Oklahoma Franchise Tax Instructions

Item c • place the beginning and ending reporting period (mm/dd/ Oklahoma minimum/maximum franchise tax return a.

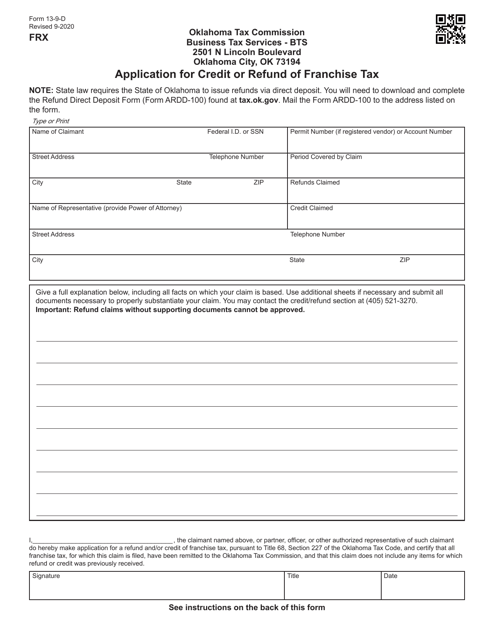

Form 13-9-d Download Fillable Pdf Or Fill Online Application For Credit Or Refund Of Franchise Tax Oklahoma Templateroller

If no number has been issued, leave blank.

Oklahoma franchise tax instructions. Oklahoma must file an annual franchise tax return and pay the franchise tax by july 1 of each year. Lets say you own a cute little diner in tulsa that earns $500,000 each year. If filing a consolidated franchise tax return for oklahoma, the oklahoma franchise tax for each corporation is computed separately and then combined for one total tax.

Complete the oklahoma annual franchise tax return item a place the taxpayer fein in block a. Oklahoma business incentives and tax guide for fiscal year 2020 welcome to the 2020 oklahoma business incentives and tax information guide. Oklahoma had a business franchise tax that all corporations had to pay annually to the oklahoma tax commission.

For every $1,000 of revenue your business earns, oklahoma’s annual franchise tax will charge you $1.25. If you would like to add or change a legal name in the oklahoma tax commission, fill out packet a, and mail to: The report and tax will be delinquent if not paid on or before august 31, or if you elected to change your filing period to be the same as your corporate income tax, the report and tax will be delinquent if not paid by the fifteenth (15) day of

Acquired by the nature of all organizations falling within the purview of the franchise tax code. Companies and business trusts as defined by oklahoma statutes unless exempt by statutes must file an annual franchise tax return form 200. Mine the amount of franchise tax due.

Once an election is made, it is binding until a corporation submits a request to the otc. The maximum annual franchise tax is $20,000.00. Foreign corporations are not obliged to pay the oklahoma franchise tax but are still liable for the $100 registered agent fee.

When a corporation’s franchise tax In oklahoma, the maximum amount of franchise tax a corporation can pay is $20,000. Only those corporations with capital of $201,000.00 or more are required to remit the franchise tax.

Corporations reporting zero franchise tax liability must still file an annual return. Item b enter the account number issued by the oklahoma tax commission beginning with frx followed by ten digits. Indicate this amount on line 13 of the form 200.

Time and place for filing corporate returns shall be due no later than 30 days after How do i calculate my oklahoma annual franchise tax? Read the instructions on back “who qualifies to file form 215” to determine if you can use this form.

The maximum annual franchise tax is $20,000.00. The franchise tax is waived for revenue and assets of less than $200,000 and is capped at $20,000. The rules, legislation and appropriations related to taxes and incentives are very dynamic, and as changes occur, this tax guide will be updated.

Done in oklahoma (sales and service). Virtue of powers and privileges acquired by the nature of all organizations falling within the purview of the franchise tax code. 2020 oklahoma corporation income and franchise tax forms and instructions.

Oklahoma annual franchise tax return (form 200). 2019 oklahoma corporation income and franchise tax forms and instructions. Corporations that remitted the maximum amount of franchise tax for the preceding tax year do not qualify to file a combined income and franchise tax return.

The franchise tax is calculated at the rate of $1.25 for each $1,000.00 of capital employed in or apportioned to oklahoma. Corporations required to file a franchise tax return may elect to file a combined corporate income and franchise tax return. Corporations required to file a franchise tax return, may elect to file a combined corporate income and franchise tax return.

The maximum amount of franchise tax that a corporation may pay is $20,000.00. Oklahoma businesses must pay annual franchise taxes using form frx 200. Your total franchise tax would be $625 (500 x 1.25).

