Unrealized Capital Gains Tax Meaning

This makes sense because the asset is illiquid until it is disposed of. A tax on such dividends is a tax an capital increase, and not on income, and, to be valid under the constitution, such taxes must be apportioned according to.

Capital Gains Taxes Explained Short-term Capital Gains Vs Long-term Capital Gains - Youtube

That means you could lose your house.

Unrealized capital gains tax meaning. This policy allowed the richest americans to get richer by minimizing their tax obligations. An unrealized gain is a profit that exists on paper, resulting from an investment. An unrealized gain is when something you own gains value, but you don't sell it, like your house or your retirement fund.

A stock dividend, evincing merely a transfer of an accumulated surplus to the capital account of the corporation, takes nothing from the property of the corporation and adds nothing to that of the shareholder; The idea is to tax a portion of the population on their figurative gains; Wealth tax on billionaires' unrealized gains is on the way.

A new annual tax on billionaires’ unrealized capital gains is likely to be included to help pay for the vast social policy and climate package lawmakers hope to finalize this week, senior democrats said sunday. Treasury secretary yellen proposes a tax on unrealized capital gains to finance biden's build back better plans. What this means is the $1,000 increase in value would be taxed even though it is an unrealized capital gain, that is, no sale has occurred.

When biden officials say they want to tax unrealized capital gains, that means they want to tax you on the appreciation whether or not you sell. Taxing unrealized gains as they accrue—which congressional democrats have said is on the table for america’s billionaires—or removing the tax code provision allowing heirs to inherit investments without inheriting the original cost basis. It is a profitable position that has yet to be sold in return for cash, such as a stock position that has.

An unrealized capital gains tax on corporate assets could hit those with real estate especially hard, but companies with bitcoin also come to mind. I think it's a big mistake, he said. Democrats need to rethink their plan to tax billionaires on their unrealized capital gains, which will discourage investment in the u.s.

This means there should be no wealth tax , whether levied on annual wealth or. An unrealized capital gains tax is a tax that happens when the value of my investments increase even if i have not actually sold them. So, if that $100 stock doubles in value to $200, the government would tax the profits even if you didn't sell it.

The new proposal would tax unrealized capital gains, meaning that the wealthy would no longer be able to defer tax payments on gains made each year. You start a successful company and that company’s value goes from zero to $1 billion in one year. Beware the voices who would advocate for taxing unrealized gains in wealth as a source of government revenue.

When it comes down to determining the amount you have to pay tax on these gains, a lot depends on the. 3.) taxing unrealized capital gains means that your effective tax rate is arbitrary and path dependent. If the proposal were to pass, billionaires.

Unrealized capital gains tax means if you buy a stock for $100 and it goes up to $500 then back down to $50 you owe taxes on the $400 profit you never made. This means there should be no capital gains tax, much less a tax on unrealized capital gains (or inflationary gains). Getting to that figure, though, requires redefining income altogether—and changing how they approach capital gains, too.

December 31st passes and under the proposed tax law you now owe taxes on those unrealized capital gains. Yesterday, i commented nancy pelosi says a wealth tax on billionaires' unrealized gains is on the way. Your unappreciated gains total $850,000.

Deferring capital gains taxes allows rich americans to earn returns on untaxed money until the assets are sold — at which point investors can time the sale to blunt any tax burden. Capital gains tax is 30%, you owe us$275,000. So back to the sneakers.

Billionaires may be the first target, but a successful deployment could see the net widen; This means that someone who owns stock or property that increases in value does not pay tax on that increase until they actually sell that asset. Currently, the tax code stipulates that unrealized capital gains are not taxable income.

The ideology behind taxing “unrealized capital gains” is the same ideology in the premise of “sharing the wealth.” it is an ideology that stems from a belief that your dollar earned comes at the cost of my dollar not achieved. Stocks, collectibles, real estate). currently, taxpayers only pay the capital gains tax when an asset is sold. The us treasury has appraised your house is worth $1,000,000.

Democrats are pushing a tax on unrealized gains. I buy them for $10,000 and after year 1 they are worth $500,000. This “mark to market” regime, or wealth tax would force americans to pay taxes every year on the paper gain in the value of assets (i.e.

In the meantime, those untaxed gains can be used as collateral for loans.

