Bexar County Tax Office Pay Online

2022 data current as of dec 2 2021 1:21am. Within this site you will find general information about the district and the ad valorem property tax system in texas, as well as information regarding specific properties within the district.

City Of Live Oak - Event View

Taxes become delinquent if not paid by the due date.

Bexar county tax office pay online. Registration renewals (license plates and registration stickers) vehicle title transfers. Go to the travis county tax office. There are many ways to pay property taxes in bexar county.

What you need to pay online : Paypal credit offers financing options for qualified property owners. Your business personal property account number;

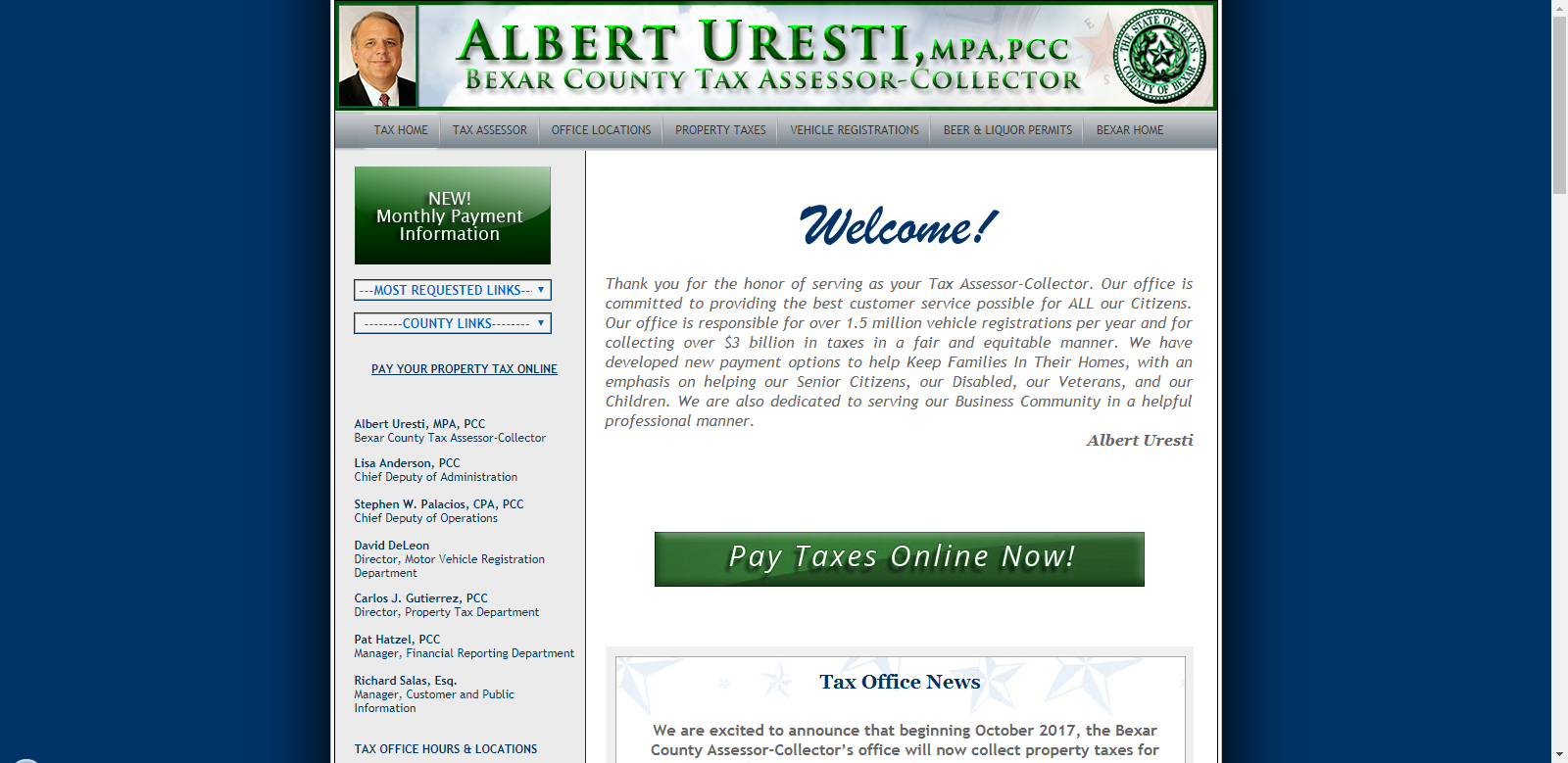

2021 and prior year data current as of nov 5 2021 6:58am. Thank you for visiting the bexar county epayment network. The bexar county tax office offers the option of paying your property taxes online with either a major credit card or an electronic check (ach).

