Jefferson Parish Property Tax Rate

The tax rate is the sum of the individual millage that were approved by voters for such purposes as fire protection, law enforcement, education, recreation, and other functions of parish government. The 2018 united states supreme court decision in south dakota v.

Millages

However, because of the varying tax rates between taxing districts, the average tax bill fluctuates from parish to parish.

Jefferson parish property tax rate. Property tax overview jefferson parish sheriff, la. You can use the louisiana property tax map to the left to compare jefferson parish's property tax to other counties in louisiana. Millage rate (for this example we use the 2018 millage rate for ward 82, the metairie area) x.11340:

Tax on a $200,000 home: Tax on a $200,000 home: Our research shows that the majority of people that appeal successfully reduce their property tax bill.

Use this louisiana property tax calculator to estimate your annual property tax payment. The jefferson parish assessor's office determines the taxable assessment of property. 3.50% on the sale of food items purchased for preparation and consumption in the home;

Jefferson parish sheriff’s office 200 derbigny street, suite 1200 gretna, la 70053 residents with questions about their property tax collection. Tax on a $200,000 home: Get driving directions to this office.

Jefferson parish is ranked 2326th of the 3143 counties for property taxes as a percentage of median income. The louisiana state sales tax rate is currently %. On average, a homeowner pays $5.05 for every $1,000 in home value in property taxes with the average louisiana property tax bill adding up to $832.

The average yearly property tax paid by jefferson parish residents amounts to about 1.25% of their yearly income. The median property tax (also known as real estate tax) in jefferson parish is $755.00 per year, based on a median home value of $175,100.00 and a median effective property tax rate of 0.43% of property value. The tax approved by voters would add an additional $117.71 annually to the average sales price of a home in jefferson parish, which is a property valued at $224,000.

A successful appeal results in an average savings of $650. “this vote is validation of the bold steps we have taken and the ambitious course we have set for our children,” said new superintendent cade brumley. Jefferson parish real estate tax homes for sale.

Located in southeast louisiana adjacent to the city of new orleans, jefferson parish has a property tax rate of 0.52%. What is the rate of jefferson parish sales/use tax? 0.12145 old metairie & metairie:

6 hours ago the tax rate is the sum of the individual millage that were approved by voters for such purposes as fire protection, law enforcement, education, recreation, and other functions of parish government. The jefferson parish assessor's office determines the taxable assessment of property. The jefferson parish assessor's office determines the taxable assessment of property.

Tax on a $200,000 home: This rate is based on a median home value of $180,500 and a median annual tax payment of $940. The minimum combined 2021 sales tax rate for jefferson parish, louisiana is.

4.75% on the sale of general merchandise and certain services; Jefferson parish, louisiana property tax rates. Take the yearly taxes, and.

On december 11, 2021, voters in jefferson parish will decide whether to renew two property tax millages on the ballot that directly impact the quality of life for jefferson parish residents. $755.00 6 hours ago the median property tax (also known as real estate tax) in jefferson parish is $755.00 per year, based on a median home value of $175,100.00 and a median effective property tax. If your homestead/mortgage company usually pays your property taxes, please.

The jefferson parish sales tax rate is %. Government building 200 derbigny, 4th floor, suite 4200 gretna, la 70053 phone: 3.5% on the sale of prescription drugs and medical devices prescribed by a physician

Our success rate is 37% better than the jefferson parish, louisiana average. This is the total of state and parish sales tax rates. Houses (6 days ago) the tax rate is the sum of the individual millage that were approved by voters for such purposes as fire protection, law enforcement, education, recreation, and other functions of parish government.

Houses (4 days ago) online property tax system. Jefferson parish assessor's office services. Tax rate tax amount ;

The following local sales tax rates apply in jefferson parish: Property tax overview jefferson parish sheriff, la. (504) 364 2900 (phone) the jefferson parish tax assessor's office is located in gretna, louisiana.

The calculator will automatically apply local tax rates when known, or give you the ability to enter your own rate. The jefferson parish tax assessor is the local official who is responsible for assessing the taxable value of all properties within jefferson parish, and. *due to the annual tax sale this site can only be used to view and/or order a tax research certificate.

