How To Avoid Inheritance Tax In Florida

Three common strategies used to minimize taxes include: You may have a hefty tax bill if you take the entire amount of an inherited retirement account in a single year, but if you withdraw some this year and some early next year, you can spread the.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

There are extreme cases where an estate will still need to pass through probate even if the decedent had.

How to avoid inheritance tax in florida. The internal revenue service announced today the official estate and gift tax limits for 2021: Having multiple partners take ownership of the property will reduce the overall size of the estate and lower the inheritance tax significantly. Generally, the property value used for inheritance tax purposes is the date of death.

The florida constitution prohibits inheritance taxes. Even if you successfully change your domicile to florida, you may still be subject to new jersey estate taxes (if it is reinstituted) and inheritance taxes. There are no inheritance taxes or estate taxes under florida law.

How much inheritance is tax free in the us? If you stand to inherit property and you want to avoid paying taxes on it, there are three possible options for minimizing or eliminating capital gains tax altogether. The third option to avoid paying capital gains tax on an inherited property is to move into the home and use it as a primary residence.

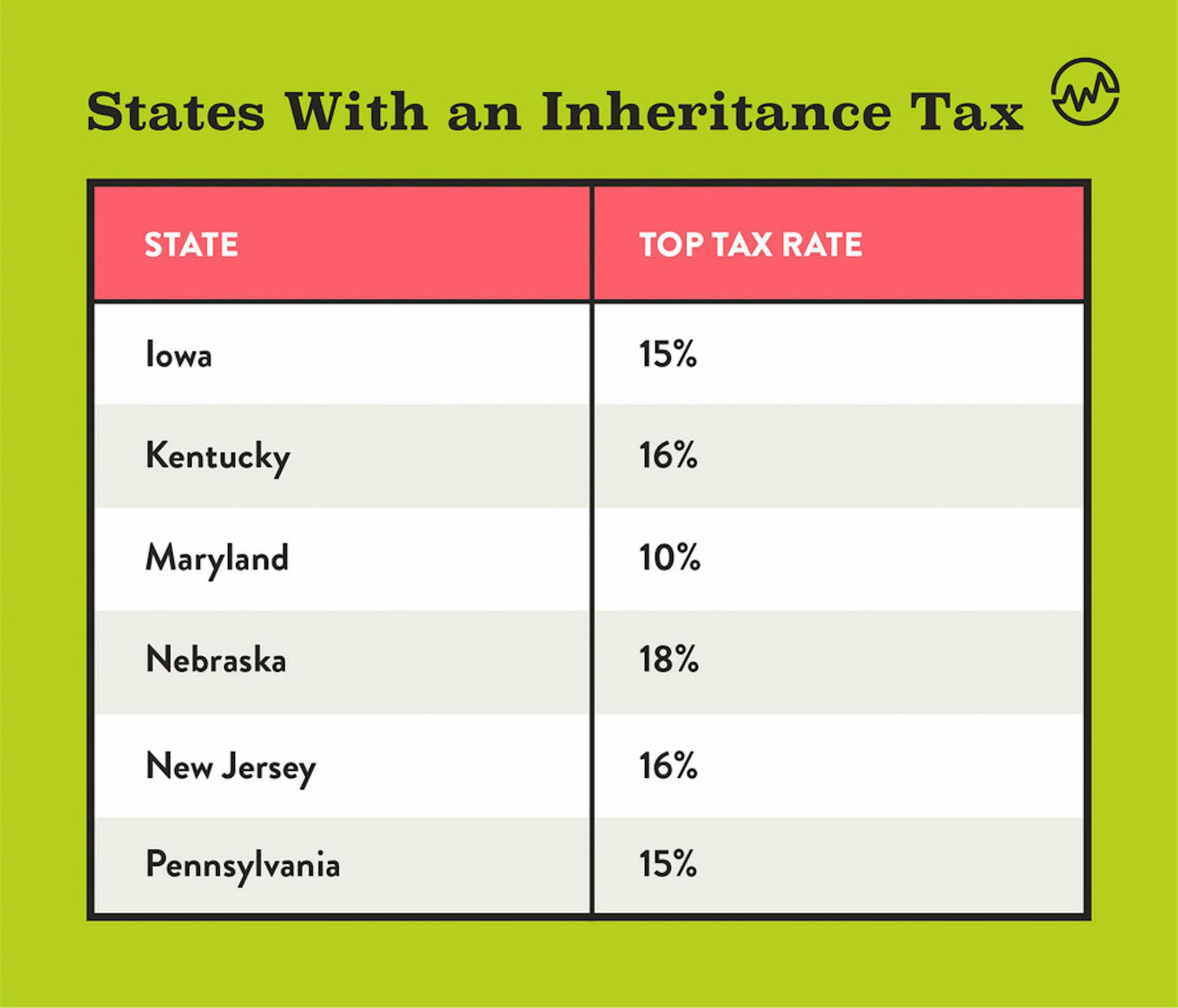

Another way to avoid probate of your assets in florida is through joint ownership of assets. So if you live in a state that has an inheritance tax you may owe tax even though the assets were in the state of florida. However, if those trusts or plans were not made, the only way estate assets can be distributed in florida is through the probate.

