Do Nonprofits Pay Taxes In Canada

Generally, donations of gift cards, gift certificates, checks, cash, or services are not subject to tax since there is not an exchange of merchandise or goods. The minimum penalty is $100, up to a maximum of $2,500, for each failure to file.

Complete Guide To Donation Receipts For Nonprofits

Nonprofits are also exempt from paying sales tax and property tax.

Do nonprofits pay taxes in canada. Both charities and nonprofit organizations do not have to pay income tax. The cra bans both of these organizations from using their income to benefit members. Tax time can be stressful for nonprofit and charitable organizations in canada, especially when the filing requirements are not well understood within the organization.

Questions answered every 9 seconds. By contrast, an organization that is incorporated under the canada business corporations act is generally referred to as a business corporation. Questions answered every 9 seconds.

An npo cannot issue tax receipts for donations or membership fees contributed. Do nonprofit organizations pay taxes? The charity can then issue charitable donation receipts for tax purposes.

Once accepted, a registered charity is exempt from income tax under paragraph 149(1)(f). Only certain npos have to file form t1044. Cra can assess penalties of $25 per day for failure to file this form.

Ad a tax advisor will answer you now! Some have thousands of employees, while others employ a couple of key people and rely on. It's often assumed that nonprofits are completely tax exempt, but they can still be subject to taxes if they have ubti.

However, charities are operated exclusively for charitable purposes, while npos may operate for the benefit of social welfare, pleasure, sport, recreation or any nonprofit purpose. However, items withdrawn from resale inventory and donated to organizations such as nonprofit museums, art galleries, and libraries are not taxable. While the income of a nonprofit organization may not be subject to federal taxes, nonprofit organizations do.

Many of the benefits you enjoy today are made possible through tax revenue, such as: For the most part, nonprofits and churches are exempt from the majority of taxes that. The only exception to this rule is a

In short, the answer is both yes and no. In canada, tax is collected by the different levels of government to pay for the facilities, services, and programs they provide. Most nonprofits have paid staff.

Ad a tax advisor will answer you now! When you acquired the real property by way of lease, licence or similar arrangement, you are entitled to claim itcs for the tax paid or payable on your lease payments that became due on or after the effective date of the election, to the extent that you use the property in commercial activities, as long as it is used more than 10% in those activities.

All Type Of E-tax Filing And Gst Registration Accounts Services Done Here ---- All Type Of Tax Related Matter L Tax Consulting Filing Taxes Income Tax

Bisniscom Jakarta - Pajak Reklame Yang Ditempelkan Di Kendaraan-kendaraan Angkutan Dalam Jaringan Daring Di Dki Jak Income Tax Return Income Tax Tax Refund

Tax Lien Help Greensboro Ga 30642 Mm Financial Blog Irs Taxes Tax Debt Relief Tax Debt

When You Need Your Taxes Done Righthelp Is A Phone Call Away Location Does Not Matterwe Prepare Us F Tax Preparation Income Tax Income Tax Preparation

