Kaufman County Tax Rates

Kaufman county homeowners are leaving money on the table. Kaufman county is ranked 300th of the 3143 counties for property taxes as a percentage of median income.

Top Marginal Income Tax Rates Britain France Germany And The United Download Scientific Diagram

75474 zip code sales tax and use tax rate | quinlan {kaufman county} texas.

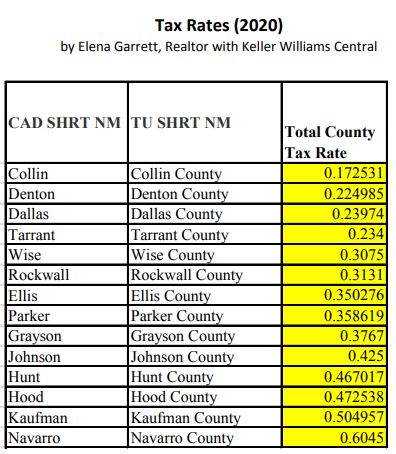

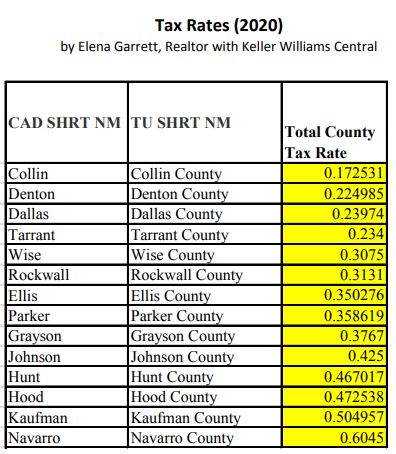

Kaufman county tax rates. The county property tax rate has gone down from.5887 in 2019 to.4612 in 2022, a decrease of 12 cents, or 21.6 percent. The tax rate was lowered by 8.67 percent from.504957 to.461171 per $100 valuation. 2021 low income housing apartment capitalization rate:

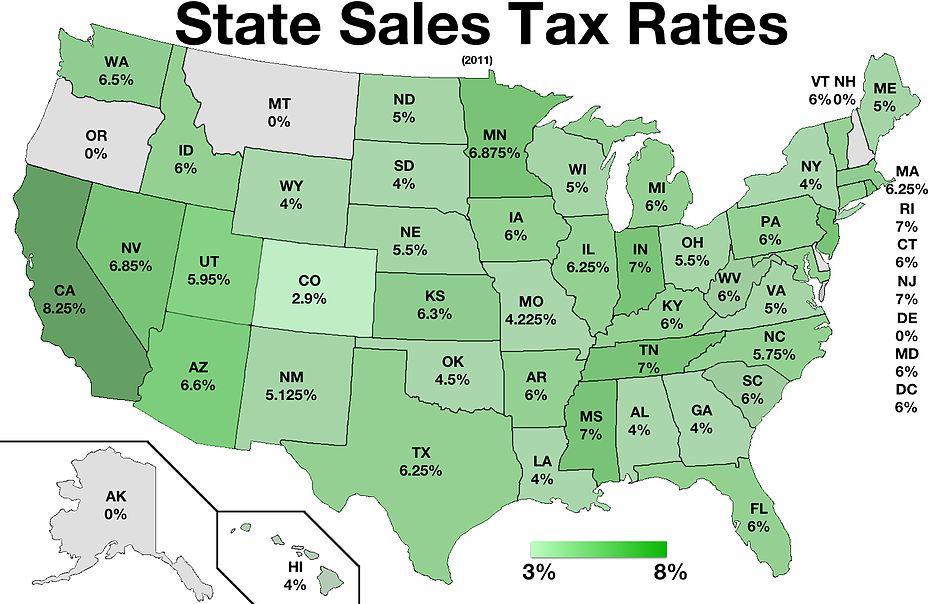

The county property tax rate has gone down from.5887 in 2019 to.4612 in 2022, a decrease of 12 cents, or 21.6 percent. [ 1 ] state sales tax is 6.25%.rank 13.estimated combined tax rate 6.25%, estimated county tax rate 0.00%, estimated city tax rate 0.00%, estimated special tax rate 0.00% and. Watch here for budget details and interesting stories of how your tax dollars are used to improve the quality of life in kaufman county.

75142 zip code sales tax and use tax rate | kaufman {kaufman county} texas. Below you can find links to information related to the financial and bookkeeping records for the district. There is no applicable county tax, city tax or special tax.

