New Mexico Gross Receipts Tax Table 2021

Corporate income & franchise tax. New mexico has a statewide gross receipts tax rate of 5.125%, which has been in place since 1933.

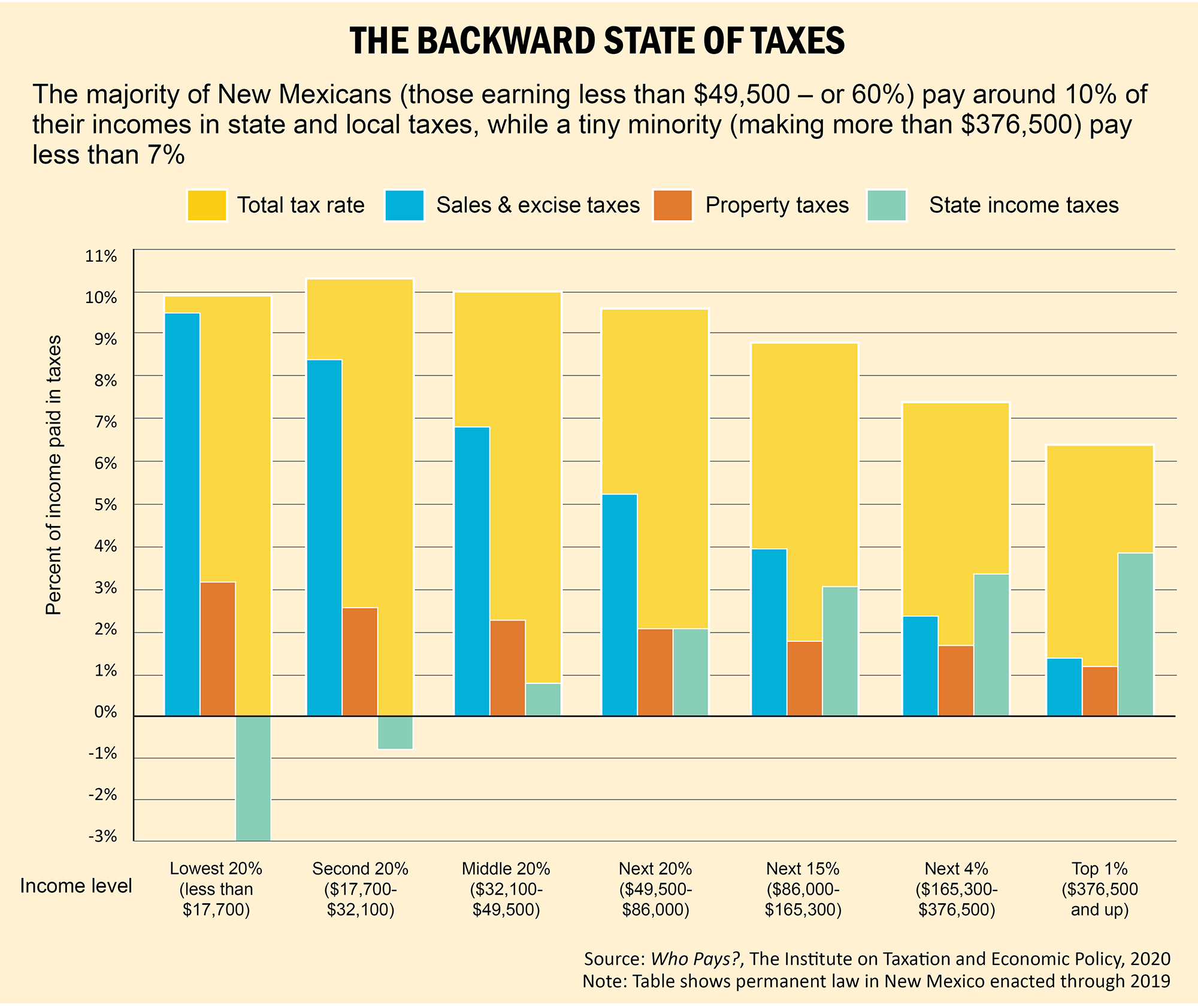

