New Mexico Gross Receipts Tax Return

The filing process forces you to detail your total sales in the state, the amount of gross receipts tax collected, and the location of each sale. Selling property in new mexico;

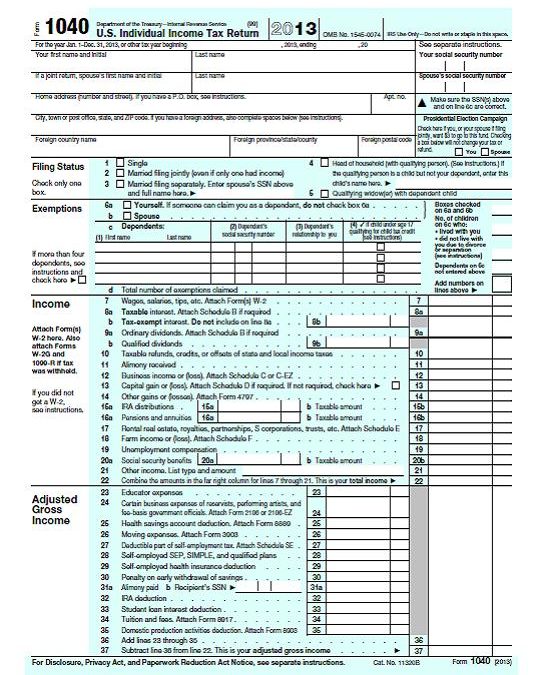

Tax Return Fake Tax Return Income Tax Return Irs Tax Forms

Michelle lujan grisham signed legislation amending certain provisions of the new mexico gross receipts tax.

New mexico gross receipts tax return. How to register for a gross receipts tax permit in new mexico. The gross receipts tax rate now is calculated based on where the. Gross receipts are the total amount of money or value of other consideration received from:

Granting a right to use a franchise employed in new mexico; Granting a right to use a franchise employed in new mexico; 707 15.707 1 hours ago businesses that do not have a physical presence in new mexico, including marketplace providers and sellers, also are subject to gross receipts tax if they have at least $100,000 of taxable gross receipts in the previous calendar year.

Interstate telecommunications gross receipts are the total amount of money or the value of other. After registering, the business will be issued a combined reporting system (crs) number, sometimes known as a new mexico tax identification number. Gross receipts tax taxation and revenue new mexico.

You may apply this credit when you file your return online. New mexico gross receipts quick find is available from the department’s web map portal. For monthly gross receipts tax filers, gross receipts tax returns due august 25 will be the first gross receipts tax report using the new sourcing rules.

Performing services in new mexico, and. 24 for a person who lacks physical presence, including a marketplace provider, “engaging in business” for new mexico purposes means having, in the previous. File oil & gas tax;

Selling property in new mexico; To reach the taxation and revenue department’s web map portal directly, click on the portal graphic below or follow this link: Signature of taxpayer or authorized agent print name title date i declare that i have examined this return including any accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct and complete.

However, like sales tax, businesses can choose to pass their grt onto their buyers rather than pay it out of pocket. Granting a right to use a franchise employed in new mexico; Selling property in new mexico;

File oil & gas tax; 113rev 0012021new mexico taxation and revenue department*30300200*. Welcome to the taxation and revenue department’s forms & publications page.

Effective beginning july 1, 2019, new mexico applies an economic nexus standard for gross receipts and deductions required to be reported for the new mexico gross receipts tax (gross receipts tax). The folders on this page contain everything from returns and instructions to payment vouchers for both income tax programs and business tax programs. Imposition and rate of tax;

Leasing or licensing property employed in new mexico; The legislation also expands the gross receipts tax deduction for. You can locate tax rates, tax authorizations, decisions and orders, and statutes & regulations.

Leasing or licensing property employed in new mexico; Rather than a sales tax, the state of new mexico has a gross receipts tax (grt.) unlike sales tax, a gross receipts tax is a tax on businesses for the privilege of doing business in new mexico. A gross receipts tax is a tax applied to a company’s gross sales, without deductions for a firm’s business expenses, like costs of goods sold and compensation.

