Jefferson Parish Sales Tax Rate 2021

The jefferson parish, louisiana sales tax is 9.75% , consisting of 5.00% louisiana state sales tax and 4.75% jefferson parish local sales taxes.the local sales tax consists of a 4.75% county sales tax. The jefferson parish sales tax is 4.75%.

Louisiana Sales Tax Rates By County

The louisiana state sales tax rate is currently %.

Jefferson parish sales tax rate 2021. What is jefferson parish tax rate?? The jefferson parish sales tax rate is %. A tax increase of $22.24 million annually, by.

There is no city sale tax for jefferson. Unlike other taxes which are restricted to an individual, the jefferson parish property tax is levied directly on the property. The jefferson parish assessor's office determines the taxable assessment of property.

The sales tax rate is always 4.9% every 2021 combined rates mentioned above are the results of colorado state rate (2.9%), the county rate (1%), and in some case, special rate (1%). Click here for parish and state contact information website support: The current total local sales tax rate in jefferson parish, la is 9.200%.

The base state sales tax rate in louisiana is 4.45%. A separate tax return is used to report these sales. This is the total of state and parish sales tax rates.

Jefferson, la sales tax rate. The median property tax in jefferson parish, louisiana is $755 per year for a home worth the median value of $175,100. The jefferson davis parish sales tax is 5%.

11, 2021, voters in jefferson parish will decide whether to renew two property tax millages on the ballot that directly impact the quality of life for jefferson parish residents. None of the cities or local governments within jefferson parish collect additional local sales taxes. How do i pay my property taxes??

, la sales tax rate. The median property tax in jefferson parish, louisiana is $755 per year for a home worth the median value of $175,100. Louisiana sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a.

This tool allows you to lookup a location by address or coordinates for an accurate sales/use tax rate and easily calculates your total. A separate tax return is used to report these sales. This is the total of state and parish sales tax rates.

Try using our sales tax explorer tool. Please refer to the colorado website for more sales taxes information. The jefferson parish sales tax is collected by the merchant on all.

The current total local sales tax rate in jefferson parish, la is 9.200%. 4 hours ago jefferson parish, louisiana sales tax rate 2021 up to 9.2%. The minimum combined 2021 sales tax rate for jefferson parish, louisiana is.

Notification of change of sales tax rate for remote dealers and consumer use tax. How much is jefferson parish sales tax? 1855 ames blvd., suite a.

Jefferson davis parish, louisiana sales tax rate 2021 up to 9.95%. Jefferson parish collects, on average, 0.43% of a property's assessed fair market value as property tax. These millages have been in place since 2005 and help fund public safety, parks, culture, economic development and senior services.

Need to lookup a louisiana sales tax rate by address or geographical coordinates? Yearly median tax in jefferson parish. The jefferson parish sales tax is 4.75%.

What is jefferson parish property tax? Airport district tax in addition to the sales/use tax imposed on transactions occurring in jefferson parish, an additional levy is imposed on the sale at retail and/or rental of tangible personal property originating within the new orleans airport sales tax district. What is the sales tax rate in jefferson davis parish?

The jefferson davis parish sales tax rate is %. Decrease in state sales tax rate on telecommunications services and prepaid calling cards effective july 1, 2018. Jefferson parish collects, on average, 0.43% of a property's assessed fair market value as property tax.

The local sales tax rate in jefferson parish is 4.75%, and the maximum rate (including louisiana and city sales taxes) is 9.2% as of november 2021. The jefferson's tax rate may change depending of the type of purchase. This is a period of time in which the former owner can reclaim the property by repaying the amount bid at the jefferson parish tax deeds (hybrid) sale plus 12% per annum 5%.

Find your louisiana combined state and local tax rate. You can find the sales/use tax registration form. Louisiana is ranked 1929th of the 3143 counties in the united.

The link below will take you to the jefferson parish sheriff's office 'forms and tables' page of their web site. What is the sales tax rate in jefferson parish? The minimum combined 2021 sales tax rate for jefferson davis parish, louisiana is.

The tax rate is the sum of the individual millage that were approved by voters for such purposes as fire protection, law enforcement, education, recreation, and other functions of parish government. The current total local sales tax rate in jefferson, la is 9.200%. In order to redeem, the former owner must pay jefferson parish 12% per annum 5% on the amount the winning bidder paid to purchase the property at the jefferson parish tax deeds.

