Philadelphia Property Tax Rate 2019

Please use this website for the current real estate tax balances due on a property. Counties in pennsylvania collect an average of 1.35% of a property's assesed fair market value as property tax per year.

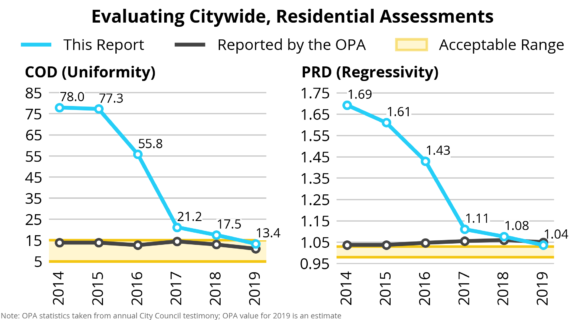

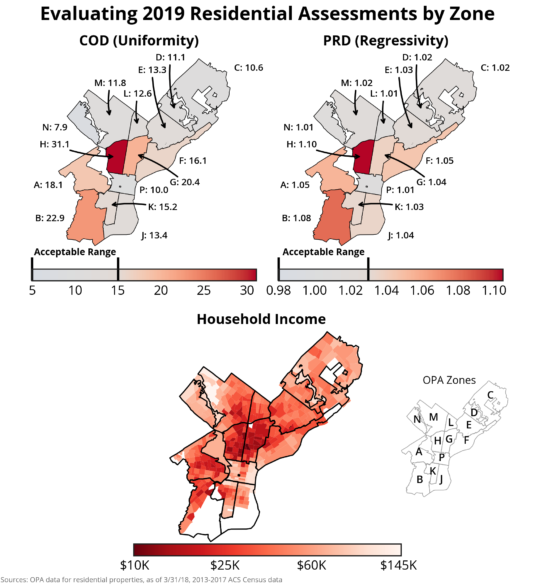

The Accuracy And Fairness Of Philadelphias Property Assessments - Office Of The Controller

The homeownership rate in philadelphia county, pa is 52.3%, which is lower than the national average of 64.1%.

Philadelphia property tax rate 2019. People in philadelphia county, pa have an average commute time of 32.5 minutes, and they drove alone to work. Between 2018 and 2019 the median property value increased from $167,700 to $183,200, a 9.24% increase. Alternatively, the office found, removing specifically the school district portion of the tax abatement in that same year (revenue from the current 1.4 percent property tax rate is split 55.

Property tax in philadelphia county is calculated by multiplying the taxable value with the corresponding tax rates and is an estimate of what an owner not benefiting from tax exemptions would pay. For the 2021 tax year, the rates are: The fiscal year 2020 budget does not contain any changes to the tax rate, so, the same tax rate as 2019 will be used to calculate next year’s tax bills.

There is a general property tax rate of 1.3998% for the whole county, comprised of 0.6317% allocated to the city, and 0.7681% allocated to schools. For example, philadelphia was considering a 4.1% property tax increase for 2019. The city of brotherly love's rate of 1.1% places it.

The median property tax in pennsylvania is $2,223.00 per year for a home worth the median value of $164,700.00. Find more information about philadelphia real estate tax, including information about discount and assistance programs. Pennsylvania is ranked number sixteen out of the fifty states, in order of the average amount of property taxes collected.

The city’s current property tax rate is 1.3998 percent. That’s a bargain compared to allegheny county (home to pittsburgh) which has an average effective property tax rate of 2.08%. The average effective property tax rate in philadelphia county is 0.98%.

The city of philadelphia and the school district of philadelphia both impose a tax on all real estate in the city. The combined rate accounts for federal, state, and local tax rate on capital gains income, the 3.8 percent surtax on capital gains and the marginal effect of pease limitations (which results in a tax rate increase of 1.18 percent). However, to avoid having to increase property taxes, the city council introduced a package that would find income from sources such as a wage tax and a city grant that would cut the budget in other departments.

Previous interest rates for calendar year 2019, interest was charged at the rate of 8%. Six philadelphia properties have been awarded state historic tax credits, the wolf administration announced this week, providing a total of $600,000 in financial benefits to the real estate teams who are redeveloping local historic buildings. In just the last year property values across the city increased 8 percent (taxable value increased by 11 percent), with several pockets of the city increasing by more than 20 percent, some by more than 70 percent, according to the city's latest citywide property.

Proponents of the flat tax system will be glad to hear that pennsylvania has a flat income tax rate of 3.07%. The tax credit awards, administered by the state’s department of community and economic. Only owners of properties with new construction or expiring tax breaks will receive new assessments this year.

Philadelphia performs well for commercial property tax rates compared to other cities in the nation, according to a recent report. Effective january 1, 2021, for all taxes except real estate tax and liquor tax, interest is charged at the rate of 5% per year, 0.42% of the unpaid balance per month. That’s the lowest rate of.

Why are there variations in pa property tax rates? The city of philadelphia's tax rate schedule since 1952. Find valuations, real estate taxes, physical details, trash and recycling days, school information, and city service areas for properties within the city of philadelphia.

In 2019 homeowners paid an average of $3,561, raising $306.4 billion. Aggregate & local property tax stats. This raised $323 billion in property taxes across the nation.

Risk Of Stock Market Loss Over Time 1926 - 2019 Stock Market Marketing Loss

The Accuracy And Fairness Of Philadelphias Property Assessments - Office Of The Controller

Philadelphia-county Property Tax Records - Philadelphia-county Property Taxes Pa

The True Cost Of Living In Philadelphia

You Pay Lots Of Philly Taxes But Do You Know Why - Philadelphia Magazine

Philadelphia 10-year Tax Abatement Changes What You Need To Know Nj Lenders Corp

Philadelphia-county Property Tax Records - Philadelphia-county Property Taxes Pa

How A Philadelphia Property Tax Issue Nearly Cost Us Our House

This Map Makes It Easy To Compare Your Property Tax Change To Your Neighbors - On Top Of Philly News

This Map Makes It Easy To Compare Your Property Tax Change To Your Neighbors - On Top Of Philly News

Philadelphia-county Property Tax Records - Philadelphia-county Property Taxes Pa

Pin On Travel

Moving In Philadelphia Guide To Philadelphia Neighborhoods

Philadelphia-county Property Tax Records - Philadelphia-county Property Taxes Pa

Philadelphia Cost Of Living 2021 Can You Afford Philadelphia Data

Philadelphia Reopens Heres Whats Changing At Revenue Department Of Revenue City Of Philadelphia

5 Best Suburbs Of Philadelphia Extra Space Storage

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

Redfins Hottest Affordable Neighborhoods Of 2019 Real Estate Articles The Neighbourhood Real Estate News