Leasing or licensing property employed in new mexico; New mexico sales tax collection and reporting update. The taxation and revenue department of new mexico implemented two changes effective july 1, 2021:

Gross receipts are the total amount of money or value of other consideration received from: Gross receipts are the total amount of money or value of other consideration received from: Denomination as gross receipts tax.

On march 9, 2020, new mexico gov. Performing services in new mexico, and performing services outside of new mexico, the product of which is. Performing services in new mexico, and.

Oregon Tax Forms 2020 Printable State Form Or-40 And Form Or-40 Instructions

How To File A Gross Receipts Tax Grt Return In Taxpayer Access Point Tap - Youtube

Alabama Tax Forms And Instructions For 2020 Form 40

Arizona Tax Forms 2020 Printable State Az Form 140 And Az Form 140 Instructions

Mississippi Tax Forms And Instructions For 2020 Form 80-105

How To File A Gross Receipts Tax Grt Return In Taxpayer Access Point Tap - Youtube

Georgia Tax Forms 2020 Printable State Ga Form 500 And Ga Form 500 Instructions

How To File And Pay Sales Tax In New Mexico Taxvalet

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

Need A Household Employer Unified Registration Form Heres A Free Template Create Ready-to-use Forms At Formsbankcom Registration Form Employment Form

X1kailne4g2xmm

Wisconsin Tax Forms And Instructions For 2020 Form 1

City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return

Understanding The 1065 Form Scalefactor

Irs Pushing Up Income Brackets For Inflation Relief

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

Connecticut Tax Forms And Instructions For 2020 Ct-1040

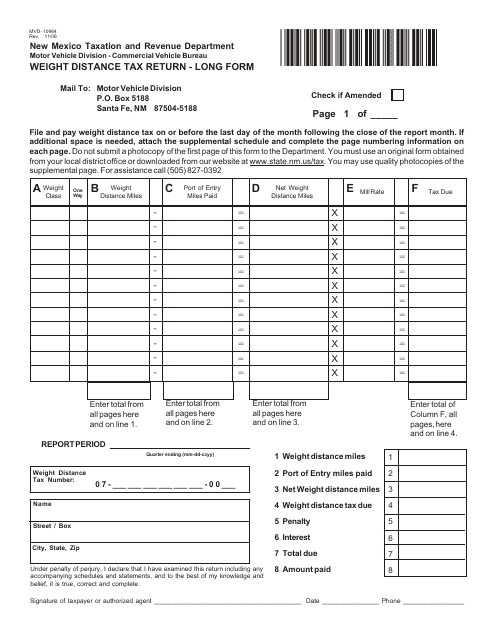

Form Mvd-10964 Download Printable Pdf Or Fill Online Weight Distance Tax Return Long Form New Mexico Templateroller

