Paying Indiana State Taxes Late

The penalty for filing late is normally five percent of the unpaid taxes for each month or part of a month that a tax return is late. Short period filers see note following line 22 instructions.

Great News Washington January 22 2019 Late Last Week The Treasury Department And The Int Internal Revenue Service Real Estate Professionals Filing Taxes

In the event an indiana sales tax filing deadline was missed due to circumstances beyond your control (e.g., weather, accident), the indiana dor may grant you an extension.

Paying indiana state taxes late. Indiana department of revenue interest rates. Find a local tax pro If you are enclosing a payment, mail to:

That penalty starts accruing the day after the tax filing due date and will not exceed 25 percent of your unpaid taxes. It should be noted that indiana does not impose interest on late property tax payments. Intax supports the ability to file and pay electronically for the following taxes:

If no payment is enclosed, mail to: Failure to file a tax return; Generally, the penalties charged on the tax you owe increase over time, but you can minimize them by filing your state return as soon as possible.

On april 22, the indiana general assembly did not adopt certain provisions of the current internal revenue code and governor eric holcomb signed this into law on april 29. Indiana property taxes are due twice a year, in may and november. What happens if you don't pay indiana property tax.

Payment of estimated taxes is due in installments. Enter the amount of estimated taxes paid by. If you file for a federal extension of time to file with the irs, you will automatically receive the state extension of time to file.

With department of revenue approval, you can also set up a tax payment plan or file a payment under a deadline extension through the epay system. Including local taxes, the indiana use tax can be as high as 0.000%. You may request a filing extension, but this does not push back the payment due date.

Indiana state income tax forms need to be submitted by april 15th to not be considered late. The indiana use tax rate is 7%, the same as the regular indiana sales tax. Interest is paid on certain overpayments/refunds, and is based on the average investment yield on state money for the state's previous fiscal.

Fiscal year and short tax year filers must remit by the twentieth day of the fourth, sixth, ninth, and twelfth months of the taxable year. A property is eligible to be sold at a tax sale when the prior year's spring installment of property taxes remains unpaid. Interest is computed on a daily basis, so each day you are late paying your taxes, you'll owe 0.0082% of the balance.

For more information, refer to our section on penalties and interest. The consequences of not filing or paying state taxes include penalties, interest, license suspension, jail time and more. Interest is assessed on amounts due to the indiana department of revenue which are not timely paid (delinquency payments).

If you owe money to the irs upon completing your tax return, it's best to make that payment on time. The maximum amount that you could extend the filing date is 60 days after the tax due date. Tax rates fees & penalties.

So, if you owe the irs $1,000 and you're 90 days late, first calculate your. Get a better understanding now. This penalty is also imposed on payments which are required to be remitted electronically, but are not.

If the due date falls on a national or state holiday, saturday or sunday, payment postmarked by the day following that holiday or sunday is considered on time. Failure to file a tax return; How indiana tax sales work

Indiana’s extension of time to file pushes back the filing date to november 16, 2020. A representative can research your tax liability using your social security number. Individual tax returns and payments, originally due by april 15, 2021, are now due on or before may 17, 2021.

Therefore, indiana taxpayers may pay their spring property tax payments up to and including july 10, 2020, without penalty. There are several ways you can pay your indiana state taxes. Absent this extension the due date would have been april 15, 2020.

The cost of paying your taxes late. It doesn’t matter if you owe taxes, are due a refund or you are breaking even. Filing an indiana sales tax return late may result in a late filing penalty as well as interest on any outstanding tax due.

