Payment Plan For Mississippi State Taxes

And you are not enclosing a payment, then use this address. Open bankruptcy case or open/pending state court case?

Prepare Your 2021 2022 Mississippi State Taxes Online Now

If you live in mississippi.

Payment plan for mississippi state taxes. There are several options available when making a payment to your student account. You can make estimate payments through tap. The due date for filing a ms tax return and submitting ms payments is april 18, 2022.

If you apply for an extension of time to file and owe tax, you need to make your extension payment by the due date. This is the rate collected across the state, with one exception. Welcome to the online mississippi tax quickpay for businesses and individuals.

“abolishing the state income tax would give every mississippi worker a pay raise. Through your account, you can request an ipa for a balance of $20,000 or less, and with 36 or fewer scheduled monthly payments. How to make a credit card payment.

Payment plan (installment agreement) electronic federal tax payment system (eftps) You need to have a clean record for the past 5. Establish an account on the dtf website.

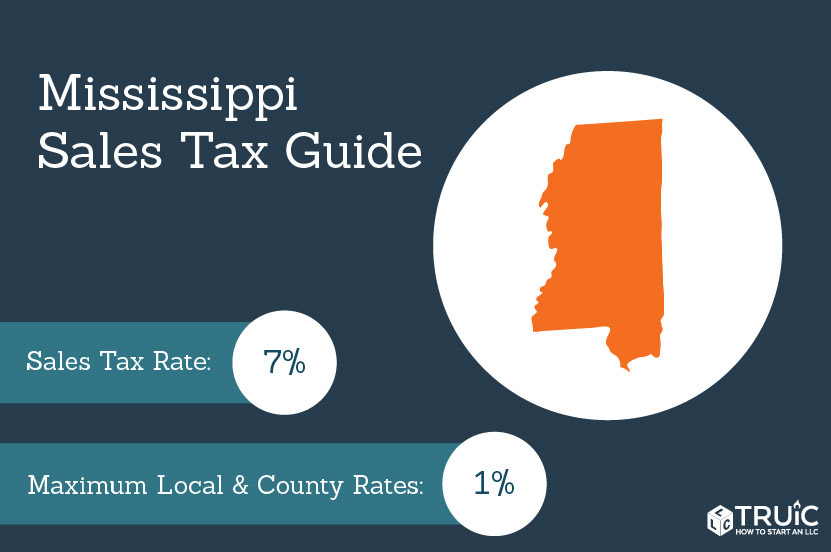

Irs payment plans over $50,000. A tax payment plan lets you pay off your missouri tax liability in installments. The state sales tax rate in mississippi is 7%.

You can pay, or schedule a payment for, any day up to and including the due date. If you cannot pay your state taxes and want to request a payment plan, take one of these options: Mississippi is one of just a few states to apply sales taxes to groceries.

However, the taxpayer must consider other alternatives as an installment agreement. Other resolution options are available if you cannot afford the payment plan, but they require more financial documents. It would mean they had more money to spend on their priorities and families.” gov.

Any taxpayer who enters into an installment agreement in missouri should. The payor may deduct from mississippi taxable income the amount of any payments made under a mpact prepaid tuition contract in the tax year. This application cannot be done online;

Note that the kansas dor offices are closed from march 23 through april 6. To avoid penalty and interest, payment of taxes due should be made on or before april 15, 2021. Every individual taxpayer who does not have at least eighty percent (80%) of his/her annual tax liability prepaid through withholding must make estimated tax payments if his/her annual tax liability exceeds two hundred dollars ($200).

Earnings from mpact are exempt from federal and state income tax when paid to a school by mpact. And you are enclosing a payment, then use this address. Pay income tax through online services, regardless of how you file your return.

However, prescription drugs are exempt from the sales tax in mississippi. 15 presented his executive budget plan for fiscal year 2023, which includes his recommendation to eliminate the income tax. And you are filing a form.

Select make an estimated payment from the left hand menu. When a mississippi taxpayer cannot pay off their taxes, in certain cases a taxpayer can set up an installment agreement with the mississippi department of revenue. However, the process for approval isn’t as streamlined.

Generally, any taxpayer who owes $20,000 or less in state taxes will qualify for a new york state income tax payment plan. Payment plan requests setup through 97tax.com always calculate your payment at the full 60 months and according to. Mississippi’s state tax payment plan or installment agreement.

There is an additional 1% tax in jackson, the state capital. Here are some other conditions. Individual taxpayers who owe up to $75,000 to the division of taxation can pay in monthly installments for up to 60 months (five years).

What are the tax benefits? Consult a tax professional for detailed information. You cannot apply online if.

Bank account (direct pay) debit or credit card; If you owe more than $50,000, you may qualify for a streamlined processing payment plan, an irs pilot program that allows you to pay over the course of 84 months. The state does grant ipas for balances greater than $20,000.

You can use this service to quickly and securely pay your mississippi taxes using a. The missouri state tax payment plan is referred to as the state’s internet installment agreement program. Estimated tax payments must not be less than 80% of the annual income tax liability.

Box 5328, mississippi state, ms 39762. There is an additional convenience fee to pay through the ms.gov portal. Qualifying for a payment plan is relatively easy and is available to most taxpayers.

Pay personal income tax owed with your return. This program allows you to pay what you owe using digital payments. Individuals and businesses can apply.

Under the agreement, you'll make monthly payments toward your unpaid tax balance. This form only works if you are filing a timely return and the total tax owed is more than $75 but not more than $3,000. Payment in full required, no payment plan available:

Instead of paying taxes in a lump sum, you make monthly payments until you have paid off the balance. Payment on a tax due return can be made using direct debit at the time the return is efiled, when supported by the software. The fastest and easiest way to request an ipa is through your online services account.

Top Income Tax Rate By State - States With No Income Tax 1alaska 2florida 3nevada 4south Dakota 5 Retirement Income Best Places To Retire Retirement

Mississippi State Tax Payment Plan Details

This Map Shows How Taxes Differ By State Gas Tax Healthcare Costs Better Healthcare

Which States Pay The Highest Taxes Family Money Saving Business Tax Economy Infographic

Pin On Coronavirus Columbus Ohio And Usa

Mississippi Tax Rate Hr Block

Home Page

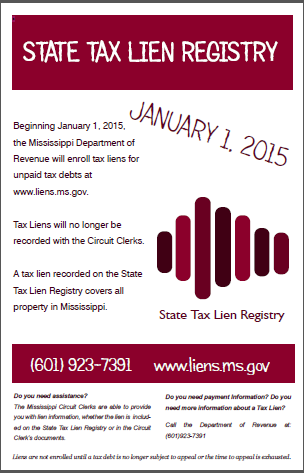

State Tax Lien Registry Dor

Monday Map State Income Taxes On Social Security Benefits Social Security Benefits Social Security Income Tax

Mississippi Could Spend Half Billion More In 2022 Budget - Mississippi Today

Stamp Act Stamp Prints Book Cover

Filing Mississippi State Tax Returns Things To Know Credit Karma Tax

How To File And Pay Sales Tax In Mississippi Taxvalet

Pin On Plethora Of Personal Finance Potpourri

Mississippi Sales Tax - Small Business Guide Truic

Median Household Income And Taxes - State Tax Levels In The United States - Wikipedia Flag Coloring Pages Oregon State Flag Tax

Car Insurance Template Pdf - Fill Online Printable With Regard To Proof Of Insurance Card Template Progressive Insurance Report Card Template Id Card Template

Mississippi State Tax Hr Block

Pin On Taxes