Katherine Douglas On Twitter Unschooling Homeschool Homeschool Education

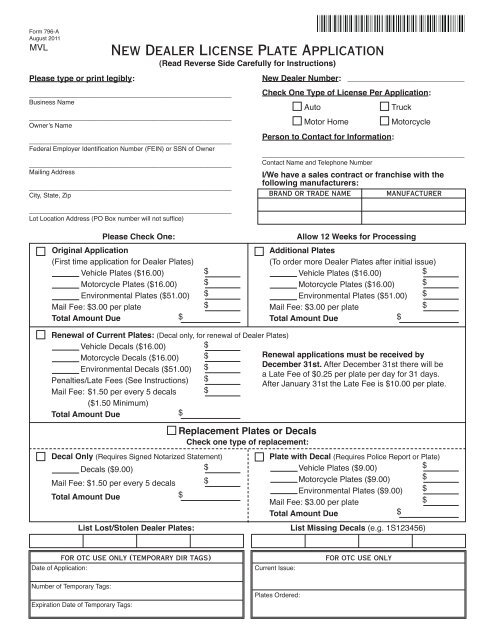

New Dealer License Plate Application - Oklahoma Tax Commission

Pin By Ca Gulshan Sharma On Legal Services Goods And Service Tax Legal Services Registration

Consignment Store Agreement Form Order Form Template Order Form Template Free Order Form

What Is Irs Treas 310 And How Is It Related To 2020 Tax Returns - Ascom

2

Pin By Succentrix Business Advisors On Taxes Tax Return No Worries Be Confident In Yourself

Get Your Tax And Legal Advice Under One Roof - Solubilis Always With You Legal Advice File Income Tax Filing Taxes

Oklahoma Taxpayer Access Point

Franchise Tax Board Homepage Tax Franchising California State

Godzilla - Monsters Inc By Roflo-felorezdeviantartcom On Deviantart Godzilla Funny Godzilla Godzilla Franchise

Be Safe Twilight Tattoos Tattoos Inspirational Tattoos

Amazoncom Mega Construx Pokemon Lucario Power Pack Toys Umbreon Pokemon Cosas De Pokemon Pokemon Lego

2

2

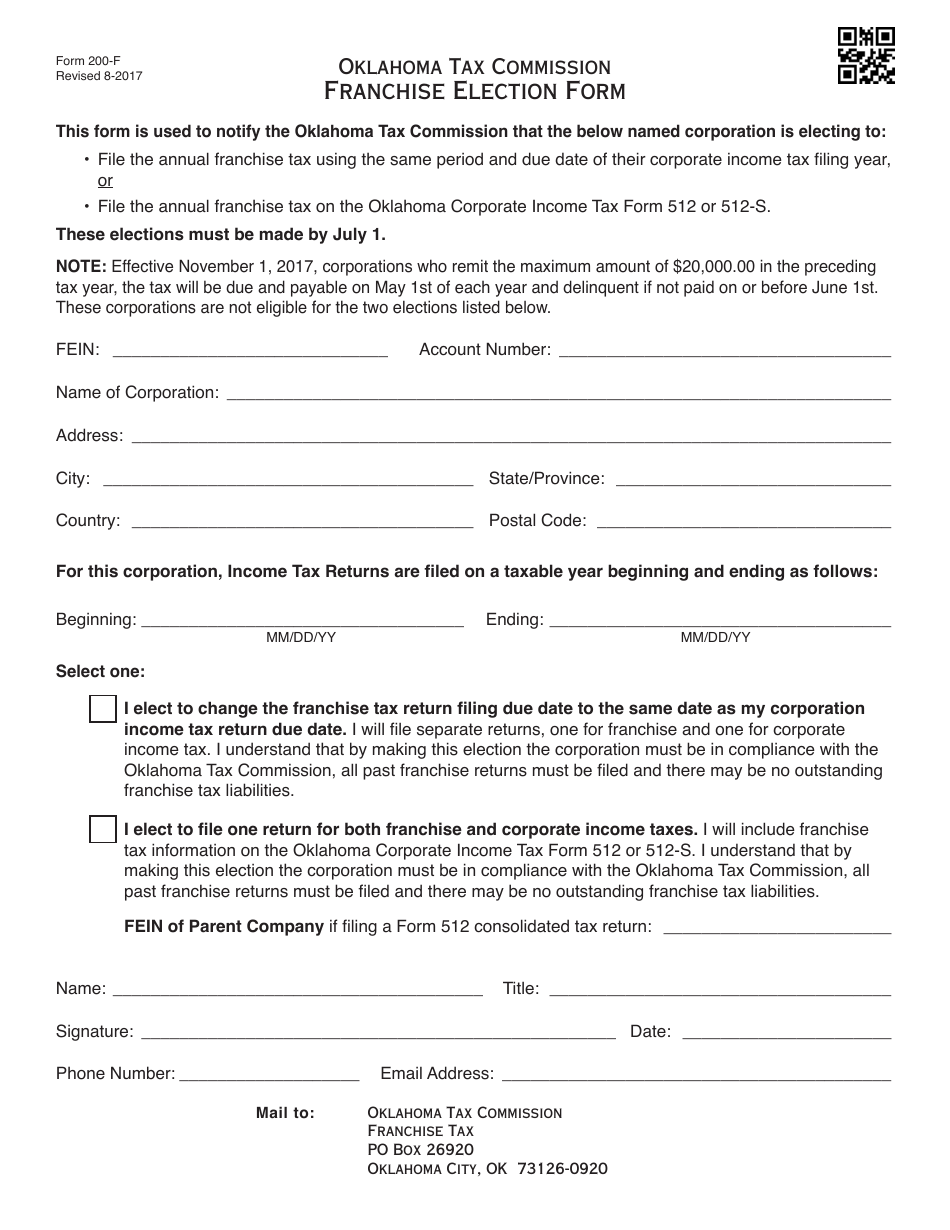

Otc Form 200-f Download Fillable Pdf Or Fill Online Franchise Election Form Oklahoma Templateroller

2

Pin On Jett Moon Essence

Pin On Dumbass Of The Day