St Charles Parish Louisiana Covid-19 Information From The Data Center

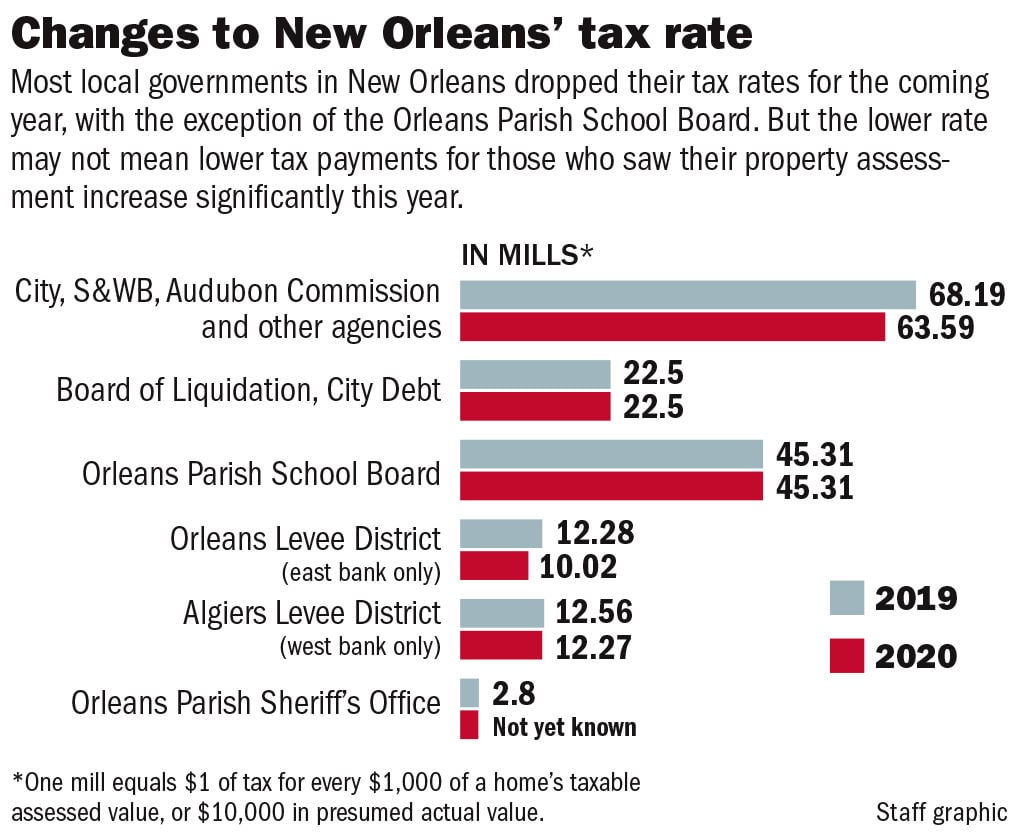

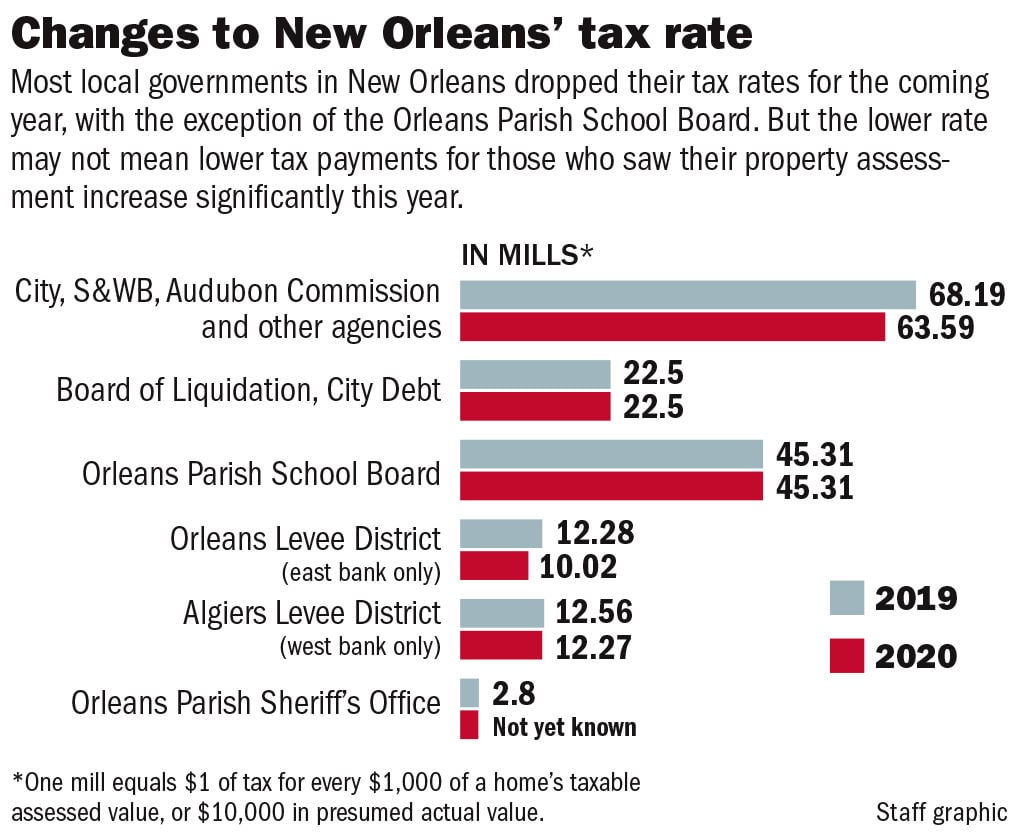

Taxes In New Orleans All But Set Property Owners Can Expect A Slight Dip In Rates Local Politics Nolacom

