Retroactive Capital Gains Tax History

For taxable revenue above this threshold, any income from capital gains and certified dividends are topic to preferential tax rates. Generally reduced the ordinary individual income tax rates and provided for a limited capital gains reduction.

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

Capital gains tax rates in europe.

Retroactive capital gains tax history. Capital gains planning opportunities exist; During the past 25 years there have been around 6 significant retroactive tax. In recent years, such retroactive rate changes have occurred as late into the year as august.

The capital gains rate increase could be significantly lower than proposed; Perhaps, had congress looked to enact such changes earlier in 2021, the chance to make the capital gains tax changes retroactive (to, perhaps, the start of. Still another would make the change.

Based on this history, it really appears that the capital gain rate will more likely increase to the 28% to 30% mark. A historical review suggests that any tax legislation enacted in 2021 could have retroactive effect to transactions completed at any time in 2021. For tax 12 months 2019, no capital gains tax is owed if taxable revenue is beneath $39,375 for single filers ($seventy eight,750 for joint filers).

While the most significant recent capital gains rate change, provided by the jgtrra, was largely prospective, it was still, in part, retroactive and included a complicated transition rule that functionally split the single calendar year 2003 into two periods for purposes of computing the capital gains tax. Perhaps, had congress looked to enact such changes earlier in 2021, the chance to make the capital gains tax changes retroactive (to, perhaps, the start of the year) would have been greater. Retroactive tax changes have occurred in the past.

At this point, though, it’s looking like the earliest the biden tax plan will be passed is. 7 rows signed 7 june 2001. Up until now, the tax rate on capital gain has been zero, 15% or 20%, depending on your income.

Another would raise the capital gains tax rate to 39.6% for taxpayers earning $1 million or more. But prior to such legislative change, could be subject to a higher capital gains rate. Retroactive tax provisions in 1969, 1987, and 1993 withstood constitutional challenges in part because they were designed to create more taxpayer equity and to eliminate loopholes:

A report by the tax policy center shows that capital gains realizations rose by 60 percent in 1986 before the new tax rate of 28 percent was due to come into effect in 1987 from the previous 20 percent. In some cases, you add the 3.8% obamacare tax, but at worst, your total tax bill is 23.8%. President joe biden is formally calling for his proposal for the largest capital gains tax in history to be retroactive.

This resulted in a 60% increase in the capital gains tax collected in 1986. In 1969, during richard nixon’s administration, congress passed the tax reform act of 1969, which raised certain income tax rates with at least twenty retroactive effective dates. The 1987 capital gains tax collections were slightly below 1985.

The higher the rate, the less likely taxpayers will sell assets and be subject to the tax. A historical review suggests that any tax legislation enacted in 2021 could have retroactive effect to transactions completed at any time in. Are retroactive tax increases constitutional or even fair?

Although congress has the constitutional authority to make retroactive tax increases, they have historically been the exception rather than the rule. Similarly, widespread exits jumped 40 percent in 2012 when the tax rate increased to 25 percent from 15 percent in 2013. Generally reduced the ordinary individual income tax rates and provided for a limited capital gains reduction.

Pushing it to 2022 would create a mess joe biden campaigned on raising the capital gains tax rate to 39.6% from 20.0% on those earning more than $1 million.

2

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

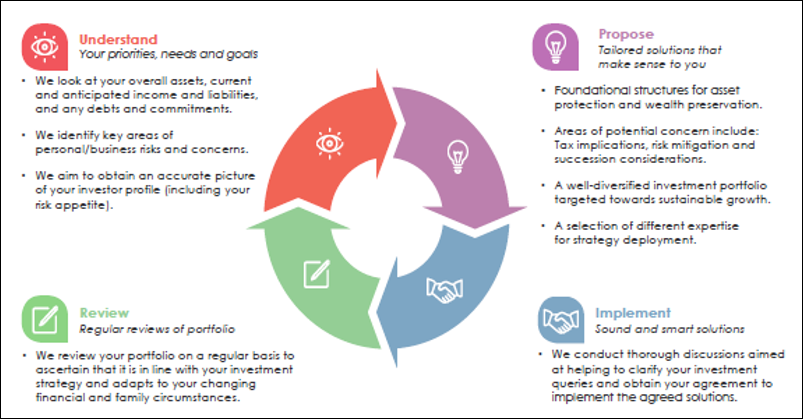

Banking Privilege Ocbc Nisp

2

Capital Gains Tax 101

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

How Do You Create Price Levels In Quickbooks Quickbooks Levels Price

Banking Privilege Ocbc Nisp

2

2

2

Banking Privilege Ocbc Nisp

Would Teachers Strike In Clark County Mirror Labor Wins Elsewhere Teachers Strike School District Boards National Education Association

Pin By Ad Roberts On Tax Board Creepy Photos Funny Black Memes New Year Meme

Banking Privilege Ocbc Nisp

![]()

Pin On Legal

After Being Forcefully Arrested A Black Jogger In San Antonio Says He Was Guilty Before Proven Innocent Black Joggers Joggers Nigerian Men

Just Pull Yourself Up By Your Own Bootstraps They Said Rfullcommunism Investing Raising Capital Midwest

2