Nh Meals Tax Rate

There are, however, several specific taxes levied on particular services or products. The meals and rentals tax is a tax imposed at a rate of 9% on taxable meals, occupancies and rentals of vehicles.

Gops Ricciardi Nh Republicans Must Embrace Property Tax Relief - Nh Journal

Detailed new hampshire state income tax.

Nh meals tax rate. Hotels, seasonal home rentals, campsites, restaurants and vehicle rental agencies are required to register with and obtain a license from the department of revenue New hampshire's meals and rooms tax is a 8.5% tax on room rentals and prepared meals. The current tax on nh rooms and meals is currently 9%.

New hampshire meals and rooms tax rate drops beginning friday. Starting october 1, the tax rate for the meals and rooms (rentals) tax will decrease from 9% to 8.5%. New hampshire is one of the few states with no statewide sales tax.

Years ending on or after december 31, 2026, nh i&d rate is 2%. The meals and rentals (m&r) tax was enacted in 1967 at a rate of 5%. Chapter 144, laws of 2009, increased the rate from 8% to the current rate of 9% and added campsites to the definition of hotel.

City manager karen conard announced, “the 2021 tax rate has increased just $0.33, or 2.2%, from the prior year’s tax rate of $14.70 and is lower than the tax rate of $15.07 that was anticipated at the time the city council adopted the fy22 annual budget this past june due to an increase in revenues coming to the city from the state, particularly the rooms & meals tax.” • this budget helps consumers by reducing the meals and rooms tax from 9% to 8.5%, its lowest level in over a decade. Motor vehicle fees, other than the motor vehicle rental tax, are administered by the nh department of safety (rsa 261).

The budget cuts the 5% interest and dividends tax by one percent a year, starting in 2023 and eliminating it by 2027, so that really doesn’t affect this budget much. The m&r tax is paid by the consumer and is collected and remitted to the state on the 15th of each month by operators of hotels, restaurants, or other businesses providing taxable meals, room rentals, and motor vehicle rentals. Speaking of the rooms and meals tax, the budget would cut that rate from 9% 8.5% starting in january.

The tax is assessed upon patrons of hotels and restaurants, on certain rentals, and upon meals costing $.36 or more. Years ending on or after december 31, 2027, nh i&d rate is 0%. Tax excluded receipts 1 2.

Tax included receipts 3 4. The rate is reduced to 8.75% beginning on or after october 1, 2021. You may be required to file new hampshire business tax returns if your gross business income exceeds $50,000.

New hampshire department of revenue administration (nhdra) is reminding operators and the public that starting october 1, 2021, the state’s meals and rooms (rentals) tax ratewill decrease by 0.5%, from 9% to 8.5%. This booklet contains the following new hampshire state tax forms and instructions necessary for the monthly and seasonal filing of the meals & rentals (m&r) tax. The new hampshire state sales tax rate is 0%, and the average nh sales tax after local surtaxes is 0%.

Subscribe to meals & rentals operators notifications, to receive nh dra announcements, guidance, and other helpful information file and pay your meals & rentals tax online at granite tax connect please note that effective october 1, 2021 the meals & rentals tax rate is reduced from 9% to 8.5% Years ending on or after december 31, 2025, nh i&d rate is 3%. The new hampshire income tax has one tax bracket, with a maximum marginal income tax of 5.00% as of 2021.

Please note that effective october 1, 2021 the meals & rentals tax rate is reduced from 9% to 8.5%. Nh meals and rooms tax. Total meals tax (line 2 plus line 4) 5 receipts from rentals 6.

This budget reduces taxes in every sector of our economy creating tax relief across the spectrum of our citizens. Tax rate drops from 9% to 8.5% Meals tax at 8.26% (multiply line 3 by.0826) 4 5.

Concord — the new hampshire department of revenue administration (nhdra) is reminding operators and the public that starting october 1, 2021, the state’s meals and rooms (rentals) tax rate will decrease by 0.5%, from 9% to 8.5%. Meals tax on gross receipts at 9% (multiply line 1 by.09) 2 3. The tax is assessed upon patrons of hotels (or any facility with sleeping accommodations) and restaurants, as well as on motor vehicle rentals.

New hampshire meals and rooms tax is decreasing from 9% to 8.5% effective october 1, 2021. Receipts from meals and beverages 1.

New Hampshire Meals And Rooms Tax Rate Cut Begins

Nh Meals And Rooms Tax Decreasing By 05 Starting Friday Manchester Ink Link

Cut To Meals And Rooms Tax Takes Effect - Nh Business Review

Cut To Meals And Rooms Tax To Take Effect On Friday New Hampshire Bulletin

Transparency Nh Department Of Revenue Administration

Sales Taxes In The United States - Wikiwand

Sununu Promises Tax Cuts For Everyone But Bpt Reduction Isnt In His Budget Plan - Nh Business Review

The State Budget For Fiscal Years 2022 And 2023 - New Hampshire Fiscal Policy Institute

