Kaufman County Tax Appraisal

Applies to property owners whose value notice from the county is dated more than 30 days ago; Property not previously exempt.2021 low income housing apartment capitalization rate:

Kaufmantxorg

Kaufman county is a county located in the u.s.

Kaufman county tax appraisal. Public property records provide information on homes, land, or commercial properties, including titles, mortgages, property. Information provided for research purposes only. Kaufman county collects, on average, 2% of a property's assessed fair market value as property tax.

Kaufman county has one of the highest median property taxes in the united states, and is ranked 251st of the 3143 counties in order of median property taxes. The board does not appraise property, make decisions affecting the. Pro members in kaufman county, tx can access advanced search criteria and the interactive gis map.

Use up/down arrow keys to increase or decrease volume. Taxnetusa pro members get full access. Assessor, collector, and delinquent taxes kaufman county tax assessor and collector kaufman county annex 100 north washington, kaufman, tx.

Delinquent tax data is available in bulk. Therefore, the property owner has missed the 2021 filing. O’connor is the leading representative for the kaufman county appraisal district property owners because:

For over 20 years, o’connor has provided property tax consulting services in the kaufman county appraisal district and has continuously produced results. Kaufman county tax collector 100 north. Kaufman county tax office p.o.

All members can search kaufman county, tx appraisal data, and print property reports that may include gis maps, land sketches, and improvement sketches. To search and pay your property online online, you will need one of the following information: As of the 2010 census, its population was 103,350.

Search kaufman county property tax and assessment records by owner name, property address, or account number. While the value appraisal hall provided to the kaufman herald does explain exactly where all of those taxes are going: Applies to property owners whose value notice from the county appraisal district is dated within the last 30 days.

The tax office, its officers, agents, employees and representatives shall not be liable for the information posted on the tax office website in connection with any actions losses, damages, claims or. A board of 6 directors governs the appraisal district. Kaufman county assessor's office services.

Effectiv e january 1, 1980, an appraisal district was established for each county with the responsibility for (1) listing and appraising taxable Kaufman county appraisal district property tax protest summary. The tax office, its officers, agents, employees and representatives shall not be liable for the information posted on the tax office website in connection with any actions losses, damages, claims or liability in any way related to use of, distribution of or reliance upon such information.

The median property tax in kaufman county, texas is $2,597 per year for a home worth the median value of $130,000. Account number, owner's name, address, cad reference number, or fiduciary number. Box 339 kaufman, texas 75142

The kaufman county tax office makes no representations as to the accuracy or reliability of any information accessed from its computer data base. The kaufman county property appraiser is responsible for finding, locating, and fairly valuing all property within kaufman county with the purpose of assessing the taxable value. The kaufman county single appraisal district was established by the passage of hb 1060 in may 1978, which resulted in the implementation of the property tax code and created the appraisal district.

Its county seat is kaufman. Legal descriptions and acreage amounts are for appraisal district use only and should be verified prior to using for legal purpose and or documents. Congressman from texas who was the first jewish person to.

(we need 1 business day notice to file a protest). Pay your kaufman county, texas property taxes online using this service. Box 339 kaufman, texas 75142

Board members select the chief appraiser, adopt the annual district budget, appoint appraisal review board members, and ensure that the district follows the policies and procedures required by law. Both the county, established in 1848, and the city were named for david spangler kaufman, a diplomat and u.s. Kaufman county tax office p.o.

$2,729.09 to kaufman isd, $1,582.26 to the city of kaufman, $842.85 to kaufman county, $243.93 to trinity valley community college and $183.68 to roads and bridges, they don’t explain why his or any of the other thousands of homes and businesses. Kaufman county property records offices. It's generally done at market value, which is essentially what someone.

The board’s authority over appraisal matters is limited. Kaufman county property records are real estate documents that contain information related to real property in kaufman county, texas. Kaufman county property tax appraisal.

The tax office, its officers, agents, employees and representatives shall not be liable for the information posted on the tax office website in connection with any actions losses, damages, claims or liability in any way related to use of, distribution of or reliance upon such information. Please contact the appraisal district to verify all information for accuracy. Kaufmancad tax protests filed for 2017 number of protests total number property tax protests 6,044 number single family property tax protests 4,710 number multifamily / apartment property tax protests 15 number commercial property tax protests.

Get property records from 3 offices in kaufman county, tx.

Kaufman-cadorg

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/XMIFG7GE7D6TUDEFWUWHPVMEHQ.jpg)

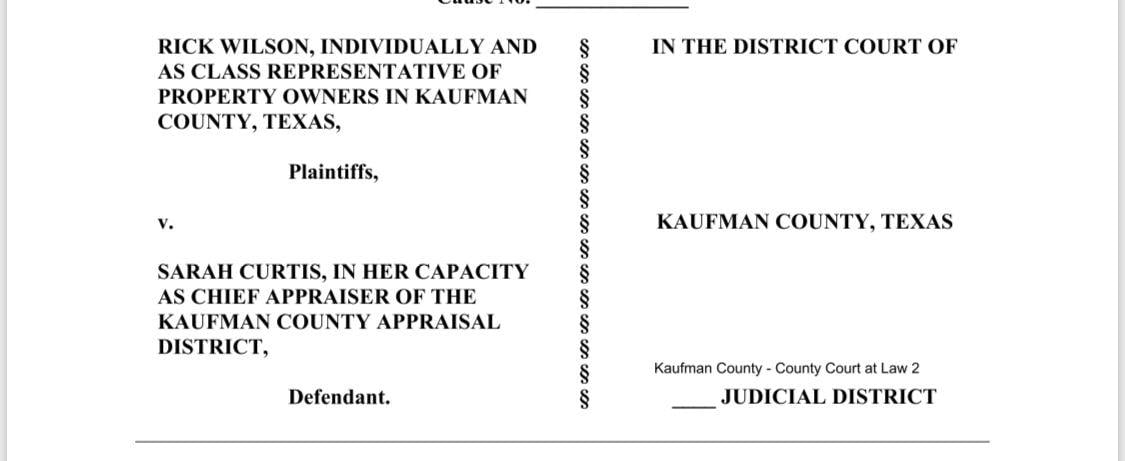

Another Way To Fight Property Taxes A Mayor Sues County Appraisal District Over Faulty Appraisals

Kaufman County Texas Property Search And Interactive Gis Map

Kaufman-cadorg

Kaufman Cad Official Site Kaufman Tx

Forney Mayor Files Suit Against County Appraisal District Business Inforneycom

Kaufman Cad Property Search

Kaufmancountytxnewswagitcom

Kaufmancountytxnewswagitcom

Another Way To Fight Property Taxes A Mayor Sues County Appraisal District Over Faulty Appraisals

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/67UWFZQQPDKB4KVZWWE6CDU2BE.jpg)

Another Way To Fight Property Taxes A Mayor Sues County Appraisal District Over Faulty Appraisals

Kaufman County Appraisal District - How To Protest Property Taxes

Kaufman Cad Official Site Kaufman Tx

Kaufman Cad Official Site Kaufman Tx

Thousands Impacted After Kaufman County Appraisal District Hugely Devalues Properties Wfaacom

Kaufman Central Appraisal District Facebook

Tax Assessor Kaufman County

Property Values Rising Again In Kaufman County Around Town Kaufmanheraldcom

Kaufman Cad Official Site Kaufman Tx