Watch here for budget details and interesting stories of how your tax dollars are used to improve the quality of life in kaufman county. Kaufman county's fiscal 2021 tax rate of $0.504957 per $100 of tav provides ample capacity below the constitutional charter cap of $0.80. The herald last week reported the city tax rate dropped about a penny, but that was based on the effective tax rate, not the actual rate.

The kaufman county sales tax rate is %. 2020 rates included for use while preparing your income tax deduction. The sales tax jurisdiction name is kaufman , which may refer to a local government division.

The texas state sales tax rate is currently %. The county dropped the tax rate from 59 cents per $100 valuation to 53 cents per $100 valuation last year, but still brought in an estimated $4.2 million, or an 8 percent increase, in revenue. The minimum combined 2021 sales tax rate for kaufman county, texas is.

The county tax on a $200,000 home would have been $1,177. Texas property tax code section 26.16. Kaufman county fresh water supply district no.

The 6.25% sales tax rate in kaufman consists of 6.25% texas state sales tax. Tax rate tax amount ; “we kind of lead the charge.”.

The herald last week reported the city tax rate dropped about a penny, but that was based on the effective tax rate, not the actual rate. The local sales tax rate in kaufman county is 0%, and the maximum rate (including texas and city sales taxes) is 8.25% as of november 2021. District info budgets tax info financials

Kaufman county collects very high property taxes, and is among the top 25% of counties in the united states ranked by property tax collections. Listing of entities within kaufman county. 4b the information provided on this page is for kaufman county fresh water supply district no.

You can print a 6.25% sales tax table here. You can use the texas property tax map to the left to compare kaufman county's property tax to other counties in texas. Kaufman county homeowners are leaving money on the table.

This is the total of state and county sales tax rates. Kaufman central appraisal district is responsible for the fair market appraisal of properties within each of the following taxing entities (click on the name to be redirected to their website, if available): (that have provided the information required) the information below is posted as a requirement of senate bill 2 of the 86th texas legislature.

For tax rates in other cities, see texas sales taxes by city and county. Sales tax and use tax rate of zip code 75142 is located in kaufman city, kaufman county, texas state.tax risk level: The average yearly property tax paid by kaufman county residents amounts to about 3.74% of their yearly income.

The herald last week reported the city tax rate dropped about a penny, but that was based on the effective tax rate, not the actual rate. Sales tax and use tax rate of zip code 75474 is located in quinlan city, kaufman county, texas state.tax risk level: The median property tax (also known as real estate tax) in kaufman county is $2,597.00 per year, based on a median home value of $130,000.00 and a median effective property tax rate of 2.00% of property value.

Please see your tax bill or visit the kaufman county tax office website for more information. The county property tax rate has gone down from.5887 in 2019 to.4612 in 2022, a decrease of 12 cents, or 21.6 percent. The county property tax rate has gone down from.5887 in 2019 to.4612 in 2022, a decrease of 12 cents, or 21.6 percent.

What is the sales tax rate in kaufman county? The latest sales tax rate for kaufman, tx. This rate includes any state, county, city, and local sales taxes.

Mud04 kaufman county mud #4 0.200000 0.800000 1.000000 mud1 kaufman county mud #14 0.390000 0.610000 1.000000 mud10 kaufman county mud. [ 2 ] state sales tax is 6.25%.rank 13.estimated combined tax rate 6.75%, estimated county tax rate 0.50%, estimated city tax rate 0.00%, estimated special tax rate 0.00% and.

