Putnam County Property Tax Rate

1st installment is due by june 30 th and a 6% discount is applied. There are 52 counties in the state with higher property taxes and only 5 counties that have lower rates.

Hendry-county Property Tax Records - Hendry-county Property Taxes Fl

Divide the taxable value of your property by $1,000.

Putnam county property tax rate. Tax amount varies by county. The 2021 county tax rate is $2.472 @ $100.00 (2.472%) assessed value. The tax collector is the agent of the florida department of revenue for the collection of certain sales taxes, which is 7%.

Property tax in putnam county. Counties, cities, towns, villages, school districts, and special districts each raise money through the real property tax. This includes the county discretionary tax of 1% on purchases up to $5,000.00.

The first six months of ownership. The median property tax (also known as real estate tax) in putnam county is $792.00 per year, based on a median home value of $98,200.00 and a median effective property tax rate of 0.81% of property value. The putnam county tax assessor is the local official who is responsible for assessing the taxable value of all properties within putnam county, and may establish the amount of tax due on that property based on the fair market value appraisal.

All responses are directed toward customer understanding and satisfaction of how nys real property. Putnam county is ranked 1741st of the 3143 counties for property taxes as a percentage of median income. by michelle price ucbj managing editor.

Our office only collects county taxes, and does not collect city. The new tax rate will be $2.472, an increase of 10 cents from the new certified rate of $2.372 following reappraisal. Unpaid tangible personal property accounts begin accruing interest at a rate of 1 ½ % per month;

The assessed value on real estate is based in part on market value. I agree i do not agree The rates listed are per $100 of assessed value.

Note that 0.309% is an effective tax rate estimate. The putnam county commission sets the tax rate, it is usually set in july. 40 gleneida ave | room 104 carmel, ny 10512.

Putnam county assessor's office services. $17.00 x 25 = $425.00 (your tax bill) this is the amount of taxes due on your home this year. The average yearly property tax paid by putnam county residents amounts to about 1.73% of their yearly income.

The median property tax (also known as real estate tax) in putnam county is $797.00 per year, based on a median home value of $124,000.00 and a median effective property tax rate of 0.64% of property value. Our office has no control over your property tax rate, which is established by the putnam county board of commissioners, based on their budgets and spending. In fact, the county commissioners are authorized by state law to establish a tax rate that will generate the same amount of revenue they had the prior year, even if property appraisals have declined.

See detailed property tax report for 21 brookdale rd, putnam county, ny. Counties in illinois collect an average of 1.73% of a property's assesed fair market value as property tax per year. What is the putnam county tax rate?

The putnam county, ohio sales tax is 7.00%, consisting of 5.75% ohio state sales tax and 1.25% putnam county local sales taxes.the local sales tax consists of a 1.25% county sales tax. Local property taxes in indiana are paid in arrears. Putnam county assessor's office services.

The putnam county tax assessor is the local official who is responsible for assessing the taxable value of all properties within putnam county, and may establish the amount of tax due on that property based on the fair market value appraisal. Unpaid tangible personal property accounts begin accruing interest at a rate of 1 ½ % per month; The median property tax in illinois is $3,507.00 per year for a home worth the median value of $202,200.00.

2nd installment is due by september 30 th and a 4.5% discount is applied. To obtain the most current information, please contact the putnam county tax collector's office. The putnam county sales tax is collected by the merchant on all qualifying sales made within putnam county

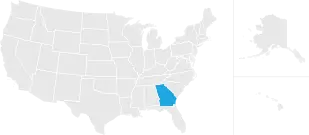

In new york state, the real property tax is a tax based on the value of real property. You can use the tennessee property tax map to the left to compare putnam county's property tax to other counties in tennessee. The money funds schools, pays for police and fire protection.

Changes occur daily to the content. The assessed value on business personal property is based on depreciated cost. Customers who pay by installment method are eligible for a discount for early payment of their taxes.

3% penalty and advertising fee applies to unpaid real property taxes; Who sets the county tax rate and when? Real property tax service agency putnam county new york.

3% penalty and advertising fee applies to unpaid real property taxes; The discounts and payment dates are as follows. As new york property tax rates go, putnam county is on the low end at only 0.309%.

(here the answer is 25.) multiply this by the tax rate (17 mills). Does the putnam county trustee's office collect city taxes?

Property Taxes Are Getting Higher Out Of Alignment

Property Taxes Are Getting Higher Out Of Alignment

Nassau-county Property Tax Records - Nassau-county Property Taxes Ny

Georgia Property Tax Calculator - Smartasset

Nassau-county Property Tax Records - Nassau-county Property Taxes Ny

Property Taxes Are Getting Higher Out Of Alignment

St-lucie-county Property Tax Records - St-lucie-county Property Taxes Fl

Httpwwwretaxcom Online Shopping Clothes Women Gaming Tips Photo Book

Georgia Property Tax Calculator - Smartasset

Florida County Map With Abbreviations

Property Taxes Are Getting Higher Out Of Alignment

Nassau-county Property Tax Records - Nassau-county Property Taxes Ny

St-lucie-county Property Tax Records - St-lucie-county Property Taxes Fl

Property Taxes Are Getting Higher Out Of Alignment

Nassau-county Property Tax Records - Nassau-county Property Taxes Ny

Nassau-county Property Tax Records - Nassau-county Property Taxes Ny

Nelsonville New York Ny 10516 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

St-lucie-county Property Tax Records - St-lucie-county Property Taxes Fl

Georgia Property Tax Calculator - Smartasset