Sacramento Property Tax Rate

This does not include personal (unsecured) property tax bills issued for boats, business equipment, aircraft, etc. 13 counties have higher tax rates.

The Property Tax Inheritance Exclusion

Sacramento county collects, on average, 0.68% of a property's assessed fair market value as property tax.

Sacramento property tax rate. The median property tax (also known as real estate tax) in sacramento county is $2,204.00 per year, based on a median home value of $324,200.00 and a median effective property tax rate of 0.68% of property value. The sacramento county tax assessor is the local official who is responsible for assessing the taxable value of all properties within sacramento county, and may establish the amount of tax due on that property based on the fair market value appraisal. This is the total of state, county and city sales tax rates.

This is known as the local option farmland and open space program (williamson act). It is designed to give readers a general understanding of california’s property tax system. A breakdown of the city of sacramento sales tax rate.

The california sales tax rate is currently %. What is the sales tax rate in sacramento, california? Some property owners in san diego city have a 1.17461% tax rate, while some in chula vista have a rate of 1.14221%.

See detailed property tax report for 2526 h st, sacramento county, ca. The median property tax on a $324,200.00 house is $2,204.56 in sacramento county. How are property taxes calculated in sacramento county?

Look up the current sales and use tax rate by address California city & county sales & use tax rates (effective october 1, 2021) these rates may be outdated. Funds from these sales tax measures are used alongside local property tax revenues and other funds to pay for infrastructure, public safety.

Throughout each county there are probably 20 different tax rate areas, but they don't vary too much. This calculator can only provide you with a rough estimate of your tax liabilities based on the. Sacramento county collects relatively high property taxes, and is ranked in the top half of all counties in the united states by property tax collections.

The sacramento sales tax rate is %. The minimum combined 2021 sales tax rate for sacramento, california is. The median property tax on a $324,200.00 house is $2,399.08 in california.

This tax has existed since 1978. Sacramento county tax rate area reference by primary tax rate area primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton, city of 1 03 sacramento, city of 1 04 folsom, city of 22 05 galt, city of 24 06 citrus heights, city of 27. At that rate, the total property tax on a home worth $200,000 would be $1,620.

Sacramento county has property tax rates that are similar to most counties in california. This is mostly due to the general tax levy of 1%. Note that 1.127% is an effective tax rate estimate.

The county’s net assessed value after the deduction of property tax exemptions for homeowners,. California property tax provides an overview of property tax assessment in california. Sacramento county has one of the higher property tax rates in the state, at around 1.127%.

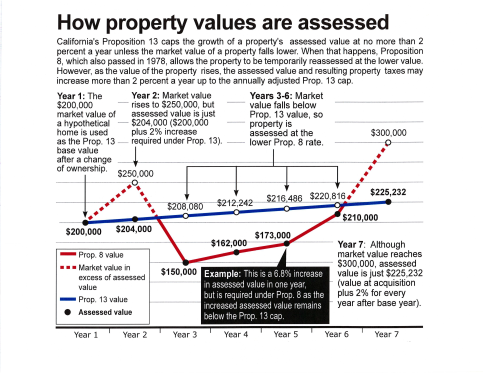

Sacramento county assessor's office services. Proposition 13, enacted in 1978, forms the basis for the current property tax laws. The median property tax on a $324,200.00 house is $3,404.10 in the united states.

Proposition 13, enacted in 1978, forms the basis for the current property tax laws. Please make your property tax payment by the due date as stated on the tax bill. Property taxes throughout ca are 1% of the assessed values plus any locally voted taxes.