Dfw Tax Property Rates 2020 Elena Garrett Realtor In Dallas Texas My Blog

Global Tax Maps - Tax Fans Allen

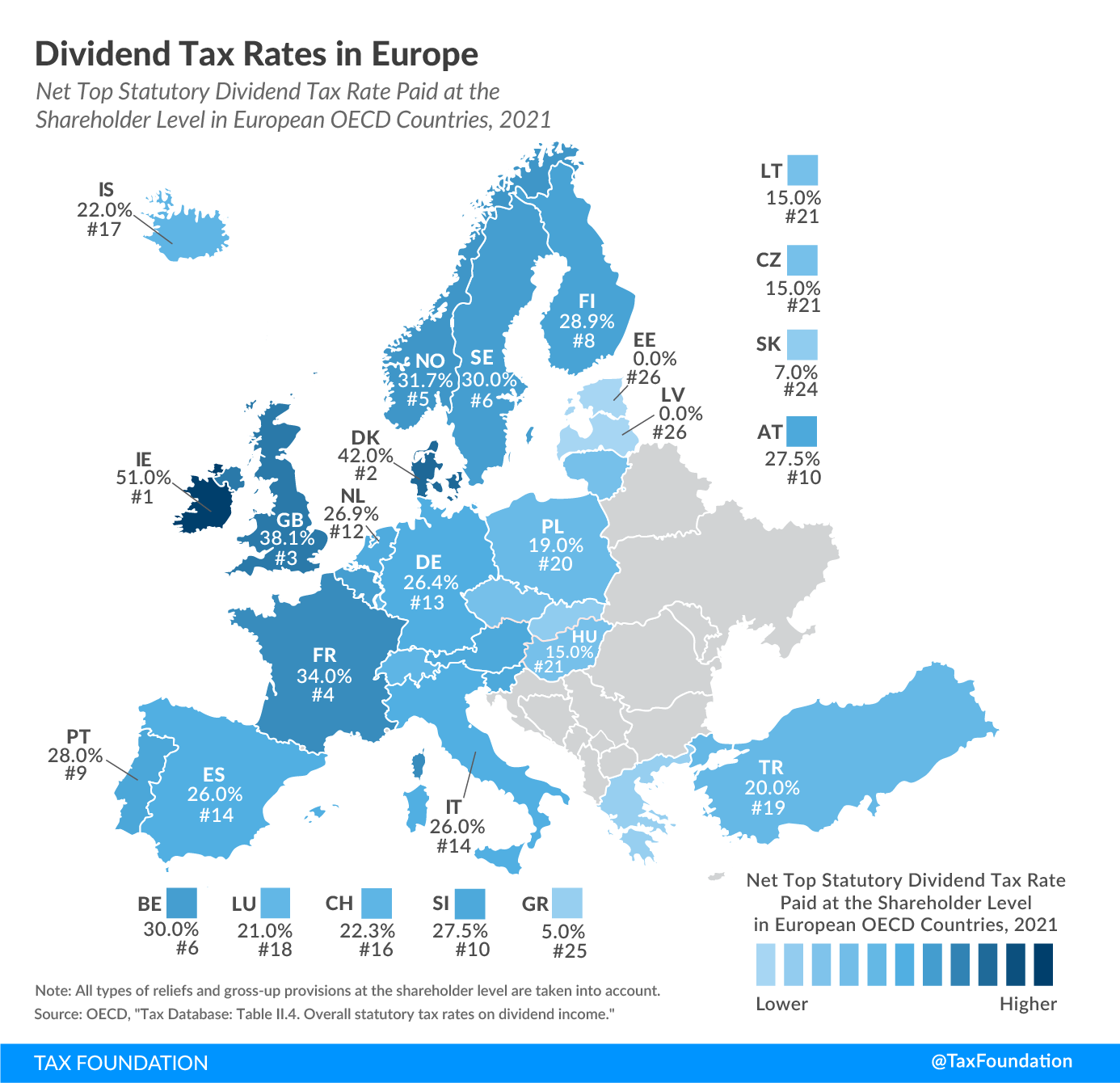

Dividend Tax Rates In Europe Tax Fans

Kaufman-county Property Tax Records - Kaufman-county Property Taxes Tx

Tax Information - Independence Title

Sales Tax Rates In The Us - Foreign Usa

Which Texas Mega-city Has Adopted The Highest Property Tax Rate

Sales Taxes In The United States - Wikiwand

Tax Rates Hunt Tax Official Site

825 Sales Tax Calculator Template Tax Printables Sales Tax Calculator

States With The Highest And Lowest Property Taxes Property Tax High Low States

Tax Information - Independence Title

Texas Sales And Use Tax Rates - Texas Comptroller Of Public

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/XG7G6DT4SENYSHBA3GCD62F25M.jpg)

Is Your Government Running Up The Score In The Last Days Of The Old Property Tax Law By Raising Taxes

How To Pay Presumptive Tax In Kenya - Winstar Technologies How To Pay Tax Payment Business Tax

County Approves Budget Lowers Tax Rate Kaufman County

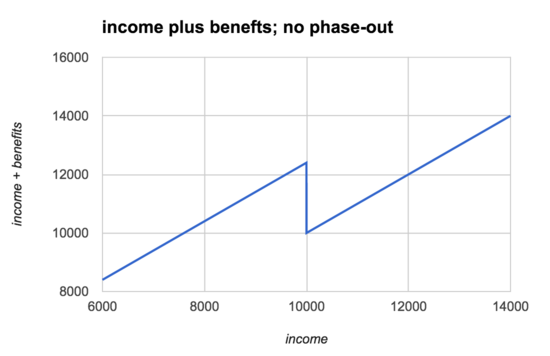

Effective Marginal Tax Rates

Tax Information - Independence Title

Sales Taxes In The United States - Wikiwand