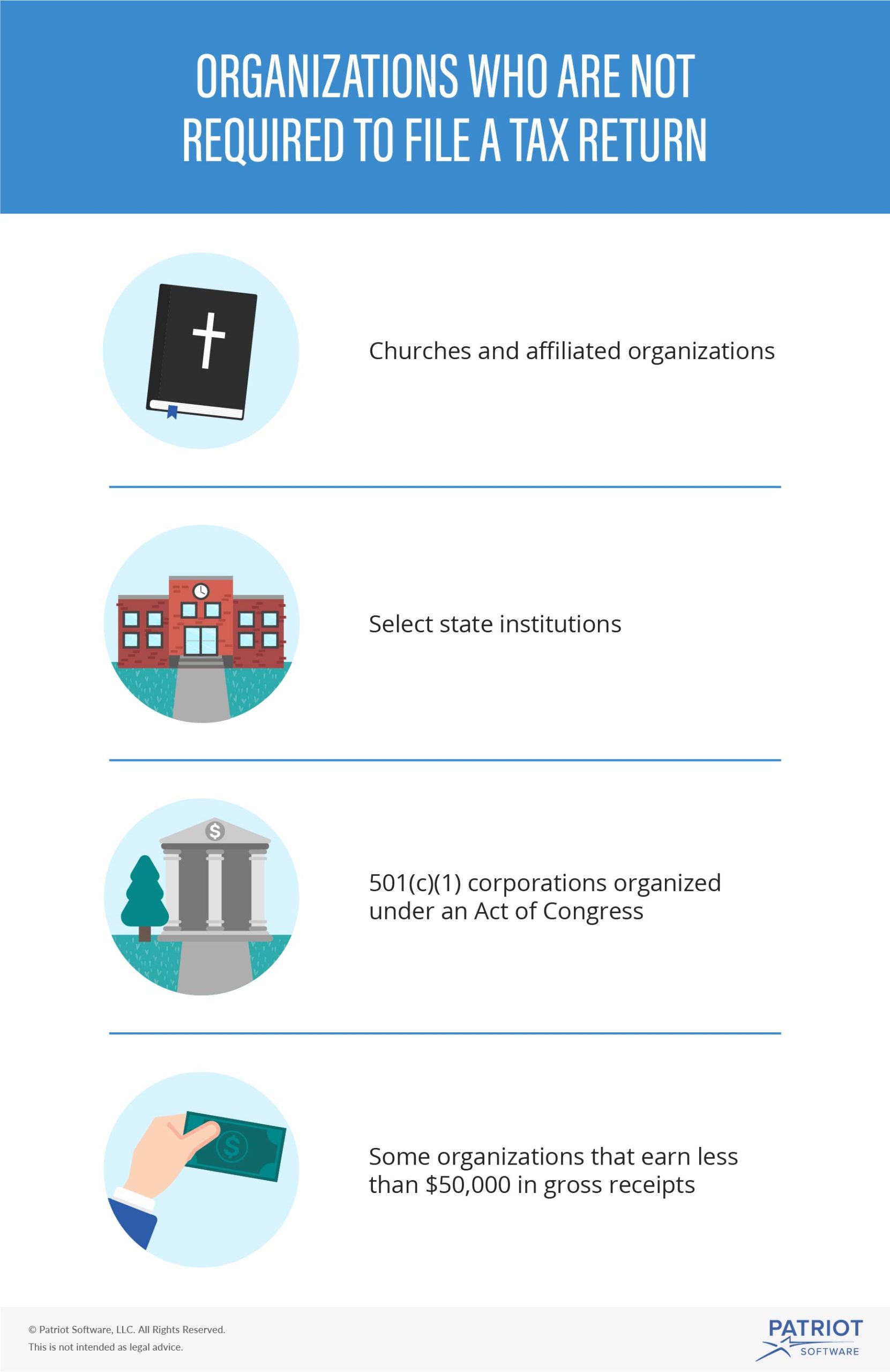

Do Nonprofits File Tax Returns If Theyre Tax-exempt

Canadian Tax Requirements For Nonprofits And Charitable Organizations

Pdf Taxation Of Non-profit Associations In An International Comparison

Ask Inyathelo - Assess Your Board Financial Year End Assessment Do You Know What

Four Reasons The Nonprofit Sector Needs A New Name - Onn

Intuit Quickbooks Desktop Premier Plus 2021 With Payroll Enhanced 1-year Subscription Windows Int940800f099 - Best Buy Quickbooks Small Business Accounting Business Finance

Xls Xlsformat Xlstemplates Xlstemplate Check More At Httpsmavensocialcofree-househ Budget Spreadsheet Template Budgeting Worksheets Budget Spreadsheet

Sources And Uses Of Incomes In The Nonprofit Sector

Pin On Organizational Resources

Charitable Giving In Canada Charitable Giving Infographic Charitable

What Is A 501c Nonprofit Legalzoomcom

Non Profit Vs Not For Profit Top 6 Best Differences With Infographics

How It Works - The Bitcoin Infografik By Reuters Bitcoin Economy Infographic What Is Bitcoin Mining

Intuit Quickbooks Desktop Premier Plus 2021 With Payroll Enhanced 1-year Subscription Windows Int940800f099 - Best Buy Quickbooks Small Business Accounting Business Finance

Pin On Luxe Accounting Tax Services