Marin County Property Tax Calculator

The median property tax on a $868,000.00 house is $5,468.40 in marin county. Marin county finance director roy given said that under proposed changes, marin could be required to turn over an additional $3.7 million a year in property tax revenue to the state.

Santa Clara County Ca Property Tax Calculator - Smartasset

Marin county has one of the highest median property taxes in the united states, and is ranked 26th of the 3143 counties in order of median property taxes.

Marin county property tax calculator. The median property tax on a $868,000.00 house is $9,114.00 in the united states. Marin county, california property tax rates. The marin wildfire prevention authority measure c is a special tax charged to all parcels of real property located in marin county within the defined boundary of the “member taxing entities.”.

Marin county collects very high property taxes, and is among the top 25% of counties in the united. The county’s average effective property tax rate is 0.81%. The calculator will automatically recalculate anytime you press the tab key after making a change to an input field.

Property information * property state: Present this offer when you apply for a mortgage. Penalties apply if the installments are not paid by.

Secured property taxes are payable in two (2) installments which are due november 1 and february 1. The tax division includes the property tax and tax collector sectors within the department of finance. Marin county collects, on average, 0.63% of a property's assessed fair market value as property tax.

Choose rk mortgage group for your new mortgage. That is nearly double the national median property tax payment. Transfer tax is a tax imposed by states, counties, and cities on the transfer of the title of real property from one person (or entity) to another within the jurisdiction.

However, depreciation is taken into account so the assessed value that the tax base is calculated on can be lower (sometimes considerably) than. Box 4220, san rafael ca 94913; Property owners can pay in person at the marin county tax collector's office which is located at civic center, room 202, in san rafael.

$5,500.00 3 hours ago the median property tax (also known as real estate tax) in marin county is $5,500.00 per year, based on a median home value of $868,000.00 and a median effective property tax rate of 0.63% of property value. It’s based on the property’s sale price and is paid by the buyer, seller, or both parties upon transfer of real property. The voters approved this parcel tax in march 2020, by approximately 71%, for a period of ten years starting with the 2020/21 fiscal year.

Payments after that date will incur a penalty. This calculator can only provide you with a rough estimate of your tax liabilities based on the. Modular/panelized are built partially or entirely off site and delivered to the property.

Marin county tax collector p.o. Property tax bill information and due dates. Conversion of finished part of house.

The main responsibilities of the property tax division include: Sausalito, ca houseboats/floating homes in marin county are considered real property and taxed at the same rate as land based homes which is 1% plus parcel tax, school bonds, special assessments etc. The information provided above regarding approximate insurance, approximate taxes and the approximate total monthly payment (collectively referred to as approximate loan cost illustration) are only.

This tool can calculate the transfer/excise taxes for a sale or reverse the calculation to estimate the sales price. The median property tax paid by homeowners in the bay area’s contra costa county is $4,941 per year. Having trouble finding what you're looking for in our website?

Complete or change the entry fields in the input column of all three sections. Secured property tax bills are mailed only once in october. The median property tax on a $868,000.00 house is $6,423.20 in california.

Marin county collects the highest property tax in california, levying an average of $5,500.00 (0.63% of median home value) yearly in property taxes, while modoc county has the lowest property tax in the state, collecting an average tax of $953.00 (0.6% of. This calculator will help you to determine how much house you can afford and/or qualify for. The median property tax in marin county, california is $5,500 per year for a home worth the median value of $868,000.

Change property tax mailing address? Calculating tax bills for over 97,000 secured, unsecured and unitary properties. The california constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law.

Double check your url and if the issue persists, please take a minute to email us. See detailed property tax report for 123 park st, marin county, ca. We're here to help you!

Marin county, california mortgage calculator. We are unable to locate the configuration files for the adu calculator you've requested. At that rate, the total property tax on a home worth $200,000 would be $1,620.

