San Francisco Sales Tax Rate

Sales tax in california counties county san luis obispo state rate 7.25% county rate 0% total sales tax 7.250% Please ensure the address information you input is the address you intended.

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Sales tax is 8.5 percent;

San francisco sales tax rate. [ 2 ] state sales tax is 7.25%. Hollywood, laketown, san francisco, waconia, watertown, young america page 1 of 5. Where can my clients smoke?

The authority to collect transfer taxes and list of documentary transfer tax exemptions are codified in article 12c of the san francisco business and tax regulations code. Nonresidents who work in san francisco also pay a local income tax of 1.50%, the same as the local income tax paid by residents. The san francisco, california, general sales tax rate is 6.5%.

The current total local sales tax rate in san francisco, ca is 8.625%. The california sales tax rate is currently %. Until 2018, all businesses with a taxable san francisco payroll expense greater than $150,000 must file a payroll expense tax statement for their business annually by the last day of february for the prior calendar year (jan.

Sales and use taxes in california (state and local) are collected by the california department of tax and fee administration, whereas income and franchise taxes are collected by the franchise tax board. Sales tax = total amount of sale x sales tax rate (in this case 8.5%). 5 digit zip code is required.

The tax is calculated as a percentage of total payroll expense, based on the tax rate for the year. The tax rate given here will reflect the current rate of tax for the address that you enter. At 7.25%, california has the highest minimum statewide sales tax rate in the united states, which can total up to 10.75% with local sales taxes included.

This is the total of state, county and city sales tax rates. Depending on the zipcode, the sales tax rate of san francisco may vary from 6.5% to 9.25%. Tax rate for nonresidents who work in san francisco.

1788 rows california city & county sales & use tax rates (effective october 1, 2021). If you make purchases in the city by the bay, you should be aware of the sales tax in san francisco. Sales tax and use tax rate of zip code 94112 is located in san francisco city, san mateo county, california state.

Or to make things even easier, input the san francisco minimum combined sales tax rate into the calculator at the top of the page, along with the total sale amount, to get all the detail you need. The state then requires an additional sales tax of 1.25% to pay for county and city funds. You can find more tax rates and allowances for san francisco county and california in the 2022 california tax tables.

To get the correct sales tax rate, use the sales tax rate calculator or map on our website. The state sales tax rate in california is 7.250%. The minimum combined 2021 sales tax rate for san francisco, california is.

The true state sales tax in california is 6.00%. With local taxes, the total sales tax rate is between 7.250% and 10.500%. The 8.5% sales tax rate in san francisco consists of 6% california state sales tax, 0.25% san francisco county sales tax and 2.25% special tax.

Residents of san francisco pay a flat city income tax of 1.50% on earned income, in addition to the california income tax and the federal income tax. As of march 2013, the sales tax rate in the city was 8.75 percent, which is slightly higher than the overall california sales tax. Transfer taxes are also imposed on leaseholds with a term of 35 years or more, and transfers involving legal entities that own real property in san francisco.

The sales tax jurisdiction name is san francisco tourism improvement district (zone 2), which may refer to a local government All in all, you'll pay a sales tax of at least 7.25% in california. The san francisco county, california sales tax is 8.50%, consisting of 6.00% california state sales tax and 2.50% san francisco county local sales taxes.the local sales tax consists of a 0.25% county sales tax and a 2.25% special district sales tax (used to fund transportation districts, local attractions, etc).

California (ca) sales tax rates by city. What is the sales tax rate in san francisco, california? City total sales tax rate san francisco 8.500% san jose 9.250% santa ana 9.250% santa clarita 9.500%

Metro counties sales and use tax rate guide effective 10/01/2021 ‐ 12/31/2021 other local rate city rate county transit Find 2264 listings related to sales tax rate in san francisco on yp.com. The december 2020 total local sales tax rate was 8.500%.

There is no applicable city tax. Type an address above and click search to find the sales and use tax rate for that location. The county sales tax rate is %.

San francisco county in california has a tax rate of 8.5% for 2022, this includes the california sales tax rate of 7.5% and local sales tax rates in san francisco county totaling 1%. See reviews, photos, directions, phone numbers and more for sales tax rate locations in san francisco, ca. What is the sales tax rate?