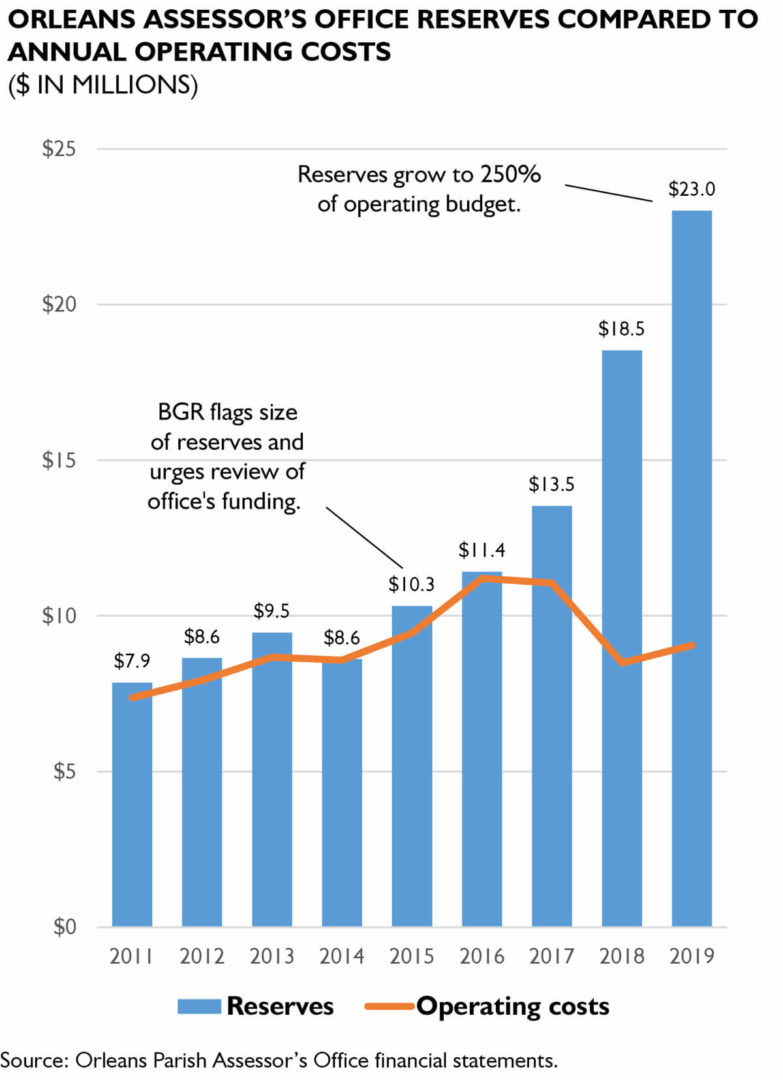

Policywatch Revisiting Assessment Issues In New Orleans

Jefferson Parish Voters Approve Water Sewer Taxes Westwego Picks New Mayor

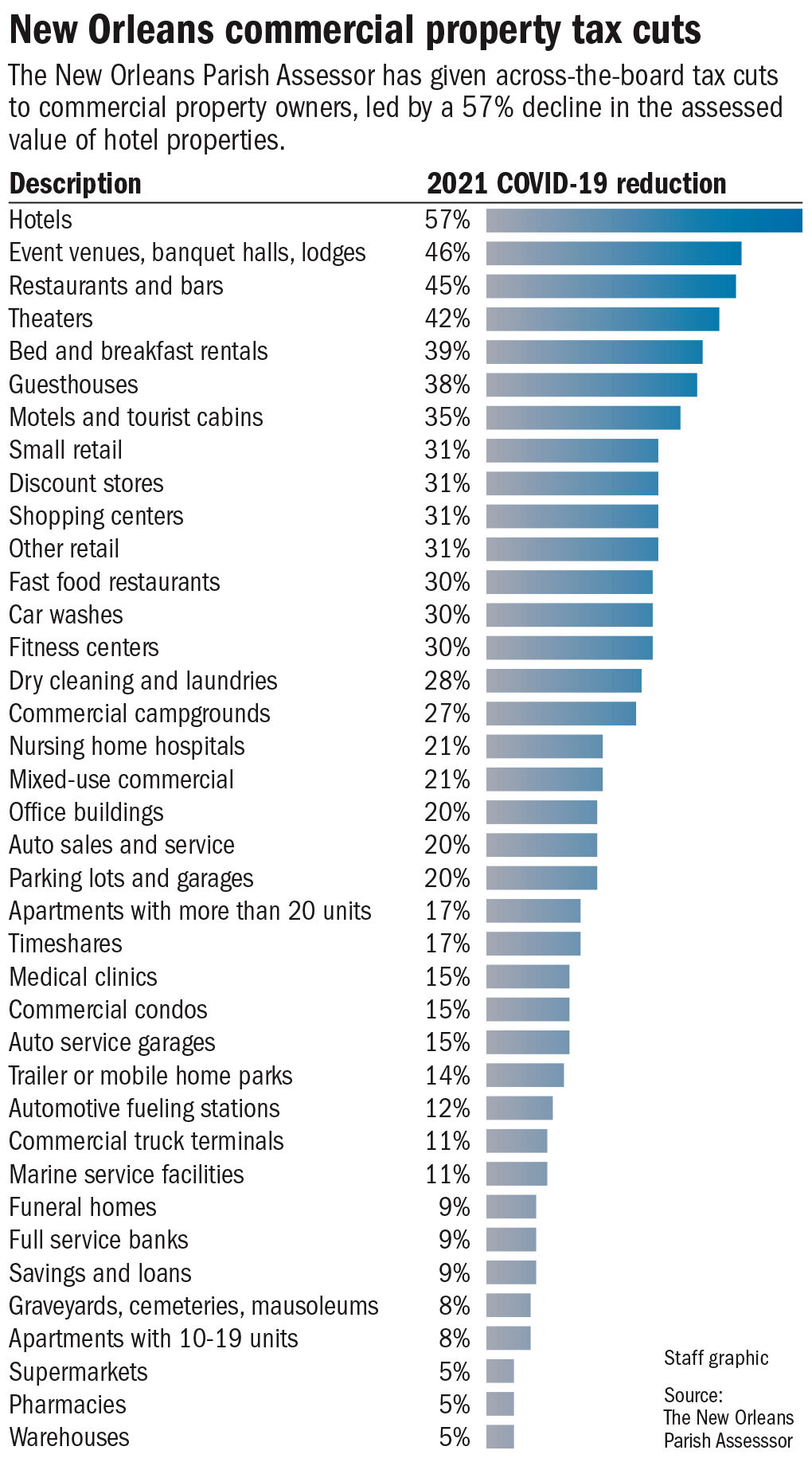

Property Taxes For New Orleans Homes Have Surged Now Businesses Could Get A Huge Tax Cut Business News Nolacom

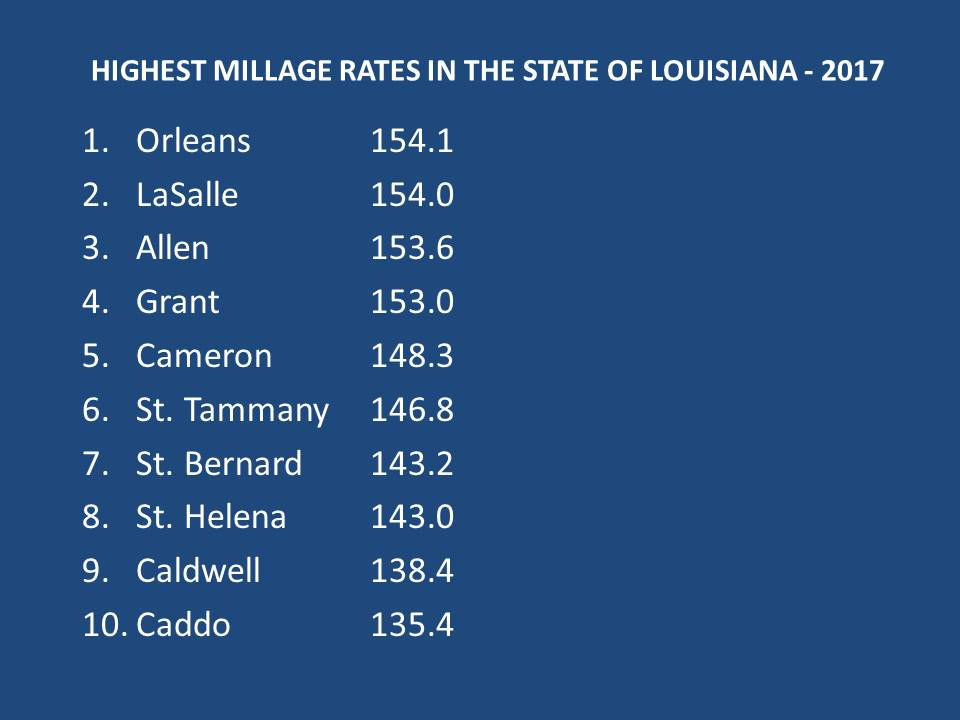

10 Louisiana Parishes With The Highest Property Tax Rates - 3 Are In Metro New Orleans Archive Nolacom

Tax Assessment Reductions Available To Some Property Owners

Online Property Tax System

Louisiana Property Tax Calculator - Smartasset

Yubbnohrcfya_m

Jefferson Parish Public Flood Portal Geoportal

Flood Insurance Rate Maps

Xtxn54cvfe0zym

Which Louisiana Parishes Pay The Highest Lowest Property Taxes Local Politics Nolacom

Jefferson Parish Residents Receiving Sticker Shock At Property Tax Bills

/cloudfront-us-east-1.images.arcpublishing.com/gray/YTRWB54PLJFCTIWMMQAFXOG46U.bmp)

Jefferson Parish Residents Receiving Sticker Shock At Property Tax Bills

10 Louisiana Parishes With The Highest Property Tax Rates 3 Are In Metro New Orleans

Jefferson Parish School Leader Sings Praises Of Proposed Millage For Teacher Raises Wwno

Heres Whats On The Ballot Saturday In Your Parish Wwltvcom