Draftkings Sportsbook Tax Form

Click on “document center” which you will see on the left hand side of this page. When a wager pays out $600.00 or more of net winnings at odds of 300.

Daily Fantasy Sports Tax Reporting

New jersey and new hampshire, for example, do not allow betting on collegiate sports teams from within their jurisdictions.

Draftkings sportsbook tax form. Click to see full answer. That number then goes on your u.s. Draftkings sportsbook users can wager on the vast majority of teams, sports and events.

You should attach the schedule 1 form to your form 1040. You report winnings and then losses are itemized. If you don't need to itemize, you don't get it.

The right to take bets in one of the country’s most populous states comes at a hefty price—a 51% tax on revenue, higher than any other jurisdiction (arizona, for example, is 8%).some have publicly doubted whether any operator will be able to. The best place to put this 1099 is under ''other common income''. In general, winnings are reported to the irs in certain situations:

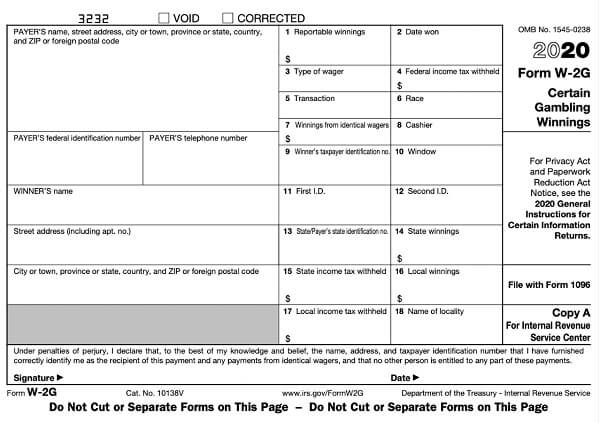

Here are two of the basic irs forms used to report winnings from gambling, including the standard personal income tax form. Draftkings was one of nine operators recently recommended for mobile licenses in new york. It can be found in the wages & income section, and i have attached a screenshot.

If a wager is subject to irs reporting requirements,. Entrants may be requested to complete an affidavit of eligibility and a liability/publicity release (unless prohibited by law) and/or appropriate tax forms and forms of identification including but not limited to a driver's license, proof of residence, and/or any information relating to payment/deposit accounts as reasonably requested by draftkings in. How are daily fantasy sports winnings calculated for tax purposes?

So, if you enter a daily fantasy sports contest on draftkings and post a net profit of more than $600 for the year, as we have mentioned above, dk must issue a. Daily fantasy play winnings are also subject to taxes just like any other income, so make sure you are including your dfs winnings on your tax returns. Draftkings seems to think that since they have the option to file for an extension, they should do that most years because they can’t do things in a timely fashion.

This is standard operating procedure for daily and traditional sports betting sites, and is one of the requirements for draftkings, and sites like it, to stay in. No matter the amount, gambling winnings are taxable. For sports bettors, the irs form 1099 will be the most common tax form.

Certain gambling winnings are generally considered ordinary income for u.s federal tax purposes, but not all wins are reported to the internal revenue service. Are gambling winnings reported to the irs? So if you're net $10k, but that is after $5k in losses, you'll need to report/pay income tax on $15k.

Must be 21+ and in virginia to place wagers. Steps to retrieve your draftkings 1099 forms. Individual income tax return form 1040 (pdf), line 7a (designated “other income”).

Those winning a substantial amount are likely to receive a tax form, and the irs will also receive that form. It's not like capital gains where you take your profits minus your losses. And if you really bring home the bacon, earning at least $5,000 for sports betting, this definitely goes on your tax record.

However, some state betting regulations prohibit wagering on certain sports or athletic events. The amount reported is unique to each customer’s wager and circumstances. Draftkings uses a formula to calculate your net profits on draftkings:

On the next screen, click 'this was prize winnings'. A majority of companies issue tax forms by january 31st every year as required by law. How do i get credit for withholding with the irs?

However, you can also apply the. Once on this page, you see a variety of account related items. What to do if your 1099 form is not available?

We will withhold federal income tax from the winnings if the winnings minus the wager exceed $5,000 and the winnings are at least 300 times the wager. The other operators recommended for licenses are bally bet, pointsbet, resorts world, rush. Include the amount from box 1 as “other income” on form 1040, schedule 1 (pdf).

According to the law, fantasy sports winnings of any size are considered taxable income. These prohibited bets will not be shown. The irs will then compare the information to the taxpayer’s return.

Where can i find my tax forms/documents? The answer is yes, your cumulative net profit is taxed, and draftkings is contractually required to send a 1099 tax form to any player that nets of $600 in profit in a calendar year. Maintaining good records of your gambling activity will allow you to itemize your losses and deduct them from your final tax bill.

The new york state gaming commission has recommended that nine sports betting operators, including draftkings, caesars, fanduel and betmgm, receive mobile licenses to operate in the state, which is imposing a controversial 51% tax rate on sports betting revenue.

Draftkings Tax Form 1099 Where To Find It How To Fill

Draftkings Sportsbook And Casino Pa How To Play And Get 1500 Free

Draftkings Sportsbook Promo Code Welcome Bonus Dec 2021

How To Pay Taxes On Sports Betting Winnings Bookiescom

What To Do When Receiving A Draftkings W9 Form Request

Fantasy Sports Taxes Sports Betting Taxes Dfs Army

Connecticut Hasnt Legalized Sports Betting But A State Casino Is Now Partnering With Draftkings

Draftkings Sportsbook Colorado A Phenomenal Sports Betting App

Paying Tax On Your Sports Betting Profits Is Simple Kind Of

Terms Of Use Draftkings Sportsbook

When And How Do You To Submit A Fanduel W9 Form

Heres How To Find Your Draftkings 1099 Form Online

Oregon Sports Betting 2021 Updates

Draftkings Sportsbook Ohio The Best Sports Betting App Coming Soon

Restore Restricted Or Locked Draftkings Sportsbook Account

Paying Tax On Your Sports Betting Profits Is Simple Kind Of

Draftkings Sportsbook Indiana App User Guide Promo Code

Draftkings Tax Form 1099 Where To Find It How To Fill

Draftkings Sportsbook Promo Code Welcome Bonus Dec 2021