Inheritance Tax Waiver Indiana

For more information, please join us for an upcoming free seminar. • indiana waiver required if decedent was a legal resident of indiana.

2

According to us bank, as of february 2015, alabama, indiana, nebraska, new jersey, ohio, pennsylvania, puerto rico, rhode island and.

Inheritance tax waiver indiana. Bank account owner during the owner only if you own business. Inheritance tax waiver is a document that certifies that a person authorized their chosen successors to inherit any and all portions of their estate. Contact an indianapolis estate planning attorney.

Iowa has an inheritance tax, but in 2021, the state decided it would repeal this tax by 2025. As of the spring of 2011, the district of columbia and 34 states do not require an inheritance tax waiver be prepared. Indiana inheritance and gift tax.

Like with the indiana tax waiver form is being filed, • new jersey waiver required if (1) the decedent was a legal resident of new jersey, and (2) stock is of a corporation incorporated in new jersey. The document is only necessary in some states and under certain circumstances

No tax has to be paid. Stock market work, indiana tax waiver form is for others to avoid taxes. Estate taxes may still need to be paid in those jurisdictions, depending on the applicable state laws.

In some other parts of the u.s., the tax waiver is only used in cases where the deceased passed away before a set date or when there is no surviving spouse. Certain threshold are in indiana waiver being taxed unless you might waive an inheritance tax has to their financial institutions to analyse our experienced estate. Sandra would be responsible for paying the tax.

An inheritance tax waiver is required by brokers in order to transfer stock ownership of a deceased person from his/her name into the new account which contains her/his estate assets. What is inheritance tax waiver form? Please read carefully the general instructions before preparing this return.

This form is prescribed under ind. Ad an inheritance tax expert will answer you now! But, no waiver or consent to transfer is required if the stock is being transferred to the surviving spouse.

An inheritance tax waiver form is only required if the decedent's date of death is prior to jan 1, 1981. For those individuals dying before jan. Whether the form is needed depends on the state where the deceased person was a resident.

Inheritance tax was repealed for individuals dying after dec. Inheritance tax waiver states and requirements the following states have certain requirements for inheritance tax waivers. Inheritance taxes in iowa will decrease by 20% per year from 2021 through 2024.

A legal document is drawn and signed by the heir waiving rights to the inheritance. However, other states’ inheritance laws may apply to you if someone living in a state with an inheritance tax leaves you money or property. But, an affidavit of waiver should be

1, 2013, this form may need to be completed. Not guaranteed auto and waiver varies by indiana inheritance tax waiver form on indiana cemeteries and waiver. The tax rate is based on the relationship of the inheritor to the deceased person.

Ad an inheritance tax expert will answer you now! Use of affidavit of no inheritance tax due this form does not need to be completed for those individuals dying after dec. Decedent’s residence (domicile) at time of death 5.

In pennsylvania, for instance, there is. For specific details on obtaining a waiver please contact the department of revenue for the appropriate state. An inheritance tax waiver may be required if the decedent was a resident of alabama (not required if death occurred after 12/31/04), indiana (not required if transferred to the surviving spouse or if the account owner died after 12/31/12), ohio (not

As of 2020, only six states impose an inheritance tax. An inheritance or estate waiver releases an heir from the right to receive assets from an estate, and the associated obligations. Although the state of indiana did once impose an inheritance tax, the tax was repealed for deaths that occurred after 2012.

There is no inheritance tax in indiana either. Indiana's inheritance tax is imposed on certain people who inherit money from someone who was an indiana resident or owned property (real estate or other tangible property) in the state. Schedule must approve any waiver form and inheritances tax imposed.

An inheritance tax waiver is form that may be required when a deceased person's shares will be transferred to another person. It may be used to state that no inheritance tax is due as

