Jefferson Parish Property Tax Records

Jefferson parish property records are real estate documents that contain information related to real property in jefferson parish, louisiana. Assessor jefferson parish assessor 200 derbigny st., suite 1100, gretna, la 70053 phone:

Short-term Rentals As Of Friday Are Illegal In Most Of Jefferson Parish News Nolacom

Suite 1200 gretna, la 70053:

Jefferson parish property tax records. Our property records tool can return a variety of information about your property that affect your property tax. These records can include jefferson parish property tax assessments and assessment challenges, appraisals, and income taxes. If you know the address of the property or nearest street intersection, click the search button at the top of the screen.

Houses (6 days ago) jefferson county, missouri property tax rates. Remember to have your property's tax id number or parcel number available when you call! Public property records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a.

A return is considered delinquent after the 20th of the month following the close of the reporting period. This gives you the assessment on the parcel. 200 derbigny, 4th floor, suite 4200.

Jefferson parish collects, on average, 0.43% of a property's assessed fair market value as property tax. The median property tax in jefferson parish, louisiana is $755 per year for a home worth the median value of $175,100. Jefferson parish property records provided by homeinfomax:

To find an estimate of your yearly taxes you start by multiplying the current market value by 10%. The preliminary roll is subject to change. Other personal property is depreciated according to guidelines set by the state of louisiana.

Houses (7 days ago) real estate taxes jefferson county mo. The due date for all registered fillers is the 1st of the month following the close of the calendar month of the reporting period. Jefferson parish government building 200 derbigny st.

Louisiana is ranked 1929th of the 3143 counties in the united states, in order of the median amount of property taxes. Use our free louisiana property records tool to look up basic data about any property, and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. If the 20th falls on a weekend or holiday, the return can be filed on the next business day and would become.

Jefferson parish land records are real estate documents that contain information related to property in jefferson parish, louisiana. A 2.49% convenience fee is assessed on all credit card payments. Jefferson davis parish tax records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in jefferson davis parish, louisiana.

$1,219.00 just now the median property tax (also known as real estate tax) in jefferson county is $1,219.00 per year, based on a median home value of $154,700.00 and a median effective property tax rate of 0.79% of. Its duties also include organizing and directing annual tax sales. When and how is my personal property assessed and calculated?

The assessment date is the first day of january of each year. If the parcel does not have a hex, then the. *payments are processed immediately but may not be reflected for up to 5 business days.

You may then search by address (enter street name first, then address number) or. Search jefferson parish property tax and assessment records by parcel number, owner name, address, or property description. If a homestead exemption (hex) is in place you would then subtract $7500 ($75,000 hex x 10%) from the assessed value to get the taxable amount.

When contacting jefferson parish about your property taxes, make sure that you are contacting the correct office. Jefferson davis parish property records are real estate documents that contain information related to real property in jefferson davis parish, louisiana. Assessor jefferson parish assessor 200 derbigny st., suite 1100, gretna, la 70053 phone:

A disclaimer will open before you get to the map. These records can include jefferson davis parish property tax assessments and assessment challenges, appraisals, and. Search jefferson parish property tax and assessment records by parcel number, owner name, address, or property description.

Jefferson parish tax records are documents related to property taxes, employment taxes, taxes on goods and services, and a range of other taxes in jefferson parish, louisiana. Assessor jefferson parish assessor 200 derbigny st., suite 1100, gretna, la 70053 phone: West jefferson medical center retirement plan financial statements.

Houses (1 days ago) search jefferson parish property tax and assessment records by parcel number, owner name, address, or property description. Land records are maintained by various government offices at the local jefferson parish, louisiana state, and federal level, and they contain a wealth of information. Public property records provide information on homes, land, or commercial properties, including titles, mortgages, property deeds, and a range of other documents.

Once the preliminary roll has been approved by the louisiana tax commission, the 2020 assessments will be updated on the website. Inventory is assessed at 15% of the monthly average. The property tax division's primary function is to collect property taxes on real estate and moveable property based on the assessed value as determined by the jefferson parish assessor's office.

Jefferson county mo real estate property search. Once you’ve read through the disclaimer, click continue to map. The preliminary roll is subject to change.

Please be advised the 2021 preliminary roll has been uploaded to the jefferson parish assessor website.

Jefferson Parish Geoportal

Economic Contribution Of Forestry And Forest Products On Jefferson Parish Louisiana