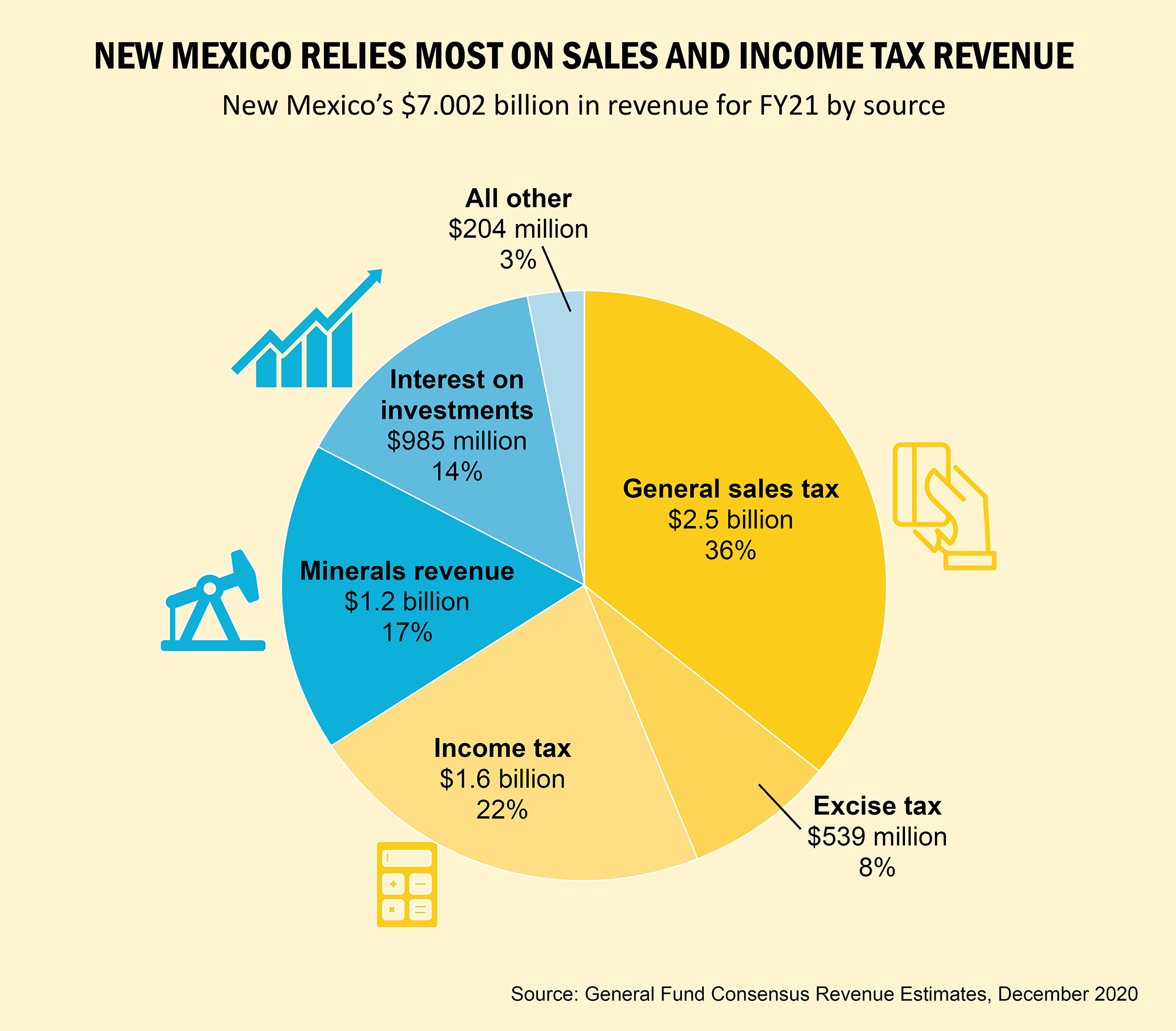

A Guide To New Mexicos Tax System New Mexico Voices For Children

The proposal would lower the statewide gross receipts tax rate to 4.875% from 5.125%.

