Wake County Nc Sales Tax Calculator

When calculating the sales tax for this purchase, steve applies the 4.75% tax rate for north carolina plus 2% for wake county’s tax rate and. The calculator should not be used to determine your actual tax bill.

North Carolina Income Tax Calculator - Smartasset

There is no city sale tax for raleigh.

Wake county nc sales tax calculator. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. The north carolina (nc) state sales tax rate is currently 4.75%. The current total local sales tax rate in wake county, nc is 7.250%.

» sales and use tax rates & other information » sales and use tax rates effective october 1, 2020 listed below by county are the total (4.75% state rate plus applicable local rates) sales and use tax rates in effect: Effective jan 1, 2020 all real property in wake county was reappraised at 100% fair market. The median property tax in wake county, north carolina is $1,793 per year for a home worth the median value of $222,300.

The wake county sales tax is collected by the merchant on all qualifying. The north carolina state sales tax rate is currently %. If this rate has been updated locally, please contact us and we will update the sales tax rate for wake county, north carolina.

The seller has paid the property. Contact your county tax department for more information. County rate =.60 raleigh rate =.3730 combined rate =.9730 recycling fee = $20.

Property value divided by 100: In durham and orange counties specifically, there is an additional 0.5% tax which is used to fund the research triangle regional public transportation authority. The raleigh, north carolina, general sales tax rate is 4.75%.the sales tax rate is always 7.25% every 2021 combined rates mentioned above are the results of north carolina state rate (4.75%), the county rate (2%), and in some case, special rate (0.5%).

The general state and applicable local and transit rates of sales and use tax apply to the sales price of each article of tangible personal property that is not subject to tax under another subdivision in n.c. 0.25% lower than the maximum sales tax in nc. Excise tax calculator nc real estate.

A customer living in cary, north carolina finds steve’s ebay page and purchases a $350 pair of headphones. Depending on local municipalities, the total tax rate can be as high as 7.5%. The prior assessed value represented 100% fair market value as of jan 1, 2016.

The wake county sales tax rate is %. North carolina assesses a 3 percent sales tax on all vehicle purchases, according to carsdirect. At a total sales tax rate of 6.75%, the total cost is $373.63 ($23.63 sales tax).

The property is located in the city of raleigh but not a fire or special district. This rate includes any state, county, city, and local sales taxes. Two attorneys, a real estate broker, and a wake county dept.

This title insurance calculator will also estimate the nc land transfer tax where applicable this calculator is designed to estimate the closing costs for one to four family residences and. Wake county has one of the highest median property taxes in the united states, and is ranked 571st of the 3143 counties in order of median property taxes. Easily calculate the north carolina title insurance rates and north carolina property transfer tax;

The median home value in wake county is $265,800, with a median property tax payment of $2,327. The wake county, north carolina sales tax is 7.25%, consisting of 4.75% north carolina state sales tax and 2.50% wake county local sales taxes.the local sales tax consists of a 2.00% county sales tax and a 0.50% special district sales tax (used to fund transportation districts, local attractions, etc). There is no applicable city tax.

101 rows how 2021 sales taxes are calculated for zip code 27587. The december 2020 total local sales tax rate was also 7.250%. Your county vehicle property tax due may be higher or lower, depending on other factors.

The median property tax on a $222,300.00 house is $1,733.94 in north carolina. Told me that it doesn’t matter if the seller has already paid the property taxes for the current fiscal year, that taxes for the current calendar year will still be collected from the seller at closing and credited to the buyer for the months the seller owned the home (i.e. In addition to that statewide rate, every county in north carolina collects a separate sales tax, which ranges from 2% to 2.25% in most counties.

Customarily called excise tax, or revenue stamps. The 7.25% sales tax rate in raleigh consists of 4.75% north carolina state sales tax, 2% wake county sales tax and 0.5% special tax. The median property tax on a $222,300.00 house is $2,334.15 in the united states.

The minimum combined 2021 sales tax rate for wake county, north carolina is. You can print a 7.25% sales tax table here. For tax rates in other cities, see north carolina sales taxes by city and county.

Wake county collects, on average, 0.81% of a property's assessed fair market value as property tax. This calculator is designed to estimate the county vehicle property tax for your vehicle. The sales tax rate for wake county was updated for the 2020 tax year, this is the current sales tax rate we are using in the wake county, north carolina sales tax comparison calculator for 2022/23.

Excise tax / revenue stamps: 2020 rates included for use while preparing your income tax deduction. The latest sales tax rate for raleigh, nc.

Total real estate commission is typically between 5% and 6% of the total purchase price (between 2.5% and 3% for each agent). (9 days ago) real estate. Wake county is located in northern north carolina.

, nc sales tax rate. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in wake county. Plus $20 recycling fee =.

This is the total of state and county sales tax rates. How 2021 sales taxes are calculated in raleigh. It’s made up of 13 municipalities including raleigh, the state’s capital and the county seat.