Prop 19 - Property Tax And Transfer Rules To Change In 2021

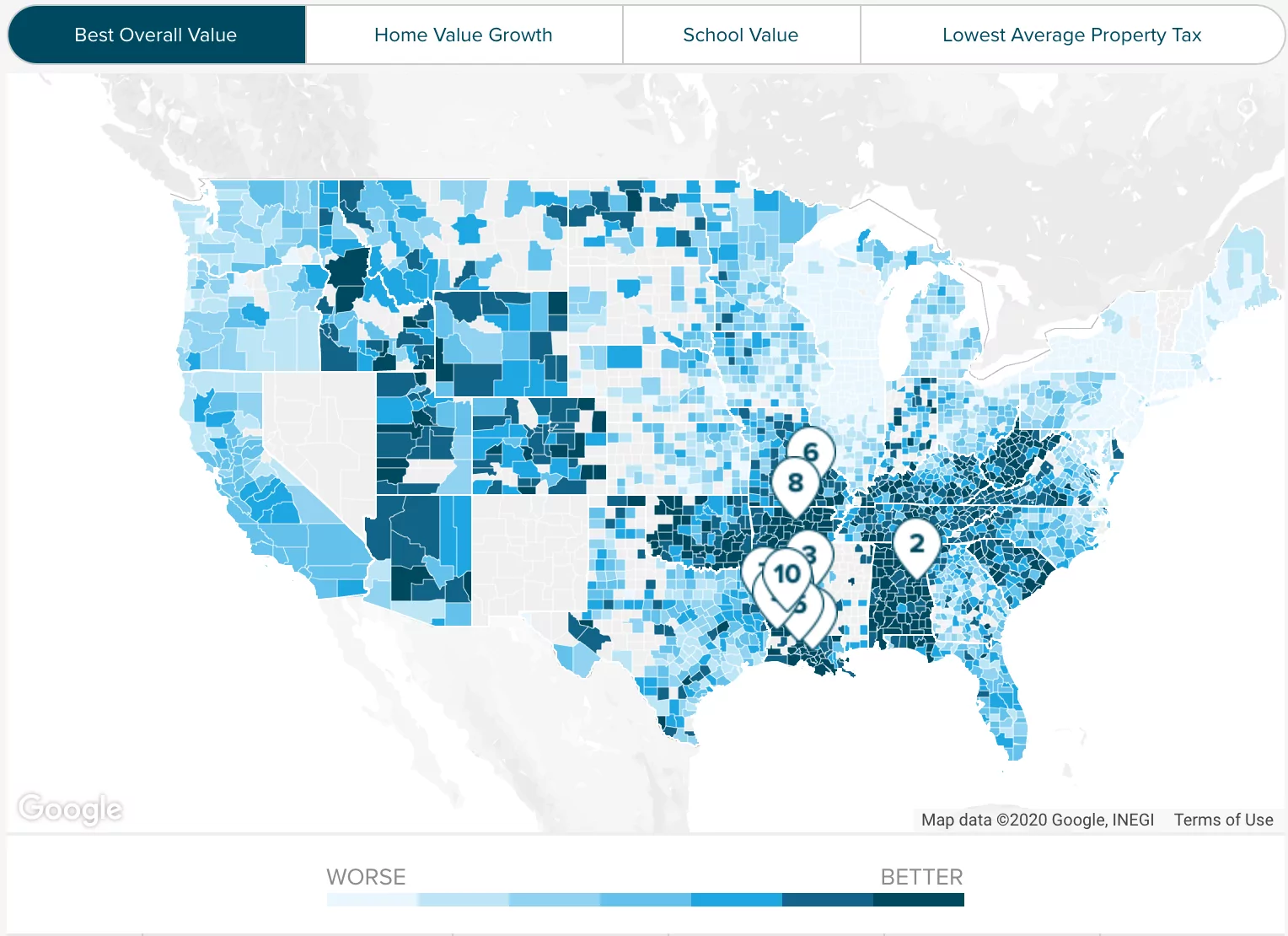

Property Tax By County Property Tax Calculator Rethority

California Property Tax Calculator - Smartasset

Understanding Californias Property Taxes

Marin-county Property Tax Records - Marin-county Property Taxes Ca

Marin County Mails Property Tax Bills Seeking 126b

Property Tax Calculator - Smartasset

Marin County California Property Taxes - 2021

Property Tax By County Property Tax Calculator Rethority

Property Tax Calculator

Transfer Tax - Who Pays What In Marin County California

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/AG6OHRRKQX7QIZY564ZI2QIFMQ.jpg)

Think Dallas-fort Worth Property Taxes Are High Well Youre Right

Transfer Tax - Who Pays What In Marin County California

Property Tax By County Property Tax Calculator Rethority

Faqs - Assessor - Recorder - County Clerk - County Of Marin

Marin Wildfire Prevention Authority Measure C Myparceltax

California Property Tax Calculator - Smartasset

Marin-county Property Tax Records - Marin-county Property Taxes Ca

Property Tax Bills Sent To Marin County Residents San Rafael Ca Patch