Personal Property Tax Rate Richmond Va

$3.50 per $100.00 of the assessed value $1.00 per real estate tax rate: Tax rate † westmoreland county:

101 N 29th St Richmond Va 23223 Realtorcom

The 2021 state personal income tax brackets are updated from the virginia and tax foundation data.

Personal property tax rate richmond va. Henrico county has one of the highest median property taxes in the united states, and is ranked 594th of the 3143 counties in. Business personal property tax is a tax on the furniture, fixtures, machinery, and tools used in a business, trade, or profession. Table 1 rates of county levies for county purposes (pdf) table 2 rates of city levies for city purposes (pdf) table 3 rates of town levies for town purposes (pdf) table 4 rates of county district levies for district purposes (pdf)

Taxable assets include items that have been received free of charge, as. If you have questions about personal property tax or real estate tax, contact your local tax office. Annual tax amount = $354.35.

$0.87 per $100.00 of the assessed value. Also, for credit card payments there is a 2.5% convenience fee in addition to the total tax and transaction fees charged. The tax rate is 1 percent charged to.

Boats, trailers and airplanes are not prorated. May 1st real estate tax rate: Richmond is the capital of virginia and the place where virginia’s property tax laws were established.

Before the official 2021 virginia income tax rates are released, provisional 2021 tax rates are based on virginia's 2020 income tax brackets. Chesterfield county collects, on average, 0.83% of a property's assessed fair market value as property tax. The median property tax in chesterfield county, virginia is $1,964 per year for a home worth the median value of $235,600.

$1.38 per $100.00 assessed value total amount due by june 1st (penalty is 10% of tax bill) henrico county. 1.0% † commonwealth of virginia: The median property tax in virginia is $1,862.00 per year for a home worth the median value of $252,600.00.

Personal property taxes on automobiles, trucks, motorcycles, low speed vehicles and motor homes are prorated monthly. Business equipment, campers, utility trailers, storage mobile homes, etc. Virginia consistently receives a triple a bond rating from the major rating agencies.

Virginia’s corporate income tax rate has not changed since 1972. Virginia is ranked number twenty one out of the fifty states, in order of the average amount of property taxes collected. $3.50 per $100.00 assessed value first half due june 5th, second half due december 5th

There is a $1.50 transaction fee for each payment made online. $2.14 per $100 of assessed valuation: Tangible personal property tax tax rate:

Personal property taxes are billed once a year with a december 5 th due date. $0.76 † commonwealth of virginia: Tangible personal property is the property of individuals and businesses in.

Personal property taxes and real estate taxes are local taxes, which means they're administered by cities, counties, and towns in virginia. 4.3% † placid bay sanitary district; City of richmond personal property tax rate:

49% (for 2020) x $694.80 = $340.45. Reduce the tax by the relief amount: State and local governments are required to operate with balanced budgets and are known for their fiscal responsibility.

The median property tax in henrico county, virginia is $1,762 per year for a home worth the median value of $230,000. Chesterfield county has one of the highest median property taxes in the united states, and is ranked 470th of the 3143. Effective tax rates/$100 † westmoreland county:

The tangible personal property tax is a tax based on the value of the property, commonly referred to as an ad valorem tax. In order to determine the tax bill, your local tax assessor’s office takes into account the property’s assessed value, the current assessment rate, as well as any tax exemptions or abatements for that property. Richmond’s average effective property tax rate is 1.01%.

The daily rental property tax is collected by businesses that derive at least 80 percent of their rental receipts (excluding the rental of vehicles licensed by the state) from rental of personal property for 92 consecutive days or less. Personal property taxes are assessed on any vehicle, motorcycle, boat, trailer, camper, aircraft, motor home, or mobile home owned and registered as being garaged in richmond county as of january 1 st of each tax year. Real estate (including residential mobile.

The total tax is 5 percent (4 percent state and 1 percent local) a seller is subject to a sales tax on gross receipts derived from retail sales or leases of taxable tangible personal property. Virginia tax forms are sourced from the virginia income tax forms page, and are updated on a yearly basis. Local tax rates tax year 2019.

This does not include the registration fee currently set at $40.00 per vehicle. Counties in virginia collect an average of 0.74% of a property's assesed fair market value as property tax per year. Tax rates differ depending on where you live.