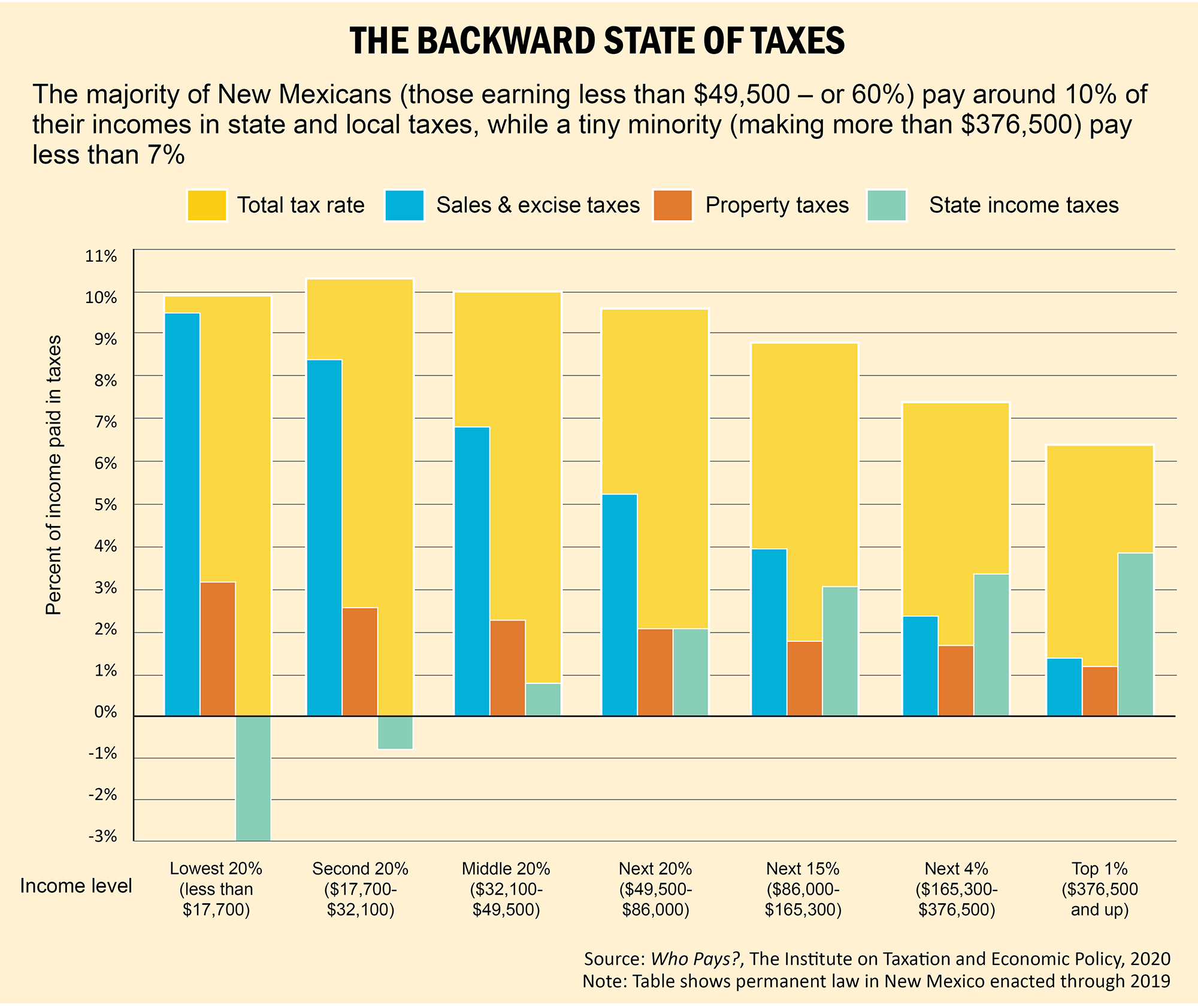

New mexico gross receipts tax table 2021. Seven states currently levy gross receipts taxes, while several others, including pennsylvania, south carolina, virginia, and west virginia, permit local taxes imposed on a gross receipts base. Transactions among related persons are gross receipts. Supporters also say it would help ease the pyramiding that results from the state’s tax policies.

