Tax Lawyer Vs Cpa Reddit

The ceiling for cpa is much lower and compensation reflects that. I think us cpa's sometimes get the shaft because people associate cpa with ‘person who does your taxes'.

5 Things Lawyers Can And Cannot Claim At Tax Time Law Cpd

A lot of the time when people are working on their wills and trusts, you’ll have an accountant sitting on one side and an attorney sitting on the other, both of whom are attempting to dictate the situation, causing conflict between the two.

Tax lawyer vs cpa reddit. Honestly, tax lawyer is an entirely different path from a cpa. Ad professional tax relief attorney & cpa helping to resolve complex tax issues. Certified public accountants (cpas) know the tax code and can help you maximize your tax savings, among other things.

Not sure if here is the proper place to post this question, but let's go for it! Here's an overview of both. One of the only law fields that is still in need of professionals is tax law, so consider that.

Get a free consultation today & gain peace of mind. By being both a cpa and lawyer, my ability to understand the numbers as well as the legalities associated with estate planning help me bridge that gap. One of the biggest differences is that a cpa is a better fit in the event that the tax situation is more complicated.

California, for example, imposes a $800 annual tax on all llcs. They day to day work of tax advisor and a tax lawyer in the same geo area at the same size firm are similar and on and on. He's kind of living the life right now.

The main reason to create an llc would be for asset protection, and this is attorneys' area. Tax attorney vs cpa reddit : It is just so much cheaper.

When you're looking to hire a tax professional, you want someone knowledgeable — someone you can trust to get the job done and keep your personal information secure. International tax law is an ever better career choice. An enrolled agent and a certified public accountant are both tax experts, but when you should work with an ea vs cpa differs based on your needs.

I'm brazilian and would like to work helping. Hello guys, my name is lucas. The pay isn't as terrible as you make it out to be, and you have lots of flexibility down the road.

The ceiling for cpa is much lower and compensation reflects that. In light of this, i don’t see why being a cpa isn’t seen as being a more lucrative profession by the average person. Ad professional tax relief attorney & cpa helping to resolve complex tax issues.

The purpose of this blog is to explain what tax attorneys and cpas do while also detailing the distinctions between the two. Both cpas and tax lawyers can help you with simple tax preparation to minimize how much you owe the irs while increasing your return amount. Cpas might have more expertise on the financial side of tax prep, while an attorney can provide legal advice in the face of adversity or possible problems.

Both cpas and tax lawyers can help with tax planning, financial decisions, and minimizing tax penalties. Get a free consultation today & gain peace of mind. Here's what you need to know about getting a tax appraisal.

I am a 7th year international tax attorney. Looking at masters of tax or perhaps going to law school later, can't really understand the rift between the cpa and law from a tax perspective, or even a transactional perspective. Cpa vs tax attorney reddit.

A cpa lawyer is simply someone who is both a cpa and a lawyer. It will not change your taxes. Your taxes will be exactly the same with or without an llc.

Cpas have some similarities to tax attorneys in that they both provide tax services to their clients, but there are many key differences that set them apart. More posts from the accounting community. In law and master's degree in tax law and accounting degree, which one would be better to be working with taxes and advising clients/companies?

I'm speaking from a canadian perspective in ontario. Might not be very relevant as i work in the uk but i'm dual accountancy and solicitor qualified (plus the cta, don't recommend heh!) so just my 2c. However, if your situation isn’t overly complicated, a cpa will cost you less than a lawyer.

Or just be an accountant; A professional with this designation typically makes $15,000 to $20,000 more than cpas annually. Every professional gets bitched around their first few years.

Every tax problem has a solution. Beware that attorneys notoriously disagree on asset protection among themselves,. In fact, an llc can cost you more in taxes, depending on where you live and operate.

Casually comparing the cash flow of cpa firms and law firms for sale on business broker websites, it appears that there are many more cpa firms for sale with strong cash flows to owner >200k+. Honestly, tax lawyer is an entirely different path from a cpa. Both certified public accountants, known as cpas, and tax attorneys are available to individuals and organizations attempting to navigate the often confusing universe of taxes.

Tax attorneys and cpas often occupy the same space, but there are several key differences between the two professions. They both tend to have similar clients and refer back and forth. Every tax problem has a solution.

Understanding those distinctions will help you plan your finances, submit your taxes, improve your tax. (no offense at those who actually do individual tax). My attorney's firm charges $450/hour for attorneys and $210/hour for paralegal work, and they want a $3250 down payment.

I believe it's just that a cpa does not inherently make you part of an elite group, whereas being a doctor, lawyer , or other highly educated professional does. Because the answer is either yes, or yes, but come talk to me in the summer. Following that year, i studied for and passed the cpa exam.

Tax code, and who uses that knowledge to help.