Tangible personal property is defined in n.c. That makes the county's average effective property tax rate 0.88%. North carolina has a 4.75% statewide sales tax rate , but also has 324 local tax jurisdictions (including cities, towns, counties, and special districts) that collect an average local sales tax of 2.188%.

The state of north carolina charges an excise tax on home sales of $2.00 per $1,000.00 of the sales price. This sales tax is known as the highway use tax, and it funds the improvement and maintenance of.

How To Calculate Sales Tax A Simple Guide Bench Accounting

The Ultimate Guide To North Carolina Property Taxes

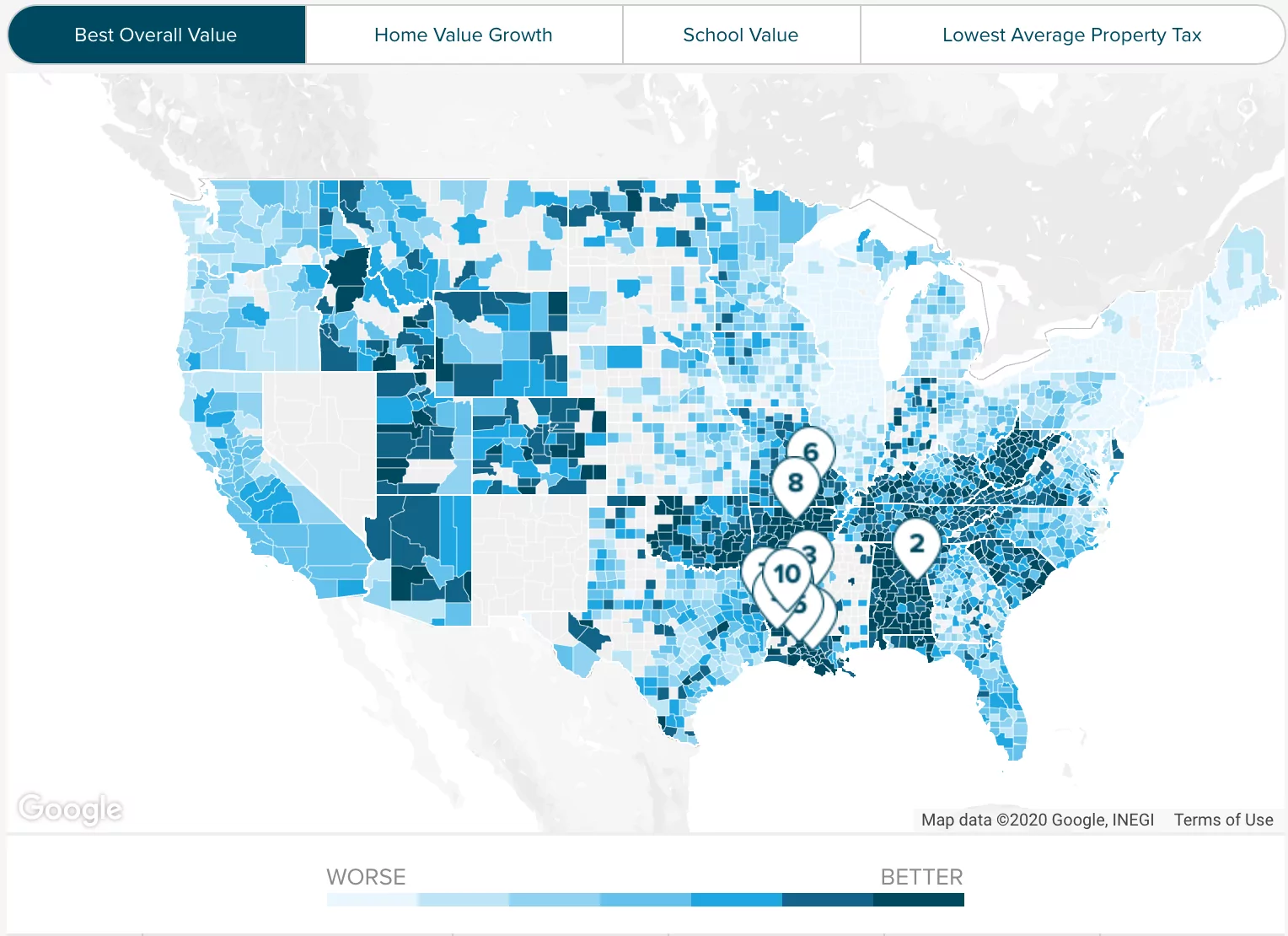

Wake County Nc Property Tax Calculator - Smartasset

North Carolina Sales Tax - Taxjar

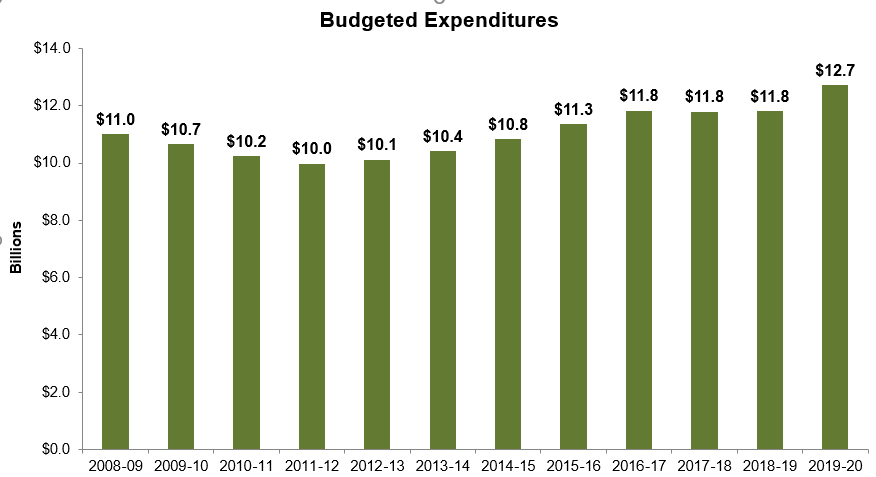