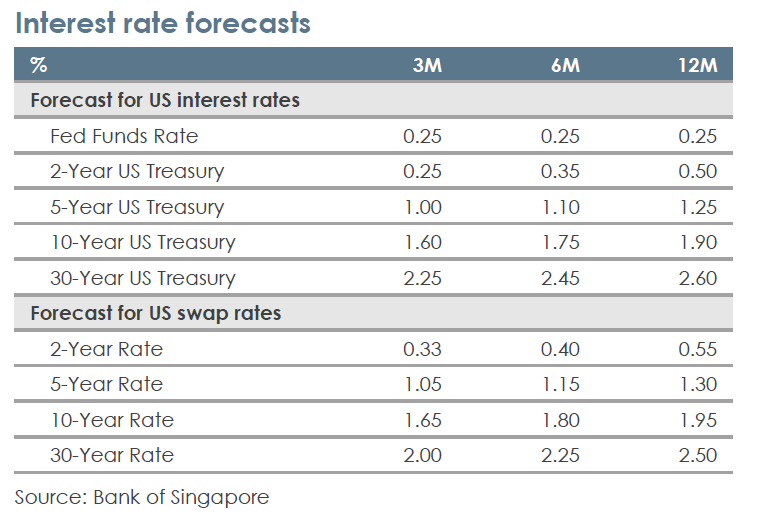

Depending on local municipalities, the total tax rate can be as high as 9.0625%. This tax alert summarizes some of the guidance on sourcing sales of services. “new mexico is an outlier in the imposition of its gross receipts tax and broad inclusion of sales of services, which creates unique complexities in the administration of this tax,” wrote erica kenney, cost’s west coast tax counsel.

New mexico has a gross receipts tax that is imposed on persons engaged in business in new mexico. The new mexico state sales tax rate is 5.13%, and the average nm sales tax after local surtaxes is 7.35%. Reporting location for the sale of services

The new mexico department of taxation and revenue recently reminded taxpayers of several important changes to the sourcing and collection of the state gross receipts and compensating tax (sales and use tax). Prior to july 1, 2021, the gross receipts tax was calculated and collected based on where the seller was located. The proposal would trim new mexico’s gross receipts tax rate by 0.25%, putting the rate at under 5%.

The new mexico department of revenue is. Tax alert | july 07, 2021. Oil, natural gas and mineral extraction.

Governmental gross receipts tax for the privilege of engaging in certain activities by governments, there is a governmental gross receipts tax of 5% imposed on the receipts of new mexico state and local government agency, institution, instrumentality or political subdivision (except public school districts and an entity licensed by the The state since march has been allowing restaurants, bars and brewpubs to keep the gross receipts tax they collect, but so far only 552 have taken the new mexico taxation & revenue department up. Gross receipts location code and tax rate map gis data disclaimer applies:

New mexico sales tax details. Gross receipts location code and tax rate map; The new mexico state tax tables for 2021 displayed on this page are provided in support of the 2021 us tax calculator and the dedicated 2021 new mexico state tax calculator.

The new mexico (nm) state sales tax rate is currently 5.125%. We also provide state tax tables for each us state with supporting tax calculators and finance calculators tailored for each state. Groceries are exempt from the new mexico sales tax.

The governor’s office said the proposed reduction would save new mexicans an estimated $145 million annually. These taxes gained popularity among states in the 1930s but began to be repealed or struck down as unconstitutional by state courts in the 1970s. This map represents boundaries and rates for new mexico gross receipts tax districts as identified on the gross receipts tax rate schedule published by.

Owner’s receipts from transactions with owned entity are gross receipts. The final changes to the new mexico administrative code, if adopted, will be filed on or about august 26, 2021. Gross receipts tax sourcing change.

2021 new mexico state sales tax. New mexico has not decreased its statewide gross receipts tax rate since 1981, according to the new mexico. Lease purchase agreement as a sale.

Exact tax amount may vary for different items. The proposal would trim new mexico’s gross receipts tax rate by 0.25%, putting the rate at under 5%. The governor’s office said the proposed reduction would save new mexicans an estimated $145.

Effective july 1, 2021, legislation enacted in 2019 (house bill 6) and 2020 (house bill 326), will.