Your property serial number look up serial number; Credit card payments are processed through jetpay, which charges a 2.10% convenience fee. Please select the type of payment you are interested in making from the options below.

Prior year data is informational only and does not necessarily replicate the values certified to the tax office. After locating the account, you can pay online by credit card or echeck. If you receive a declined payment notice, contact your credit card company or banking institution.

For convenience, taxpayers can now request to receive their property tax statement via email. Search for any account whose property taxes are collected by the bexar county tax office. To pay business personal property taxes :

The bexar county tax office collects ad valorem property taxes for bexar county, the road and flood control fund, and 57. Please follow the instructions below. Bexar appraisal district is responsible for appraising all real and business personal property within bexar county.

You can search for any account whose property taxes are collected by the bexar county tax office. You could visit a local tax office, but it is far more convenient to pay online using a credit card or using echeck to pay directly from a bank account. Clicking on the link below will take you to to a webpage with specific information and instructions for making that type of payment through our convenient and secure online network.

Search accounts whose taxes are collected by bexar county for overpayments. The hays county tax office also collects property taxes for all other taxing jurisdictions (school districts, cities and special districts). To pay real property taxes :

Change of address on motor vehicle records. Convenience fee of $3 (for balance under $100) or 3% (for balance over $100) paypal payments;

2

Information Lookup Bexar County Tx - Official Website

Bexar County Texas - Government - Home Facebook

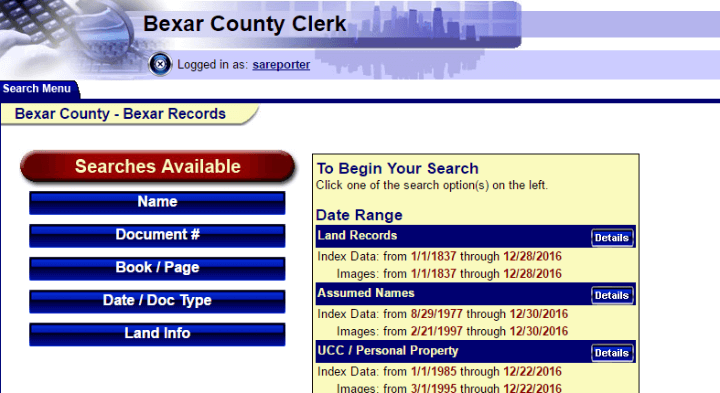

How To Research A Propertys History Using Bexar Countys Free Records Search John Tedesco

Bexar County Precinct 1 Justice Of The Peace Court In San Antonio

Cash-strapped Property Owners In Bexar County Face June 30 Tax Deadline Tax Deadline Bexar County Tax

Bexar County Tax Office To Stay Open But Close Lobbies What That Means For You

Property Tax Information Bexar County Tx - Official Website

Everything You Need To Know About Bexar County Property Tax

Evictions Property Tax Foreclosures In Bexar County Suspended Due To Covid-19 Concerns San Antonio News San Antonio San Antonio Current

2

Bexar County Property Tax Loans - Ovation Lending

Michael Berlanga For Bexar County Tax Assessor Collector - Home Facebook

Bexar County Texas - Government - Home Facebook

As Property Tax Bills Arrive Protesters Are Encouraged To Act Now Woai

Bexar County To Transform Operations With Telework E-government System

2

Bexar County Cities Ranked By Property Tax Rate Total During 2016 - San Antonio Business Journal

Bexar County Commissioners Get First Look At 28 Billion 2022 Budget