tiket Ker Malaysia Tiket Pesawat

Fillable Form 1003 Loan Application Standard Form Application Form

Lollipop Retro Vector Sign Design On Old Metal Texture Vintage Background With Delicious Candy Sw Poster Vintage Retro Retro Vector Vintage Labels Printables

Annual Report Design Annual Report Graphic Design Business

Hawaii Rental Application Template Rental Application Hawaii Rentals Rental

How To Take Care Of Yourself For Less-avoiding The Pink Tax Care The Balm

Wholesale Special Air Plants - Tillandsia Ionantha Variety Air Plants Large Air Plants Plants

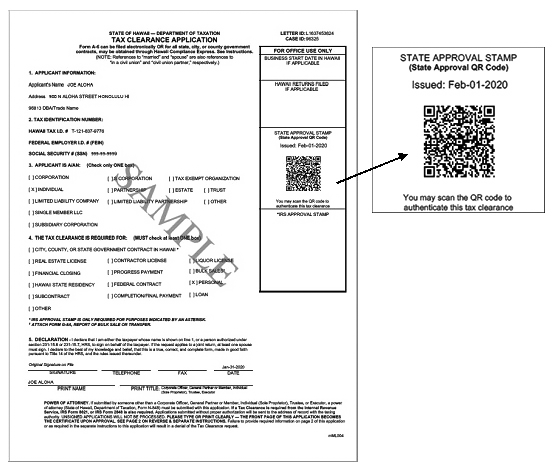

Tax Clearance Certificates Department Of Taxation

Pin By Mary Davison On Hotels Event Marketing Hotel Corporate Meeting

Hawaiis Revised Get Tax Rates By County New Tat Requirement 2019 -

Pin By Samuel Avery On Contest Winning Lotto Winning Numbers Winning Lotto Win For Life

Pin On Girls Toddler Clothes

The Worst States For Taxes Tax Deductions Travel Nursing Pay Tax Return

Pin On Gree

Come And Enjoy Theme Night Dinner Indian And Arabian Night At Waterfall Restaurant 25 26 March 2019

What Is An Ein Number Do You Need One Sole Proprietorship Employer Identification Number Things To Sell

How To Lower The Cost Of Managing Your Rentals - Landlord Station Being A Landlord Tenant Screening Rental