Mexico Tax Revenue 1977 2021 Ceic Data

Indonesia Money Supply M2 1968 2021 Ceic Data

Layanan Premier Ocbc Nisp

Banking Privilege Ocbc Nisp

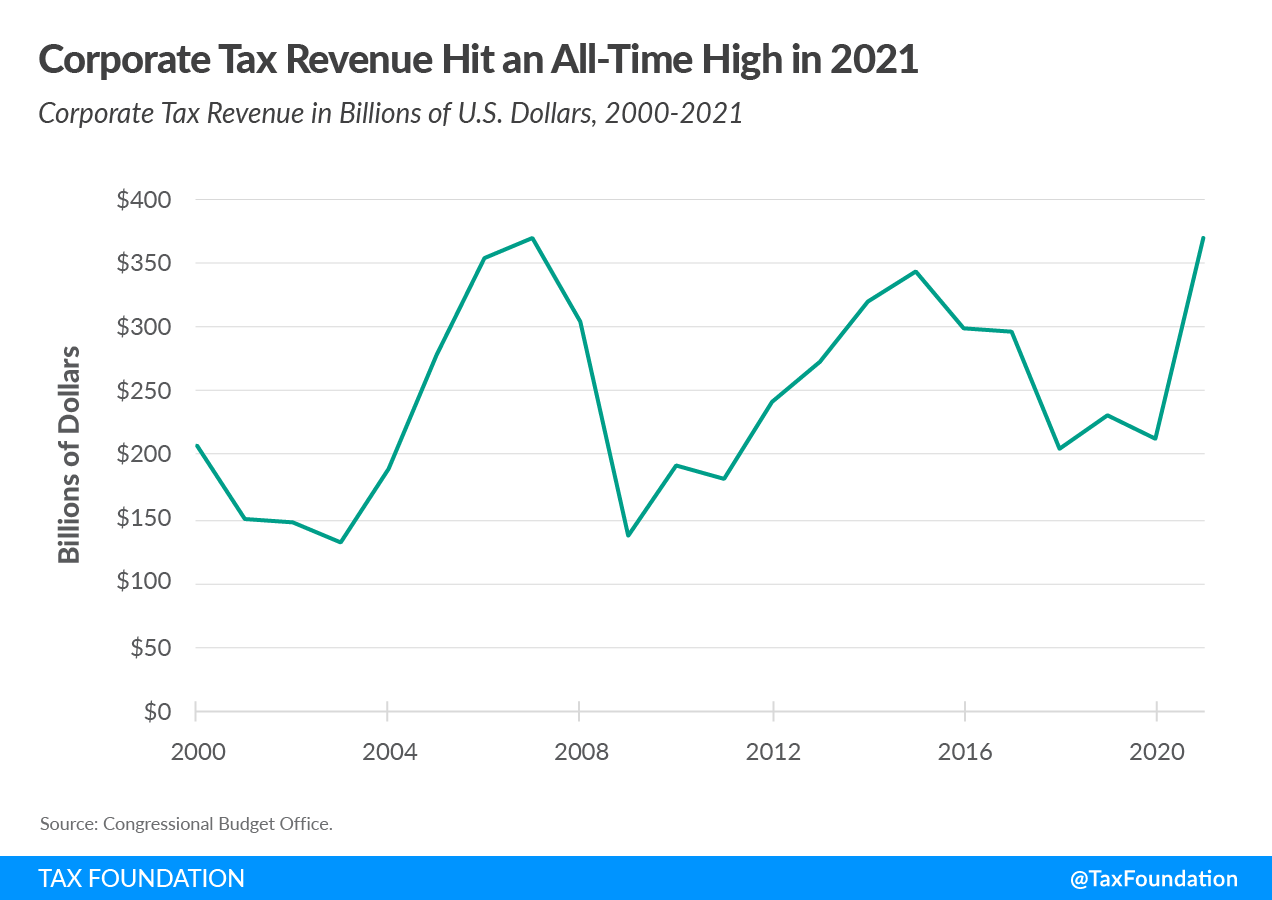

Corporate Tax Revenue Hit An All-time High In 2021 Tax Foundation

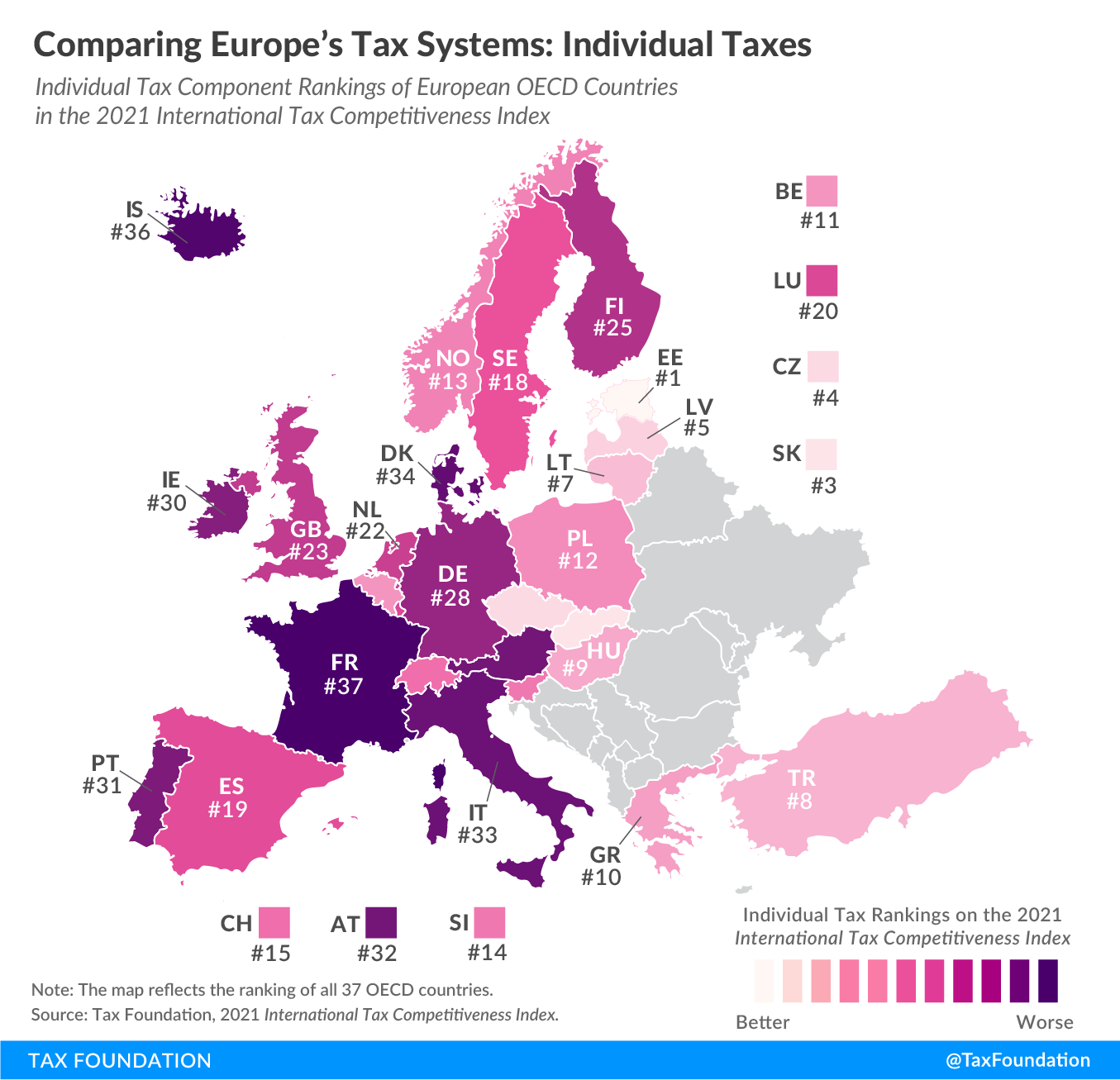