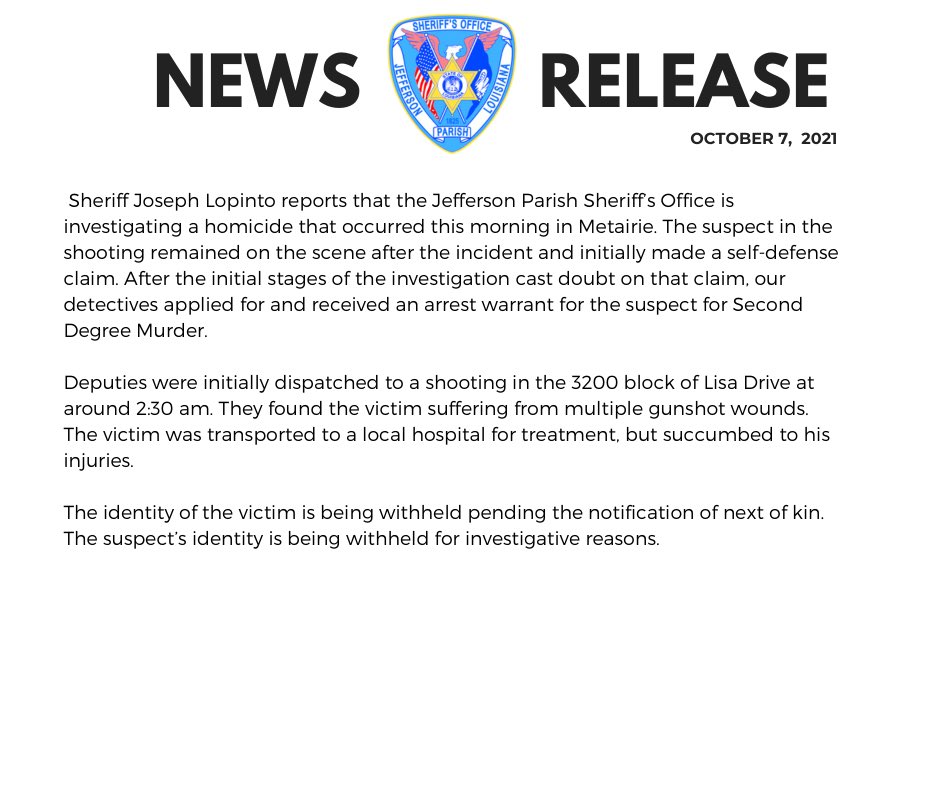

Jp Sheriffs Office Jeffparishso Twitter

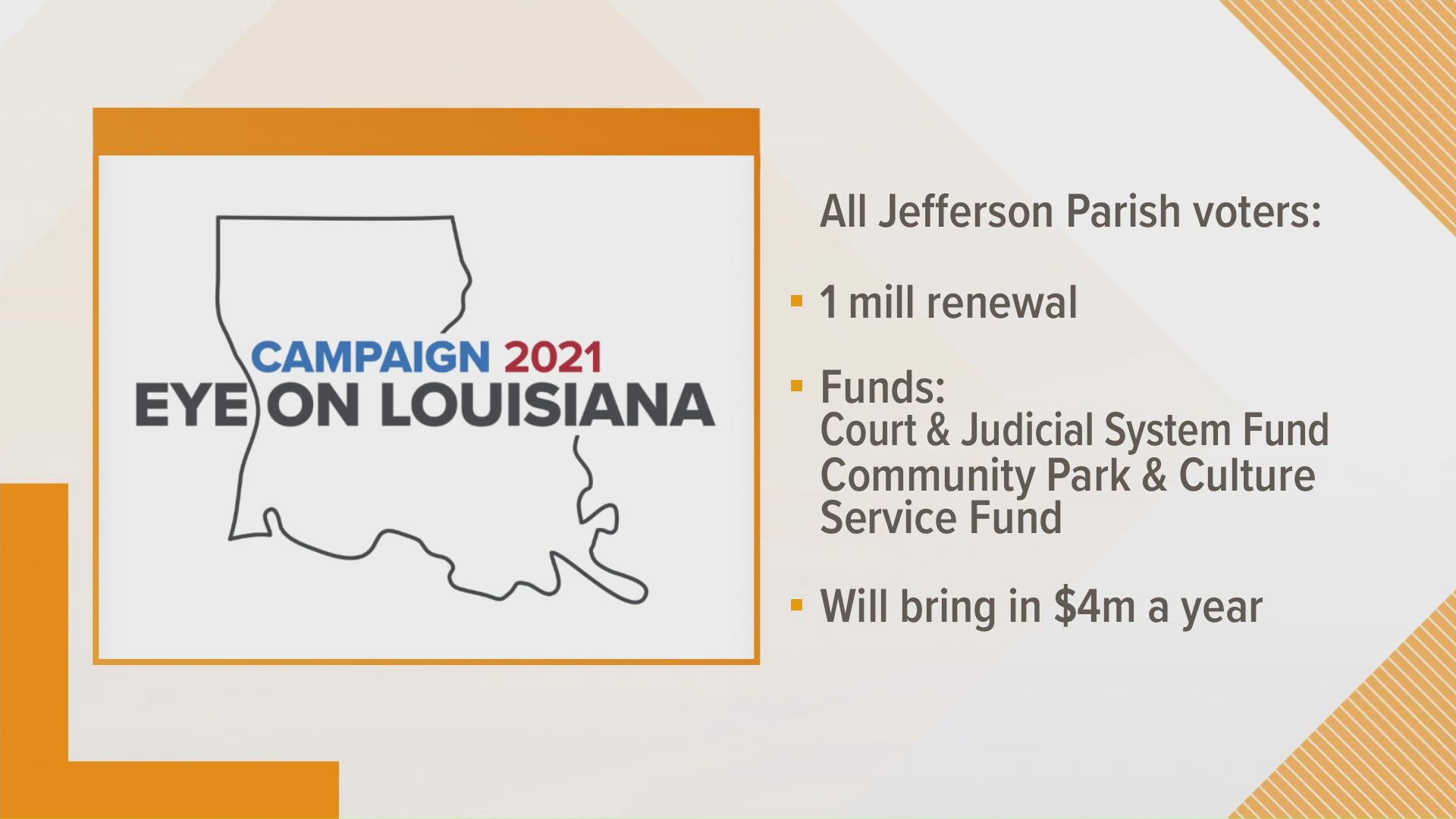

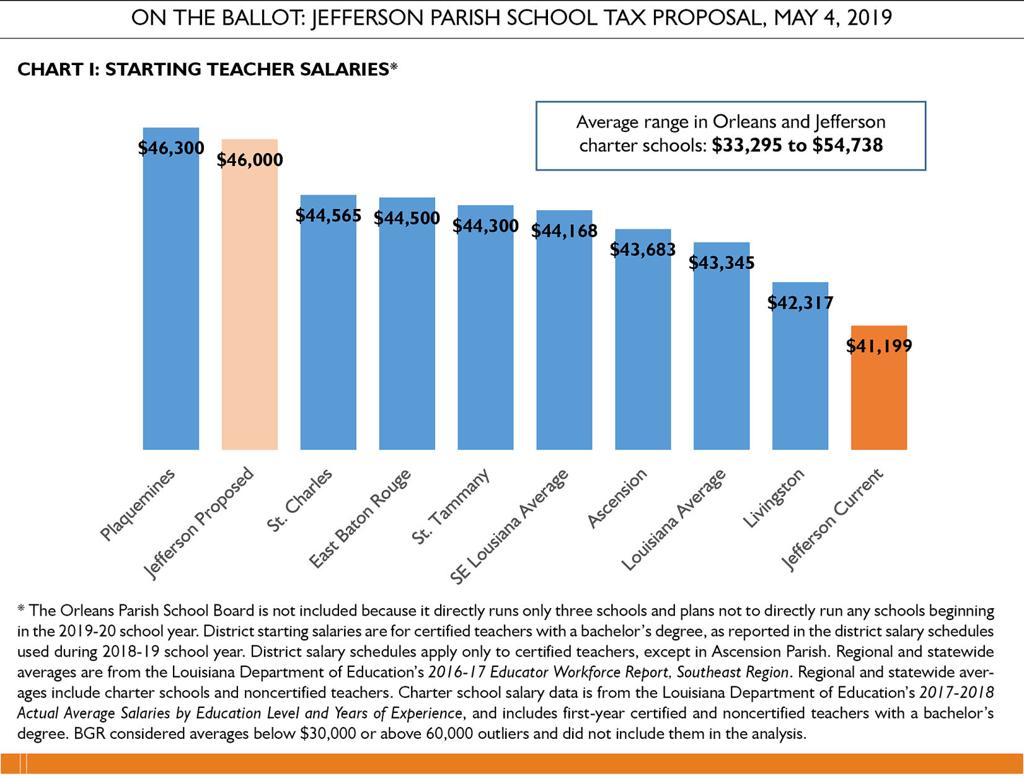

Tax Proposals On Jefferson Parish Ballots Wwltvcom

Jefferson Parish Sheriffs Office Jefferson Parish Sheriffs Office

Jefferson Parish Sales Tax Exemption Certificate - Fill Online Printable Fillable Blank Pdffiller

Millages

Jefferson Parish Backs Tax For Teacher Pay Raises News Nolacom

Jefferson Parish School Registration - Fill Online Printable Fillable Blank Pdffiller

Jefferson Parish Clerk Of Court Forms - Fill Online Printable Fillable Blank Pdffiller

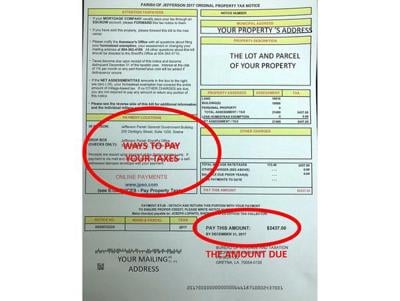

Payments Jefferson Parish Sheriff La - Official Website

Jefferson Parish Occupational License - Fill Online Printable Fillable Blank Pdffiller

Grace Notes With John Fortunato Gone Jefferson Parish Sheriffs Offices United Front Starts To Fray Stephanie Grace Theadvocatecom

29 Salaries At Jefferson Parish Sheriff Shared By Employees Glassdoor

Jefferson Parish Property Taxes Due Sunday Local Politics Nolacom

Online Property Tax System

Fees Jefferson Parish Clerk Of Court

Jefferson Parish Geoportal

Millages