Where Do I Pay Overdue Excise Tax In Ma

For your convenience payment can be made online through their website www.kelleyryan.com. The deputy collector is located at different registries in massachusetts.

Motor Vehicle Excise Tax Wellesley Ma

Bills for the calendar year 2021 have been issued and will continue to do so throughout the year.

Where do i pay overdue excise tax in ma. Demand bills will be sent on all excise bills not paid within the thirty day period. If a motor vehicle owner moves within massachusetts and has not paid an excise tax for the current calendar year, he / she should immediately notify the assessors office of his / her new address. You must make payment directly to their office.

1 year after the excise was paid If an excise tax is not paid within 30 days from the issue date, the treasurer/collector will send a demand, with a fee for $5. Residents who own motor vehicles have to pay taxes based on the value of their vehicles each year.

We send you a bill in the mail. Once they receive payment from you, they will contact the registry of motor vehicles to release your account so that you can renew your license and/or registration. You pay an excise instead of a personal property tax.

Deputy collector, pks associates, inc. 355 east central street, franklin, ma 02038. If the motor vehicle excise bill is.

If your vehicle isn't registered, you’ll have to pay personal property taxes on it. You must make payment directly to their office. If you move within massachusetts and have not paid an excise tax for the current year, you should:

Taxpayers should be prepared to pay the full amount due. Excise bill abatement if an owner of a motor vehicle feels that they are entitled to an adjustment of their excise bill, it is strongly recommended that they pay the bill in full, then contact the board of assessors for an application for abatement. 3 years after the excise's due date, or;

Call to find which registry's that they are located at. | town of randolph ma. How do i pay for overdue excise taxes that have been sent to jeffery & jeffery for collections?

There are no special considerations for financial hardship. You must make payment in cash, money order or cashier’s check to have the mark removed immediately. There are two applications to choose from:

Taxpayers should be prepared to pay the full amount due. Government websites by civicplus ®. Money collected on all bills, excluding deputy tax collectors’ fees, is put into the municipal treasury.

Generally, tax collectors and deputy tax collectors do not accept partial payment of an excise bill. Jeffery & jeffery will no longer accept cash for bills they collect on behalf of the tax collector. You can reduce the excise you have paid by filing an abatement application.

Masstaxconnect log in to file and pay taxes. You need to pay the bill within 30 days of the date we issued the bill. Application for abatement long form;

It appears that your browser does not support javascript, or you have it disabled. Payment for a motor vehicle excise bill is due 30 days from the date the excise bill is. You must file applications for abatement with your local board of assessors within:

The owner must pay the motor vehicle excise tax to the city or town in which he / she resided along with the place of garaging as of january 1st. The demand bill will add a flat $15.00 charge to each bill, plus interest at the rate of 12% per annum from the due date to the date of payment. Pay the motor vehicle excise to the city or town in which the vehicle was registered on january 1.

Money collected on all bills, excluding deputy tax collectors' fees, is put into the municipal treasury. In addition, interest will accrue on the overdue bill at an annual rate of 12% from the day after the due date. If javascript is disabled in your browser, please.

They are sent to city or town assessors who commit them to the local tax collectors for distribution and collection of payment. The excise for any particular year is due to the municipality in which the vehicle was registered on january 1 of that year. Application for abatement short form;

Please note all online payments will have a 4.5% processing fee added to your total due. If you feel you do not owe this excise tax, do not ignore it! There are no special considerations for financial hardship.

Generally, tax collectors and deputy tax collectors do not accept partial payment of an excise bill. You can go there and pay them directly. For immediate clearance of marked bills, payments in cash can be made at the deputy collector’s office in brockton city hall monday through friday from 8:30am to 4:30pm.

Excise bills are prepared by the registry of motor vehicles according to the information on the motor vehicle registration.