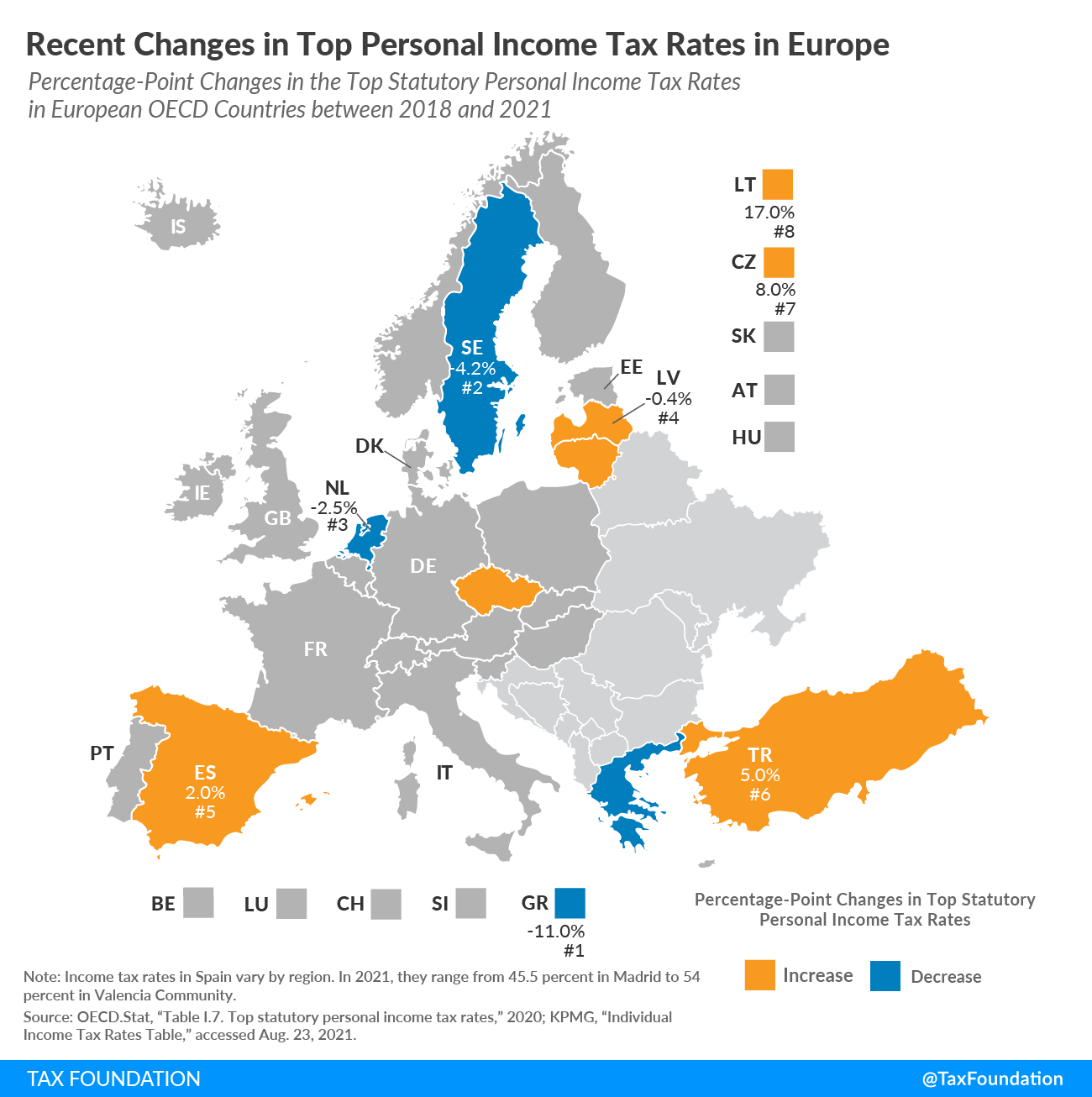

Comparing Income Tax Systems In Europe 2021 Tax Foundation

Germany Tax Revenue 1991 2021 Ceic Data

Tax Rates Climb Amid Debate Over Revising State Code - Albuquerque Journal

Banking Privilege Ocbc Nisp

Germany General Government Revenues 2021 Data 2022 Forecast 1991-2020 Historical