However, a house in florida isn't subject to pa inheritance tax, even for pa residents. Just because florida lacks an estate or inheritance tax doesn’t mean that there aren’t other tax filings that an estate. If an individual’s death occurred prior to that time, then an estate tax return would need to be filed.

Kessler one method of avoiding estate tax is through a family limited partnership. So if you inherit your parents’ home. At least one type of trust is set up to avoid and alleviate these taxes.

The probate process is not required in florida if the decedent has set up a trust (or family trust) which in most cases helps their estate to avoid probate. This could result in a. In fact, “family limited partnership” is often a misnomer, because the entity formed is usually a family llc instead.

More good news for you. By selling it right away, you aren’t leaving any room for the property to appreciate in value any further. Joint ownership of assets avoids probate.

The florida state legislature cannot enact a florida estate tax or inheritance tax that conflicts with the state constitution— florida voters would have to amend the constitution for the legislature to impose income or inheritance taxes. New jersey nonresident inheritance tax issues. Inheritance taxes are levied against each individual bequest made from an estate to a beneficiary.

By washington state estate planning & probate lawyer william o. Therefore, if a pa resident used cash to buy a house in florida, they would avoid pa inheritance tax on these dollars. There is no inheritance tax in the state of florida but you could be assessed inheritance tax based on assets owned in other states.