Every 2021 combined rates mentioned above are the results of california state rate (6.5%), the county rate (0.25%. Smoking is permitted only in designated smoking areas. If you are a buyer, you need to factor in the tax rate to the cost of your purchase to ensure that the purchase.

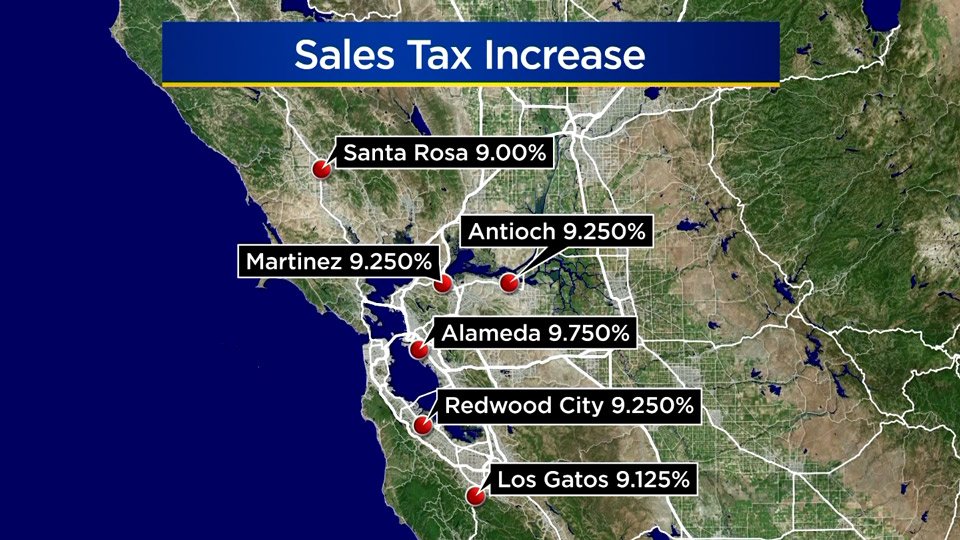

Sales Tax Rates Rise Monday Out-of-state Online Sellers Included Cbs San Francisco

Sales Tax Collections City Performance Scorecards

The Sales Tax Rate In San Francisco Usa Is 85 For A Given Purchase The Amount Of Taxes Paid Is Rounded To The Nearest Cent Denote The Rounding Error By Interval-05 To

San Francisco Sales Tax Rate And Calculator 2021 - Wise

States With Highest And Lowest Sales Tax Rates

Understanding Californias Sales Tax

Us Cities With The Highest Property Taxes

Santa Clara County Supervisors Push Sales Tax Measure For November Ballot The Mercury News

