South Dakota Used Vehicle Sales Tax Rate

Unfortunately, if you live close to a state with a lower or no car sales tax, such as if you live near delaware, you cannot buy a car in that state to avoid sales tax. All fees are assessed from purchase date regardless of when an applicant applies for title and registration.

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

Mobile / manufactured homes are subject to the 4% initial registration fee.

South dakota used vehicle sales tax rate. The december 2020 total local sales tax rate was also 6.500%. The south dakota dmv registration fees you'll owe. The cost of a vehicle inspection/emissions test.

The state sales tax rate in south dakota is 4.500%. The south dakota department of revenue administers these taxes. Governmental or sales tax exempt agency.

The south dakota (sd) state sales tax rate is currently 4.5%. Additionally, if you want to avoid surprise maintenance costs after buying a used car, you should think about ordering a vehicle. Depending on local municipalities, the total tax rate can be as high as 6.5%.

Subject to the sales and use tax based on the lesser of 5% of the total lease payments plus other charges or $300. The 6.5% sales tax rate in tripp consists of 4.5% south dakota state sales tax and 2% tripp tax. 4% is the smallest possible tax rate (meckling, south dakota) 4.5%, 5.5% are all the other possible sales tax rates of.

South dakota municipalities may impose a municipal sales tax, use tax, and gross receipts tax. The current total local sales tax rate in rapid city, sd is 6.500%. For tax rates in other cities, see south dakota sales taxes by city and county.