Immigration And Lying On Your Tax Return The Quickest Way To Deportation Verni Tax Law

Tax 101 Accounting Humor Law School Humor Accounting

Cause - Unfair Taxes Tax Lawyer Tax Payment Plan Retirement Planning

Pin By Tax Services Of Londonderry I On Tax Lawyer Los Angeles Tax Quote Law Quotes Inspriational Quotes

What Do I Need To Know Before I Hire A Bankruptcy Attorney Bankruptcy Attorney Atlanta Debt Relief Debt Relief Programs Bankruptcy

Tax Attorney Vs Cpa Guide Why You Might Need A Tax Attorney

Pin By Kenneth R Cone Cpa On Funny Things To Consider Taxes Humor Accounting Humor Lawyer Humor

What Can You Do With An Accounting Degree Accounting Jobs Accounting Degree Accounting

Post-moass An In-depth Examination Of Financial Advisors Tax Attorneys Certified Public Accountants Wills Rsuperstonk

When Do You Need A Tax Attorney Los Angeles Tax Attorneys

Im A Cryptocurrency Tax Attorney Helping Traders Stay Out Of The Irss Crosshairs Ama Rcryptocurrency

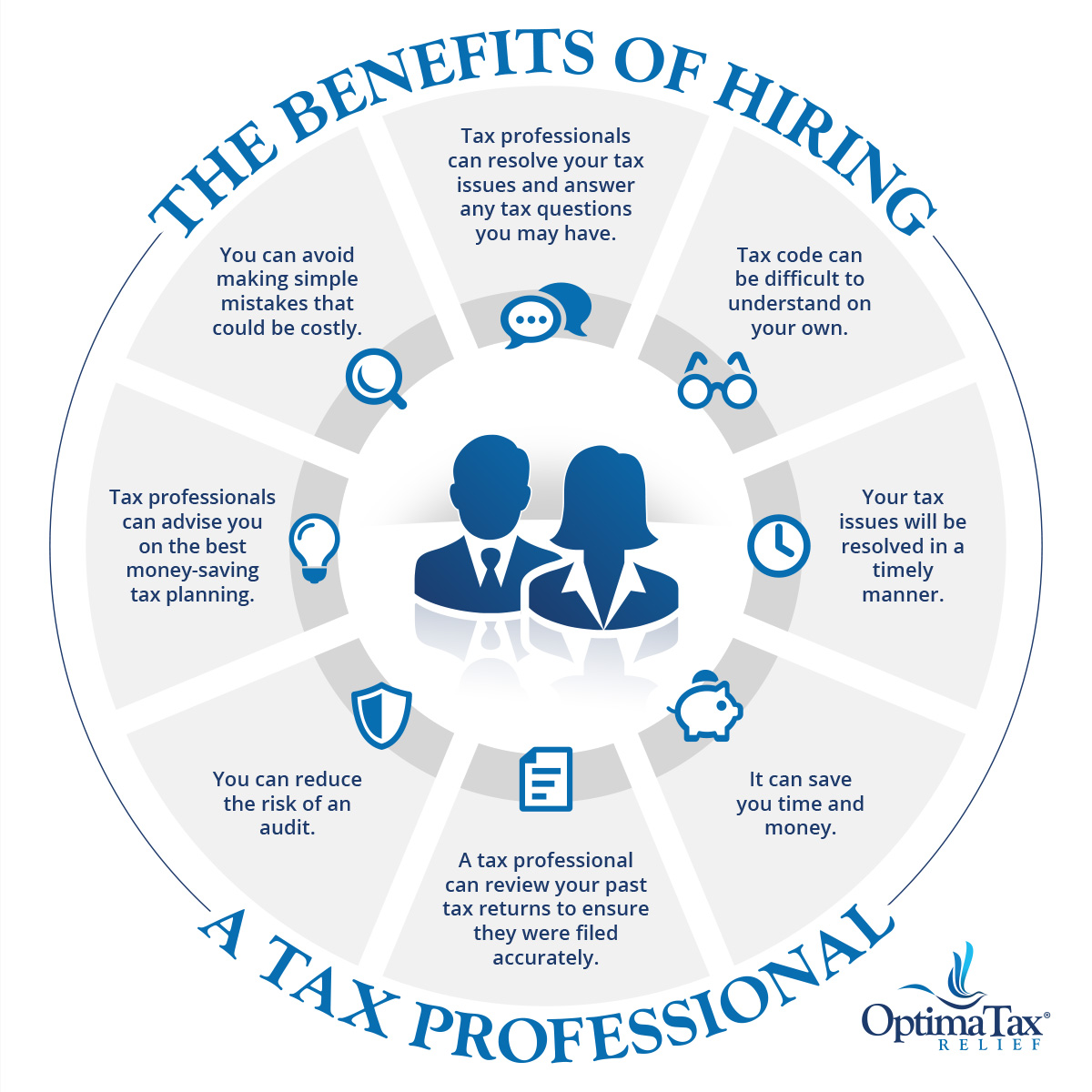

Hiring A Tax Professional - Your Complete Guide Optima Tax Relief

Accounting Vs Law What Is The Difference

Fraudulent Tax Resolution Companies Verni Tax Law

What Can A Tax Attorney Do For You Hchgchamber

Transferring Property To Avoid Paying The Irs Taxes Verni Tax Law

Five Steps To A Successful Business Turnaround Success Business Cryptocurrency Crypto Coin

International Tax Lawyers Manhattan New York Tax Lawyer Tax Accountant Accounting Firms

Tax Lawyers Can Save Us From Double Taxation Verni Tax Law