Capital Gains Tax Examples Low Incomes Tax Reform Group

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

Capital Gains Tax 101

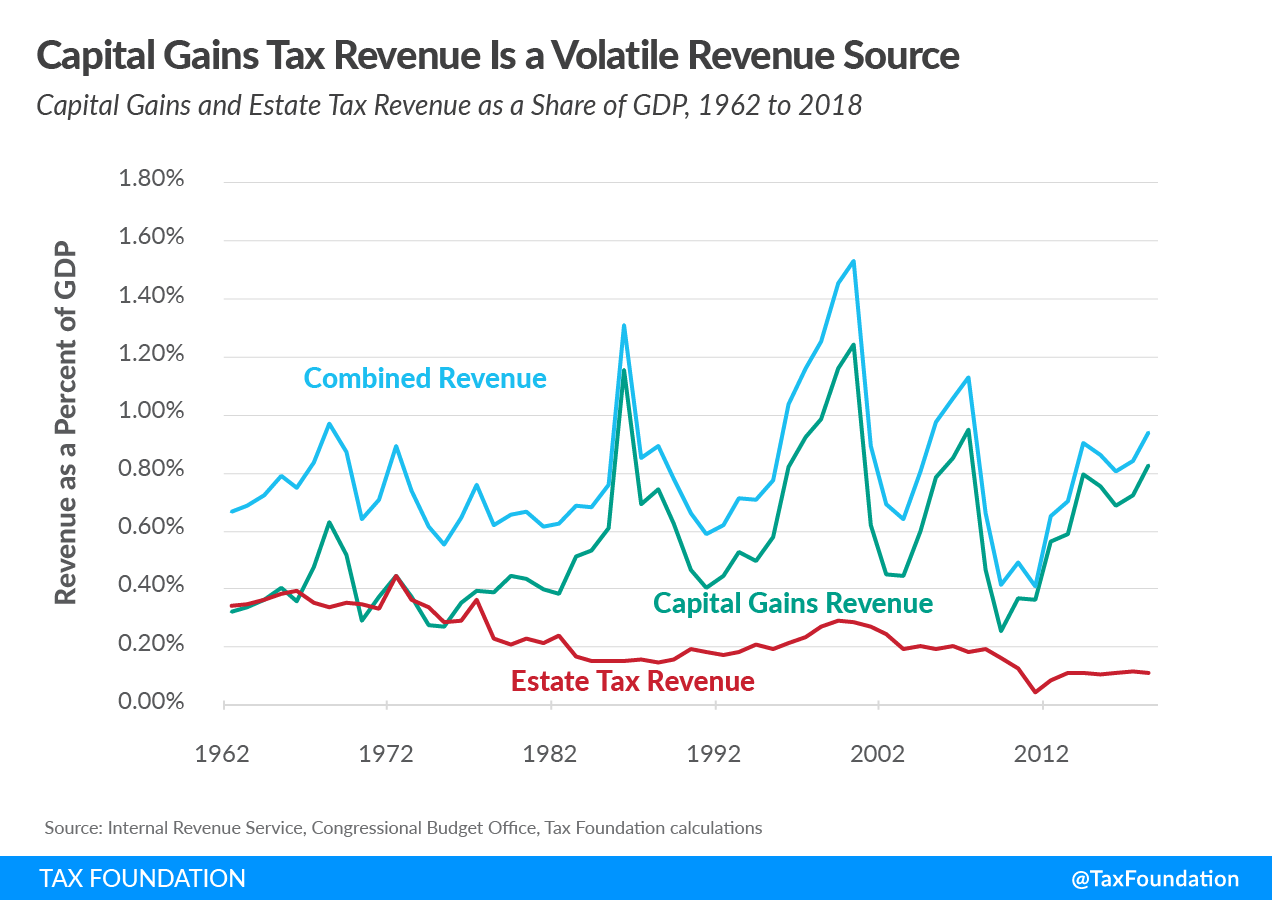

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

Penjelasan Pajak Atas Capital Gain Saham Adalah Sebagai Berikut

Supplier Power One Of Porters Five Forces Force Power Porter

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

The Overwhelming Case Against Capital Gains Taxation

What Is Capital Gains Tax And When Are You Exempt - Thestreet

Direct Indirect Labor Overhead Costing In Budgeting And Reporting Income Statement Directions Cost Of Goods Sold

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

Penjelasan Pajak Atas Capital Gain Saham Adalah Sebagai Berikut

Looking Back On Taxation Of Capital Gains Mark To Market Means To Pay On Unrealized Capital Gains Annuall Stock Market Capital Gain Savings And Investment

Penjelasan Pajak Atas Capital Gain Saham Adalah Sebagai Berikut

Threat Of New Entrants One Of Porters Five Forces Threat Force Porter

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

No Us Wont Tax Your Unrealized Capital Gains Alexandria

What Is Capital Gains Tax And When Are You Exempt - Thestreet