Local tax rates in louisiana range from 0% to 7%, making the sales tax range in louisiana 4.45% to 11.45%. The tax is calculated by multiplying the taxable assessment by the tax rate. Authorizes an increase to the parishwide sales tax rate in order to fund maintenance and improvements to the parish justice center.

The louisiana state sales tax rate is currently %. , la sales tax rate.

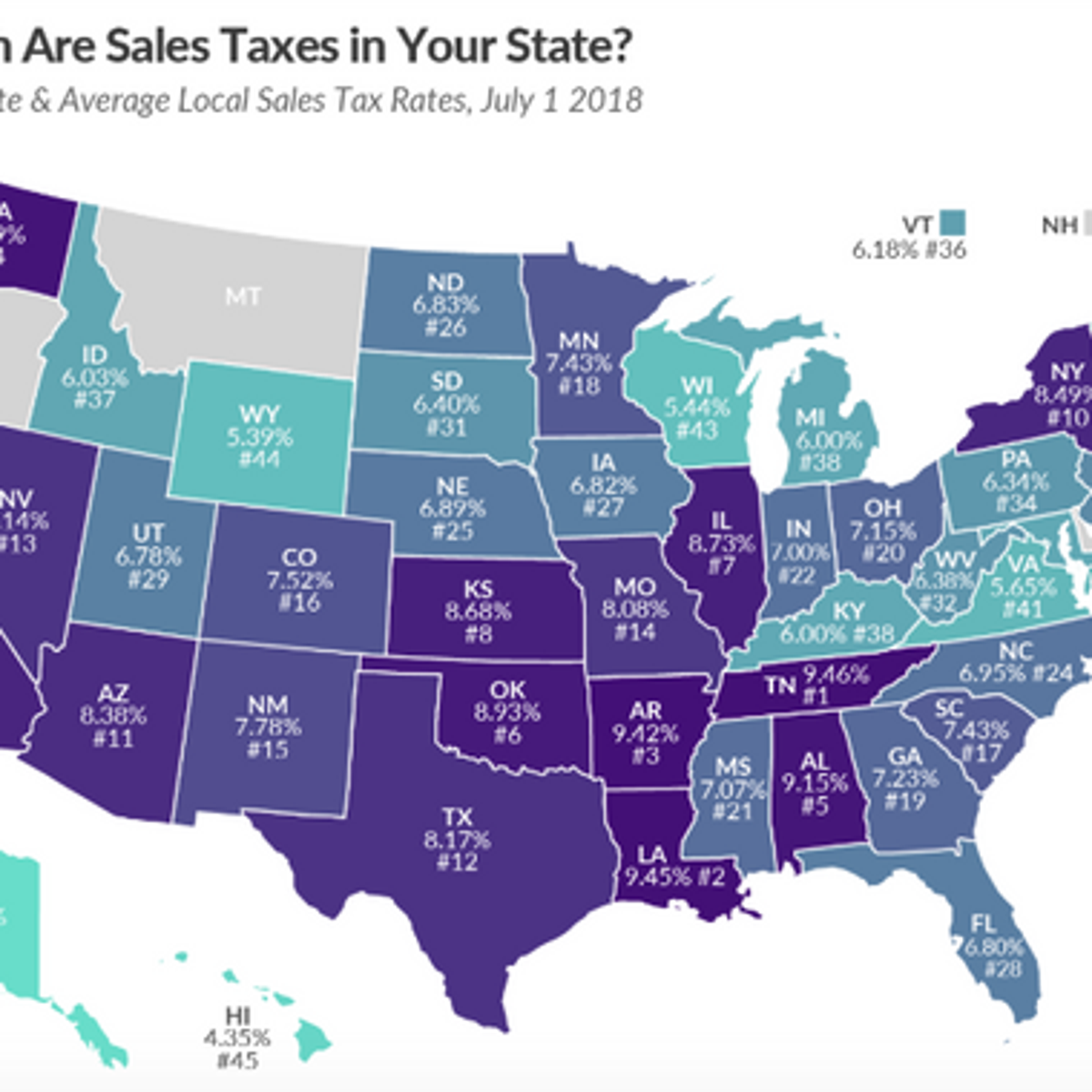

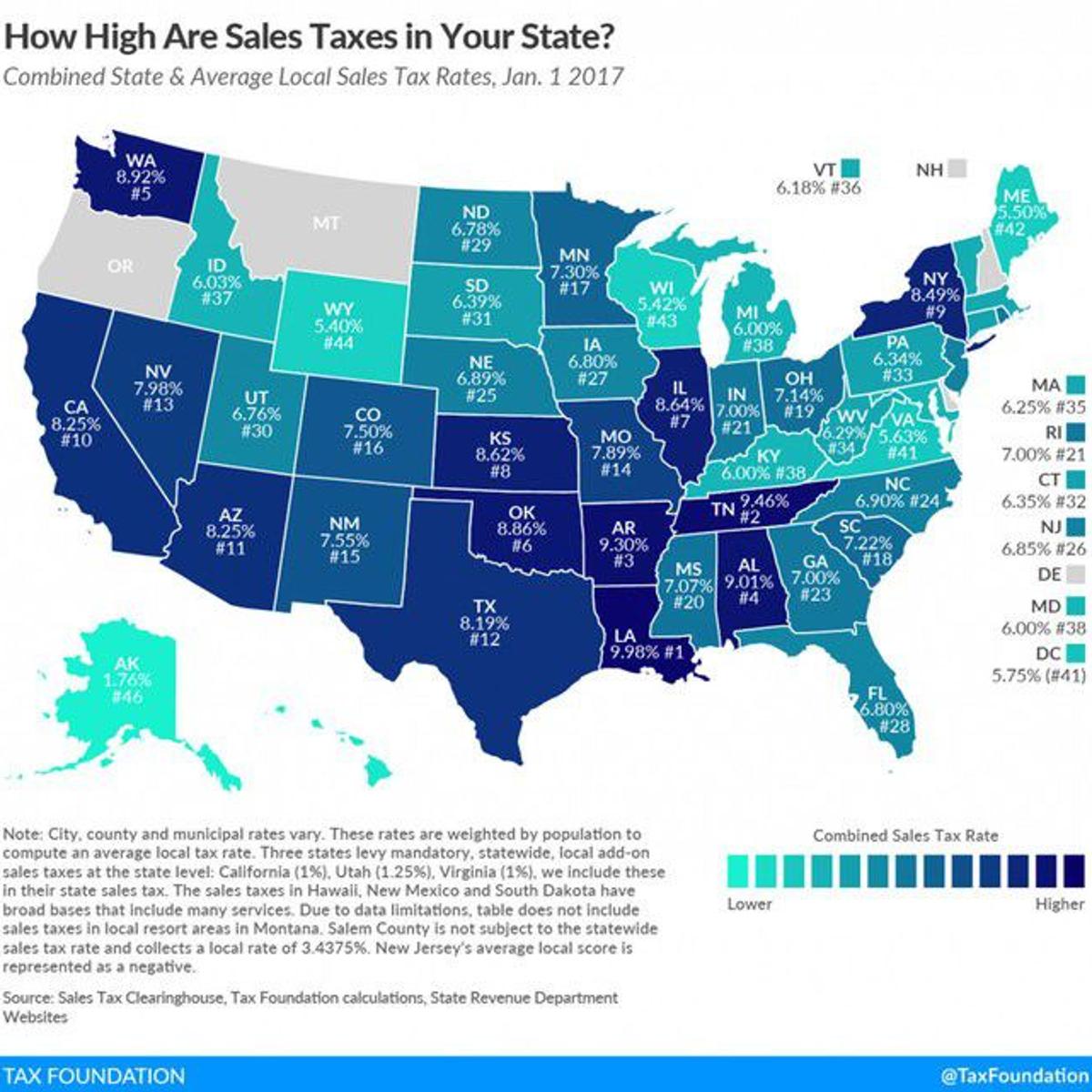

Louisiana Doesnt Have The Highest Sales Tax Rate In The Country Anymore Local Politics Nolacom