New Hampshire Sales Tax Rate - 2021

2

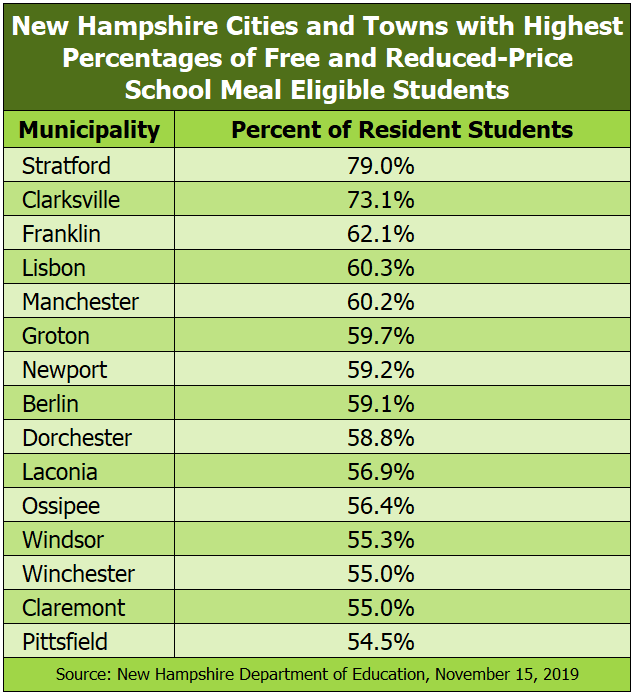

The Other New Hampshire Property-poor Municipalities News Eagletimescom

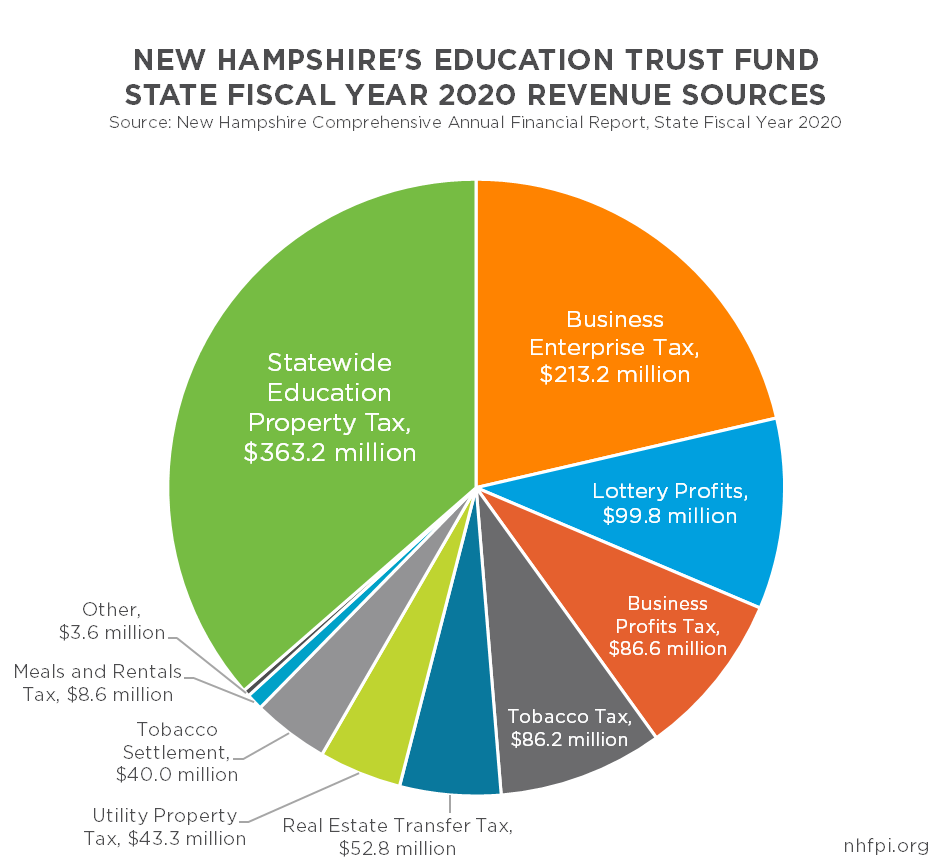

The State Budget For Fiscal Years 2020 And 2021 - New Hampshire Fiscal Policy Institute

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

States With Highest And Lowest Sales Tax Rates

New Hampshire Sales Tax Rate - 2021

Nh Senate Panel Hears Bid To Increase Restaurants Take Of Rooms And Meals Tax - Nh Business Review

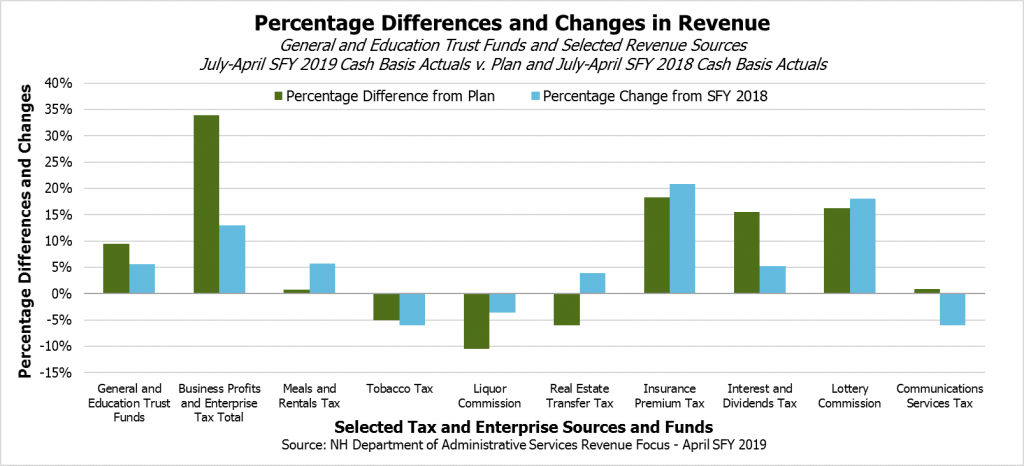

Funding The State Budget Recent Trends In Business Taxes And Other Revenue Sources - New Hampshire Fiscal Policy Institute

Historical New Hampshire Tax Policy Information - Ballotpedia

Understanding New Hampshire Taxes - Free State Project