Franklin County Ohio Sales Tax On Cars

Simply multiply the sum of the figures from steps 1 and 2 by your local tax rate. But did you check ebay?

Man Killed In Two-vehicle Crash In Chardon Township Oshp Says

Ad looking for great deals?

Franklin county ohio sales tax on cars. Taxes are due on a vehicle, even when the vehicle is not in use. The properties in community reinvestment areas in franklin county had an abated value of more than $4.2 billion,with about $111 million in taxes that weren't collected under agreements with local. $15.00 title fee** plus sales tax on purchase price.

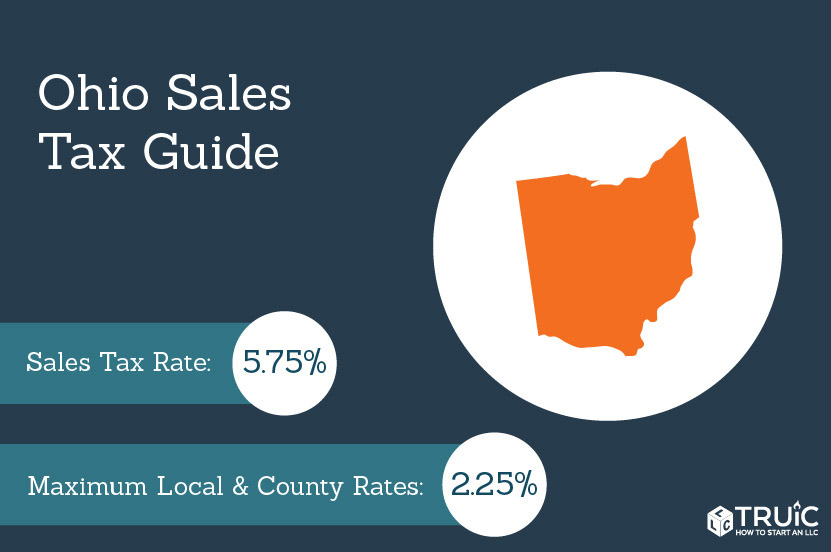

Ad looking for great deals? Ohio collects a 5.75% state sales tax rate on the purchase of all vehicles. The county sales tax rate is %.

* in addition to franklin county, a 0.5 percent sales tax funding the central ohio transit authority is collected in parts of delaware, fairfield, licking and union counties. Please make checks payable to: The franklin county sales tax rate is %.

Franklin county clerk of courts. Groceries and prescription drugs are exempt from the ohio sales tax; Counties and cities can charge an additional local sales tax of up to 2.25%, for a maximum possible combined sales tax of 8%;

Some cities and local governments in franklin county collect additional local sales taxes, which can be as high as 0.5%. The ohio state sales tax rate is 5.75%, and the average oh sales tax after local surtaxes is 7.1%. But did you check ebay?

Completes the annual tag and tax payments for your vehicle. Ohio cities and/or municipalities don't have a city sales tax. This is the total of state and county sales tax rates.

Division of motor vehicles, you will receive a tag & tax notice listing both vehicle registration fees and taxes due. The minimum combined 2021 sales tax rate for franklin, ohio is. Vehicles owned by a business pay tax based on the first letter of the business name.

The minimum combined 2021 sales tax rate for franklin county, ohio is. 2020 rates included for use while preparing your income tax deduction. Payment plans ask how to set up a payment plan to pay delinquent taxes.

January 2022 sales tax rates color.ai author: The latest sales tax rate for dublin, oh. Now, your annual vehicle inspection, registration.

How 2021 sales taxes are calculated in ohio. For example, if you are purchasing a ford focus with a cash selling price of $18,000 and a dealer documentation fee of $250, while living in fulton county, (which has a 7% sales tax rate,) the total ohio car tax is $1,277.50. The ohio sales tax rate is currently %.

The franklin county sales tax is 1.25%. The 2018 united states supreme court decision in south dakota v. The following is a list of the services and duties of the delinquent tax division at the franklin county treasurer's office.

Zip county rate zip county rate zip county rate zip county rate county rate table by zip code december 2021 43117 7.25%pickaway 43119 7.50%* franklin 43119 7.00%* madison 43123 7.50%* franklin 43123 7.00%* madison 43125 7.50%* franklin 43125 7.25%* pickaway 43126 7.50%* franklin 43126 7.25%* pickaway 43127 7.25%hocking Just as in the past, vehicle owners will receive the notice about 60 days prior to their vehicle’s registration expiration. We have almost everything on ebay.

Every 2021 combined rates mentioned above are the results of ohio state rate (5.75%), the county rate (0.75% to 2.25%), and in some case, special rate (0% to 0.5%). The state general sales tax rate of ohio is 5.75%. If your address is current with the n.c.

I live in franklin county so from what i understand, the tax on a new vehicle purchase is 7.5% (5.5 for state and 2 for the county). The tax is based on the 40% value of the vehicle. According to the sales tax handbook, you pay a minimum of 5.75 percent sales tax rate if you buy a car in the state of ohio.

Tax lien sale find out about our annual tax lien sale and access information for taxpayers and potential buyers. There are also county taxes that can be as high as 2%. All title transfers and exemption claims on motor vehicles and other equipment is regularly audited by the ohio department of taxation in accordance with ohio revised code (rc) 4505.09 (b) (2) (c) and 5739.13 to verify if the sales tax liability has been satisfied.

This rate includes any state, county, city, and local sales taxes. Check out top brands on ebay. You need to pay taxes to the county after you purchase your vehicle and.

Check out top brands on ebay. Ohio has 1424 special sales tax jurisdictions with local sales taxes in addition to the. We have almost everything on ebay.

If you need access to a database of all ohio local sales tax rates, visit the sales tax data page. The ohio state sales tax rate is currently %. The franklin sales tax rate is %.

We accept cash, check or credit card payments (with a 3% fee). This is the total of state, county and city sales tax rates. Taxes on motor vehicles are due on the owner’s birth date.

Dublin, oh is in franklin county. Some dealerships may also charge a. Dublin is in the following zip codes:

Franklin County Raising Plate Fees

Pin On Dmv Kiosks

Sales Tax On Cars And Vehicles In Ohio

Sales And Use Tax Electronic Filing Department Of Taxation

Ohios New Car Sales Tax Calculator Quick Guide

Ohio Tint Laws - 2020 2021 - Car Tinting Laws

Buying And Selling A Vehicle Department Of Taxation

Cars And Car Repairs For Low Income Families

Tow Impound And Police Auctions - Ohio Auto Auctions

Ohio Sales Tax - Small Business Guide Truic

Goodwill Vehicle Donation And Auto Auction Goodwill Columbus

Nnb0e16wuwokfm

Xzzzdnvquwbham

Used Tesla For Sale In Columbus Oh - Cargurus

Auto Title Manual - Franklin County Ohio

Vkqljcj8asd3nm

Law Enforcement Pushing To Keep Front License Plates Wsyx

1944 Cleveland East Ohio Gas Explosion Amazing More People Were Not Hurt Cleveland Ohio Ohio History Cuyahoga County

Z Cars Llc 1529 Georgesville Rd Columbus Oh 43228 Usa