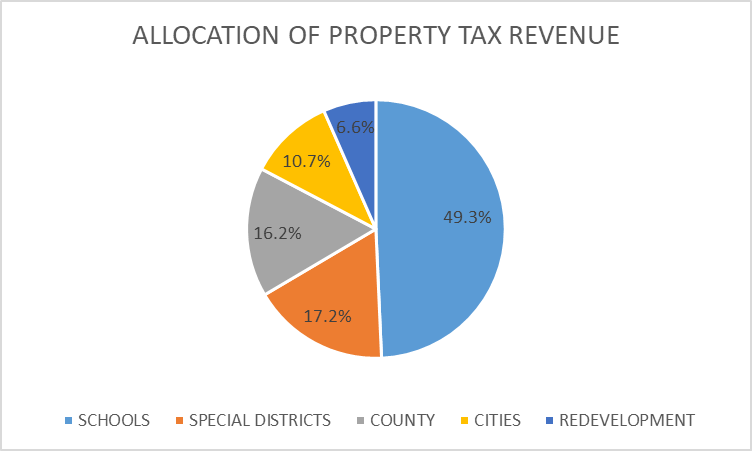

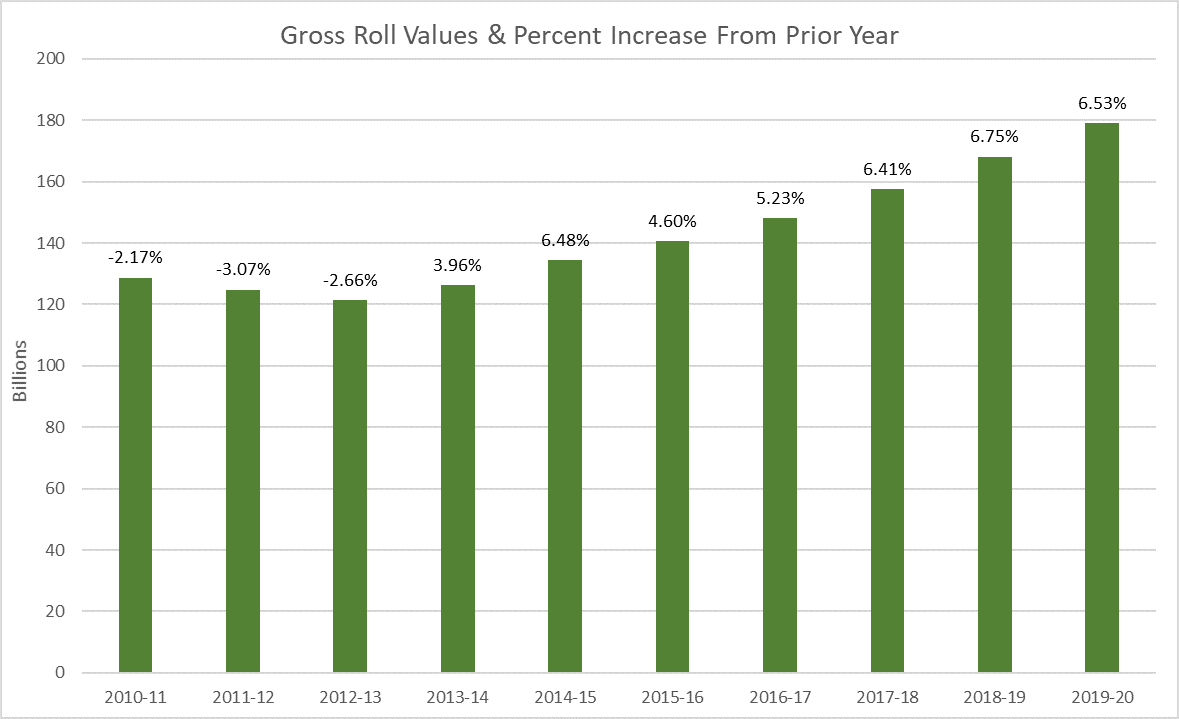

44 out of 58 counties have lower property tax rates. A delinquency penalty will be charged at the close of the delinquency date. This is an increase of 6.4% (or $9.5 billion) over last year.

The california constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law. Permits and taxes facilitates the collection of this fee. The publication begins with a brief history of proposition 13, which since 1978 has been the foundation of california’s property tax system.

Specifically, farmers are able to take 20 to 75 percent off their property tax bill if they agree not to develop their land for ten years and do so with at least 100 acres. The county’s average effective property tax rate is 0.81%. Sacramento county the county’s average effective property tax rate is 0.81%.

Assessed value is calculated based on market value using a base year value. For a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. Sacramento county has one of the highest median property taxes in the united states, and is ranked 359th of the 3143 counties in order of.

Property tax in sacramento county. It's also home to the state capital of california. The county sales tax rate is %.

California, like every other state, offers property tax breaks for agricultural land. In comparison, some los angeles residents have tax rates around 1.19302%. Revenue and taxation code sections 6051, 6201

The median property tax in sacramento county, california is $2,204 per year for a home worth the median value of $324,200. Sacramento county is located in northern california and has a population of just over 1.5 million people.

2019-20 Sacramento County Property Assessment Roll Tops 179 Billion

Understanding Californias Property Taxes

How To Calculate Property Tax Everything You Need To Know - New Venture Escrow

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeographycom

Transfer Tax In Sacramento County California - Who Pays What

Sacramento-county Property Tax Records - Sacramento-county Property Taxes Ca

Understanding Californias Property Taxes

2019-20 Sacramento County Property Assessment Roll Tops 179 Billion

Tax Accounting General Information

Financesaccountynet

Majority Of Homeowners And Renters Benefiting From The Tax Cuts And Jobs Act John Burns Real Estate Consulting - Secured Income Group

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeographycom

Understanding Californias Property Taxes

2019-20 Sacramento County Property Assessment Roll Tops 179 Billion

Understanding Californias Property Taxes

Sacramento-county Property Tax Records - Sacramento-county Property Taxes Ca

Sacramento County Property Tax - Anderson Business Advisors Asset Protection Tax Advisors

Understanding Californias Property Taxes

Sacramento-county Property Tax Records - Sacramento-county Property Taxes Ca