A Guide To New Mexicos Tax System New Mexico Voices For Children

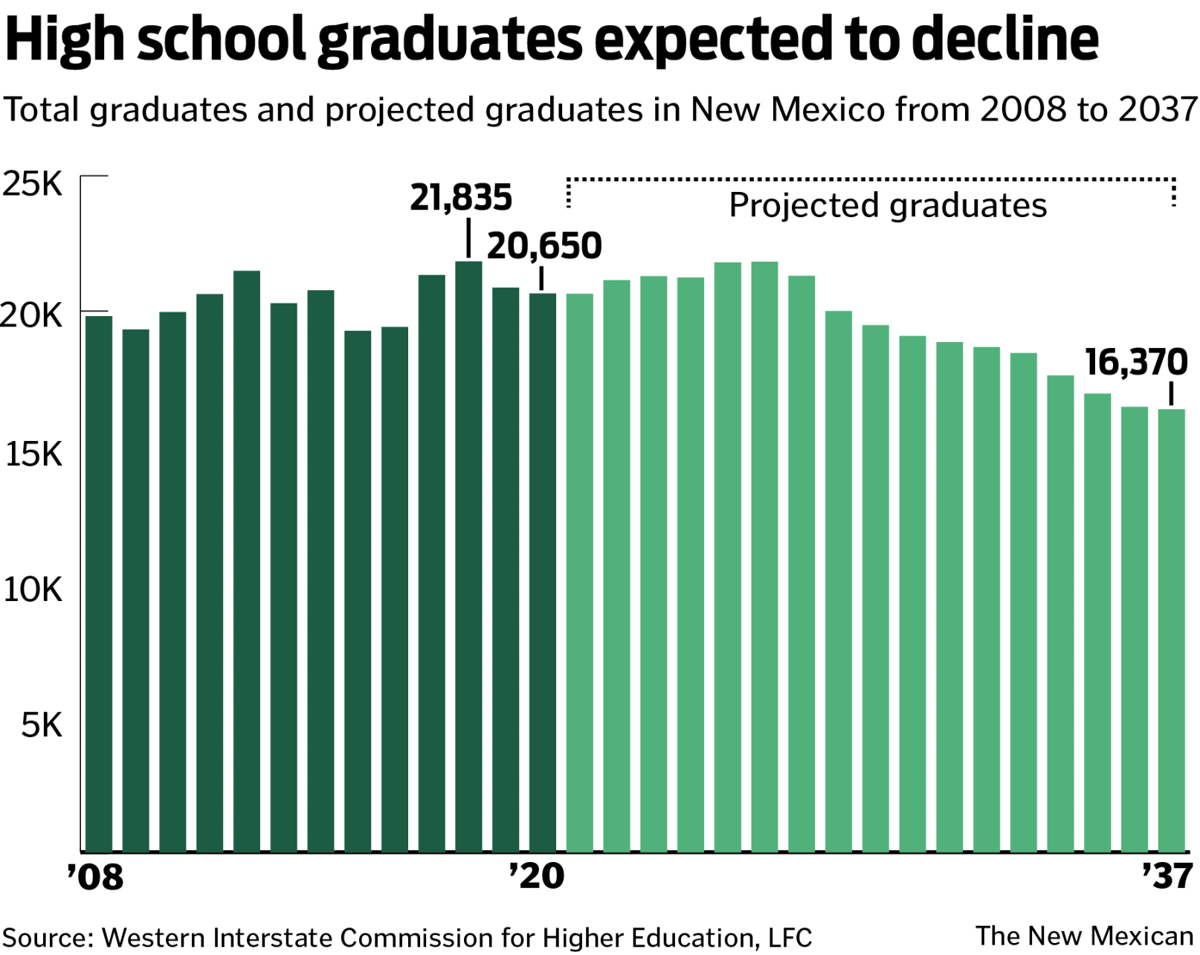

Report New Mexicos Stagnant Population Trends May Require Funding Rethink Legislature New Mexico Legislative Session Santafenewmexicancom

Indonesia Gross National Product Gnp 1993 2021 Ceic Data

Thailand Income Revenue Department By Source 2021 Statista

Indonesia National Government Debt 2009 2021 Ceic Data

Indonesia Tax Revenue Of Gdp 2014 2021 Ceic Data

Recent Changes In Top Personal Income Tax Rates In Europe 2021

Japan Tax Revenue 1983 2021 Ceic Data

Indonesia Real Gdp Growth 1994 2021 Ceic Data