Late Filing And Late Payment Penalties - Ils

Irs And Indiana Dor Extend Tax Filing Deadline To May 17 2021 Whitinger Company

Indiana Sales Tax - Small Business Guide Truic

What Canadian Businesses Need To Know About Us Sales Tax - Madan Ca

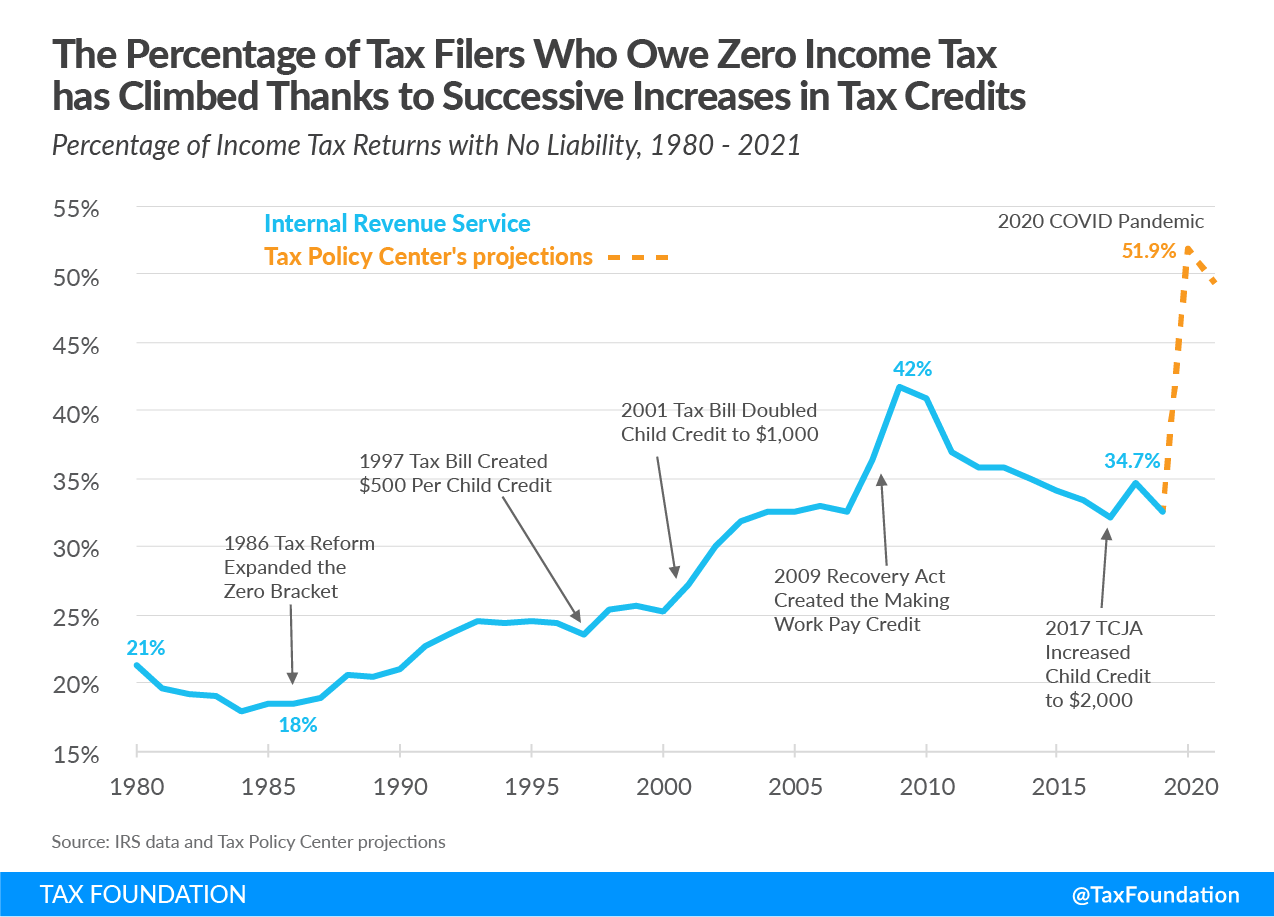

Increasing Share Of Us Households Paying No Income Tax

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

Tax Deadlines Hr Block

Dor Stages Of Collection

Look Uppay Property Taxes

Consequences Of Not Filing Or Paying Federal Or State Taxes - Tax Group Center

Paying Your Taxes

How To Pay Your Taxes With A Credit Card In 2021 Forbes Advisor

Business Taxes Annual V Quarterly Filing For Small Businesses - Synovus

Here Are Key Tax Due Dates If You Are Self-employed Forbes Advisor

Turbotax Vs Hr Block Which Online Tax Service Is Best

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

Pay Your Federal State Taxes On Efilecom Debit Check

Irs Extends Filing And Payment Deadlines For Tax Year 2020 Tax Pro Center Intuit

Tax Day 2021 Deadline The Last Day You Can File And How To Get An Extension - Cnet