Louisiana Sales Tax - Taxjar

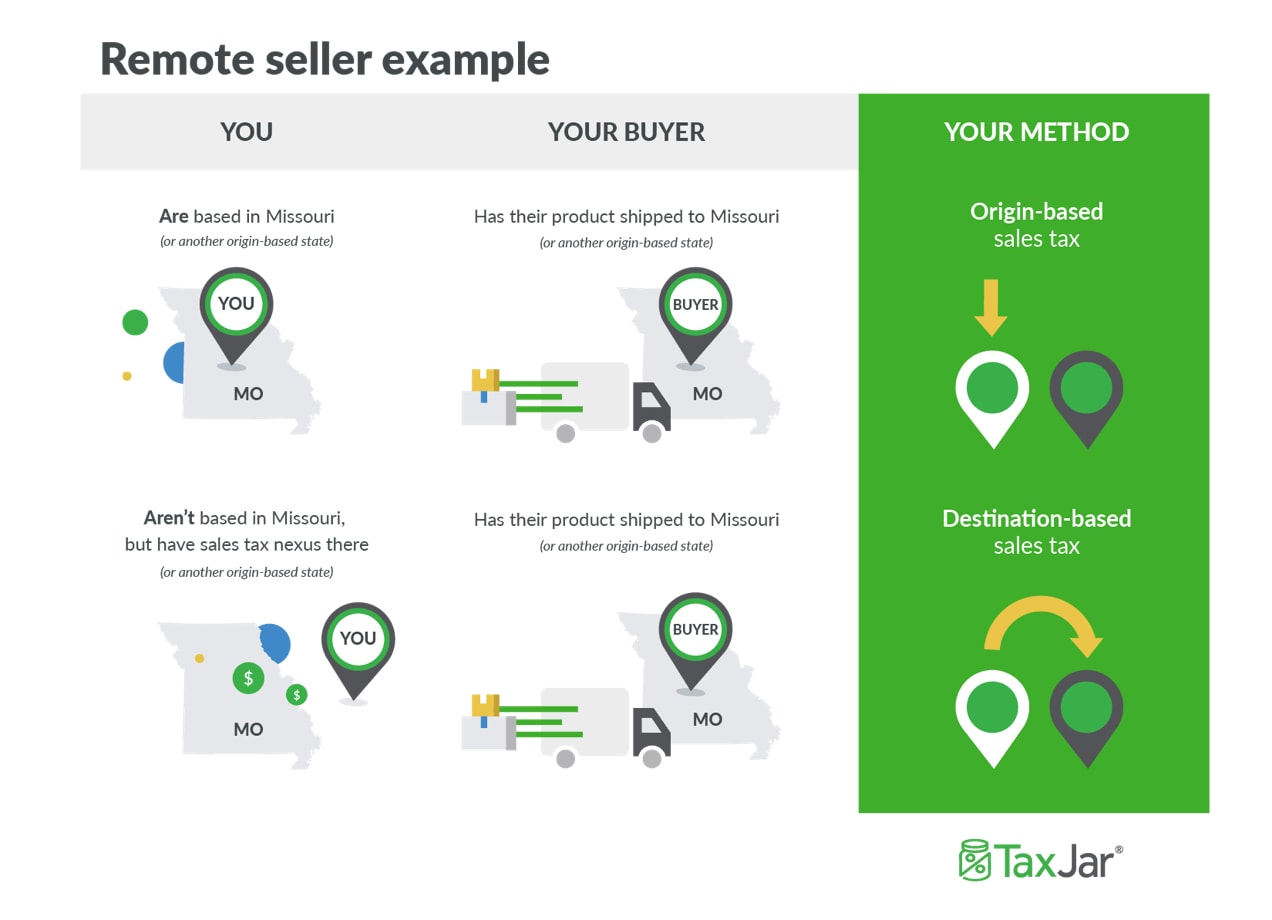

How To Charge Your Customers The Correct Sales Tax Rates

Louisiana Sales Tax Calculator Reverse Sales Dremployee

Louisiana How Do I Add My State Sales Tax Return To My Parish E-file Account - Taxjar Support

How To Calculate Sales Tax Definition Formula Example

How To Calculate Sales Tax - Video Lesson Transcript Studycom

Louisiana Sales Tax - Small Business Guide Truic

How To Charge Your Customers The Correct Sales Tax Rates

Race Equity And Taxes In Louisiana - Louisiana Budget Project

How To Charge Your Customers The Correct Sales Tax Rates

Louisiana Has The Highest Sales Tax Rate In America Business News Nolacom

Sales Tax Statutes And Regulations

Louisiana Sales Tax Rates By City County 2021

How To Charge Your Customers The Correct Sales Tax Rates

Louisianas Regressive Tax Code Is Contributing To Racial Income Inequality - Louisiana Budget Project

Ebr 05 Sales Tax Increase Effective April 1st Faulk Winkler Llc

How To Charge Your Customers The Correct Sales Tax Rates

Louisiana Has Nations Highest Combined State And Local Sales Tax Rate