Texas Property Tax Lenders

The finance commission has collected and analyzed current and historical data in an effort to Property tax loan companies in texas.

Texas Property Tax Loans Funding Loans For Property Taxes

The housing meltdown over the last.

Texas property tax lenders. With the economy still lagging, many texans are faced with property tax bills that they are struggling to pay. The largest texas property tax lender, propel tax has paid out over $600m in property tax loans since 2007. Direct tax loan has been connecting top property tax lenders with residential and commercial borrowers since 2013.

Property tax lenders nueces county tx. Tax liens and personal liability chapter 351, texas finance code: In texas, there has been a lot of discussion about property tax loans.

Opinions expressed by forbes contributors are their own. Texas (finance commission) study the fees, costs, interest, and other expenses charged to property owners by property tax lenders in conjunction with the transfer of property tax liens and the payoff of loans secured by property tax liens. Property tax lenders denton county tx.

Welcome to the official texas property tax loans® website. The governmental tax lien is transferred to the property tax lender, and you pay the lender. However, several lenders hold multiple licenses for their various locations or operating companies, thus the true number of active property tax lending companies is closer to 70.

Property tax lenders lubbock county tx. This office requires minimum standards of capitalization, professionalism, and official licensing for property tax lenders. As of the date of this article, there are 88 property tax lending companies with an active license;

Our goal is to help more people breathe easier at tax time and keep their property and finances completely secure. (a) a property tax lender is not limited to making property tax loans to residents of the community in which the office for which the license or other authority is granted is located. We provide easy approval and fast funding in texas.

To visit our arlington location click here. Property tax lenders el paso county tx. In this environment, many property owners are.

(b) a property tax lender may make, negotiate, arrange, and collect property tax loans by mail or online from a licensed office. Property tax lenders hidalgo county tx. I felt completely helpless. stories of real people, experiencing real struggles with their texas properties, and how tptla solved their situations.

A property tax loan is a loan where you and the lender negotiate agreed upon terms, and the lender pays your tax obligation to the county or applicable tax office. With afic’s executive level management involved in the day to day business, afic is the most dynamic and flexible property tax lender in the industry. The dangers of property tax lending.

Property tax lenders gregg county tx. The state of texas regulates property tax lending through the occc office. The tax office reflects your account as paid, and all municipal collection actions cease.

There are no upfront costs and no sales gimmicks. Reach out to the texas property tax lenders at tax ease. Occc's rules title 7, chapter 89, texas administrative code.

Property tax lenders webb county tx. Afic stands apart as a property tax lender with its complaint free, 65+ year better business bureau track record, and. I am grounded in autos but range broadly.

These are the primary statutes and rules that apply to property tax lenders. This is not a complete list of laws that property tax lenders are required to comply with. Property tax lenders galveston county tx.

Our online application process is simple; We are a statewide alliance of companies that advance and protect the profession of property tax lending to help texas property owners. Today, afic is one of the top property tax lenders in the state of texas.

Primary state statute chapter 32, texas tax code: It is a huge honor for us to be able to help property owners paying off their property taxes and save their estate from foreclosure. With nearly 20 years of experience in the industry, tax ease employs the best texas property tax lenders in the state to assist with substantial tax bills and delinquent fees.

Mcallen Property Tax Loans Texas Property Tax Loans

San Antonio Property Tax Loans Texas Property Tax Loans

How To Protest Your Property Taxes In Texas - Home Tax Solutions

Texas Property Tax Loans Funding Loans For Property Taxes

Homestead Exemption Overview - Mortgagemarkcom

Dallas Property Tax Loans Tx Property Tax Relief Home Tax Solutions

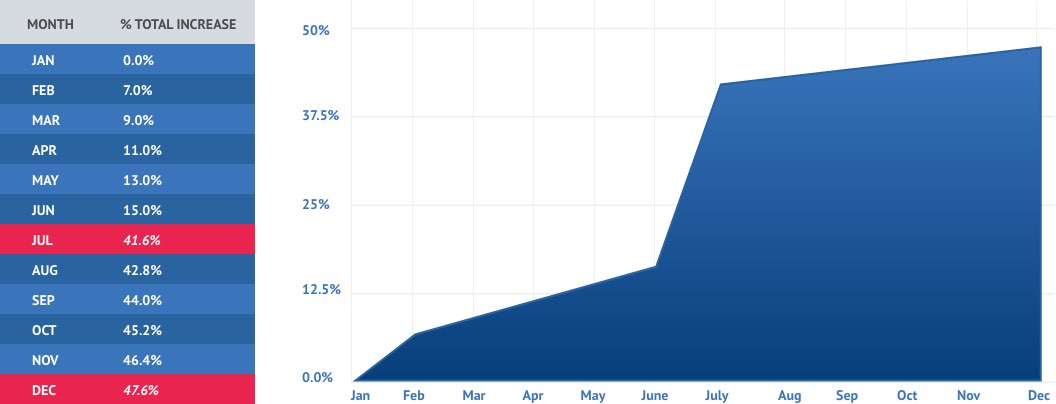

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart - Tax Ease

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart - Tax Ease

Houston Property Tax Loans Texas Property Tax Loan Solutions

Penalties For Failure To Pay Property Taxes Texas Property Tax Loans

Penalties For Failure To Pay Property Taxes Texas Property Tax Loans

Texas Property Tax Loans Funding Loans For Property Taxes

Paying Property Taxes Late What Happens If You Dont Pay Property Taxes In Texas Tax Ease

Property Taxes 101 Understanding Your Property Tax Propel Tax

Six Texas Property Tax Exemptions To Know About Tax Ease

How Long Can You Go Without Paying Property Taxes In Texas A Guide To How Long Property Taxes Can Go Unpaid In Texas Before For Foreclosure - Tax Ease

Changes To 2018 Texas Property Taxes Home Tax Solutions Blog

Texstar Escrow And Tax Loan Services

Penalties For Failure To Pay Property Taxes Texas Property Tax Loans