Are Hoa Fees Tax Deductible In Nj

Hoa dues are typically not tax deductible for the home you live in. You can deduct your property taxes paid or $15,000, whichever is less.

37 York Dr 1a Edison Nj 08817 35 Photos Mls 2203384r - Movoto

Generally, if you are a first time homebuyer, your hoa fees will almost never be tax deductible.

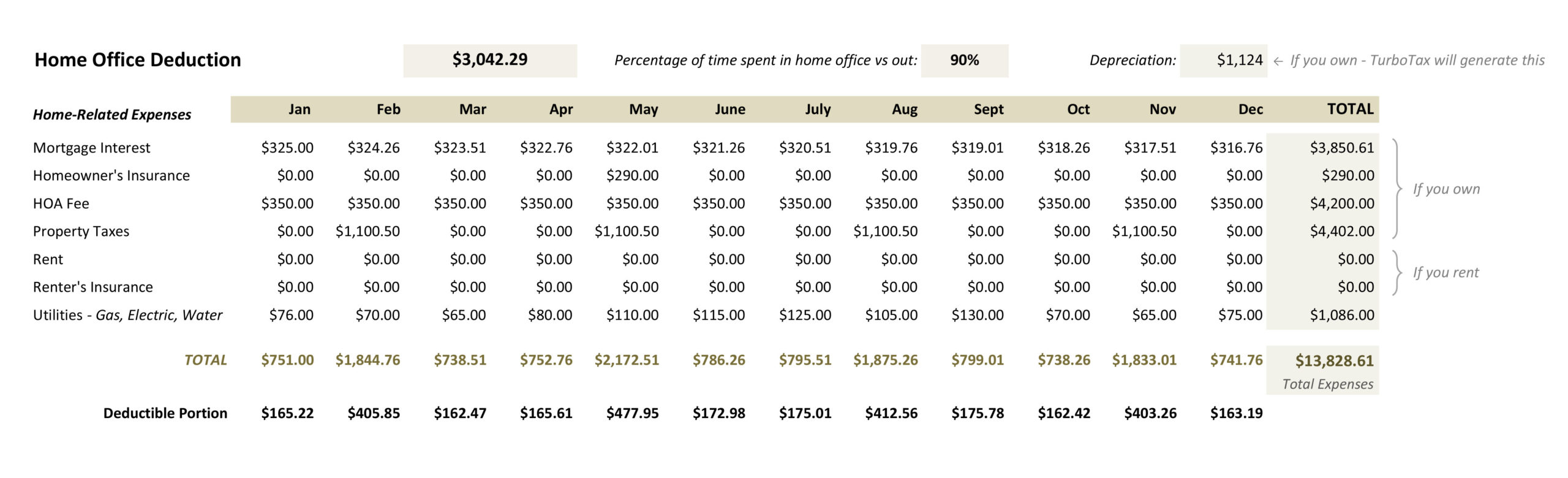

Are hoa fees tax deductible in nj. Here are the expenses that may be used to minimize state estate tax liability in new jersey: First, though, let’s take a look at what an hoa is, what they offer, and what that can mean for you come april 15. The home office deduction might also provide some relief if you have an office in your home.

Under the new tax law for 2018, you can deduct up to $10,000 in state and property taxes. The answer is yes and no. If you want to make the most of those tax benefits, check out our tax tips for homeowners in new jersey.

However, if you rent it out, your hoa dues may be deductible as a rental expense. It does this with the help of hoa dues — fees that the association collects from members. If the home is a rental property, however, hoa fees do become deductible.

Nj income tax property tax deduction/credit for homeowners and tenants. These benefits generally are available on a That should make everything a little more clear to you and help keep you out of trouble with the irs.

For the most part no, but there are exceptions. If you use the property as your primary residence, then your hoa fees are not deductible. If you have purchased a home or condo, you are likely paying a monthly fee to cover repairs and maintenance on the outside of your home or in common areas.

Homeowners pay for these services through a fee levied monthly, quarterly or annually. If the hoa fee is assessed for an improvement, you may be able to recoup your share of the cost of the improvement by taking a depreciation. You can also deduct mortgage interest up to $750,000 if it is a new loan.