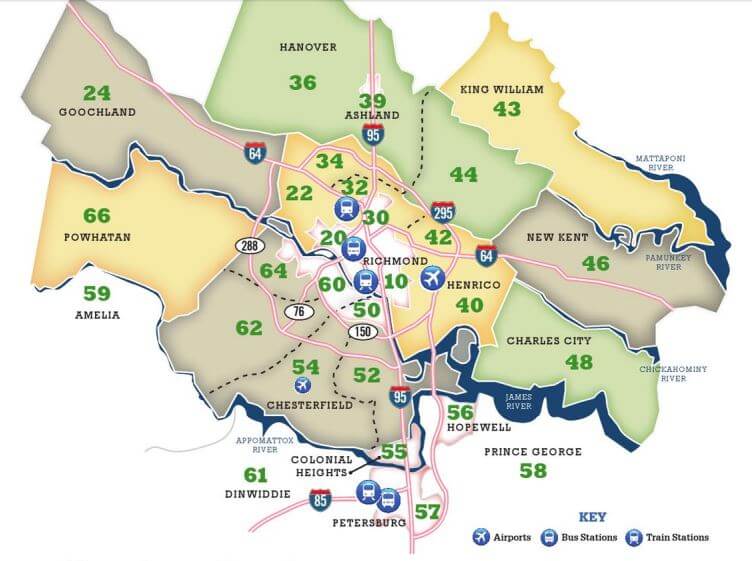

Use the map below to find your city or county's website to look up rates, due dates, payment information, and contact information. $3.70 per $100.00 assessed value due: Henrico county collects, on average, 0.77% of a property's assessed fair market value as property tax.

Kmu6ol-grwaxhm

Sppup1jikcqccm

1 W Main St Richmond Va 23220 Realtorcom

Mehangai Ki Maar Essay In 2021 Essay Writing Tips Conference Planning Essay

Tax Abatement In Richmond Virginia - Significant Properties In Richmond Virginia

Home Down Payments In 2021 Home Buying Homeowners Insurance First Time Home Buyers

New Tax Assessments Show Richmond Property Values Surging 73 Percent The Biggest Increase In A Decade Richmond Local News Richmondcom

Richmond Virginia Va Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

3224 Patterson Ave Richmond Va 23221 - Realtorcom

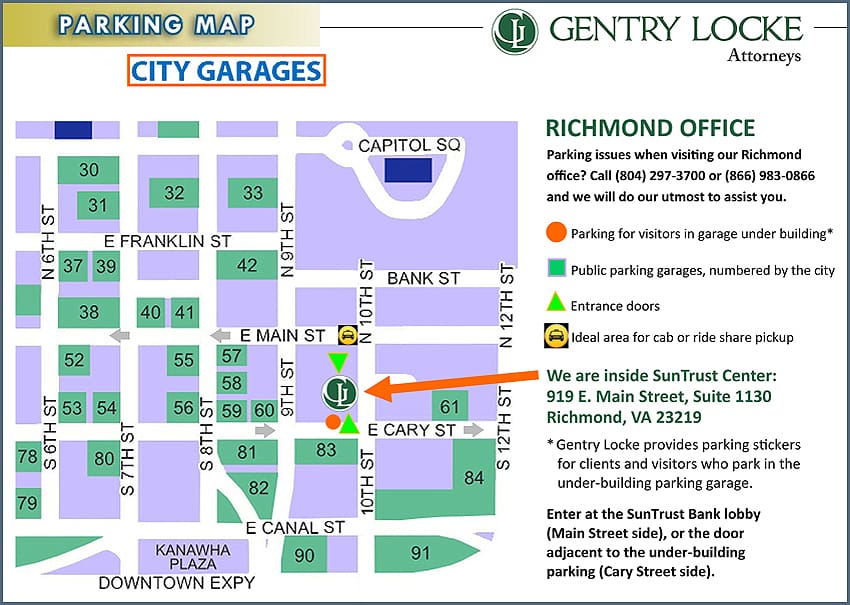

Visiting Our Richmond Office - Gentry Locke Attorneys

Tax Exempt Bond Program Richmond Redevelopment Housing Authority

Richmond Virginia Va Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Richmond Va Multi Family Homes For Sale Real Estate Realtorcom

New Tax Assessments Show Richmond Property Values Surging 73 Percent The Biggest Increase In A Decade Richmond Local News Richmondcom

Guide-to-richmond-area-mls-real-estate-zones Mr Williamsburg

Schedule Your Eflyer Master Suite Plans Real Estate House Styles

Binswanger Glass Richmond Va 23230 Commercial Home Auto Glass

Formerly Redlined Areas Of Richmond Are Going Green - Chesapeake Bay Foundation

Try The 4-both Method To De-clutter Your Living Room Place 4 Boxes On The Ground Let One Box Be Your Trash Investment Firms Investing Real Estate Investing