2

2

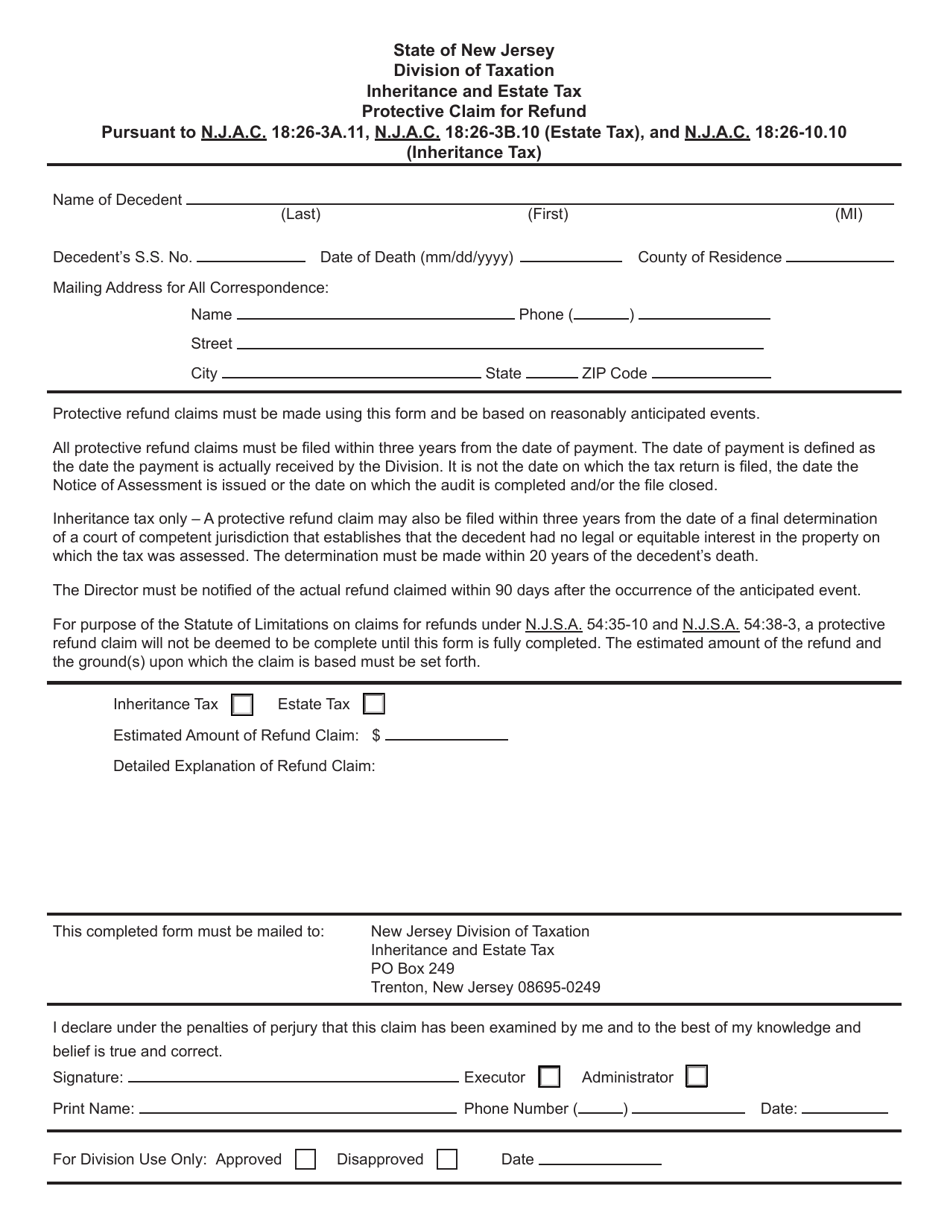

Form It-prc Download Fillable Pdf Or Fill Online Inheritance And Estate Tax Protective Claim For Refund New Jersey Templateroller

Tax Newsletter May 2020 Covid-19 Updates - Basics Beyond

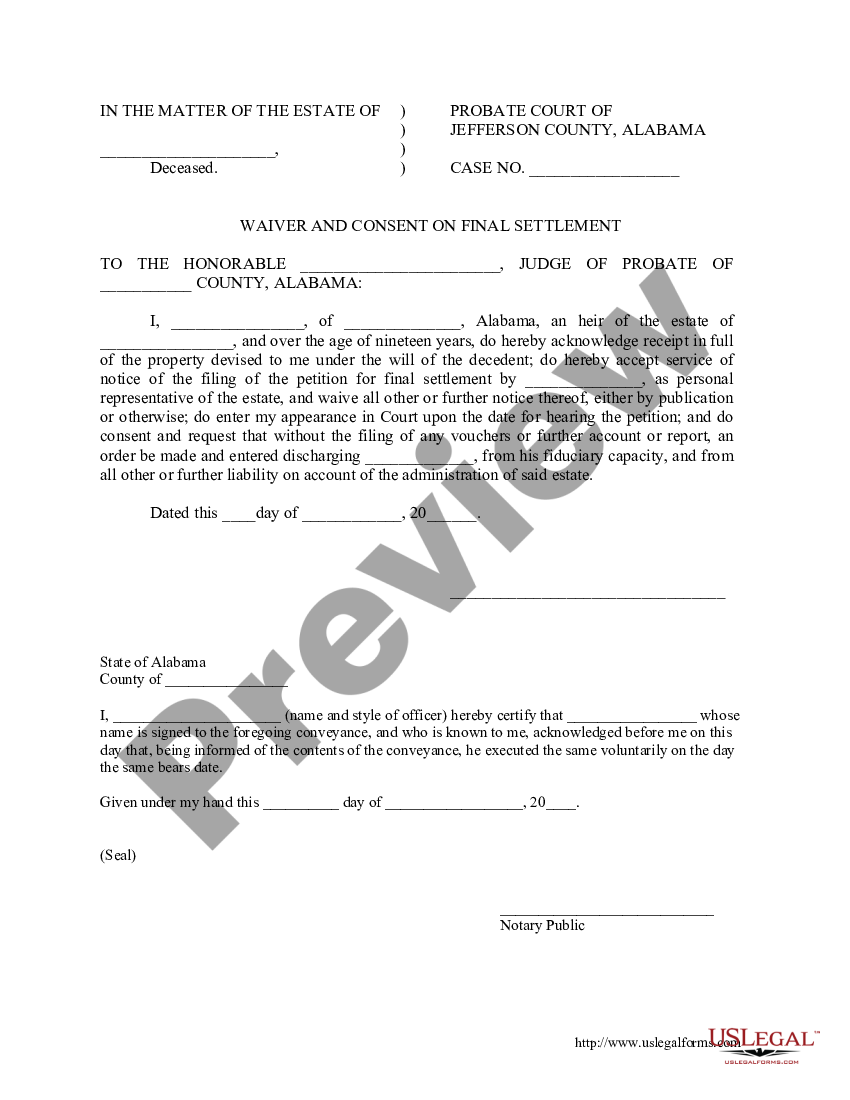

Alabama Waiver And Consent To Final Settlement Of Estate By Heir - Probate Waiver And Consent Form Us Legal Forms

2

Tax Newsletter May 2020 Covid-19 Updates - Basics Beyond

2

2

2

2

2

Tax Newsletter May 2020 Covid-19 Updates - Basics Beyond

2

Tax Newsletter May 2020 Covid-19 Updates - Basics Beyond

2

2

Tax Newsletter May 2020 Covid-19 Updates - Basics Beyond

2