2

Getting Answers Springfield Mans 35-year-old Excise Tax Bill News Westernmassnewscom

Pdf The Economics Of Excise Taxation

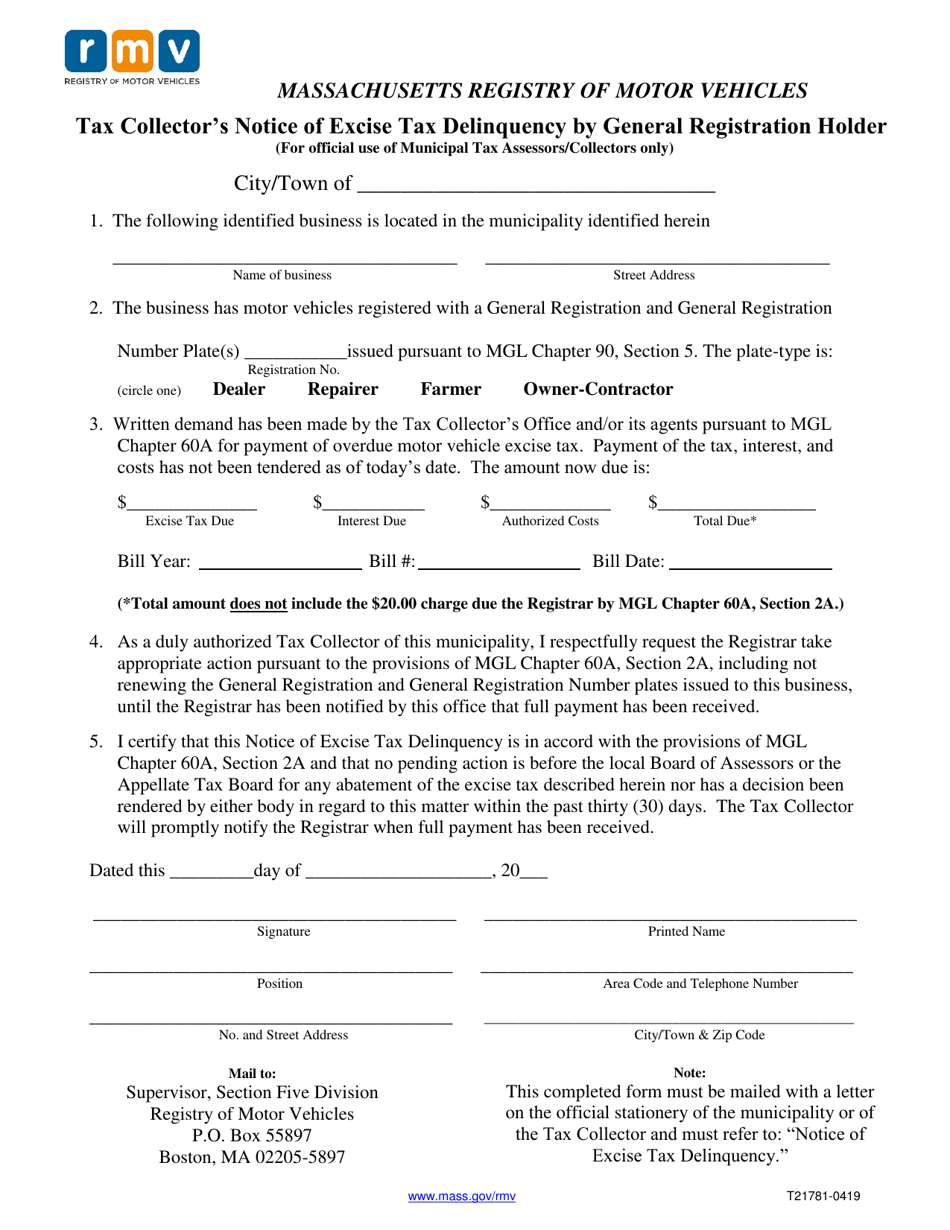

Form T21781 Download Printable Pdf Or Fill Online Tax Collectors Notice Of Excise Tax Delinquency By General Registration Holder For Official Use Of Municipal Tax Assessorscollectors Only Massachusetts Templateroller

2

Welcome To Easton Ma

2

2

2

2

Chicopee Residents See Late Fees After Allegedly Not Receiving Excise Tax Bills

Tax Collector Littleton Ma

2

2

2021 Motor Vehicle Excise Tax Bills Fairhaven Ma

Excise Tax Milton Ma

2

Overdue Excise Tax Warrants Acushnet Ma

Online Banking To Pay For Town Bills Cohasset Ma