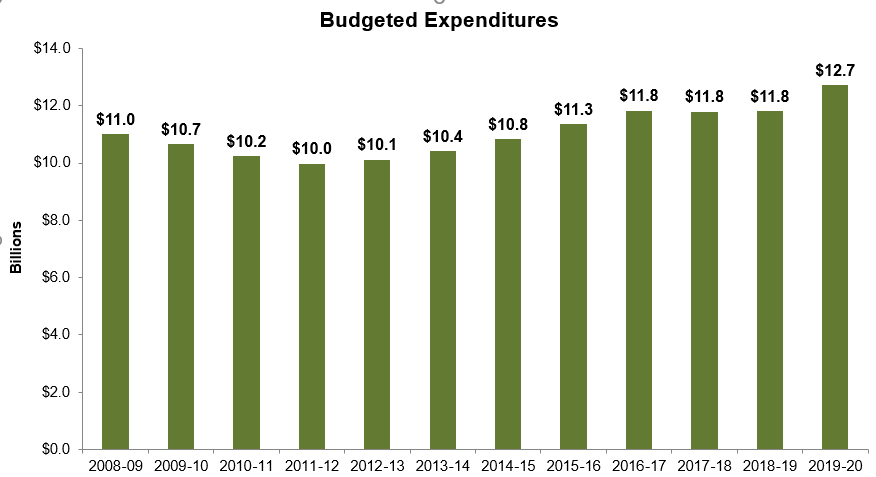

County Budget And Tax Survey - North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

North Carolina Sales Tax Calculator Reverse Sales Dremployee

North Carolina Sales Tax Rates By City County 2021

2021 Sales Tax Changes Report - Avalara

2021 Mileage Reimbursement Calculator

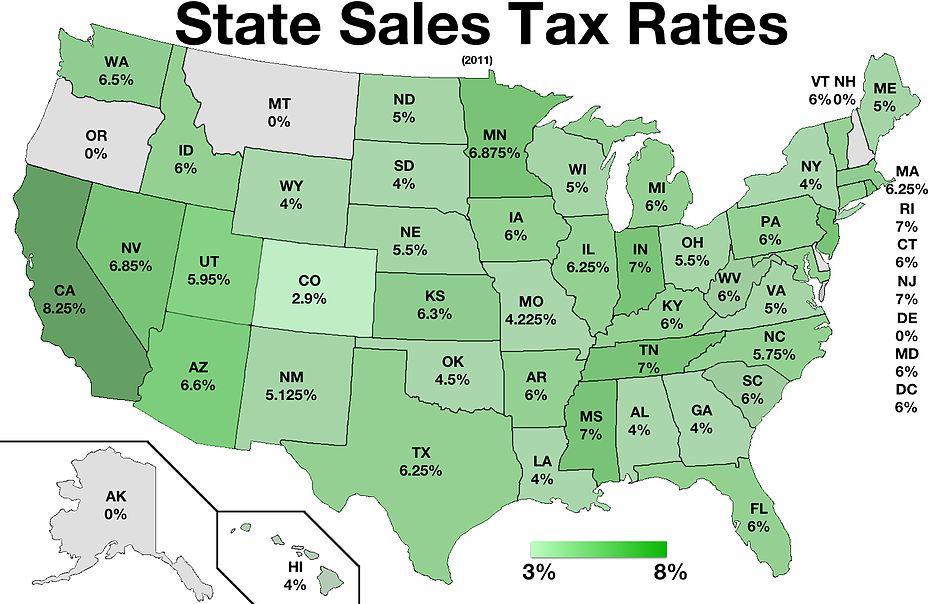

Sales Taxes In The United States - Wikiwand

Is Food Taxable In North Carolina - Taxjar

Sales Taxes In The United States - Wikiwand

North Carolina Income Tax Calculator - Smartasset

Sales Taxes In The United States - Wikiwand

.png)

Taxes Fees

2021 Sales Tax Changes Report - Avalara

North Carolina Sales Tax - Small Business Guide Truic

2021 Sales Tax Changes Report - Avalara

Sales Taxes In The United States - Wikiwand