How To Calculate Cannabis Taxes At Your Dispensary

Prop K - Sales Tax For Transportation And Homelessness Spur

Understanding Californias Sales Tax

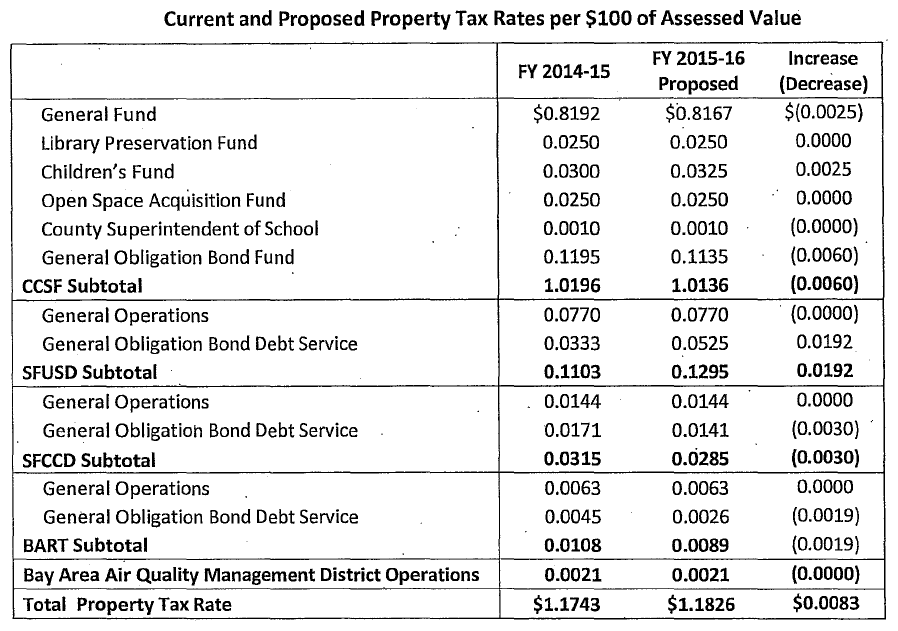

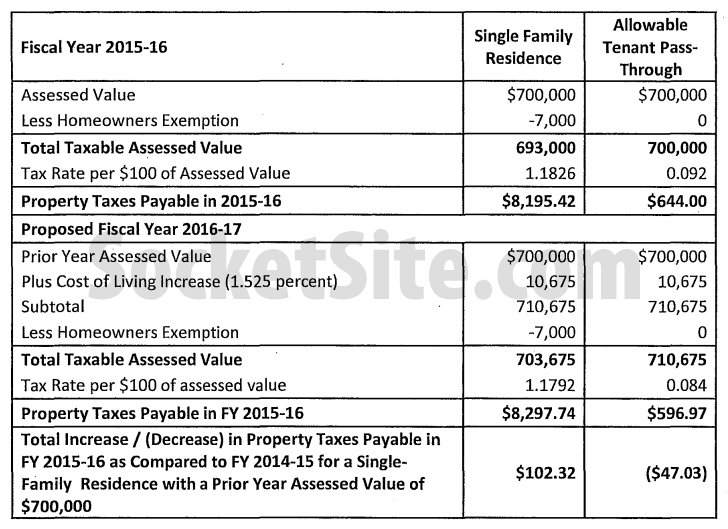

San Francisco Property Tax Rate To Rise Where The Dollars Will Go

Sales Gas Taxes Increasing In The Bay Area And California

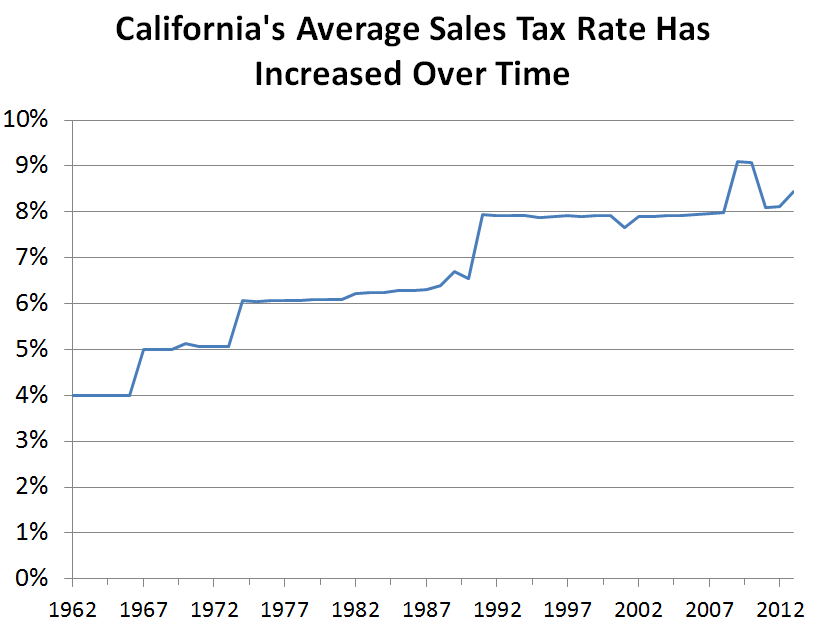

Californias Sales Tax Rate Has Grown Over Time Econtax Blog

Sales Tax Is Rising In San Francisco And These Bay Area Cities This Week

Californias Corporate Income Tax Rate Could Rival The Federal Rate Tax Foundation

Prop K - Sales Tax For Transportation And Homelessness Spur

Property Tax Rate In Sf Slated To Drop Where The Dollars Will Go

Worst In The State Sf Sales Tax Data Show Likely Population Decline