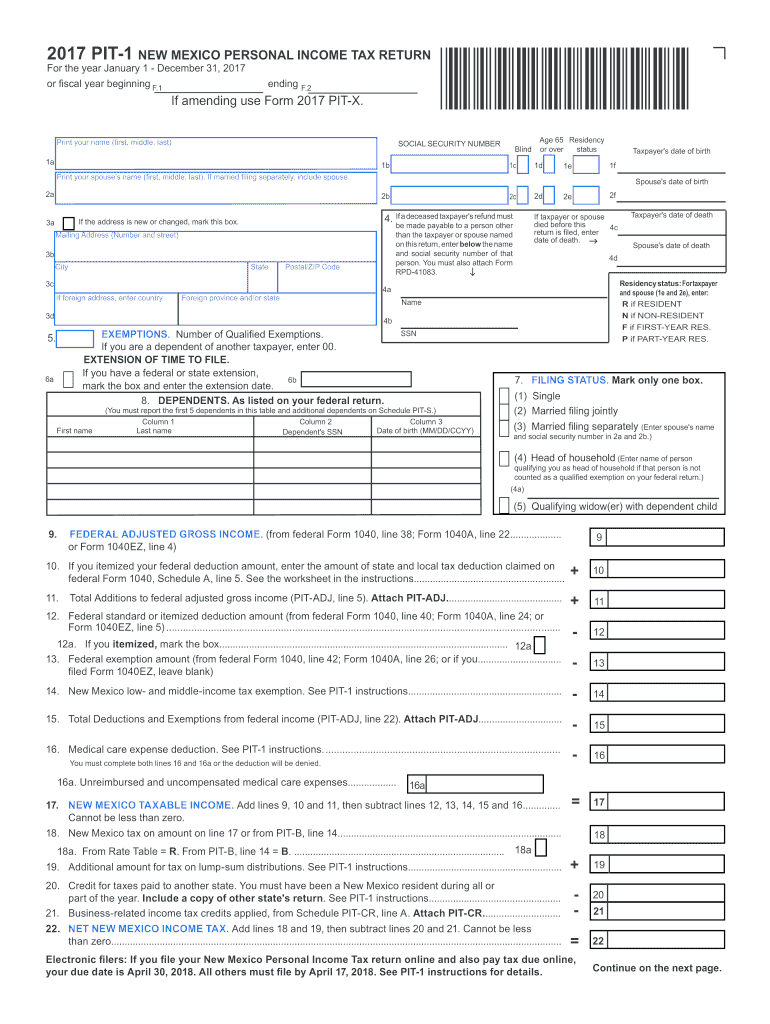

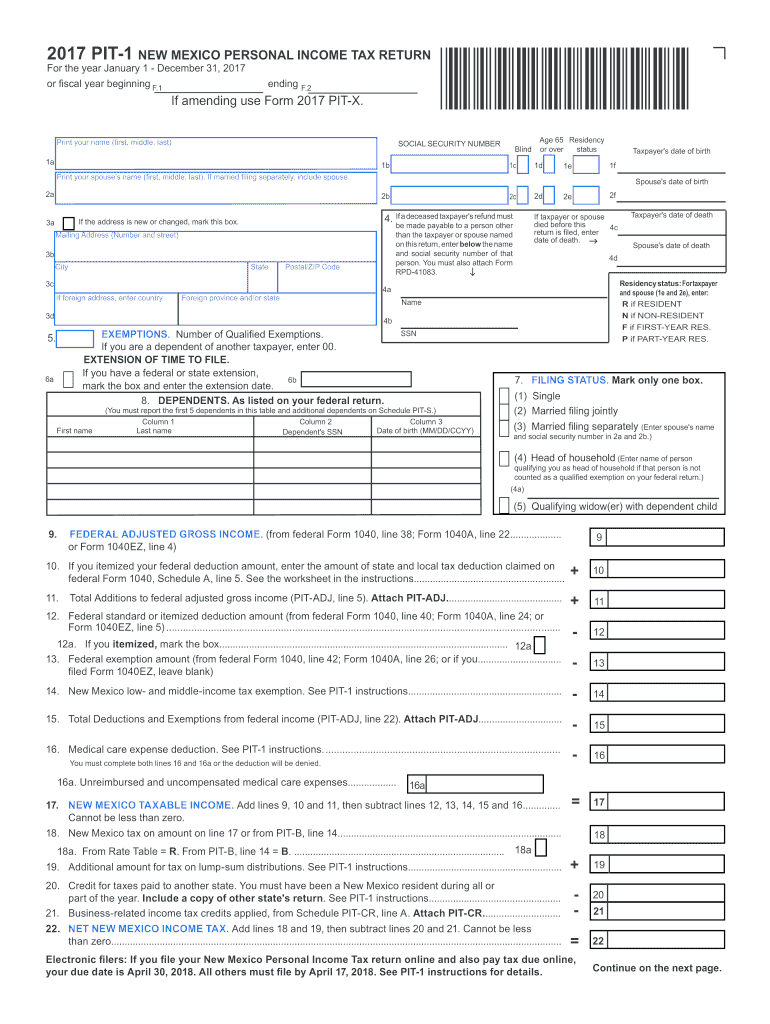

2017 Form Nm Trd Pit-1 Fill Online Printable Fillable Blank - Pdffiller