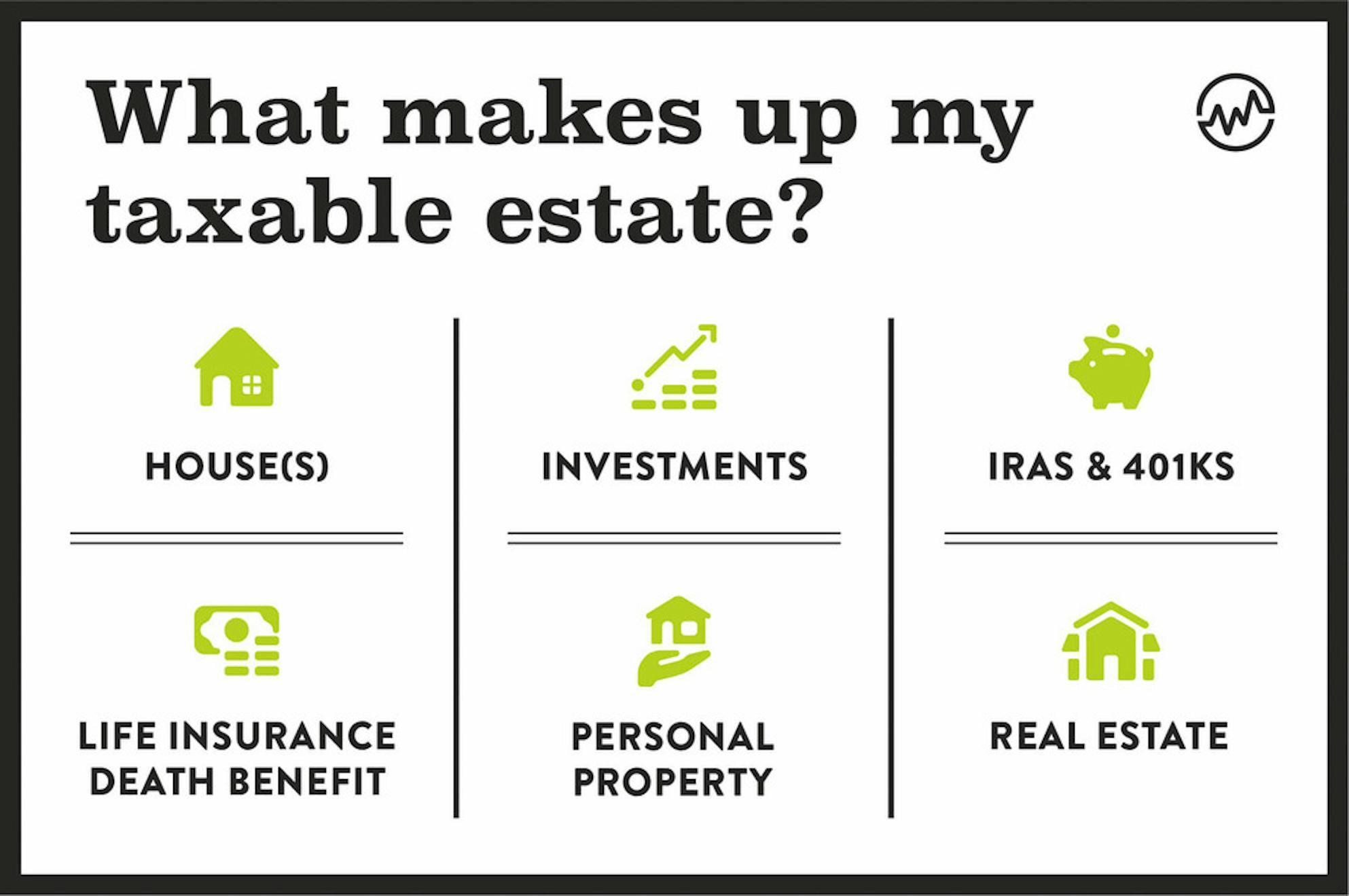

Constitutional amendments require 60% voter approval. The estate pays the estate tax, and the beneficiary pays the inheritance tax, although an estate can be set up to pay that cost on behalf of the beneficiary. Life insurance proceeds aren’t generally taxable as income to your beneficiaries.

Regardless, the purpose and function are the same. When the home is eventually sold, homeowners can generally exclude $250,000 in capital gains from tax or up to $500,000 in capital gains from tax if a joint return is filed with a spouse. Failing to keep your beneficiaries current can cost your loved ones thousands of dollars in unnecessary legal expenses to claim their inheritance.

The first is to simply sell the property as soon as you inherit it. The estate and gift tax exemption is $11.7 million per individual , up from $11.58 million in 2020. Gift tax and inheritance tax.

Through proper estate planning, you can avoid or minimize the amount of taxes your beneficiaries have to pay. For example, liquid assets such as cash sitting in a bank account is subject to pa inheritance tax. Ways to avoid an inheritance tax.

This applies to the estates of any decedents who have passed away after december 31, 2004.

Florida Estate Tax - Rules On Estate Inheritance Taxes

Florida Inheritance And Estate Tax Definition Alper Law

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To Avoid Estate Taxes With A Trust

Irish Tax And Uk Inheritances

Inheritance Tax How Much Will Your Children Get Your Estate Tax - Wealthfit

Inheritance Tax How Much Will Your Children Get Your Estate Tax - Wealthfit

Florida Estate And Inheritance Taxes - Estate Planning Attorney Gibbs Law - Fort Myers Fl

Inheritance Tax How Much Will Your Children Get Your Estate Tax - Wealthfit

Recent Changes To Estate Tax Law Whats New For 2019

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Httpwwwbingcomimagessearchqinheritance Jokes Free Lesson Plans Gambling Humor

Florida Inheritance And Estate Tax Definition Alper Law

Rare Florida Deed Called Lady Bird Deed May Reduce Probate For Families Florida Probate Lawyers Palm Beac Probate Estate Planning Documents Estate Planning

Inheritance Tax How Much Will Your Children Get Your Estate Tax - Wealthfit

How To Beat The Five-year Inheritance Tax Freeze Httpswwwmoneyinternationalcominheritance-tax-freeze Expats Iht Tax In 2021

Does Your State Have An Estate Or Inheritance Tax State Estate And Inheritance Tax Rates And Exemptions In 2020 - Skloff Financial Group

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How To Avoid Estate Taxes With A Trust