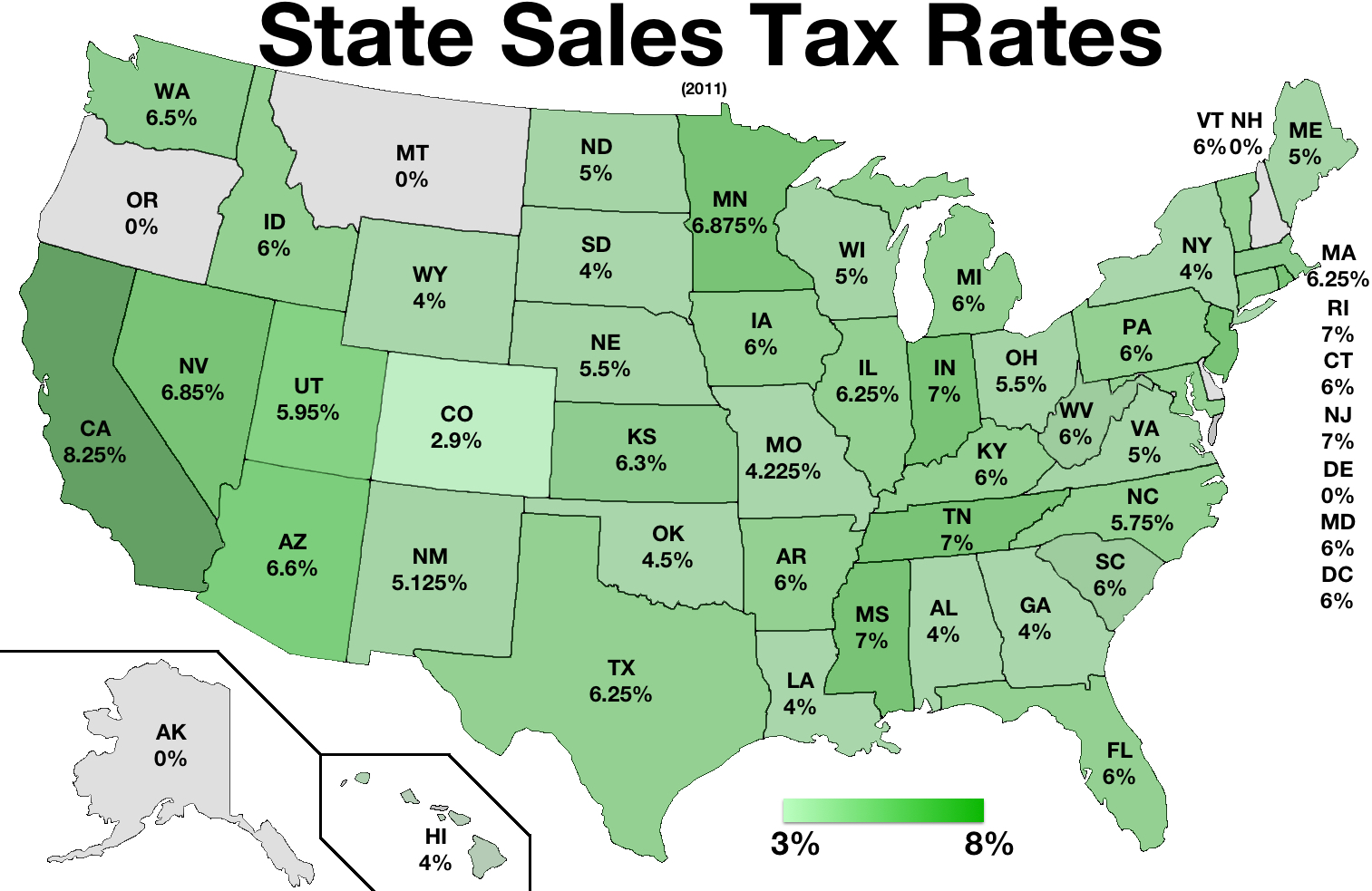

The states with the highest car sales tax rates are: State sales tax and any local taxes that may apply. Consumers use, rental tax, sales tax, sellers use, lodgings tax and more.

One exception is the sale or purchase of a motor vehicle which is subject to the South dakota has recent rate changes (thu jul 01 2021). South dakota state rate(s) for 2021.

The south dakota state sales tax rate is 4%, and the average sd sales tax after local surtaxes is 5.83%. Click search for tax rate. Exact tax amount may vary for different items.

There is no applicable county tax or special tax. Motor vehicles registered in the state of south dakota are subject to the 4% motor vehicle excise tax. Counties and cities can charge an additional local sales tax of up.

4.25% motor vehicle document fee. Some of the south dakota tax type are: Real property taxes local real property taxes in south dakota vary from one to three percent of the market value of the structure, with most rates falling around two percent.

With few exceptions, the sale of products and services in south dakota are subject to sales tax or use tax. Select view sales rates and taxes, then select city, and add percentages for total sales tax rate. 2021 south dakota state sales tax.

Vehicle leases & rentals tax fact) 1 | june 2018 │ south dakota department of revenue │ motor vehicle sales & purchases motor vehicle sales and purchases. Marketplace providers are required to remit sales tax on all sales it facilitates into south dakota if the thresholds of 200 or more transactions into south dakota or $100,000 or more in sales to south dakota customers are met. For cities that have multiple zip codes, you must enter or select the correct zip code for the address you are supplying.

6.35% for vehicle $50k or less. Enter a street address and zip code or street address and city name into the provided spaces. Searching for a sales tax rates based on zip codes alone will not work.

With local taxes, the total sales tax rate is between 4.500% and 7.500%. Mary owns and manages a bookstore in rapid city, south dakota. The cost of your car insurance policy.

This includes south dakota’s state sales tax rate of 4.000%, and rapid city’s sales tax rate of 2.500%. If a motor vehicle lease contract does not exceed 90 continuous days, the $300 maximum tax does not apply and the lease is subject to the sales and use tax. 7.75% for vehicle over $50,000.

The use tax rate is the same as the sales tax rate, both for the state and the municipalities. You can print a 6.5% sales tax table here. With local taxes, the total sales tax rate is between 4.500% and 7.500%.

Municipalities may impose a general municipal sales tax rate of up to 2%. Please refer to the south dakota website for more sales taxes information. They may also impose a 1% municipal gross receipts tax (mgrt) that is in addition to the municipal sales tax.

Sales Tax Definition What Is A Sales Tax Tax Edu

Sales Taxes In The United States - Wikiwand

How Is Tax Liability Calculated Common Tax Questions Answered

Pin Op Infographics

Understanding Californias Sales Tax

Sales Taxes In The United States - Wikiwand

Sales Taxes In The United States - Wikiwand

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Taxes In The United States - Wikiwand

States With Highest And Lowest Sales Tax Rates

Pin On Seo Services

Nj Car Sales Tax Everything You Need To Know

Understanding Californias Sales Tax

Understanding Californias Sales Tax

Understanding Californias Sales Tax

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

Minnesota Sales Tax On Cars

South Dakota Sales Tax - Small Business Guide Truic