In most cases, the internal revenue service doesn't consider insurance as a deductible expense.however, there are two special circumstances when the irs allows homeowners insurance tax deductions: Yeah, we know that’s not a great answer, but it’s true. According to the internal revenue service, homeowners association fees are not tax deductible for owners who live in their homes.

These fees are used to fund the association’s maintenance and operations. Hoa special assessments are not deductible. Hoa fees aren’t tax deductible unless your second home is a rental.

New jersey follows the federal rules for deducting qualified archer msa contributions. If you only use your second home for personal use, you’re not allowed to claim a tax deduction for hoa fees. You were domiciled and maintained a primary residence as a homeowner or tenant in new jersey during the tax year;

Every homeowner’s association (hoa) is different, but there are several situations in which you can deduct some or all of your hoa fees. Additionally, are property taxes deductible in nj? You are eligible for a property tax deduction or a property tax credit only if:

Hoa fees are typically not 100 percent deductible, but you may still be able to claim some portion of them as a writeoff. If you have a home business or if you're a landlord. If you own a rental property and pay hoa fees, you could get a tax break.

Please know that to qualify for tax deductions of any type on a rental property, your property has to be rented out at least 15 days per year. Under certain conditions, you may also deduct improvements or significant repairs to improve the sales price and staging expenses. Video of the day for landlords only

The answer regarding whether or not your hoa fees are tax deductible varies depending on the situation. Most expenses realted to a funeral or burial, including all costs of a funeral home, mortuary services, the costs of a headstone and any engraving, any meals or food/beverages provided at a funeral or memorial service, flowers, thank you notes and any fees or. The previous limit was $1 million, and that amount still holds true.

Irs regulations can be a little complicated, but in general, hoa fees are not deductible if the property you own in the community is your primary residence. While hoa fees aren’t tax deductible for your primary residence, there are other expenses that are deductible. You may be wondering whether this fee is tax deductible.

Homeowners associations are allowed a $100 deduction on taxable income, and a flat rate of 30% applied. A homeowners association runs a community by imposing certain rules, preserving its aesthetics, and maintaining various aspects of the neighborhood. While the closing costs such as legal fees for the title search, title insurance, or recording fees are not deductible, you can reduce your capital gains by lowering the profit when you add these expenses to the cost basis of your home.

Secondly, if you own an investment property, you can deduct all hoa dues. Your primary residence , whether owned or rented, was subject to property taxes, that were paid either as actual property taxes or through rent; If you purchase property as your primary residence and you are required to pay monthly, quarterly or yearly hoa fees, you cannot deduct the hoa fees from your taxes.

Are homeowners association fees tax deductible? The short answer is no. Understand the new tax laws with the implementation of the tax cuts and jobs act, the tax laws changed (in some ways pretty dramatically) at the end of 2017.

There are certain exceptions, though, such as if you use the property as a rental property or a place of work. New jersey resident homeowners may be entitled to property tax relief benefits, credits, or deductions provided by the state of new jersey. Records to support these expenses should be available.

So let’s go over when an hoa fee is tax deductible and when it’s not. Excess contributions that you withdraw before the due date of your tax return are not taxable.

Can I Write Off Hoa Fees On My Taxes

320 South St Apt 11j Morristown Nj 07960 Realtorcom

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

Are Homeowners Association Fees Tax Deductible Budgeting Money - The Nest

Are Hoa Fees Tax Deductible In Nj - Ark Advisor

67 White St Unit D Eatontown Nj 07724 - Realtorcom

New Jersey Hoa Condo Association Tax Return Filing The Concise Guide

Is Car Insurance Tax Deductible Hr Block

Hoa Dues Vs Hoa Fees Vs Hoa Assessment Clark Simson Miller

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

Are Homeowners Association Fees Tax Deductible Budgeting Money - The Nest

Are Hoa Fees Tax Deductible - Clark Simson Miller

Calculating Your Home Office Expenses As A Tax Write-off Free Template - Lin Pernille

Are Homeowners Association Fees Tax Deductible Budgeting Money - The Nest

Can I Write Off Hoa Fees On My Taxes

What Are Hoa Fees Complete 2020 Guide -

Are Hoa Fees Tax Deductible - Clark Simson Miller

Are Hoa Fees Tax Deductible - Clark Simson Miller

Paying Personal Expenses Out Of A Closely Held Business Civil And Criminal Tax Implications Verni Tax Law