North Carolina Estate Tax Id

Search rutherford county property tax bill records by owner name, account number, bill number, parcel id number and pay property taxes online. The best way to search is to enter your property key or last name as it appears on your tax bill.

Top 10 Safest Cities In North Carolina - Newhomesource

If you wish to avoid providing your social security information to an employer in the state of north carolina, then you want your very own federal tax id.

North carolina estate tax id. Nc has no estate tax (other states still have the “death tax”) also called the death tax, this tax was repealed in 2013. Applying for an ein with the irs is free ($0). A tax id number is also called an employer identification number or ein.

Taxes pending on the estate should also be paid by the survivors of the decedent who inherited the estate. In other words, an individual owning property as of that date is liable for property taxes in the county where the property is. Box 1049 smithfield, nc 27577 [email protected] the federal estate tax exemption is $11.18 million in 2018.

North carolina secretary of state business registration get a federal and state tax id number The federal estate tax exemption increased to $11.18 million for 2018, when the 2017 tax law took effect. Before filing form 1041, you will need to obtain a tax id number for the estate.

Online approval takes 15 minutes. The estate will need its own tax identification number if sets up an estate checking account, or if there is interest or dividends payable to the estate. Start estate tax id (ein) application.

And mail takes 4 weeks. While there isn’t an estate tax in north carolina, the federal estate tax may still apply. You can get an ein for your north carolina llc online, by fax, or by mail.

The tax office is responsible for listing, assessing, billing, and collecting all ad valorem (property) taxes for carteret county in accordance with nc general statutes. Must have a valid taxpayer id number (social security number, individual taxpayer id number, or federal tax id) to enter on the form. This is something that is going to make you feel more confident in being able to work for them.

While there isn’t an estate tax in north carolina, the federal estate tax may still apply. Nc has no estate tax (other states still have. To print a property record card or export search results into a csv format that can be used with excel please follow these steps:

Use our free north carolina property records tool to look up basic data about any property, and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. North carolina tax id number how to get a north carolina tax id number even small businesses need and can benefit from a north carolina tax id number. The tax office maintains tax information on approximately 51,000 real property parcels, 8,000 personal property (boats, business equipment, etc.) accounts, and 61,000 motor.

Fax takes 4 business days. Generally if the estate has over $5 million of assets, you will need to get advice about estate taxes, and those. Here are some advantages :

• the owner, principal officer, trustor, grantor, etc. Apply for ein number in north carolina. An estate is a legal entity created as a result of a person's death.

If the deceased person has an estate that generates more than $600 in annual gross income, then the decedent and their estate are separate taxable entities. Tax assessor rutherford county tax department 229 north main st., courthouse addition, rutherfordton, nc. Csv export, res prc) and hit go.

That is why you will need an ein/federal tax id number. Due by apr 15 the year following the death; What is an estate of a deceased individual?

A tax id number is also called an employer identification number or ein. * federal tax id number. Description estates and trusts tax credit summary.

Corporations and llcs as well as partnerships and independent contractors are required to have it but sole proprietors need The exemption is portable for spouses, meaning that with the right legal steps a couple can protect up to $22.36 million upon the death of both spouses. You will use irs form.

What is a north carolina tax id (ein)? You must order a tax id number for the estate here, so that you can file the estate as a separate taxable entity. Description beneficiary's share of north carolina income, adjustments, and credits.

Only very sizeable estates need to file estate tax returns under current laws. Use our free north carolina property records tool to look up basic data about any property, and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. Nc has no estate tax (other states still have.

Department of revenue does not send property tax bills or collect property taxes. The estate consists of the real estate and/or personal property of the deceased person. The estate pays any debts owed by the decedent, and distributes the balance of the estate's assets to the beneficiaries of the estate.

For almost all the segments of the property tax, january 1 is the tax lien date. Apply for a federal tax id in north carolina. The property tax in north carolina is a locally assessed tax, collected by the counties.

Apply for tax id number online north carolina tax id numbers are also know as employer identification numbers or ein. Llc university® will show you how to get an ein number (federal tax id number) for a north carolina llc.

Pin Oleh Khuns Di Darmawangsa Castle

Largest Home In America - Biltmore Mansion Hd Mansions Houses In America Biltmore House

Pin On Oldhousesunder 50000

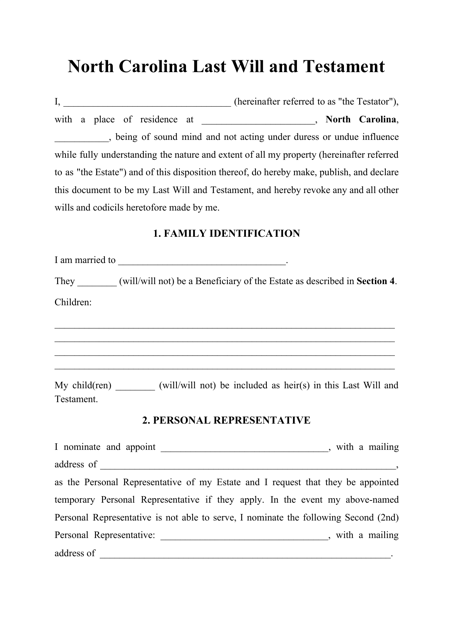

North Carolina Last Will And Testament Legalzoomcom

Politics Of North Carolina - Wikipedia

Cary Peak Suites In 2020 Best Places To Live Corporate Housing House Styles

See This Instagram Photo By Brysonthomasarchitecture 158 Likes Architect House House Designs Exterior Gorgeous Houses

Finance Training Financial Engineering Finance Financial Literacy

Luxurious Property Overlooking Beaver Lake See More Lake Homes For Sale In Lowell Here Httpwwwtnecessaryremaxarkans Arkansas Real Estate Lake House Lake

North Carolina Tax Reform North Carolina Tax Competitiveness

North Carolina Last Will And Testament Template Download Printable Pdf Templateroller

North Carolina First

Pbmares Insights 2021 North Carolina Tax Reform

See This Home On Redfin 221 Gilliam St Oxford Nc 27565 Mls 2247827 Foundonredfin Mansions Historic Homes Mansions For Sale

Lake Norman Waterfront Estate A Luxury Home For Sale In Denver Lincoln County North Carolina - Waterfront Architecture Real Estate North Carolina Real Estate

Pin By Celisiya On Home Exteriors Dream House Decor Luxury Homes Dream Houses Beautiful House Plans

North Carolina Sales Tax - Small Business Guide Truic

South Carolina Vs North Carolina - Which Is The Better State Of The Carolinas

What Is The Minimum Wage For North Carolina 2021 And Previous Years